Embarking on a journey with T4TCapital unveils a realm of opportunities for forex traders. From the intricacies of their Funding Challenge to the advantages of their scaling plan, discover how T4TCapital supports and elevates traders in the competitive forex market.

Embarking on a journey with T4TCapital unveils a realm of opportunities for forex traders. From the intricacies of their Funding Challenge to the advantages of their scaling plan, discover how T4TCapital supports and elevates traders in the competitive forex market.

- Structured Scaling Plan for Growth.

- Flexible Funding Challenge with No Time Limit.

- Competitive Profit Share Increase with Scaling.

- Comprehensive Support and Education Resources.

- Open to Multiple Evaluation Accounts for Scaling.

About T4TCapital Funds Management Prop Trading Firm

T4TCapital, a distinguished and well-established proprietary trading firm, offers a rich pool of trading talent and opportunities. Founded by Brad Gilbert, a seasoned professional trader and risk manager with over three decades of experience, T4TCapital addresses the notable gap in trader funding accessibility for the general public. Recognizing that full-time trading positions in the traditional fund management sector are often unattainable for most, T4TCapital champions the cause of equal opportunity irrespective of an individual’s race, background, or education level. The firm’s philosophy is simple: If you can demonstrate your trading prowess, T4TCapital will supply the necessary capital, cutting-edge trading technology, and support to jumpstart your trading journey.

Our Mission: T4TCapital is committed to creating a transparent and accessible funds management offering, breaking the barriers that traditionally reserved such opportunities for the extremely wealthy. The firm prides itself on delivering unprecedented value and opportunity for traders across the board.

As a Diversified Multi-Asset Class Proprietary Trading Firm, T4TCapital focuses on an array of trading domains including Equities, Forex, Metals, Commodities, and Cryptocurrencies. Upholding the highest professional standards of excellence, the firm fosters an environment of teamwork, communication, and support, enabling exceptional individuals to excel.

Proprietary Trading Mission: T4TCapital is dedicated to supporting and providing proprietary trading opportunities for all retail forex traders in their pursuit of success. With over 30 years of professional trading insight, the firm brings a unique perspective to both bank-level and retail market trading.

Solutions: Addressing one of the forex market’s major failure points, T4TCapital provides capital to forex traders aiming to achieve their aspirations of trading full-time professionally. This initiative empowers traders to explore, establish, and refine their trading styles and strategies, adapting to the ever-evolving market conditions.

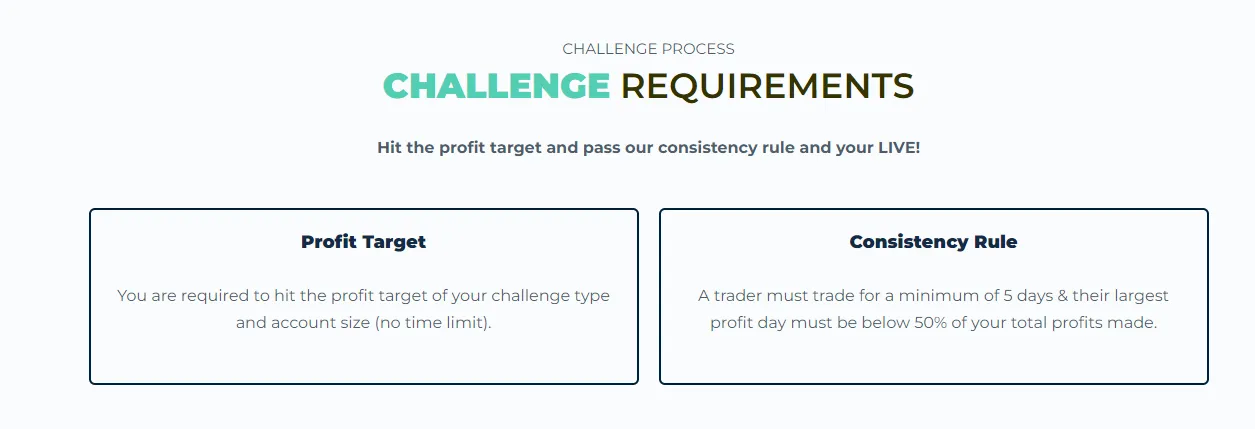

Securing a T4TCapitalFM™ Funded Account: The Process

Attaining a T4TCapitalFM™ Funded Account is exclusively achievable by passing the Funding Challenge, designed to test your trading mettle. Success in this challenge involves reaching the designated profit target without violating any drawdown limits and ensuring your most profitable day doesn’t exceed 50% of your total profits. Completion of the Funding Challenge necessitates the closure of all open trades, as the profit target is calculated post this action. With no set time limit to conquer the Funding Challenge, traders can take the time they need. Triumph grants you a T4TCapitalFM™ Funded Account within 24 hours post-success.

Multiplicity in Funding Challenges: What You Need to Know

When it comes to Funding Challenges and Live Funded Accounts, the rules are clear: traders may engage in multiple $50K & $100K Challenge accounts without limit but face a cap at $200K for live funding capital. Successful challenges lead to a consolidated live trading account, with opportunities to scale further. However, it’s important to note that performance and data cannot be transferred or combined across multiple Challenge accounts. For those in the Traders4Traders ‘High Performance Trader Mentoring’ Program, the ceiling extends to $2M in live funding, under specific conditions. The firm strictly enforces rules against misuse of multiple accounts to ensure fairness and integrity within its trading community.

Trading Platforms and Styles: Your Trading, Your Way

For trading, T4TCapitalFM™ provides access to MT5, renowned for its universal application in over-the-counter trading, with plans to incorporate cTrader and TradingView. Traders are welcomed to trade according to their personal style and use any Expert Advisors (EAs) they prefer, with the stipulation that each open position and pending order must have a stop-loss order attached. While trading on personal accounts is allowed, adherence to the firm’s rules remains paramount.

The Path to Funding: Steps and Stipulations

The Funding Challenge is not free, but it is structured as a one-off fee to alleviate pressure, allowing traders to progress at their own pace. Upon reaching the profit target, the trader must notify T4TCapitalFM™, though the firm’s audit team will also conduct a review to ensure compliance with the challenge’s rules. Successful verification leads to the issuance of the ‘Traders e-Agreement’ and the setup of a live trading account. The conditions for Funded accounts mirror those of the selected Challenge, maintaining consistency and clarity for the trader’s journey.

Challenge Resets: When and How

Traders have the option to reset their Challenge account under specific conditions, such as breaching account limits or for personal reasons. A reset provides a fresh start with a new trading account, facilitating a renewed attempt at meeting the Challenge’s criteria. This process underscores T4TCapitalFM™’s commitment to providing a supportive and adaptable trading environment.

Key Trading Guidelines and Rules at T4TCapitalFM

At T4TCapitalFM, every open position or pending order must be safeguarded with a valid stop loss. This rule is vital for risk management, especially considering the potential for significant account losses if an entry order is triggered without a stop loss during unpredictable market movements. Moreover, traders are permitted to hold positions over the weekend, albeit with caution advised regarding possible wide spreads at the Monday market opening, which could impact stop loss orders.

Minimum Trading Days and Risk Management: The T4TCapitalFM Funding Evaluation mandates a minimum of 5 trading days within the evaluation period, necessitating at least one position to be opened on each of these days. The maximum open position risk is capped at 5% of account equity, with all accounts operating under a 10:1 leverage, illustrating the firm’s commitment to prudent risk management.

Consistency Rule: To promote consistent profitability and effective risk management, T4TCapitalFM enforces a consistency rule wherein a trader’s highest profit day must not exceed 50% of their total profits. This rule underscores the importance of emotion-free, disciplined trading, aiming to cultivate a trader’s ability to generate sustainable profits.

Inactivity and Rule Breaches: Traders face automatic suspension for accounts inactive for 30 days, emphasizing the importance of regular market engagement. However, T4TCapitalFM distinguishes between soft and hard breaches, with some rule violations not necessitating a challenge reset, thereby offering traders a level of leniency to adjust and improve their strategies.

Understanding and adhering to these guidelines not only aligns with T4TCapitalFM’s standards but also equips traders with the discipline needed for long-term success in the volatile world of forex trading.

Understanding T4TCapitalFM™ Trading Regulations: Stop Loss and Weekend Trading

A mandatory stop loss order is required for every open position or pending order at T4TCapitalFM™, ensuring risk management and safeguarding your account from potential total loss, especially in scenarios where a trade is triggered without a stop loss. Moreover, traders have the flexibility to trade and hold positions over the weekend, despite the risk of wide spreads at Monday’s market open, which could impact stop loss orders. It’s crucial for traders to recognize and accept these risks without expectation of account reinstatement for such reasons.

T4TCapitalFM™ reserves the right to halt trading in response to highly volatile international events, with traders being notified through email and dashboard alerts. Additionally, the firm sets a minimum trading activity requirement, defining a trading day from 5pm New York time to 5pm the following day, and mandates that traders engage in trading activities at least once every 30 days to avoid account deactivation.

Risk Management and Trading Strategy Guidelines

Maximum open position risk is capped at 5% of account equity, with accounts set to 10:1 leverage. This risk management strategy defines the upper limit of open positions a trader can hold, based on the account’s size, to prevent excessive risk exposure.

The consistency rule, pivotal to the T4TCapitalFM™ Funding Challenge, mandates that a trader’s most profitable day cannot constitute more than 50% of total profits. This rule is designed to promote risk management and ensure the development of sustainable trading habits that prioritize consistent profitability over sporadic gains. Calculations for compliance with this rule are straightforward and are intended to encourage traders to adopt a disciplined approach to trading.

Navigating T4TCapitalFM™’s Loss Limit Regulations

The Maximum Daily Loss Limit and Maximum Overall Loss Limit are critical components of T4TCapitalFM™’s trading parameters. Breaching these limits necessitates a reset of your trading account, emphasizing the importance of continuous risk monitoring. The Maximum Daily Loss Limit accounts for all open and closed positions within a day, resetting at the start of each new trading day. Similarly, the Maximum Overall Loss Limit, whether trailing or fixed, includes all transactions throughout the account’s lifespan. These regulations underscore the necessity for prudent risk management and continuous monitoring of the equity balance within the MT5 platform.

Account limit breaches are classified as ‘hard breaches,’ requiring a reset of the challenge account to maintain fairness and uphold the integrity of the trading ecosystem at T4TCapitalFM™.

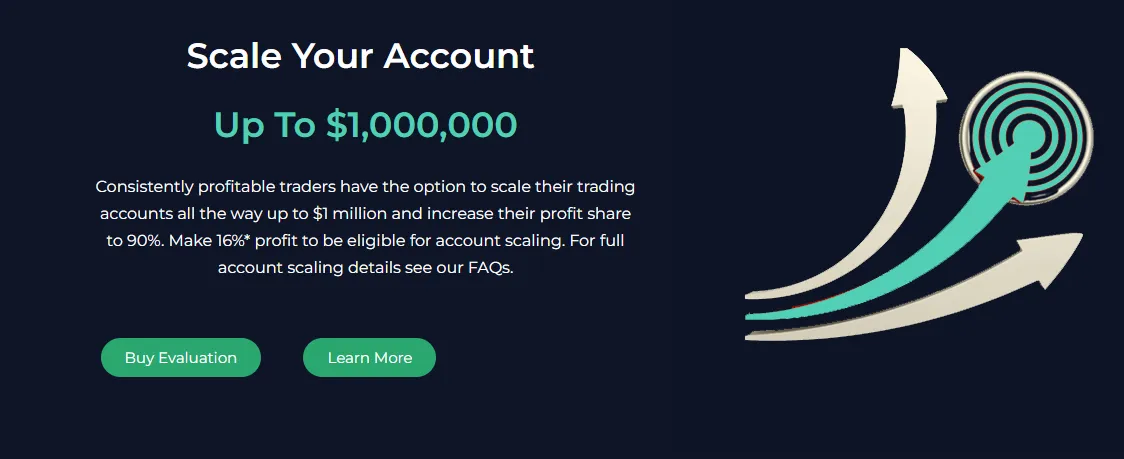

Exploring the T4TCapitalFM™ Scaling Plan: Elevating Your Trading Capital

The T4TCapitalFM™ scaling plan is meticulously designed to foster trader growth and enhance trading capital through strategic phases. Each phase in the scaling plan not only doubles the trader’s capital but also improves their profit share by an additional 5%. This structure is aimed at motivating traders to achieve higher profitability with increased trading capabilities.

| Account Size | Scaling Target | Profit Share |

|---|---|---|

| $100,000 | 16% | 75% |

| $200,000 | 16% | 80% |

| $400,000 | 16% | 85% |

| $800,000 | 10% | 90% |

Qualifying for Account Scaling: Your Path to Enhanced Trading Capacity

To qualify for account scaling at T4TCapitalFM™, traders with evaluation accounts starting from $100,000 must meet a profit threshold of 16% or higher. Upon meeting this target, traders are eligible for an account upgrade that doubles their trading limits and capital, alongside a 5% increase in their profit share. This opportunity is designed to significantly amplify a trader’s capacity to generate higher profits under more advantageous trading conditions.

Conditions for Scaling: Ensuring a Smooth Transition

Scaling is a significant milestone in a trader’s journey with T4TCapitalFM™, but it comes with specific prerequisites. Eligibility for scaling requires a minimum account size of $100,000, with the account being 16% in profit. Additionally, traders must not have previously scaled their account within the last 30 calendar days and must adhere strictly to all trading rules as outlined in the T4TCapitalFM™ Terms & Conditions. These criteria ensure that scaling is awarded to traders who demonstrate consistent profitability and adherence to the firm’s trading standards.

Profit Retention and Scaling: Maximizing Your Trading Potential

Upon electing to scale their account, traders will see their existing profits carried forward into the new, larger account. This transferred profit serves as the new baseline for drawdown limits, thereby safeguarding traders’ earnings while providing them with a broader scope for future trading activities. T4TCapitalFM™’s scaling plan thus offers a structured pathway for traders to escalate their trading career, aligning increased capital and profit shares with their proven trading prowess.

Navigating Payout Qualifications and Procedures at T4TCapitalFM™

To qualify for a payout with T4TCapitalFM™, traders must adhere to a set of conditions ensuring that they are in a position to benefit financially from their trading efforts. Notably, a trader can request their first payout within seven days after executing their initial trade. Subsequent payouts are scheduled for the first of each month, contingent upon the trader maintaining a minimum of 5.0% profit and adherence to all trading rules. Withdrawal requests lead to a deduction from the trader’s account balance, with the process taking three to five business days, potentially longer for international transfers.

Understanding the Profit Split and Payout Timing

The standard profit split for Challenge accounts stands at 75%, subject to variations based on account purchase conditions or scaling achievements. T4TCapitalFM™ encourages traders to view payouts as a reward mechanism, enhancing the value and appreciation of their trading efforts. The decision on when to initiate payouts should consider necessary drawdowns to maintain trading viability. A strategic approach involves assessing comfort with initial drawdown limits and setting profit targets accordingly, ensuring sustainable trading activity.

Requesting a Payout: Process and Options

Traders at T4TCapitalFM™ have the flexibility to decide on the timing and amount of their profit withdrawals, with requests made via a specified invoice form. Payouts can be processed through bank wire transfers or cryptocurrency, depending on the trader’s initial payment method. The firm schedules payouts on the first business day of each month, advising traders to submit requests well in advance to ensure timely processing.

Impact of Payouts on Trading Limits

Payouts directly influence a trader’s Maximum Trailing Loss (MTL) limit, adhering to a ‘no double-dip policy’. This policy ensures that payouts reduce the maximum drawdown limit proportionately, maintaining the trader’s starting balance as the threshold. Such measures emphasize the importance of prudent profit management and withdrawal strategies, enabling traders to maximize their earnings while safeguarding their trading capital.

Payout Examples: Illustrating the Impact on Account Balances

Example scenarios demonstrate how payouts affect traders’ balances and drawdown limits at T4TCapitalFM™. Whether withdrawing a portion of profits or a significant sum, the profit share arrangement determines the actual earnings received by the trader. Following a withdrawal, the trader’s account and maximum loss limits are adjusted, ensuring ongoing trading activities are supported by a prudent financial framework. These examples highlight the dual focus on rewarding trading success and maintaining disciplined risk management.

Securing Your T4TCapitalFM™ Funded Account: The Path to Trading Success

Obtaining a live T4TCapitalFM™ Funded Account is not immediate upon paying the fee; it necessitates passing the Funding Challenge first. This rigorous process ensures that only traders who demonstrate proficient trading skills and risk management can access a live funded account, devoid of any time constraints, thereby maintaining the integrity and standards of T4TCapitalFM™.

Multiple Funding Challenges: Expanding Your Opportunities

Traders are welcome to embark on multiple $50K & $100K Evaluation accounts to broaden their trading experience and opportunities. However, live funding capital is initially capped at $200K, with all verified accounts being merged into a single trading account. This setup facilitates subsequent scaling of the consolidated account as per the live account scaling program. For larger Challenges, such as the $200K or $400K, scaling up to $1M is possible but subject to T4TCapitalFM™ management approval, ensuring a balanced and fair approach to funding and scaling opportunities.

Refund Policy: Understanding Your Eligibility

T4TCapitalFM™ offers a refund for the Funding Challenge fee under specific conditions. If a trader has not engaged in any trading activity with their account, a refund is provided, highlighting the firm’s commitment to fair practice. However, once trading activity commences, the utilization of T4TCapitalFM™’s services negates the refund eligibility, reinforcing the principle that access to the firm’s resources and support constitutes a service rendered.

Funding Challenge Duration and Evaluation: Key Information

The timeline for the Funding Challenge is designed with flexibility in mind, allowing traders unlimited time to achieve the profit target while requiring at least one trading activity per month to keep the account active. This approach accommodates various trading strategies and schedules, ensuring traders can operate under conditions that best suit their approach to the markets. Similarly, the management of a Live T4TCapitalFM™ trading account does not impose a strict time limit, though inactivity beyond three months may lead to suspension, reflecting the firm’s expectation for ongoing engagement and interest in trading.

Achieving and Surpassing the Profit Target: Next Steps

Upon reaching the Funding Challenge’s profit target, the process to transition to a live funded account involves a thorough audit to confirm compliance with profit and risk management rules. Successful traders are then issued the ‘Traders e-Agreement’ to formalize the shift to live trading status. This seamless process ensures that the transition from challenge to live trading is as smooth and efficient as possible, with the same rules and limits applied to ensure consistency and clarity in trading conditions.

Challenge Fee Refund Upon Success: A Reward for Your Achievement

In recognition of traders’ success and to further incentivize excellence, T4TCapitalFM™ refunds the sign-up fee once a trader achieves a minimum of 2.5% profit. This policy not only rewards successful traders but also reinforces the value T4TCapitalFM™ places on skillful trading and risk management, underscoring the firm’s commitment to supporting traders in their continuous growth and success in the financial markets.

Final Thoughts: Unveiling the Potential with T4TCapitalFM™

T4TCapitalFM™ emerges as a beacon for ambitious traders seeking a credible path to professional trading. Through its structured Funding Challenge, the firm not only assesses a trader’s skill set and discipline but also cultivates an environment where strategic trading is rewarded with real financial opportunities. The firm’s dedication to fairness is evident in its refund policy, flexible challenge conditions, and the potential for account scaling, all of which contribute to a transparent and supportive trading ecosystem.

The multifaceted approach to trading, encompassing a variety of account sizes and the opportunity to engage in multiple challenges, ensures that traders of all levels can find a suitable platform to showcase their abilities. Moreover, the clear guidelines and requirements for payouts, combined with the profit-sharing model, highlight T4TCapitalFM™’s commitment to rewarding successful trading practices.

While the journey to obtaining a live funded account demands dedication and adherence to the firm’s trading rules, the structured pathway to success is laid out with clarity. Traders are encouraged to develop and refine their strategies within a framework designed to foster sustainable trading careers. The inclusion of a scaling plan further amplifies the potential for growth, making T4TCapitalFM™ a compelling choice for those committed to building a professional trading career.

In conclusion, T4TCapitalFM™ stands out as a prop trading firm that values skill, discipline, and a strategic approach to trading. With its comprehensive support system, clear progression pathways, and a focus on ethical trading practices, T4TCapitalFM™ offers a formidable platform for traders aiming to reach new heights in the competitive world of forex trading. For those ready to embark on this challenging yet rewarding journey, T4TCapitalFM™ may very well be the stepping stone to achieving professional trading mastery and financial success.