Discover how MyFundedFX is revolutionizing the trading world with their innovative challenge programs, providing traders with the opportunity to manage substantial accounts and earn lucrative profits.

Discover how MyFundedFX is revolutionizing the trading world with their innovative challenge programs, providing traders with the opportunity to manage substantial accounts and earn lucrative profits.

- Opportunity to Trade without Personal Capital.

- High Profit Splits up to 80%.

- Access to Large Account Sizes up to $300,000.

- Diverse Trading Options: Forex, Commodities, Indices, Cryptos.

- Rewarding for Profitable Traders.

Table of Contents

MyFundedFX Review: Empowering Traders with Challenge Programs

MyFundedFX presents a unique trading platform, specifically designed for traders who wish to participate in challenge programs. These programs are crafted to enable traders to engage in the market without the need to invest their personal funds. As a result, traders who demonstrate profitability are rewarded with a specified percentage of the profits generated. This approach ensures that they do not bear any financial risk in relation to the firm’s capital. One of the standout features of MyFundedFX is the opportunity it offers traders to handle substantial account sizes, with limits reaching up to $300,000. This presents a significant potential for high earnings, particularly with an attractive profit split of 80% in favor of the traders. The trading options available on this platform are diverse, encompassing forex pairs, commodities, indices, and even cryptocurrencies. This range provides traders with a broad spectrum of instruments to trade, maximizing their opportunities for profit in various markets.

Who are MyFundedFX?

MyFundedFX, a relatively new player in the proprietary trading firm space, was established in June 2022. The company, headquartered in the United States, operates from its office at 100 Crescent Court Suite 700, Dallas, TX 75201. This firm offers a distinctive opportunity for traders to merge their accounts up to a significant amount of $300,000. Additionally, MyFundedFX features an appealing scaling plan, providing traders with the potential to further increase their account balance. This US-based firm has built strategic partnerships with reputable brokers in the industry, including Eightcap, ThinkMarkets, and Blueberry Markets. These collaborations ensure that MyFundedFX traders have access to some of the best trading platforms and conditions in the market. The integration with these established brokers serves as a testament to the firm’s commitment to providing its traders with robust and reliable trading environments.

About Matthew Leech, CEO of MyFundedFX

At the helm of MyFundedFX is Matthew Leech, a dynamic figure who embodies the spirit of entrepreneurship in the financial and technology service sectors. His journey as a skilled trader encompasses a wide array of financial instruments, including forex, options, stocks, and cryptocurrencies. Since venturing into the trading world in 2018, Matt has not only honed his trading expertise but also has taken on the role of CEO at MyFundedFX, simultaneously managing several other business ventures.

Matt’s decision to establish MyFundedFX was driven by his perception of a critical need within the proprietary trading industry. He observed that many firms were designing programs which often overlooked the specific needs and challenges faced by individual traders. With the inception of MyFundedFX, Matt aimed to pivot from this trend. The company’s central focus is on empowering traders through education and providing a streamlined path to secure funding. Matt’s leadership is characterized by a strong commitment to this mission, ensuring that MyFundedFX remains dedicated to building and reinforcing the essential skills that traders need to become successfully funded.

Funding Program Options at MyFundedFX

MyFundedFX caters to the varied preferences and strategies of traders by offering three distinct funding program options. Each program is meticulously designed to align with different trading styles and skill levels.

- One-Step Evaluation Challenge Accounts: This program is tailored for traders who prefer a streamlined approach. It offers a single-step evaluation process, enabling traders to showcase their skills and strategy effectiveness without the need for a multi-stage evaluation.

- Normal Two-Step Evaluation Challenge Accounts: Designed for traders who are comfortable with a more traditional evaluation structure, this program involves a two-step process. It allows traders to demonstrate consistency and risk management skills over two distinct stages.

- Pro Two-Step Evaluation Challenge Accounts: Targeted towards more experienced traders, this program also follows a two-step evaluation format but with criteria and rewards structured to suit professional trading needs and expectations.

These programs reflect MyFundedFX’s commitment to providing flexible and accommodating options for traders at various stages of their trading journey.

MyFundedFX’s One-Step Evaluation Challenge Account Explained

MyFundedFX presents a streamlined one-step evaluation challenge account, designed to spot traders who consistently demonstrate discipline and skill. This one-phase evaluation allows trading with a leverage of 1:100 and offers various account sizes, each with a specific price:

- $5,000 account for $50.

- $10,000 account for $100.

- $25,000 account for $200.

- $50,000 account for $300.

- $100,000 account for $500.

- $200,000 account for $950.

- The largest, a $300,000 account, for $1,399.

One-Step Challenge: Profit Target and Loss Rules

In the one-step evaluation, traders are tasked with achieving a 10% profit target. This must be accomplished without exceeding a 4% maximum daily loss and a 6% maximum trailing loss. Importantly, there’s no time limit imposed for reaching this target, and traders are not constrained by a minimum number of trading days.

Transition to a Funded Account

Successful completion of the one-step challenge leads to a funded account. In this stage, there are no profit targets to meet, but traders must adhere to the 4% maximum daily loss and 6% maximum trailing loss guidelines. The first profit split is generous, with traders entitled to 80% of the profits made within the first 14 calendar days after initiating the first position. Payouts then continue on a bi-weekly schedule, maintaining a steady income stream for successful traders.

Scaling Plan for MyFundedFX’s One-Step Evaluation Challenge Account

The one-step evaluation challenge account offered by MyFundedFX includes a distinctive scaling plan, designed to encourage and reward consistent profitability over time. This plan outlines a path for substantial growth in account balance for successful traders.

Requirements for Scaling

Traders participating in the challenge need to meet specific performance criteria to benefit from the scaling plan:

- Achieving profitability within a three-month period.

- Maintaining an average return of at least 12% profit over this period.

Structure of the Scaling Plan

Upon meeting these requirements, traders are eligible for a 25% increase in their original account balance, subject to a maximum cap of $1,500,000. The plan operates on a rolling three-month cycle, with each successful period leading to further account growth.

Illustration of Account Growth

- Initial $200,000 account is scaled up to $250,000 after the first successful period.

- Following the next three months, the balance increases from $250,000 to $300,000.

- Subsequent periods see similar increments, such as $300,000 rising to $350,000, and so on.

Available Trading Instruments

The one-step evaluation challenge account offers a diverse range of trading instruments, providing ample opportunities for traders to leverage their skills. This includes:

- Forex pairs for currency market enthusiasts.

- Commodities as alternative trading options.

- Indices for those interested in broader market trends.

- Cryptocurrencies, catering to the modern digital asset traders.

For further insights into forex prop firms and funded trading programs, explore allproptradingfirms.com for comprehensive information.

Rules for MyFundedFX’s One-Step Evaluation Challenge Account

The one-step evaluation challenge account from MyFundedFX is governed by a set of well-defined rules, ensuring that traders adhere to specific trading parameters while striving for success. These rules are critical in maintaining the integrity and fairness of the evaluation process.

Key Rules of the Evaluation Challenge

Understanding and adhering to these rules is crucial for traders aiming to successfully navigate the evaluation phase and transition to a funded account:

Profit Target

- The profit target during the evaluation period is set at 10%.

- In the funded account phase, there are no profit targets, allowing more flexibility in trading strategies.

Maximum Daily Loss

- All account sizes are subject to a 4% maximum daily loss limit.

- This rule is essential in promoting disciplined risk management.

Maximum Trailing Drawdown

- The maximum trailing drawdown is consistently set at 6% across all account sizes.

- This drawdown is calculated based on the highest account balance achieved versus the maximum drawdown.

Specific Trading Constraints

Traders must also be mindful of other specific constraints when engaging with the one-step evaluation challenge account:

Lot Size Limit

- Lot sizes for trading instruments are typically based on the initial account balance.

- Adherence to these limits is crucial for maintaining trading discipline.

Third-Party Copy Trading and EA Risks

- Using third-party copy trading services can expose traders to the risk of violating the maximum capital allocation rule.

- Similarly, employing third-party Expert Advisors (EAs) carries the risk of employing identical strategies as other traders, potentially leading to fund withdrawal denials.

To gain a broader understanding of forex prop firms and their trading rules, visit allproptradingfirms.com for detailed insights and information.

MyFundedFX’s Two-Step Evaluation Challenge: A Comprehensive Guide

The MyFundedFX two-step evaluation challenge is tailored for traders who exhibit consistency and discipline. This evaluation program provides an opportunity to trade with a leverage of 1:100, across various account sizes, each associated with a specific fee:

- $5,000 account for $50.

- $10,000 account for $100.

- $25,000 account for $200.

- $50,000 account for $300.

- $100,000 account for $500.

- $200,000 account for $950.

- The largest, a $300,000 account, for $1,399.

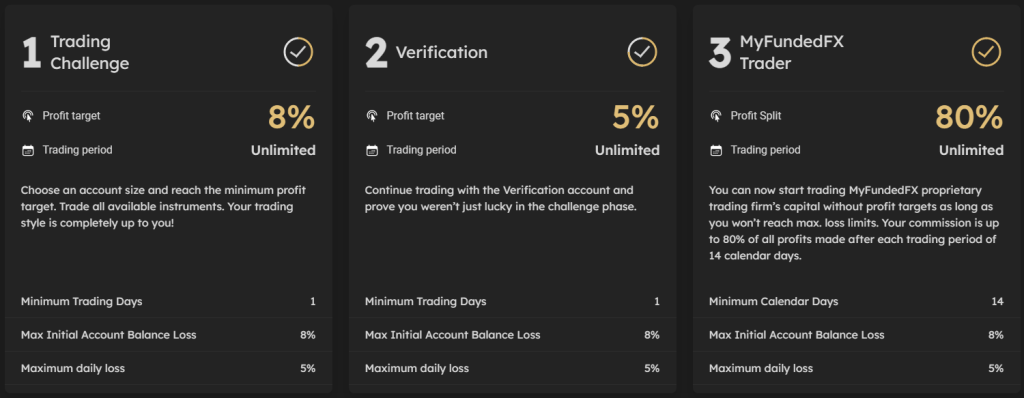

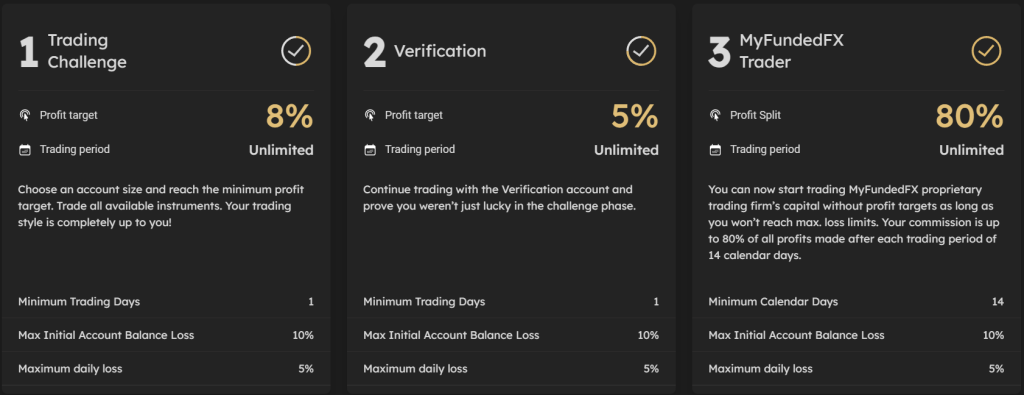

Evaluation Phase One: Target and Limits

The first phase of the evaluation requires traders to achieve an 8% profit target without exceeding a 5% maximum daily loss or an 8% overall maximum loss. This phase allows unlimited trading duration, with no set minimum trading days to qualify for the next phase.

Evaluation Phase Two: Advancing to Funded Status

In phase two, the focus shifts to a 5% profit target while maintaining the same loss limits as in the first phase. Again, there is no time limit or minimum trading day requirement for progressing to a fully funded account. Successful completion of both evaluation phases leads to a funded account where there are no set profit targets. However, the 5% maximum daily loss and 8% maximum loss rules still apply. The first payout is especially lucrative, with traders receiving 80% of the profits made in the first 14 days after placing the initial position. Thereafter, payouts are scheduled on a bi-weekly basis.

Scaling Plan for MyFundedFX’s Two-Step Evaluation Challenge Account

The two-step evaluation challenge account offered by MyFundedFX includes an enticing scaling plan. This plan requires traders to demonstrate profitability over a three-month period with an average return of 12% or more. Meeting this criterion leads to a 25% increase in the original account balance, with a cap at a maximum balance of $1,500,000.

Illustrating the Scaling Plan

Here’s how the scaling plan works:

- After the initial 3 months: A $200,000 account increases to $250,000.

- Following the next 3 months: The balance rises from $250,000 to $300,000.

- After another 3 months: The account grows from $300,000 to $350,000.

- This pattern continues, offering progressive increases in account balance.

Available Trading Instruments

Under the normal two-step evaluation challenge account, traders can engage in a variety of trading instruments. These include forex pairs, commodities, indices, and cryptocurrencies, providing a diverse range of options for traders to achieve the required profit targets.

Evaluation Challenge Account Rules Overview

Profit Targets in Different Phases

The evaluation challenge account is characterized by specific profit targets that traders must achieve to progress. During Phase 1, traders are tasked with reaching an 8% profit target. This target shifts in Phase 2, where a 5% profit target is set. It’s crucial to note that once traders are operating with a funded account, there are no profit targets imposed, offering more flexibility in trading strategies.

Maximum Daily and Overall Loss Limits

Another critical aspect of managing these accounts is adhering to loss limits. The maximum daily loss is capped at 5% for all account sizes, ensuring traders do not incur significant losses in a single day. Additionally, the overall maximum loss is set at 8%, beyond which the account is considered violated, emphasizing the importance of risk management.

Lot Size Restrictions

Traders must also be mindful of the lot size limits. These limits are usually determined based on the initial balance of the prop firm account and vary depending on the trading instrument used. This rule helps in maintaining consistency and risk management across different trading scenarios.

Third-party Copy Trading and EA Risks

Regarding the use of third-party tools, such as copy trading services or Expert Advisors (EAs), there are specific risks to consider. Utilizing a third-party copy trading service might lead to overlapping strategies with other traders, potentially affecting the uniqueness of your trading approach. Similarly, employing a third-party EA comes with the risk of strategy duplication. In both cases, exceeding the maximum capital allocation rule may result in the denial of a funded account or withdrawal.

MyFundedFX’s Pro Two-Step Evaluation Challenge Account Overview

The MyFundedFX’s Pro Two-Step Evaluation Challenge Account is designed to identify and reward traders who demonstrate consistency and discipline. This evaluation program offers a unique opportunity for traders to showcase their skills in a two-phase evaluation process, with the possibility of managing a substantial account size upon successful completion.

Account Options and Pricing

The program offers a range of account sizes, each associated with a specific entry fee:

- $5,000 Account: $70

- $10,000 Account: $135

- $25,000 Account: $250

- $50,000 Account: $375

- $100,000 Account: $575

- $200,000 Account: $1,100

- $300,000 Account: $1,600

Participants can trade with a leverage of 1:50 across these account options.

Phase One: Initial Evaluation

In the first phase of the evaluation, traders must achieve an 8% profit target without exceeding a 5% maximum daily loss or a 10% overall loss. Importantly, there is no time limit set for this phase, and traders are not bound by a minimum number of trading days.

Phase Two: Secondary Evaluation

Upon progressing to the second phase, the goal is to reach a 5% profit target, again adhering to the 5% maximum daily loss and 10% total loss constraints. Similar to the first phase, traders enjoy the flexibility of an unlimited trading period and no minimum trading day requirement.

Funded Account and Profit Sharing

Successful completion of both phases leads to a funded account. In this stage, there are no profit targets, but traders must maintain adherence to the 5% maximum daily loss and 10% total loss rules. Profits are shared generously, with traders receiving an 80% split. The first payout occurs 14 calendar days after the initial position in the funded account, followed by bi-weekly payouts thereafter.

Scaling Plan for MyFundedFX’s Pro Two-Step Evaluation Challenge Account

The Pro Two-Step Evaluation Challenge Account at MyFundedFX not only offers a pathway to a funded trading account but also includes an attractive scaling plan. This plan is designed to incrementally increase a trader’s account balance as they demonstrate consistent profitability over time.

Eligibility Criteria for Account Scaling

To qualify for the scaling plan, traders need to meet specific performance criteria:

- Traders must be profitable within a three-month period.

- An average return of 12% or more is required over this three-month period.

Meeting these criteria entitles the trader to a 25% increase in their original account balance, with the maximum account size capped at $1,500,000.

Examples of Account Growth

Here’s how the scaling plan can boost a trader’s account size:

- Initial $200,000 Account: After three months of meeting the criteria, the balance increases to $250,000.

- $250,000 Account: In the next three months, the balance can grow to $300,000.

- $300,000 Account: Subsequent three months can see an increase to $350,000.

- And the progression continues in a similar fashion.

Trading Instruments Available

Participants in the Pro Two-Step Evaluation Challenge Account have access to a diverse range of trading instruments. These include:

- Forex pairs

- Commodities

- Indices

- Cryptocurrencies

This variety allows traders to diversify their strategies and take advantage of different market dynamics.

Rules of MyFundedFX’s Pro Two-Step Evaluation Challenge Account

Understanding the rules is crucial for success in the Pro Two-Step Evaluation Challenge Account offered by MyFundedFX. These guidelines are designed to assess a trader’s skill and risk management abilities. Below is an overview of the key rules governing this evaluation program.

Profit Targets in Different Phases

Profit targets vary across different stages of the program:

- Phase 1 Profit Target: 8% of the account balance.

- Phase 2 Profit Target: 5% of the account balance.

- Funded accounts have no profit targets, offering more flexibility in trading strategies.

Maximum Daily Loss Limit

The maximum daily loss is a critical rule to manage risk effectively:

- All account sizes are subject to a 5% maximum daily loss limit.

- Exceeding this limit results in an account violation.

Overall Maximum Loss Limit

In addition to daily loss limits, there’s an overall loss threshold:

- For all account sizes, the maximum loss cap is set at 10%.

- Reaching this limit also constitutes an account violation.

Lot Size Limitation

Lot sizes for trading are determined based on the initial account balance:

- Traders must adhere to specific lot size guidelines tailored to different trading instruments.

Risks of Using Third-Party Copy Trading Services

There are specific considerations for those opting to use copy trading services:

- Using a third-party copy trading service may increase the risk of account denial or withdrawal issues if the maximum capital allocation rule is exceeded.

- This risk arises due to potential overlap with strategies used by other traders.

Risks of Using Third-Party Expert Advisors (EAs)

Similarly, there are risks associated with using third-party EAs:

- Using an EA might lead to the same risks as copy trading, especially if the strategy is widely used by others.

- Traders need to be cautious about exceeding the maximum capital allocation rule when using EAs.

VIP Program

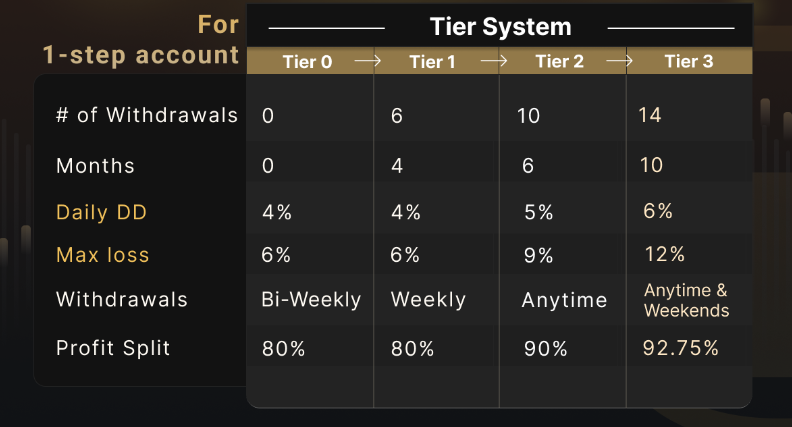

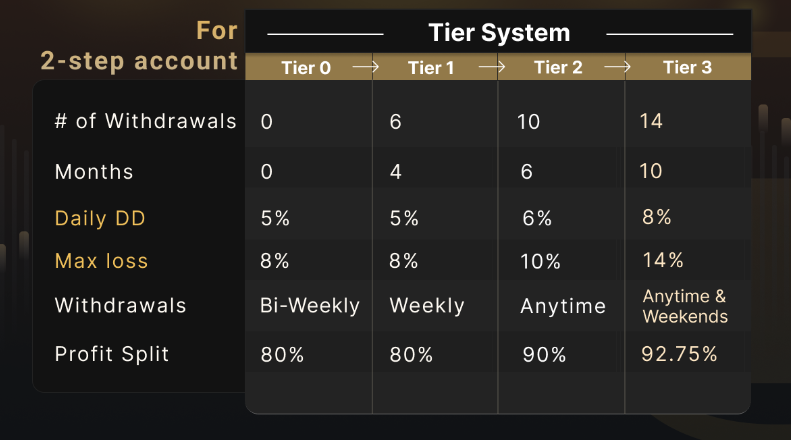

The VIP Program stands out as an exceptional offering, designed to reward traders who demonstrate consistent dedication and success in their trading endeavors. This program is structured with distinct criteria that traders must meet to qualify, emphasizing the importance of commitment and achievement in the trading journey.

VIP Program Requirements

To gain entry into the VIP Program, traders must meet several key requirements. These include:

- Successfully completing a minimum of six withdrawals.

- Engaging in trading activities for at least four months.

- Maintaining a consistent trading style throughout this four-month period. It’s important to note that styles categorized as ‘all-in’ or ‘high-risk’ do not qualify a trader for this program.

- Avoiding any account violations during the four-month qualifying period.

These criteria are designed to ensure that only the most dedicated and prudent traders are recognized and rewarded through the VIP Program.

VIP Program Benefits

The VIP Program offers a range of significant benefits for those who qualify, including:

- An enhanced profit split, reaching up to 92.75%, offering a higher share of the earnings.

- The flexibility to withdraw funds at any time without restrictions, as long as the account is in profit. The payout request button remains continually active for VIP members under these conditions.

- An increased daily drawdown limit, which is up to 6% for one-step evaluation accounts and up to 8% for two-step evaluation accounts, providing greater leeway in trading strategies.

- An expanded maximum drawdown limit, extended to 12% for one-step evaluation accounts and 14% for two-step evaluation accounts, allowing for more robust risk management.

These benefits are designed to enhance the trading experience and reward the dedication of VIP traders.

One-Step Evaluation Challenge: VIP Program

The VIP Program’s One-Step Evaluation Challenge is tailored for traders who prefer a more direct route to achieving VIP status. This challenge allows traders to demonstrate their skills and consistency in a single-phase evaluation process, streamlining their path to accessing the VIP benefits.

Two-Step Evaluation Challenge: VIP Program

Conversely, the Two-Step Evaluation Challenge within the VIP Program offers a more layered approach. This challenge requires traders to showcase their expertise over two distinct phases, adding an extra layer of assessment to ensure only the most competent and consistent traders attain VIP status.

What Sets MyFundedFX Apart From Other Prop Firms?

MyFundedFX distinguishes itself from other industry-leading prop firms through its unique funding program offerings and more lenient trading rules. Key differentiators include:

Varied Funding Programs

MyFundedFX offers a diverse range of funding programs, including a one-step evaluation and two variations of a two-step evaluation challenge. This flexibility caters to different trading styles and preferences, setting MyFundedFX apart in the sector.

Relaxed Trading Rules

Unlike many competitors, MyFundedFX offers relatively relaxed trading rules. Traders have the freedom to hold positions overnight and over weekends, and can also trade during news releases, providing greater flexibility in their trading strategies.

One-Step Evaluation Challenge

The one-step evaluation challenge at MyFundedFX requires traders to complete just one phase before qualifying for payouts. This program features a 10% profit target with a 4% maximum daily and 6% maximum trailing loss rule. Notably, there are no minimum or maximum trading day restrictions during the evaluation period. Additionally, these accounts benefit from a scaling plan, offering a balanced mix of achievable targets and unrestricted trading duration.

Two-Step Evaluation Challenge

In the two-step evaluation challenge, traders must successfully navigate through two phases to become eligible for payouts. The first phase has an 8% profit target, followed by a 5% target in the second phase. The maximum daily loss is capped at 5%, with an 8% maximum overall loss. Like the one-step challenge, there are no trading day limits, and accounts in this program also come with a scaling plan. Compared to other leading firms, MyFundedFX’s two-step challenge presents relatively lower profit targets combined with the advantage of unlimited trading periods.

Comparison: MyFundedFX vs. Funding Pips

When comparing MyFundedFX and Funding Pips, it’s essential to look at their trading objectives and terms. Here’s a breakdown of the key differences and similarities:

| Trading Objectives | MyFundedFX (Normal) | Funding Pips |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 8% | 10% |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 80% up to 90% |

This comparison shows that while there are similarities in profit targets and loss limits between MyFundedFX and Funding Pips, a notable difference lies in the maximum loss allowance and the profit split percentage.

Comparison: MyFundedFX vs. True Forex Funds

A comparative analysis between MyFundedFX’s normal program and True Forex Funds’ Quick Funding program highlights key similarities and differences in their trading objectives:

| Trading Objectives | MyFundedFX (Normal) | True Forex Funds (Quick Funding) |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 8% | 10% |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: 30 Calendar Days Phase 2: 60 Calendar Days |

| Profit Split | 80% | 80% |

This comparison reveals that while MyFundedFX and True Forex Funds share similar profit targets and loss limits, a notable distinction exists in the maximum trading period for each phase, with True Forex Funds imposing specific time constraints.

MyFundedFX vs. FundedNext: A Detailed Comparison

Overview of Trading Objectives

In the competitive world of forex prop trading, MyFundedFX and FundedNext stand out with their distinct trading objectives and evaluation criteria. Both firms offer traders opportunities to prove their trading skills, but with varying targets and rules.

Key Trading Parameters

Here’s a breakdown of the essential trading objectives for both MyFundedFX and FundedNext:

- Phase 1 Profit Target: Both firms set this at 8%.

- Phase 2 Profit Target: A consistent 5% for each.

- Maximum Daily Loss: Capped at 5% by both.

- Total Maximum Loss: MyFundedFX limits this to 8%, while FundedNext allows up to 10%.

- Minimum Trading Days: FundedNext requires a minimum of 5 calendar days, whereas MyFundedFX imposes no such restriction.

- Maximum Trading Period: Both offer unlimited trading periods for Phase 1 and 2.

- Profit Split: MyFundedFX offers a flat 80% split, while FundedNext starts at 80%, potentially rising to 90%.

Comparative Analysis of MyFundedFX

MyFundedFX, a prominent name in the prop firm arena, provides a pro two-step evaluation challenge. This challenge is designed to assess a trader’s capability to handle real-world trading scenarios. Here’s an overview of what MyFundedFX offers:

- The initial profit target is set at 8% for Phase 1, followed by 5% in Phase 2.

- Traders must adhere to a 5% maximum daily loss and a 10% overall loss limit.

- Unique to MyFundedFX, there are no constraints on minimum or maximum trading days during the evaluation.

- Additionally, the firm introduces a scaling plan within its evaluation challenge.

- When compared to other leading prop firms in the industry, MyFundedFX offers relatively achievable profit targets, average drawdown limitations, and an unrestricted trading period.

Comparing MyFundedFX and Finotive Funding: A Trading Objectives Analysis

Overview of Key Trading Parameters

MyFundedFX and Finotive Funding are two prominent players in the forex prop trading scene. Each offers unique opportunities and challenges to traders, outlined in their specific trading objectives.

Detailed Comparison of Trading Criteria

Below is a comparative analysis of the trading objectives set by MyFundedFX and Finotive Funding:

- Phase 1 Profit Target: MyFundedFX requires 8%, while Finotive Funding sets it slightly lower at 7.5%.

- Phase 2 Profit Target: Both firms maintain a 5% target in Phase 2.

- Maximum Daily Loss: A uniform limit of 5% is set by both.

- Total Maximum Loss: MyFundedFX has an 8% limit, compared to Finotive Funding’s higher threshold of 10%.

- Minimum Trading Days: Neither firm imposes minimum trading days, offering flexibility to traders.

- Maximum Trading Period: Both MyFundedFX and Finotive Funding offer unlimited trading periods for both phases.

- Profit Split: MyFundedFX offers a consistent 80% split, whereas Finotive Funding starts at 75%, with the potential to increase up to 95%.

Comparative Insights

When comparing MyFundedFX and Finotive Funding, several key distinctions emerge:

- MyFundedFX sets a slightly higher profit target in Phase 1, potentially catering to more experienced traders.

- Finotive Funding’s maximum loss allowance is more generous, providing a bit more leeway for traders in managing risk.

- The profit split at Finotive Funding is more dynamic, offering a higher potential reward for successful traders.

- Both firms provide ample opportunity for traders to operate without the pressure of minimum trading days, a feature that enhances their appeal in the prop trading community.

MyFundedFX vs. E8 Funding: Trading Objectives Comparison

Comparative Analysis of Key Trading Criteria

In the realm of forex prop trading, MyFundedFX and E8 Funding offer unique opportunities for traders. Understanding their trading objectives is crucial for anyone looking to collaborate with these firms.

Detailed Breakdown of Trading Objectives

Here’s a side-by-side comparison of the trading objectives set by MyFundedFX and E8 Funding:

- Phase 1 Profit Target: Both firms have an identical target of 8%.

- Phase 2 Profit Target: Consistently set at 5% by both MyFundedFX and E8 Funding.

- Maximum Daily Loss: Set at 5% for both firms, ensuring a level playing field.

- Total Maximum Loss: While MyFundedFX sticks to an 8% limit, E8 Funding offers a scalable limit up to 14%, providing greater flexibility.

- Minimum Trading Days: Both firms do not require a minimum number of trading days, adding to the flexibility for traders.

- Maximum Trading Period: Unlimited for both Phase 1 and Phase 2 at MyFundedFX and E8 Funding.

- Profit Split: A uniform profit split of 80% is offered by both firms.

Comparative Insights

A closer look at MyFundedFX and E8 Funding reveals several interesting contrasts and similarities:

- Both MyFundedFX and E8 Funding have aligned their profit targets for both phases, indicating a standard industry benchmark.

- E8 Funding’s scalable maximum loss feature offers traders the chance to manage risk more effectively and potentially trade more aggressively.

- The absence of minimum trading days in both firms’ policies underscores a commitment to trader flexibility and accommodates various trading styles.

- The identical profit split ratio indicates a shared approach to rewarding successful trading.

MyFundedFX vs. Smart Prop Trader: A Comparative Review

Key Trading Objectives Compared

MyFundedFX and Smart Prop Trader are two notable entities in the forex prop trading landscape. They each offer distinct trading objectives and opportunities for traders to excel.

Comparison of Trading Parameters

Here’s a detailed comparison of the trading objectives for MyFundedFX and Smart Prop Trader:

- Phase 1 Profit Target: MyFundedFX sets this at 8%, while Smart Prop Trader offers a slightly lower target of 7%.

- Phase 2 Profit Target: Both firms agree on a 5% target in Phase 2.

- Maximum Daily Loss: MyFundedFX allows up to 5%, compared to Smart Prop Trader’s tighter limit of 4%.

- Total Maximum Loss: Both firms set an 8% limit, aligning their risk thresholds.

- Minimum Trading Days: Neither firm imposes a minimum number of trading days, providing flexibility for traders.

- Maximum Trading Period: Both offer an unlimited trading period for Phase 1 and Phase 2.

- Profit Split: MyFundedFX maintains a steady 80% split, whereas Smart Prop Trader starts at 85% and can increase to 90%.

MyFundedFX: Distinctive Features

MyFundedFX differentiates itself from many leading prop firms in the industry with its unique offerings:

- It provides three different funding programs, catering to a diverse range of trading styles and preferences.

- The trading rules are relatively relaxed, allowing for a broad spectrum of trading strategies.

- Traders have the advantage of an unlimited trading period, which is not commonly found in the industry.

- MyFundedFX permits holding trades overnight and during weekends, as well as trading during news releases, offering more freedom and flexibility.

Conclusion

In conclusion, both MyFundedFX and Smart Prop Trader offer unique and competitive terms for prop traders. MyFundedFX stands out with its flexible trading conditions and diverse funding programs, while Smart Prop Trader offers a higher profit split and tighter daily loss limits. This comparison should assist traders in making informed decisions based on their individual trading styles and preferences.

Assessing the Realism of Acquiring Capital with MyFundedFX

Evaluating Trading Requirements for Forex Traders

When selecting a prop firm that aligns with your forex trading style, it’s crucial to analyze the realism of their trading requirements. MyFundedFX offers various funding programs, each with its own set of objectives and rules that cater to different trading styles.

Feasibility of the One-Step Evaluation Challenge Accounts

The one-step evaluation challenge accounts at MyFundedFX present a realistic opportunity for traders due to:

- An average profit target of 10%, which balances ambition with achievability.

- Reasonable maximum loss rules, including a 4% maximum daily and a 6% maximum trailing loss, providing a fair balance between risk and reward.

Practicality of the Normal Two-Step Evaluation Challenge Accounts

The normal two-step evaluation challenge accounts offer realistic prospects for traders with:

- Relatively low profit targets of 8% in phase one and 5% in phase two, making them achievable for a wide range of trading strategies.

- Slightly below-average maximum loss rules, with a 5% maximum daily and an 8% overall loss limit, offering a moderate level of risk management.

Viability of the Pro Two-Step Evaluation Challenge Accounts

The pro two-step evaluation challenge accounts also provide realistic goals with:

- Similarly low profit targets of 8% for phase one and 5% for phase two, encouraging consistent trading performance.

- Average maximum loss rules, including a 5% daily limit and a 10% overall limit, aligning with industry standards.

Conclusion: MyFundedFX as a Viable Option for Funding

Considering the various funding programs and their respective trading objectives, MyFundedFX emerges as an excellent choice for traders seeking realistic paths to funding. The firm’s diverse range of programs, each with attainable targets and sensible risk parameters, makes it a strong contender for traders looking to achieve funding success in the forex market.

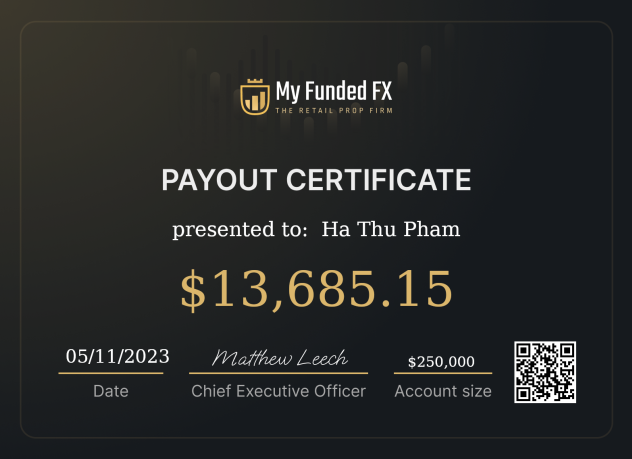

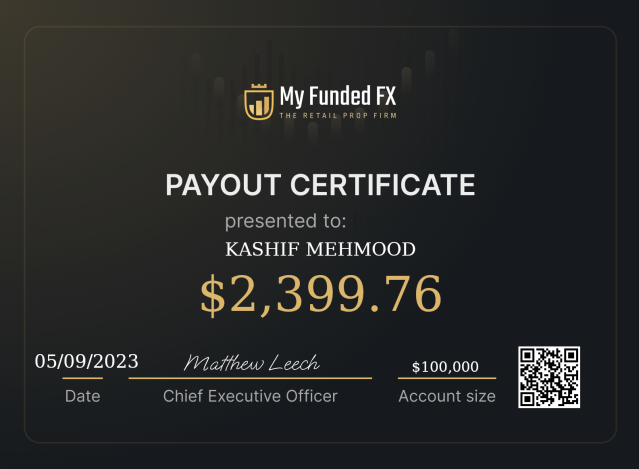

Payment Proof for MyFundedFX: Verifying Reliability

Understanding the Payout Structure of MyFundedFX

Established in June 2022, MyFundedFX has developed a transparent and consistent payout structure for its traders. Understanding the payout timeline is crucial for anyone considering this prop firm.

Payout Timeline for Live-Funded Accounts

Once you receive a live-funded account from MyFundedFX, the payout process is straightforward and timely:

- Your first payout becomes available within 14 calendar days of trading with a live-funded account.

- Subsequently, traders are eligible for bi-weekly payouts, maintaining a regular income stream.

Verifying Payment Proofs

For those seeking validation of MyFundedFX’s reliability in payments, the firm offers transparent proof:

- A significant amount of payment proof can be found on MyFundedFX’s official Discord channel.

- The “Payout proof” section on Discord showcases real examples of successful payouts to traders, reinforcing the firm’s credibility.

Conclusion: MyFundedFX’s Trustworthy Payment System

The availability of payment proofs and a clear payout structure underscore MyFundedFX’s commitment to providing a trustworthy and reliable trading environment. For traders, this means not only the opportunity to trade with a funded account but also the assurance of timely and regular payouts.

MyFundedFX Broker Partnerships

MyFundedFX collaborates with notable brokers such as Eightcap, ThinkMarkets, and Blueberry Markets to offer its services.

Eightcap: A Melbourne-based Brokerage

Founded in 2009 in Melbourne, Australia, Eightcap is an ASIC-regulated broker known for its commitment to providing outstanding financial services. The firm boasts a global presence with five offices worldwide and multiple regulatory approvals, enabling a broad range of trading options in FX, indices, commodities, and shares.

ThinkMarkets: Multi-Asset Online Brokerage

ThinkMarkets, headquartered in London and Melbourne, is a distinguished multi-asset online broker. It offers easy access to various markets, coupled with some of the industry’s most acclaimed trading solutions like MetaTrader 4, MetaTrader 5, and the proprietary ThinkTrader platform.

Blueberry Markets: Forex Trading with a Global Reach

As an ASIC-regulated online Forex broker, Blueberry Markets serves a global clientele, offering access to a wide array of financial instruments. The broker is renowned for its commitment to delivering a top-notch trading platform, ultra-competitive spreads, and dedicated 24/7 customer support.

Trading Platforms Available

Regarding trading platforms, MyFundedFX enables trading on popular platforms such as MetaTrader 4 and MetaTrader 5, catering to a diverse range of trading preferences.

Trading Instruments Offered by MyFundedFX

MyFundedFX provides an extensive range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies, with the option of leveraging up to 1:100.

Forex Trading Options

Forex traders can access a diverse array of currency pairs:

- Main Pairs: EURUSD, USDJPY, GBP/USD, USDCHF, USDCAD, AUDUSD, NZDUSD

- Comprehensive Range: Including pairs like AUDJPY, AUDNZD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, and many others.

- Exotic Options: Including EURCZK, EURDKK, EURHKD, EURNOK, EURPLN, EURSEK, and more.

Commodity Trading

Traders interested in commodities have the following options:

- Precious Metals: Including XAGUSD (Silver), XAUUSD (Gold), and XPTUSD (Platinum).

- Other Commodities: Like Copper (COPPER).

Indices for Diverse Market Exposure

Indices available for trading encompass:

- Major Global Indices: Such as DAX, ESP35, EUSTX50, FRA40, JPN225, NAS100, NGAS, SPX500, and UK100.

Cryptocurrency Trading

A wide range of cryptocurrencies are available, including:

- Major Cryptocurrencies: Like BTCUSD (Bitcoin), ETHUSD (Ethereum), and LTCUSD (Litecoin).

- Altcoins and Others: Including BATUSD, BCHUSD, BNBUSD, DASHUSD, DOGEUSD, EOSUSD, ETCUSD, IOTAUSD, NEOUSD, OMGUSD, TRXUSD, UKOil, XLMUSD, XMRUSD, XRPUSD, and ZECUSD.

Overall, MyFundedFX offers a versatile and comprehensive range of trading instruments to suit various trading strategies and preferences.

MyFundedFX Trading Fees and Commissions

MyFundedFX employs a straightforward fee structure for its trading services, encompassing commissions and spreads across various assets.

Trading Commission Details

The trading commissions for different asset classes are as follows:

- Forex: A commission of 5 USD per lot.

- Commodities: A commission of 5 USD per lot.

- Indices: No commission charged (0 USD per lot).

- Cryptocurrencies: No commission charged (0 USD per lot).

Understanding Spreads

For information on live spreads, traders can log in to their trading accounts with the following details:

- Platform: MetaTrader 5

- Server: ThinkMarkets-Demo

- Login Number: 8200010

- Password: Test1234#

- Platform Download: Click here to download the platform.

This transparent fee structure by MyFundedFX ensures that traders are well-informed about the costs associated with their trading activities.

Education and Support for Traders at MyFundedFX

Lack of Direct Educational Content

Currently, MyFundedFX does not offer educational content directly on its website. This may require traders, especially beginners, to seek learning resources elsewhere to enhance their trading skills and knowledge.

Community Discussions and Mentions

However, traders can find discussions and mentions of MyFundedFX on external forums. For instance, a notable thread on ForexFactory titled ‘PROP FIRM HUB’ by MasterrMind includes numerous mentions of MyFundedFX. This can be a valuable resource for insights and community opinions. To view this thread, click here.

Structured Dashboard for Effective Risk Management

In terms of support, MyFundedFX offers a well-organized dashboard accessible to all its clients. This dashboard aids in managing risks efficiently, providing clear insights into various trading objectives and statistics. While the direct educational support is limited, the community engagement and the structured dashboard provided by MyFundedFX can be beneficial for traders in managing their trading activities.

MyFundedFX: Community Feedback and Trader Comments

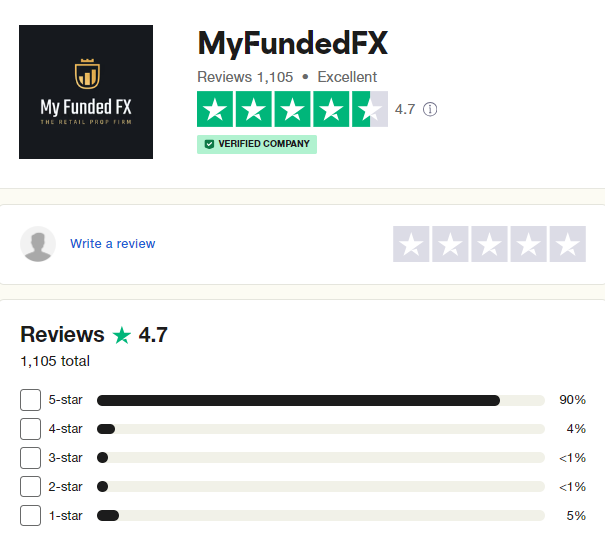

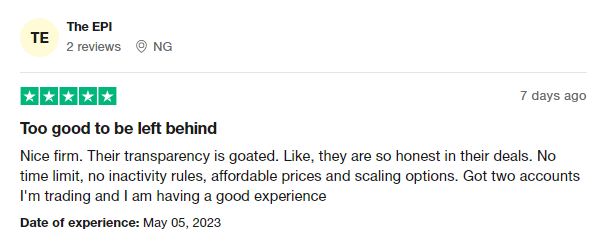

MyFundedFX has garnered significant acclaim based on user reviews and feedback. With a remarkable rating of 4.7 out of 5 on Trustpilot, the prop firm has received commendations from a broad section of its community, evident in 1,105 reviews.

The community of MyFundedFX frequently lauds its efficient live chat support team. This team is renowned for providing comprehensive and prompt responses to any inquiries, ensuring traders have the information they need for a smooth trading experience. Additionally, traders express considerable appreciation for MyFundedFX’s accommodating trading conditions. The absence of time constraints, no inactivity penalties, and a generous scaling plan are among the aspects that have received positive acknowledgment, highlighting the company’s commitment to facilitating a trader-friendly environment.

MyFundedFX’s Presence on Social Media

MyFundedFX maintains an active presence on various social media platforms, engaging with its community through different channels.

- On Facebook, MyFundedFX hosts a group that has attracted a substantial membership of 9.6k individuals, reflecting its popularity and community engagement.

- The firm’s YouTube channel boasts 3.26k subscribers and features a collection of 12 videos, providing insights and updates about their services and offerings.

- Further expanding their reach, MyFundedFX has established a Discord channel, which has garnered a remarkable membership of 46,110 members. This platform serves as a dynamic space for community interaction and discussion.

- Additionally, the firm operates a Telegram channel with 3,830 members, further facilitating communication and engagement with its community.

These social media platforms offer valuable resources and a platform for community members to connect, share experiences, and stay updated with MyFundedFX’s latest developments and offerings.

Support Services at MyFundedFX

MyFundedFX is dedicated to providing comprehensive support to its clients and community members.

- The prop firm offers a detailed FAQ page, designed to address common queries and provide essential information efficiently.

- For personalized assistance, the support team is accessible through various channels. Clients can reach out via social media platforms or directly through email at support@Myfundedfx.com.

- In addition, MyFundedFX prides itself on its highly effective live chat support. This feature ensures that users receive prompt and helpful assistance for any challenges they encounter or for general inquiries about the firm’s proprietary trading services.

This multi-channel support structure emphasizes MyFundedFX’s commitment to ensuring a seamless and supportive trading experience for its users.

MyFundedFX Review Conclusion

In summary, MyFundedFX stands out as a reputable and genuine proprietary trading firm, offering diverse funding programs tailored to traders’ needs. This London-based company presents three distinct funding options: a one-step challenge account and two variations of the two-step challenge account, each with its own unique features. The one-step evaluation challenge account is designed for efficiency, requiring traders to complete just one phase to become funded and eligible for profit sharing. The target is a realistic 10% profit, balanced against a 4% maximum daily drawdown and a 6% maximum trailing drawdown. Successful traders in this program can expect an 80% profit split and opportunities for account scaling. MyFundedFX’s standard two-step evaluation challenge follows the industry norm, comprising two phases. Traders must achieve profit targets of 8% in the first phase and 5% in the second to qualify for funding. This program operates under a 5% maximum daily drawdown and an 8% maximum total loss rule, offering 80% profit splits along with scaling opportunities. The pro two-step evaluation challenge, similar to the standard version, also requires completion of two phases. The profit targets remain the same as the standard program, but with a slightly higher tolerance for risk, featuring a 5% maximum daily and 10% maximum total loss rule. Participants in this program also enjoy an 80% profit split and scaling options. Given these offerings, MyFundedFX is an excellent choice for traders seeking a straightforward, rule-based approach to proprietary trading. The firm’s flexible conditions cater to a broad spectrum of trading strategies, making it an attractive option in the industry. Overall, MyFundedFX is a commendable choice for traders at various stages of their trading careers. Learn more about MyFundedFX and other top forex prop firms.