Embark on an in-depth exploration of TradingFunds, the Dubai-based prop trading firm revolutionizing the trading world with substantial funding options, flexible trading conditions, and enticing profit splits for skilled traders.

Embark on an in-depth exploration of TradingFunds, the Dubai-based prop trading firm revolutionizing the trading world with substantial funding options, flexible trading conditions, and enticing profit splits for skilled traders.

- Up to $2 Million in Funding.

- Flexible Trading Conditions.

- High Profit Splits (80% to 90%).

- Diverse Trading Instruments.

- No Time Limitations on Trading.

Table of Contents

TradingFunds: A Leader in Proprietary Trading

TradingFunds stands as a beacon in the proprietary trading industry, providing an unparalleled trading experience designed to overcome the challenges faced by many traders. Their platform facilitates seamless access to global markets, enabling traders to execute transactions with speed and precision. With a proven track record of empowering traders towards success, TradingFunds has solidified its status as a dependable partner for traders worldwide.

Discovering TradingFunds: A New Force in Proprietary Trading

TradingFunds emerged on the proprietary trading scene in February 2023, marking its presence with its headquarters in the vibrant city of Dubai, United Arab Emirates. As a fresh yet dynamic player, the firm is committed to uplifting disciplined yet undercapitalized traders, offering them a substantial funding opportunity of up to $2,000,000. This initiative is complemented by an attractive profit split ranging from 80% to 90%. Partnering with Eightcap as their broker, TradingFunds is positioned in the prestigious Emirates Financial Tower, signaling their commitment to excellence in the financial trading industry.

Leadership at TradingFunds

At the helm of TradingFunds is CEO Philip Hall, a pivotal figure driving the firm’s vision and strategy. As we continuously update our information, stay tuned for more insights and details about Philip Hall, the guiding force behind TradingFunds.

Funding Program Options at TradingFunds

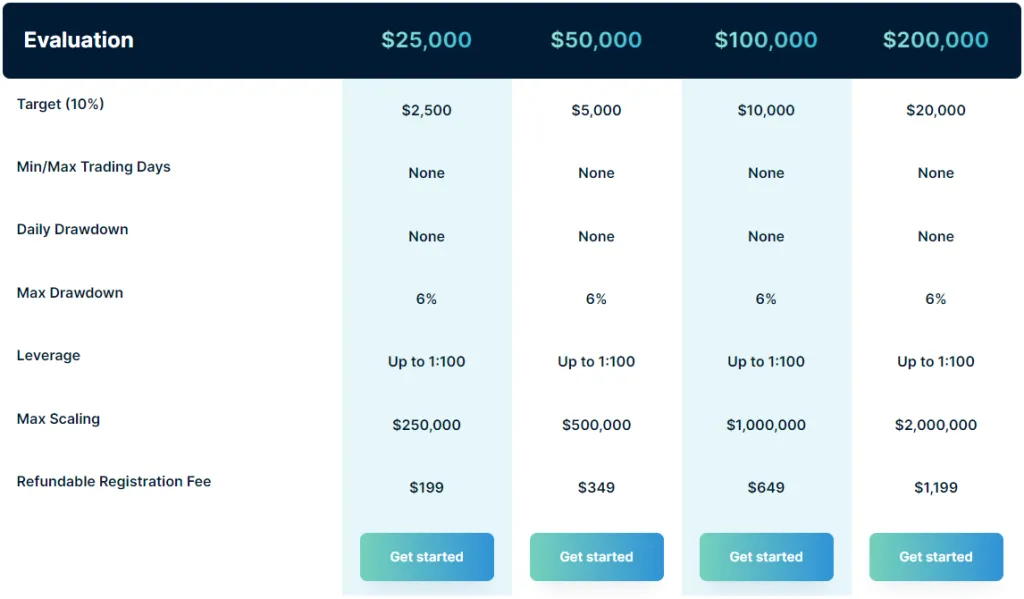

TradingFunds distinguishes itself with a one-step evaluation program, tailored to suit different trading styles and needs. This program is designed with four distinct account sizes, offering traders a streamlined path to success.

Understanding the Evaluation Program Accounts

The core objective of the TradingFunds evaluation program is to identify and nurture serious traders, enhancing their potential to maximize profits. This one-phase evaluation period emphasizes consistency in trading, rewarding traders for their steadfast approach. The program kickstarts with an initial leverage of 1:10, setting the stage for traders to showcase their skills.

In this phase, traders are tasked with achieving a 10% profit target, while adhering to a 6% maximum trailing drawdown rule. Notably, there are no restrictions on the minimum or maximum number of trading days, offering flexibility. The primary criterion for transitioning to a funded account is reaching the profit target. Upon successful completion of the evaluation phase, traders are granted a funded account. This stage liberates traders from profit targets, focusing solely on maintaining the 6% maximum trailing loss rule. Payouts commence 14 calendar days from the initiation of the first trade in the funded account, following a bi-weekly schedule. Profit splits range from 80% to 90%, depending on the profits accrued in the funded account.

Scaling Plan for TradingFunds Evaluation Program Accounts

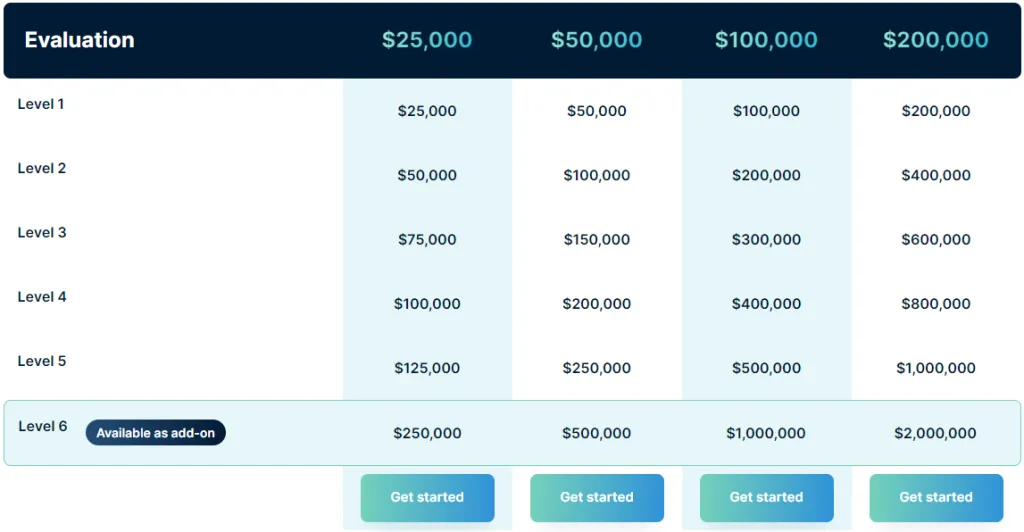

TradingFunds introduces a dynamic scaling plan within its evaluation program, designed to propel traders’ growth and success. This plan is centered around achieving set profit targets, enabling traders to advance to higher account levels.

Details of the Evaluation Program Account Scaling Plan

The cornerstone of the scaling plan is the achievement of a 10% profit target. Upon reaching this milestone, traders are eligible for an account upgrade. The extent of the account increase is contingent upon the size of the account being traded. The scaling plan is visually represented in a detailed image, providing a clear understanding of the progression based on different account sizes. When it comes to trading instruments, the evaluation program accounts offer a diverse range. Traders can engage in trading forex pairs, commodities, indices, and cryptocurrencies, giving them a broad spectrum of opportunities to reach their profit targets and scale their accounts effectively.

Rules of the Evaluation Program Account at TradingFunds

TradingFunds has established a set of definitive rules for its evaluation program accounts, ensuring clarity and fairness for its traders. These rules are crucial for traders aiming to complete the evaluation phase, withdraw profits, or scale their accounts.

Key Rules of the Evaluation Program Account

- Profit Target: The profit target is a crucial metric, set at 10% for the evaluation programs. This is the percentage of profit a trader must achieve to progress. Funded accounts, however, are exempt from profit targets.

- Maximum Trailing Drawdown: This rule stipulates a maximum drawdown of 6% for all account sizes, measured as the difference between the peak account balance and the maximum drawdown.

- Stop-Loss Requirement: Traders are obligated to set a stop-loss for each position before initiating a trade, enhancing risk management.

- Stop-Loss Risk Per Position: A fixed stop-loss risk of 2% per position is mandatory, ensuring controlled risk on each trade.

- Third-Party Copy Trading Risk: Utilizing third-party copy trading services comes with its own risks. If multiple traders use the same strategy through such a service, it could lead to a denial of a funded account or withdrawal, especially if it breaches the maximum capital allocation rule.

- Third-Party EA Risk: Similar to copy trading, using a third-party EA (Expert Advisor) can also pose risks. The use of identical strategies by multiple traders using the same EA may result in the rejection of account funding or withdrawal requests, particularly if it exceeds the set capital allocation limits.

What Sets TradingFunds Apart from Other Proprietary Trading Firms?

TradingFunds distinguishes itself within the proprietary trading firm landscape with its unique approach to trader autonomy and flexibility.

Unique Features of TradingFunds

One of the most prominent aspects that makes TradingFunds stand out is its non-restrictive approach to trading styles. Traders are at liberty to engage in trading during news events, hold positions overnight, and even over weekends. This freedom, however, comes with the responsibility to adhere to essential risk management rules, namely the mandatory stop-loss rule and a maximum risk limit of 2% per instrument. In contrast to many other leading prop firms, TradingFunds operates a one-phase evaluation program. This streamlined process requires traders to achieve a specific profit target prior to becoming eligible for payouts.

The parameters set for this evaluation include a 10% profit target and a 6% maximum trailing drawdown, along with the enforced stop-loss and a 2% maximum risk per instrument. A notable feature of this program is the absence of any minimum or maximum trading days, allowing traders the flexibility to reach their targets at their own pace without the pressure of time constraints. Furthermore, TradingFunds offers a scaling plan in their evaluation program, a feature that is not universally available with other leading prop firms.

This plan facilitates progressive growth for traders as they meet their targets. In summary, TradingFunds’ unique approach lies in its blend of trading freedom, including the ability to trade during various market conditions, and a structured yet flexible evaluation program.

These features, combined with a commitment to risk management and the absence of time limitations, position TradingFunds as a distinctive player in the proprietary trading firm industry.

Realism of Acquiring Capital from TradingFunds

For traders exploring the feasibility of obtaining capital through prop firms, the practicality of the trading requirements is a vital consideration.

Assessing the Realistic Nature of TradingFunds’ Capital Allocation

When evaluating prop firms, it’s crucial to balance the allure of high profit splits and substantial funding against the practicality of the trading requirements. Often, firms may propose attractive profit splits linked to high funded accounts. However, if these firms also demand unrealistically high percentage gains each month coupled with stringent maximum drawdown limits, the likelihood of a trader’s success can drastically diminish.

TradingFunds, in this regard, presents a more realistic and achievable scenario for traders. The firm sets an attainable 10% profit target along with a reasonable maximum loss rule, marked by a 6% maximum trailing drawdown. This balanced approach makes the prospect of receiving capital through their evaluation program accounts more feasible compared to the overly stringent conditions set by some other firms. Therefore, TradingFunds emerges as a commendable choice for traders seeking funding.

The evaluation program accounts offered by TradingFunds are designed with achievable trading objectives and payout conditions, aligning well with the realistic expectations and goals of most forex traders.

Understanding Payouts and Payment Proof at TradingFunds

In the world of proprietary trading, the authenticity and reliability of payouts are crucial factors for traders. Here’s an insight into how TradingFunds manages this aspect.

Payout Process and Proof at TradingFunds

Since its inception in February 2023, TradingFunds is relatively new in the market, which means there is yet to be substantial information available regarding payout proofs from their traders. This is a common scenario for newer firms where payout histories are still in the process of being established.

The payout procedure at TradingFunds is structured and trader-friendly. Payouts are initiated 14 days following the placement of a trader’s first trade in their funded account. Traders can anticipate an attractive profit split, ranging from 80% to 90%, which is considered high in the industry. Furthermore, the processing of payouts is conducted on the same day, ensuring timely access to earnings. In instances where a trader chooses not to withdraw their profits within the 14-day window, the option to continue trading on their account until the next profit split cycle is available.

This flexibility allows traders to strategize and plan their trading activities according to their preferences. Additionally, if a trader does not have any profits at the time of the scheduled withdrawal, their trading period is automatically extended, providing them with additional time to achieve profitability.

Broker Partnership of TradingFunds: Collaborating with Eightcap

Understanding the broker affiliations of a proprietary trading firm is essential for traders to gauge the reliability and scope of trading operations. Here’s a look at the broker used by TradingFunds.

Eightcap: The Broker Behind TradingFunds

TradingFunds has established its brokerage operations through a partnership with Eightcap. Eightcap is a reputable broker regulated by the Australian Securities and Investments Commission (ASIC) and is based in Melbourne, Australia. Since its inception in 2009, Eightcap has been on a mission to deliver superior financial services to its clients. Their global presence is marked by five offices worldwide, and they hold multiple regulations, extending their services to a diverse international clientele. Eightcap caters to a wide range of trading preferences, offering clients the opportunity to trade across various markets including FX, indices, commodities, and shares. This versatility ensures that traders associated with TradingFunds have access to a broad spectrum of trading options. When it comes to trading platforms, Eightcap provides two notable options:

- MetaTrader 4: Renowned for its user-friendly interface and advanced trading tools.

- MetaTrader 5: Offering more advanced features and greater analytical capabilities than its predecessor.

With Eightcap as its broker, TradingFunds assures its traders access to reliable and efficient trading platforms, enhancing their trading experience and opportunities in the global markets.

Trading Instruments Available at TradingFunds

TradingFunds offers an extensive array of trading instruments, catering to diverse trading preferences and strategies. Here is a comprehensive look at the instruments available for trading.

Diverse Trading Options with TradingFunds

- Forex Pairs: A broad selection of major, minor, and exotic pairs including AUD/USD, EUR/USD, GBP/USD, NZD/USD, USD/CAD, USD/CHF, USD/JPY, and many others.

- Commodities: Trade in commodities like XAG/USD (Silver), XAU/USD (Gold), XPT/USD (Platinum), XPD/USD (Palladium), BRENT, NGAS (Natural Gas), and WTI (West Texas Intermediate).

- Indices: Access global indices such as AUS200, ITA40, CHNIND, EU50, FRA40, GER30, HKIND, JAP225, SPA35, US100, US30, and US500.

- Cryptocurrencies: A wide range of cryptocurrencies including ADA/USD, AVE/USD, BCH/BTC, BCH/USD, BNB/USD, BSV/USD, BTC/EUR, BTC/USD, and many more.

With an initial leverage of 1:10, which can increase up to 1:100 through account scaling, traders at TradingFunds are equipped with the flexibility to engage in various markets. This expansive range of trading instruments, encompassing forex pairs, commodities, indices, and cryptocurrencies, allows traders to diversify their portfolios and adapt to changing market conditions.

Trading Fees at TradingFunds: Commission and Spread

Understanding the trading fees is a crucial aspect for traders considering joining TradingFunds. Here’s a breakdown of the commission and spread structure.

Trading Commission and Spread Details

| Assets | Fee Terms |

|---|---|

| FOREX | 4 USD / LOT |

| COMMODITIES | 0 USD / LOT |

| INDICES | 0 USD / LOT |

| CRYPTO | 0 USD / LOT |

To assess the live spreads, traders are advised to log in to the trading account. Here are the details for accessing the demo account on MetaTrader 5:

- Platform: MetaTrader 5

- Server: Eightcap-Demo

- Login Number: 3028689

- Password: cye3enbr

- Download Platform

This detailed overview of the trading fees, including the commission for various assets and the availability of live spread information, equips traders with essential financial information for trading with TradingFunds.

Education and Support Services at TradingFunds

TradingFunds places a strong emphasis on empowering its traders through education and support. Below is an overview of the educational content and support features they provide.

Educational Content and Supportive Tools

- Educational Content: Traders have access to a variety of educational materials under the News section. This resource pool includes a range of announcements, trading tips, and general news articles related to forex trading. This educational support is crucial for keeping traders informed and enhancing their trading strategies.

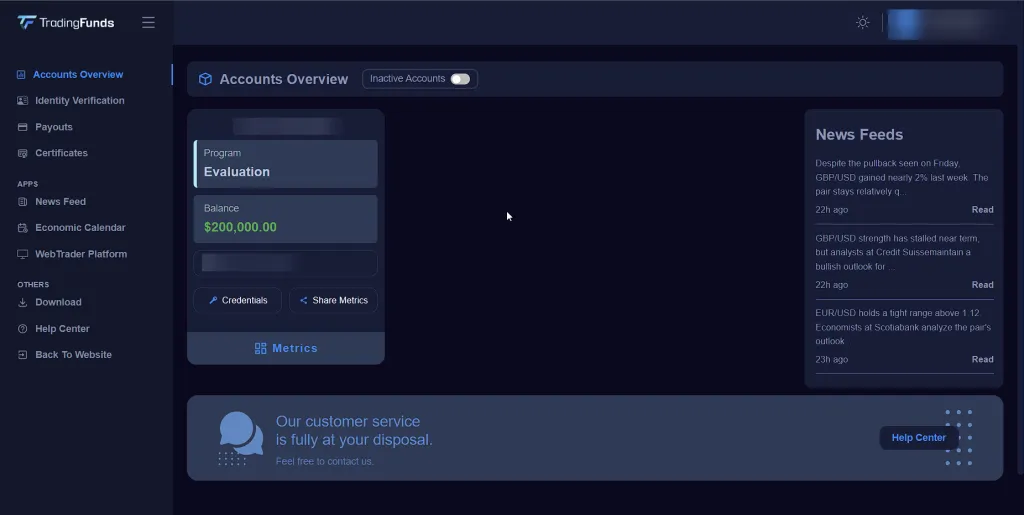

- Trading Dashboard: TradingFunds offers a well-organized trading dashboard that aids traders in monitoring their progress. This feature is particularly useful in managing risks and tracking the development of both evaluation and funded accounts. The dashboard is designed to provide traders with a clear view of their performance, assisting in more effective decision-making.

Through these educational and support services, TradingFunds demonstrates a commitment to not only providing a trading platform but also ensuring that its traders are well-equipped with the knowledge and tools necessary for successful trading.

Community Feedback on TradingFunds

Gauging trader sentiment and feedback is essential in assessing the reputation and reliability of a trading firm. Here’s what the trading community has to say about TradingFunds.

Traders’ Comments and Ratings for TradingFunds

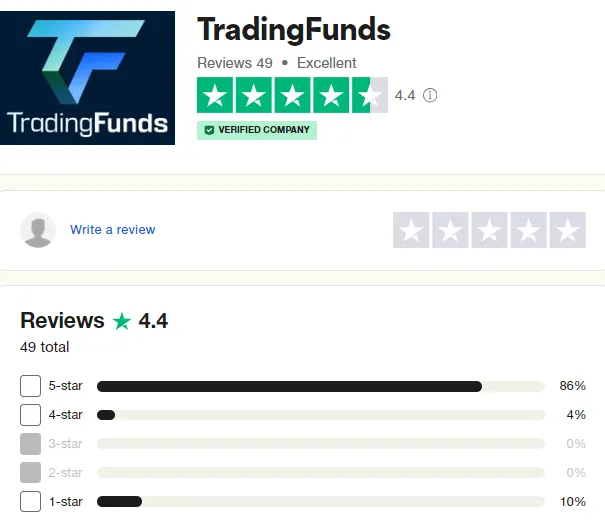

TradingFunds has garnered commendable feedback from its trading community. As evidenced on Trustpilot, the firm enjoys an impressive rating of 4.4 out of 5, based on 49 reviews. This positive response from users highlights the firm’s effectiveness and reliability in the trading world. It is, however, important to note that TradingFunds is a relatively new entrant in the market, having started its operations in February 2023. This recent inception means that the volume of feedback is still growing. The current lack of extensive feedback is primarily due to their recent launch. As the firm continues its operations, it is expected that more comprehensive feedback and reviews from traders will be added, providing a fuller picture of the firm’s performance and trader satisfaction. This initial positive reception is a promising indicator of TradingFunds’ potential and commitment to providing quality services in the proprietary trading sector.

Social Media Presence and Support Services of TradingFunds

TradingFunds extends its reach and interaction with traders through various social media platforms and comprehensive support services. Here’s an overview of their social media presence and support options.

Social Media Channels and Support Features

- Social Media Accounts: TradingFunds maintains an active presence on major social media platforms, including an Instagram account, a Facebook page, and a Twitter account. These platforms serve as additional channels for engagement, updates, and support for their trading community.

- FAQ Page: For detailed information about the company and guidelines for participating in their evaluation program, traders can refer to the FAQ page on TradingFunds’ website. This resource is valuable for obtaining clarity on common queries and operational aspects of the firm.

- Email Support: Traders seeking direct assistance can reach out to the support team via email at support@tradingfunds.com. This provides a direct line of communication for personalized support.

- Live Chat Support: TradingFunds also offers live chat support, which is operational nearly 24/7. This feature ensures prompt responses and real-time assistance, enhancing the overall support experience for traders.

Through its diverse social media presence and robust support infrastructure, TradingFunds demonstrates its commitment to maintaining an accessible, responsive, and supportive environment for its trading community.

Conclusion: TradingFunds Review

In summarizing the offerings and features of TradingFunds, it becomes evident that this new entrant in the proprietary trading firm sector brings promising opportunities for traders.

Final Assessment of TradingFunds

TradingFunds presents itself as a legitimate and innovative proprietary trading firm. It offers traders the flexibility to select from various evaluation program account sizes, catering to diverse trading needs and strategies.

The firm’s evaluation program is a streamlined one-phase challenge, designed to test and prepare traders for funded trading. Achieving a 10% profit target is the key requirement for funding, which aligns well with realistic trading goals, especially considering the 6% maximum trailing drawdown rule. Additionally, the mandatory stop-loss and 2% maximum risk per instrument rules underscore the firm’s emphasis on disciplined and risk-managed trading.

What sets TradingFunds apart is the absence of time constraints in its evaluation programs, allowing traders to progress at their own pace. Successful traders in these programs are rewarded with profit splits ranging from 80% to 90%, along with opportunities to scale their accounts. Given its flexible trading rules and comprehensive support system, TradingFunds is a commendable choice for a wide array of traders, especially those seeking a prop firm that accommodates various trading styles.

Its newness in the industry does not detract from the attractive trading conditions it offers, making it a standout choice in the proprietary trading firm landscape. Overall, TradingFunds is highly recommended for traders seeking a prop firm that combines relaxed trading rules with substantial growth opportunities, making it a compelling option in the proprietary trading sector.