Dive into our in-depth review of FTUK, a leading prop firm, where traders can significantly amplify their trading capabilities and profit margins.

Dive into our in-depth review of FTUK, a leading prop firm, where traders can significantly amplify their trading capabilities and profit margins.

- High Account Balances up to $5,760,000.

- Generous 80% Profit Splits.

- Choice Between Instant or Evaluation Funding.

- Opportunity to Double Account Balance.

- Clear 1-Phase Evaluation Process.

Table of Contents

FTUK Review: Empowering Traders for Success

FTUK stands out as a prop firm dedicated to fostering trader success. The company offers traders an opportunity to substantially increase their earning potential by providing access to three distinct trading accounts, each with a balance of up to $5,760,000. Traders have the flexibility to choose between an instant funding program and a rigorous evaluation program. In the evaluation program, traders embark on a journey that begins with a 1-Phase Evaluation Process. Success in this phase opens the door to advanced stages, where traders are tasked with meeting set Profit Targets to scale their account balance. Triumph in these stages not only demonstrates the trader’s proficiency but also brings substantial rewards. FTUK celebrates successful completion by offering an impressive 80% profit split and a doubling of the account balance, thus significantly enhancing the trader’s financial prospects.

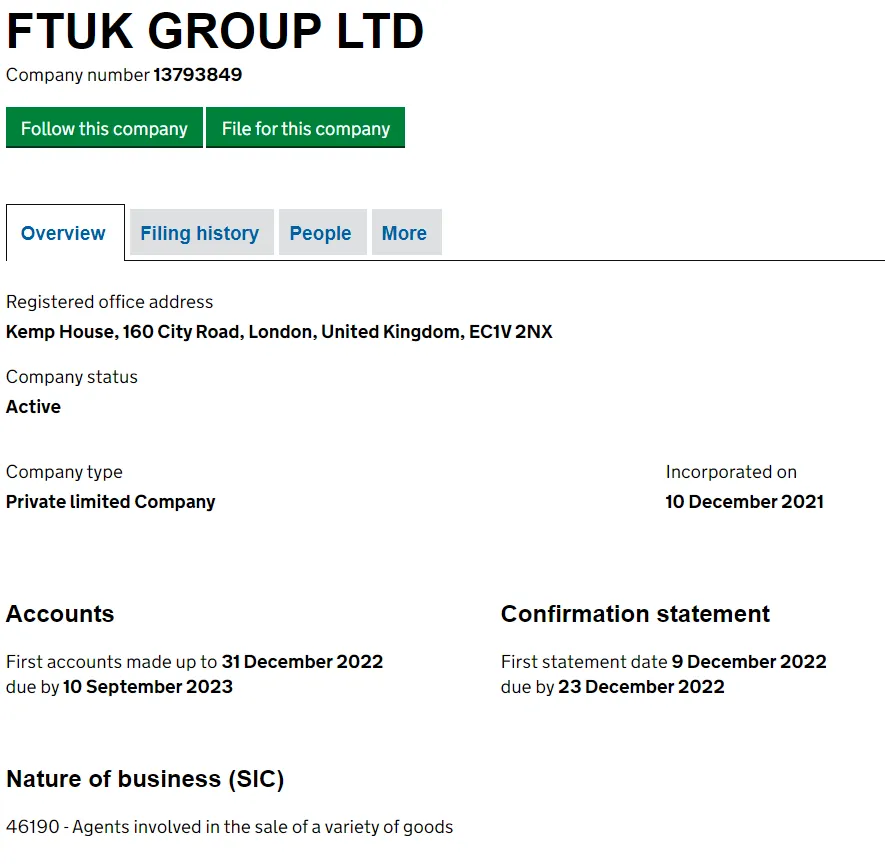

Understanding FTUK: A Comprehensive Overview

FTUK, a prominent proprietary trading firm, is established in the heart of the United Kingdom, with its main office located in London. This firm is renowned for offering its traders the opportunity to manage up to three accounts, each with a substantial balance size of $5,760,000. For their trading activities, FTUK partners with Eightcap, a well-regarded broker, to ensure a seamless trading experience.  Operating under the legal entity FTUK Ltd, the company is a registered UK business, holding the company number 13793849. FTUK’s journey began on December 10, 2021, marking its establishment as a significant player in the trading industry. The firm’s registered office is situated at Kemp House, 160 City Road EC1V 2NX, London, UK, reinforcing its presence in one of the world’s leading financial centers.

Operating under the legal entity FTUK Ltd, the company is a registered UK business, holding the company number 13793849. FTUK’s journey began on December 10, 2021, marking its establishment as a significant player in the trading industry. The firm’s registered office is situated at Kemp House, 160 City Road EC1V 2NX, London, UK, reinforcing its presence in one of the world’s leading financial centers.

Exploring FTUK’s Funding Program Options

FTUK distinguishes itself in the trading industry by providing two distinct funding program options, each tailored to suit different trader needs and preferences:

- Evaluation Program Accounts: This program is designed for traders who wish to demonstrate their trading skills and strategy efficacy. It involves a comprehensive evaluation process, through which traders can showcase their expertise and earn the opportunity to manage larger account sizes.

- Instant Funding Program Accounts: For traders seeking immediate access to substantial trading capital, FTUK offers the Instant Funding Program. This option bypasses the traditional evaluation process, allowing traders to start trading with significant funds right from the outset.

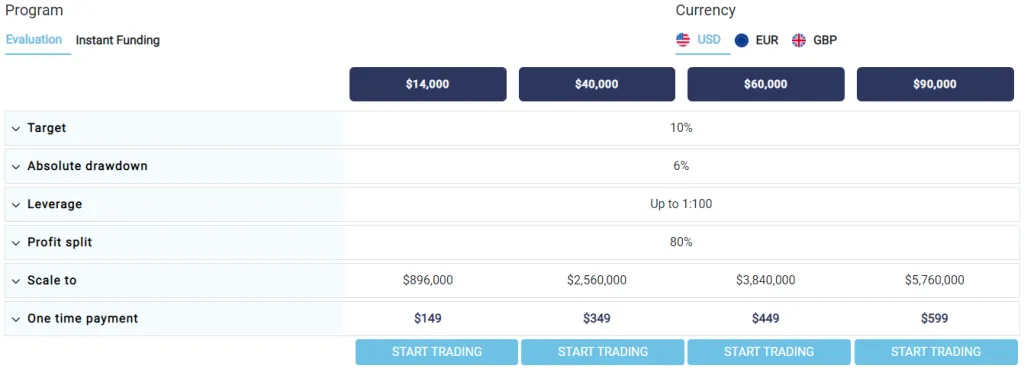

Understanding FTUK’s Evaluation Program Accounts

FTUK’s Evaluation Program Account is designed to provide traders with a flexible and accommodating environment to showcase their trading skills. Key features of this program include:

- Unlimited Time Frame: Traders are given an unrestricted time period to meet the evaluation criteria, allowing for a stress-free trading experience.

- High Leverage: The program offers up to 1:100 leverage, amplifying the potential for significant gains.

- Choice of Account Currency: Traders have the flexibility to choose their account funding in USD, EUR, or GBP, catering to a global clientele.

- Profit and Loss Guidelines: The evaluation phase requires a 10% profit target achievement without exceeding a 6% maximum loss rule. Notably, there is no minimum trading day requirement, further enhancing trading flexibility.

- Risk Management: Traders must adhere to a maximum stop loss risk of 2% per position.

Upon successful completion of the evaluation phase, traders are granted a funded account with distinct advantages:

- No Profit Targets: In the funded stage, there are no profit targets, focusing solely on consistent trading performance.

- Continued Loss Rule: The 6% maximum loss rule remains in effect, ensuring disciplined risk management.

- Flexible Payouts: Traders can request payouts from level two onwards at any time without impacting account growth or needing to compensate for withdrawn profits.

- Profit Splits: A generous 80% profit split is awarded to traders, based on the profits generated.

Evaluation Program Account Scaling Plan at FTUK

FTUK’s Evaluation Program Account features an expansive scaling plan that allows traders to progress through various levels based on their performance. The scaling plan is structured as follows:

- Level 1: $3,500 – $22,500 with 1:10 Leverage

- Level 2: $14,000 – $90,000 with 1:10 Leverage

- Level 3: $28,000 – $180,000 with 1:20 Leverage

- Level 4: $56,000 – $360,000 with 1:20 Leverage

- Level 5: $112,000 – $720,000 with 1:30 Leverage

- Level 6: $224,000 – $1,440,000 with 1:30 Leverage

- Level 7: $448,000 – $2,880,000 with 1:50 Leverage

- Level 8: $896,000 – $5,760,000 with 1:100 Leverage (available as an add-on)

The scaling process is straightforward and trader-friendly:

- To qualify for scaling, traders need to achieve a profit target of 10%.

- Traders become eligible for scaling as soon as their total profits hit the 10% mark.

- Withdrawals do not impede the account’s ability to scale up.

Here’s an example to illustrate the scaling process:

- In Week 1, a trader gains 4.2% and decides to withdraw the profits.

- In Week 2, the trader gains an additional 5.8% and again withdraws the profits.

- Since the total profits have now reached 10%, the trader becomes eligible for a scale-up.

Regarding trading instruments, the Evaluation Program Account encompasses a wide range, including forex pairs, commodities, indices, and cryptocurrencies, offering traders a diverse portfolio to trade in.

Rules for the Evaluation Program Account at FTUK

The Evaluation Program Account at FTUK operates under a set of well-defined rules to ensure fair and disciplined trading. These rules include:

- Profit Target: Traders must achieve a 10% profit target during the evaluation phase before they can complete it, withdraw profits, or scale their account.

- Maximum Loss: The account has a maximum loss threshold of 6%. If a trader’s overall loss reaches this percentage, the account is considered violated.

- Stop-Loss Requirement: Traders are obliged to set a stop-loss on every trade before opening a position, ensuring risk management.

- Stop-Loss Risk Per Position: There is a mandatory stop-loss risk of 2% required for each position, which helps in controlling potential losses on individual trades.

- Lot Size Consistency: This rule mandates traders to maintain consistency in the lot sizes of their positions, with a specified percentage limit for any variation.

- No Martingale Strategies: The use of any martingale strategy in trading is strictly prohibited, to encourage responsible trading practices.

- Third-Party Copy Trading Risk: When using third-party copy trading services, traders must be cautious of the maximum capital allocation rule. Identical trading strategies by multiple traders using the same service could lead to denial of a funded account or withdrawal requests.

These rules are designed to promote a disciplined approach to trading, ensuring that traders adhere to risk management practices while striving to achieve their financial objectives.

Add-On Options for FTUK’s Evaluation Program Accounts

FTUK enhances its Evaluation Program Accounts with a range of add-on options, designed to cater to the diverse needs and preferences of traders. These options include:

- Unlock Scaling Level 8: For those aiming higher, the option to unlock scaling Level 8 is available with a 10% price increase at the time of purchasing the evaluation account.

- No Mandatory Stop-Loss: Traders can opt out of the mandatory stop-loss requirement by choosing this add-on, which comes with a 20% price increase when purchasing the evaluation account.

- Joining Fee Refund: This option offers a refund of the joining fee for a 25% price increase, adding an extra layer of financial flexibility when purchasing the evaluation account.

- Evaluation Retake: For a 50% price increase, traders can secure the option to retake the evaluation, providing a second chance for those who need it.

Importantly, traders have the freedom to select either one of these add-ons or combine multiple options to tailor their account to their specific trading style and goals.

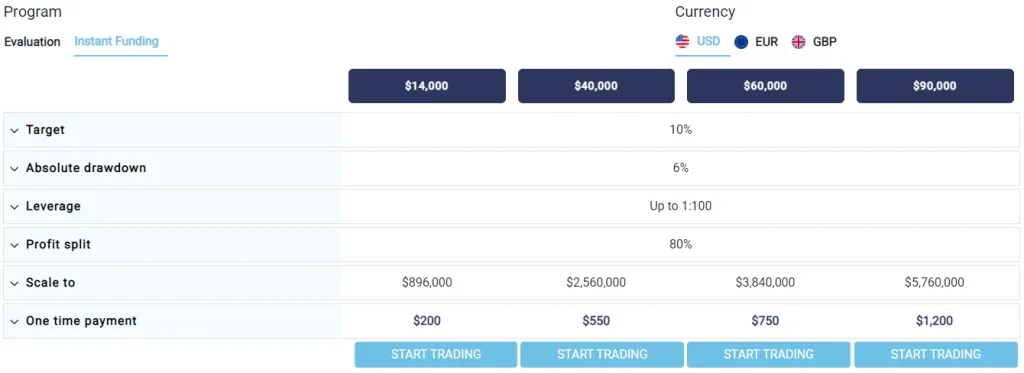

FTUK’s Instant Funding Program Accounts

FTUK’s Instant Funding Program Account is a dynamic option for traders seeking to bypass the traditional evaluation process and commence earning immediately. This program offers several key benefits:

- Direct Start: Traders can start trading and earning without undergoing any evaluation, providing a fast track to trading success.

- Generous Profit Splits: The program awards traders with an attractive 80% profit split based on the profits generated, incentivizing high-performance trading.

- High Leverage: Traders have the advantage of trading with up to 1:100 leverage, amplifying their trading capacity and potential gains.

- Choice of Account Currency: Flexibility is further enhanced by allowing traders to choose their account funding currency from USD, EUR, and GBP, accommodating a global audience.

This program is tailored for traders who are confident in their trading strategies and wish to engage in the markets immediately, with substantial financial backing and robust profit-sharing arrangements.

Scaling Plan for FTUK’s Instant Funding Program Account

FTUK’s Instant Funding Program Account offers an ambitious scaling plan, enabling traders to progressively increase their trading capital based on their success. The scaling stages are as follows:

- Levels 1 to 8 range from $3,500 to $5,760,000 in account sizes.

- Leverage varies by level, starting at 1:10 and escalating up to 1:100 at Level 8 (available as an add-on).

The scaling criteria for this program are straightforward:

- To scale up, traders must reach a 10% profit target.

- Traders become eligible for scaling as soon as their cumulative profits hit the 10% threshold.

- Importantly, making withdrawals does not impact the eligibility for scaling up.

An illustrative example of the scaling process:

- In Week 1, a trader earns a profit of 4.2% and withdraws it.

- In Week 2, the trader gains an additional 5.8% and makes another withdrawal.

- Having reached a total profit of 10%, the trader is now eligible for an account scale-up.

Trading instruments in the Instant Funding Program Account include a diverse array of options such as forex pairs, commodities, indices, and cryptocurrencies, offering traders a broad spectrum of opportunities.

Rules for FTUK’s Instant Funding Program Account

FTUK’s Instant Funding Program Account operates under a set of specific rules designed to ensure fair and disciplined trading practices:

- Profit Target: Traders need to achieve a 10% profit to complete the scaling plan, withdraw profits, or scale their account.

- Maximum Loss: A 6% maximum loss threshold applies to all account sizes. Exceeding this limit results in a violation of the account.

- Stop-Loss Requirement: Mandatory setting of a stop-loss for each trading position is required before opening a trade, aiding in effective risk management.

- Stop-Loss Risk Per Position: Traders must set a stop-loss risk of 2% for each position, helping to control potential losses on individual trades.

- Lot Size Consistency: This rule mandates maintaining similar lot sizes for opened positions, with a specified percentage for allowable variation.

- No Martingale Strategies: The use of martingale strategies is strictly prohibited, promoting responsible trading behaviors.

- Third-Party Copy Trading Risk: When using third-party copy trading services, traders must be cautious of the maximum capital allocation rule to avoid the risk of being denied a funded account or withdrawals due to identical trading strategies employed by multiple users.

These rules are integral to maintaining a structured and secure trading environment, ensuring that traders adhere to risk management protocols while pursuing their trading objectives.

Add-On Options for FTUK’s Instant Funding Program Accounts

FTUK enriches its Instant Funding Program Accounts with several add-on options, allowing traders to tailor their accounts to their individual needs and strategies. These options include:

- Unlock Scaling Level 8: Traders can opt for this add-on at a 10% price increase when purchasing their instant funding account, unlocking the highest scaling level for expanded trading capacity.

- No Mandatory Stop-Loss: For those seeking more flexibility in their trading approach, this add-on removes the mandatory stop-loss requirement at a 20% increase in the purchase price.

- Joining Fee Refund: This option allows for a refund of the joining fee, implemented at a 25% price increase when purchasing the instant funding account, offering additional financial leverage.

Traders have the freedom to select any one of these add-ons or combine multiple to customize their trading experience according to their personal preferences and trading style.

What Sets FTUK Apart from Other Proprietary Trading Firms

FTUK distinguishes itself in the proprietary trading industry with several unique features that set it apart from its competitors:

- Dual Funding Programs: Unlike many industry leaders, FTUK offers two distinct funding programs: the Evaluation Program and the Instant Funding Program, catering to diverse trader needs and preferences.

- Flexible Trading Conditions: FTUK does not impose maximum or minimum trading day requirements, granting traders the freedom to trade at their own pace. Additionally, traders can trade during news events, hold trades overnight, and over weekends, offering unparalleled flexibility.

The specifics of FTUK’s Evaluation Program further highlight its uniqueness:

- It’s a one-phase evaluation program requiring traders to hit a 10% profit target before being eligible for payouts, with a 6% maximum loss rule.

- Traders must adhere to rules like the required stop-loss, stop-loss risk per position, and lot size consistency.

- The absence of maximum or minimum trading day requirements alleviates the pressure of time constraints during the evaluation period.

FTUK’s Instant Funding Program also stands out:

- It shares the same 10% profit target and 6% maximum loss rule as the Evaluation Program, with similar trading rules.

- Traders have the opportunity to bypass the evaluation phase entirely and start earning immediately.

- Like the Evaluation Program, there are no restrictions on trading days, further emphasizing flexibility and convenience.

In summary, FTUK’s distinct approach, encompassing two versatile funding programs, lenient trading rules, and the absence of trading day restrictions, positions it uniquely among top-tier proprietary trading firms.

Assessing the Realism of Gaining Capital with FTUK

When evaluating the feasibility of receiving capital from proprietary firms like FTUK, it’s crucial to consider the realism of their trading requirements in relation to a trader’s style. Here’s an analysis of FTUK’s funding programs:

Evaluation Program Accounts

FTUK’s Evaluation Program Accounts offer a realistic path to receiving capital, primarily due to:

- Attainable Profit Targets: With an average profit target of 10%, the objectives are challenging yet achievable, aligning well with many traders’ capabilities.

- Reasonable Loss Rule: The 6% maximum loss rule provides a balanced risk framework, ensuring traders have a fair chance to succeed while maintaining disciplined risk management.

Instant Funding Program Accounts

The Instant Funding Program Accounts also present a pragmatic opportunity for traders:

- Direct Funding: Traders can start earning immediately, bypassing the evaluation phase, which is particularly appealing for experienced traders.

- Scalable Profit Targets: The initial profit target of 10% is realistic, offering the potential to quadruple capital upon successful trading.

- Practical Loss Rule: The 6% maximum loss rule is in line with standard trading practices, making it a feasible target for traders to adhere to.

In conclusion, considering the balanced profit targets, sensible maximum loss rules, and the option to choose between two different funding programs, FTUK emerges as a commendable choice for traders seeking realistic and attainable funding opportunities.

Verifying Payment Proof for FTUK

Established on December 10, 2021, FTUK provides a straightforward process for traders to withdraw their profit splits. Here’s a look at how this process works and where you can find reliable payment proofs:

- Withdrawal Process: Traders can request withdrawals by submitting an invoice. The processing time for payouts is typically up to two working days, although this may vary based on the chosen payment method.

- YouTube Channel: FTUK’s YouTube channel is a valuable resource for payment proofs. It features interviews with traders who share their experiences, including discussions about payments. Watching these videos offers insight into the reliability and timeliness of FTUK’s payment system.

- Discord Community: Another platform where traders can find payment proof is FTUK’s Discord channel. This community space provides an opportunity for traders to share their experiences and showcase evidence of successful payouts.

This combination of direct testimonies from traders and accessible platforms like YouTube and Discord underscores FTUK’s transparency and reliability in processing trader payments.

FTUK’s Choice of Broker: Eightcap

FTUK has partnered with Eightcap as its primary broker, a collaboration that enhances their trading services and global reach. Here’s a closer look at this partnership:

- Global Operations: While Eightcap’s headquarters are situated in London, their support and sales teams operate across Asia, providing comprehensive coverage for all time zones. This global presence ensures that FTUK’s clients, who are spread worldwide, receive timely and efficient support.

- Trading Platforms: FTUK offers its traders the flexibility to trade using the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are renowned for their advanced trading tools, user-friendly interface, and reliability, making them a preferred choice for traders of all levels.

This strategic choice of broker aligns with FTUK’s commitment to providing its traders with robust, reliable, and globally accessible trading services.

Trading Instruments Available with FTUK

FTUK provides its clients with a diverse range of trading instruments, encompassing various markets to suit different trading strategies. The available instruments include:

Forex Pairs

- Major pairs like EURUSD, GBPUSD, USDJPY, USDCAD, AUDUSD, and NZDUSD.

- Additional pairs including USDCHF, AUDCAD, AUDCHF, AUDJPY, AUDNZD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, GBPAUD, GBPJPY, and GBPNZD.

- Other forex pairs like NZDCAD, NZDCHF, and NZDJPY.

Metals

- Gold (XAUUSD) and Silver (XAGUSD).

Indices

- A broad range including AUS200, E35EUR, 100GBP, F40EUR, D30EUR, JPN225, E50EUR, SP500, NAS100, and DJI30.

Commodities

- Oil products like UKOIL and USOIL.

This comprehensive selection of trading instruments ensures that FTUK’s clients have access to a wide array of markets, from traditional forex trading to commodities and indices, catering to various trading styles and preferences.

FTUK’s Trading Fee Structure

FTUK implements a clear and concise fee structure for trading, encompassing both trading commissions and spreads. Here’s an overview:

Trading Commission

- Forex: A fee of 4 USD per lot is charged for forex trading.

- Commodities and Indices: No commission is charged for trading commodities and indices, offering a cost-effective option for traders in these markets.

Spread

To understand the current spread rates, FTUK provides a demo account on the Meta Trader 4 platform, allowing traders to view live spreads. The details for accessing this are:

- Platform: Meta Trader 4

- Server: EightcapLtd-Demo2

- Login Number: 20180408

- Password: SXhfhCnh

- Platform Download: Traders can click here to download the platform and access the demo account for real-time spread information.

This structured approach to fees ensures transparency and allows traders to make informed decisions when trading with FTUK.

Education and Support for Traders at FTUK

FTUK is committed to supporting its traders’ growth and success by providing a range of educational resources and a robust support system. Here’s an overview of what they offer:

FTUK Educational Content on the Blog

FTUK’s website features a dedicated blog section that is divided into four informative subsections:

- General: Covering a broad range of topics relevant to trading.

- Traders Mindset: Focusing on the psychological aspects of trading, which are crucial for long-term success.

- Technical Strategy: Offering insights and strategies for technical analysis in trading.

- Traders Interview: Sharing experiences and tips from successful traders.

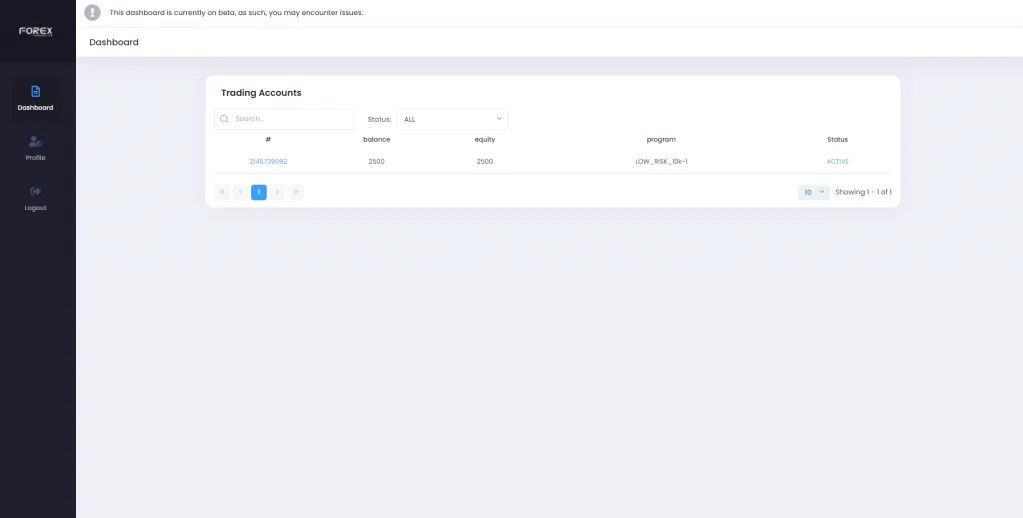

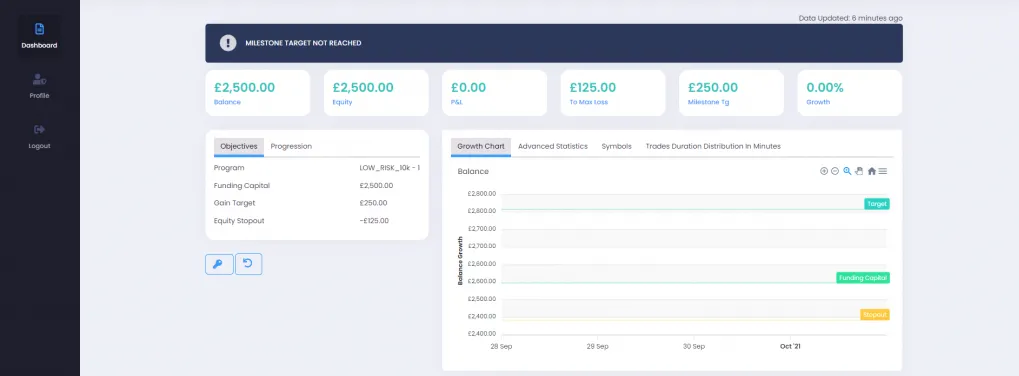

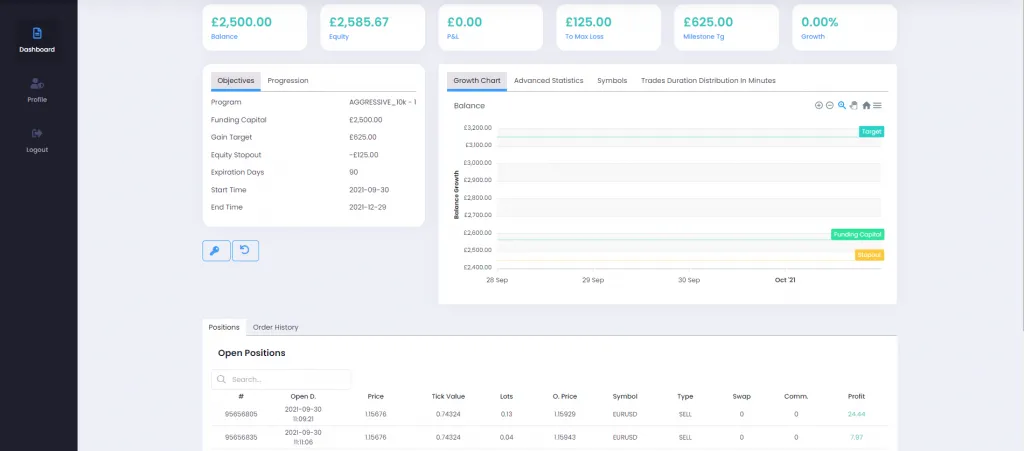

Trader Dashboard

FTUK provides its clients with an intuitively designed trader dashboard, offering several key functionalities:

- Home Page: The dashboard’s home page gives traders a comprehensive view of their account and trading performance.

- Statistics Page with Closed Positions: This section allows traders to analyze and reflect on their past trades, aiding in strategy refinement and risk management.

- Statistics Page with Open Positions: Traders can monitor their current open positions, providing real-time insights into their active trades.

These educational resources and the well-structured dashboard collectively empower FTUK’s traders with the knowledge and tools necessary for effective trading and risk management.

Trader Feedback and Reviews for FTUK

FTUK has garnered notable acclaim from its trading community, as evidenced by the feedback and reviews shared by traders. Here’s a summary of their reception:

Trustpilot Reviews

- FTUK boasts a strong presence on Trustpilot, with a high rating of 4.2 out of 5 based on 190 reviews. This score reflects the positive experiences of a large segment of their community.

- The positive feedback consistently highlights the efficiency and reliability of FTUK’s support team, underscoring their dedication to providing comprehensive assistance to traders.

Client Testimonials

- Many clients have emphasized the promptness and effectiveness of FTUK’s support services, a crucial factor in the fast-paced trading environment.

- The feedback also points to FTUK’s approach to violations, where traders are notified of soft violations instead of facing immediate account termination. This policy allows traders to learn from their mistakes and adjust their strategies accordingly, promoting a learning-friendly environment.

Overall, the positive reviews and comments from FTUK’s traders paint a picture of a prop firm that is not only committed to providing excellent support but also fosters a conducive environment for learning and growth.

Social Media Presence of FTUK

FTUK maintains a dynamic presence on various social media platforms, engaging with its community and providing updates and insights. Here’s a snapshot of their social media statistics:

- Facebook: Their Facebook page has attracted 364 followers, showcasing a growing community of engaged traders and enthusiasts.

- Twitter: On Twitter, FTUK has gathered a following of 126, using the platform for quick updates and interactions.

- Instagram: FTUK’s Instagram profile stands out with a significant 12.3k followers, indicating a robust engagement with visual content and updates.

- YouTube: The YouTube channel features 374 subscribers and a library of 90 uploaded videos, providing educational content, trader interviews, and more.

- Telegram: With 581 subscribers on Telegram, FTUK uses this platform for real-time communications and updates with its community.

FTUK’s active social media engagement reflects its commitment to staying connected with its audience, providing timely information, and fostering a vibrant trading community.

Support Services Offered by FTUK

FTUK provides comprehensive support to its clients through various channels, ensuring that traders have access to the information and assistance they need. Here’s an overview of their support services:

- FAQ Page: FTUK’s website includes a dedicated FAQ page, where traders can find answers to common questions and information about various aspects of their services.

- Social Media Support: The support team is actively engaged on social media platforms, offering an additional avenue for traders to reach out for assistance.

- Email Support: Direct email support is available at support@ftuk.com, providing a reliable way to get in touch with their team for detailed queries or assistance.

- Office Hours: FTUK’s office operates from Monday to Friday, between 09:00 and 18:00 GMT, during which traders can expect prompt responses to their inquiries.

- Telephone Support: For immediate assistance or detailed queries, traders can contact FTUK at +44 (20) 8798 2605.

These support options underscore FTUK’s commitment to offering accessible and timely assistance to its clients, enhancing the overall trading experience.

Conclusion: FTUK’s Role in the Proprietary Trading Firm Industry

FTUK emerges as a legitimate and commendable proprietary trading firm, presenting traders with two distinct funding program choices: the Evaluation Program and the Instant Funding Program.

Evaluation Program Accounts

- These accounts require traders to achieve a 10% profit target without exceeding a 6% maximum loss threshold.

- FTUK offers flexibility with no maximum or minimum trading day requirements.

- Traders must adhere to rules such as a required stop-loss, stop-loss risk per position, and lot size consistency.

Instant Funding Program Accounts

- Traders can bypass the profit target requirement for withdrawals from level two onwards.

- Similar to the Evaluation Program, there are no constraints on the number of trading days.

- The same trading rules apply: required stop-loss, stop-loss risk per position, and lot size consistency.

FTUK is highly recommended for traders seeking a prop firm with clear and straightforward rules. As a well-established entity in the proprietary trading sector, FTUK offers exceptional conditions suitable for a broad spectrum of traders, each with their unique trading styles. Considering all aspects, FTUK stands out as one of the more attractive and reliable options in the proprietary trading firm industry.