Embarking on a journey with Mena Funding promises not just the thrill of forex trading but a structured pathway to mastering the markets. With challenges tailored for every level of expertise and a clear route to scaling success, Mena Funding stands out as a beacon for aspiring traders worldwide. Dive into the details of how this prop firm is revolutionizing the way traders grow, succeed, and profit in the forex arena.

Embarking on a journey with Mena Funding promises not just the thrill of forex trading but a structured pathway to mastering the markets. With challenges tailored for every level of expertise and a clear route to scaling success, Mena Funding stands out as a beacon for aspiring traders worldwide. Dive into the details of how this prop firm is revolutionizing the way traders grow, succeed, and profit in the forex arena.

- Comprehensive Evaluation Processes.

- Up to $1.2 Million in Trading Capacity.

- Generous Profit Sharing up to 95%.

- Automatic Account Scaling Opportunities.

- Support for Expert Advisors (EAs).

Table of Contents

Mena Funding: Navigating the Waters of Demo Trading Evaluation

Understanding the role of a prop firm is essential in the fast-paced world of trading. Such entities provide traders with simulated capital, allowing them to apply their own market strategies without the risk of real financial loss. Profits made with this simulated capital can result in remuneration for the trader, highlighting a unique opportunity within the trading ecosystem.

Mena Funding emerges as a distinctive online demo trading evaluation firm, designed to challenge and identify skilled traders. By facilitating a rigorous assessment, Mena Funding offers traders a chance to showcase their prowess in a risk-free environment, only requiring an upfront fee for the evaluation process. Successful candidates, upon passing the evaluation, are then eligible to earn from the profits generated in their Simulated Funded Account, adhering strictly to the company’s Terms of Use and Trader Agreement. Importantly, Mena Funding is not a broker but a specialized demo trading evaluation company. It supports traders through either a 1-step or 2-step evaluation process, ultimately providing them with simulated funded demo accounts.

This clarification is crucial for potential participants to understand the firm’s operational model and the nature of the opportunities it presents. However, it’s important to note Mena Funding’s operational restrictions in certain countries. Due to regulatory conditions, the firm cannot offer services to traders residing in countries such as Cuba, Iran, North Korea, Myanmar, Russia (including Crimea, Donetsk, or Luhansk regions of Ukraine), Somalia, and Syria. Furthermore, these restrictions extend to individuals on sanction lists, those with financial crime or terrorism-related criminal records, or those previously prohibited due to contractual breaches. For US residents, the policy as of 20th February 2024, restricts challenge purchases on the Mena Funding site. However, US citizens living abroad with a valid resident ID may continue to access Mena Funding’s services, marking a significant update for the trading community.

Platform & Trading Conditions at Mena Funding

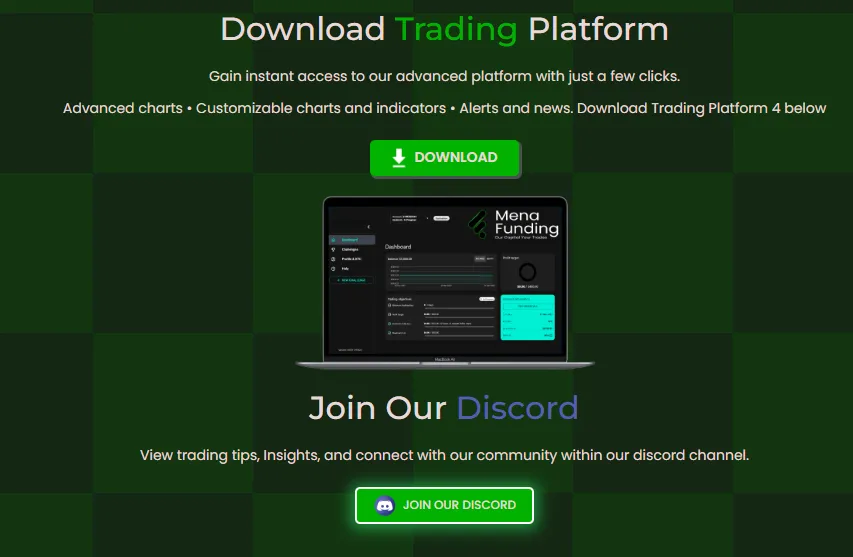

Mena Funding empowers its traders with access to the renowned MT4 platform, courtesy of its partnership with ASIC-regulated brokers EightCap and DX trade. This platform is pivotal for traders aiming to navigate the forex markets effectively, offering robust analytical tools and a user-friendly interface.

MT4 can be downloaded here, ensuring traders have the necessary software to commence their trading journey with Mena Funding and its regulated brokerage partners.

Understanding Tax Obligations and Profit Withdrawal

As independent contractors within Mena Funding’s framework, live traders are responsible for invoicing their virtual earnings and reporting to relevant tax authorities. This model emphasizes the autonomy of traders in managing their financial obligations arising from virtual profits.

Exclusive Trading Rights

It’s crucial for traders to recognize that their accounts in the challenge must solely be operated by them, without alteration post the completion of any phase. Mena Funding strictly prohibits the sharing of account login credentials and discourages the use of VPNs or VPSs for accessing trading accounts. This ensures the integrity of trading data and compliance with the firm’s regulations. Should there be a need to travel or change your trading device, it is advised to communicate these changes to Mena Funding’s support team via [email protected]. This measure is to prevent any unintended account breaches.

Eligibility and VPN Usage

To participate in Mena Funding’s programs, traders must be 18 years of age or older, aligning with the firm’s commitment to responsible trading. During the evaluation phase, it’s important to note that virtual profits cannot be withdrawn, as the primary goal is to assess the trader’s consistency and risk management skills without actual capital at stake. In line with the firm’s Terms and Conditions, the use of VPNs or VPSs is discouraged, especially for traders located in the US, as it may impact their ability to withdraw funds. Mena Funding aims to maintain a transparent and fair trading environment, ensuring that each account is managed personally and securely.

Getting Started with Mena Funding: Documentation and Evaluation Process

To embark on a trading journey with Mena Funding, traders are required to undergo a KYC/AML screening process to ensure compliance and security. This verification is facilitated through Sumsub, a platform designed for quick and efficient identity verification. The documents necessary for this process include a valid photo ID (with an expiry date no more than 14 days out), proof of address within the last 60 days, and a live selfie to verify the trader’s identity.

This stringent verification process underscores Mena Funding’s commitment to maintaining a secure trading environment, although it might restrict access to those unable to pass the KYC verification.

Onboarding and Evaluation Timeline

After completing the sign-up process and payment confirmation, traders receive their Trading Platform and Dashboard credentials within 5 minutes, although crypto payments may experience delays depending on blockchain verification times. Should there be any issues in receiving these credentials, Mena Funding’s support team is on standby to assist. The evaluation period for Mena challenges commences with the first trade, marking the start of the trader’s journey towards demonstrating their trading proficiency.

Post-Evaluation: What’s Next?

Success in the Mena Funding Challenge leads to a straightforward next step: identity verification via Sumsub and agreement signing on the dashboard. These steps are precursors to the creation of the simulated funded accounts, which are typically set up within 72 business hours post-verification.

Trading Conditions and Restrictions

Mena Funding allows the trading of a variety of instruments, including forex, commodities, indices, and crypto, on its platform. The use of Expert Advisors (EAs) is permitted, provided they align with Mena Funding’s terms, including restrictions on prohibited trading strategies and arbitrage trading. Trades can be held overnight or over the weekend, depending on the specific challenge type, with detailed guidelines available for each. However, news trading is permitted only during specific phases and accounts, with restrictions around trading during major news events to ensure fair trading practices.

Understanding Drawdown, Leverage, and Trading Strategies

Mena Funding delineates clear rules regarding daily and maximum drawdown limits, leverage, and lot size, fostering an environment that mimics real trading scenarios closely. Traders must navigate these rules to maintain account compliance and avoid breach or termination. Furthermore, Mena Funding’s partnership with Eightcap ensures competitive spreads and commissions, enhancing the trading experience. However, traders are advised against employing strategies that exploit the demo account nature, with Mena Funding prioritizing realistic and responsible trading practices. Violations of trading rules or irresponsible trading behavior can lead to account termination, emphasizing the need for professionalism within the Mena Funding trading framework.

Payouts and Funding: The Mena Funding Approach

Mena Funding stands committed to rewarding skilled traders, ensuring payouts are both guaranteed and protected under legal agreements and funded trader contracts. The firm conducts thorough vetting through its risk team to ensure payouts are made only when profits are earned legitimately, emphasizing the importance of adherence to legal and trading guidelines.

The Philosophy Behind Simulated Funding

Mena Funding’s approach to simulated funding is rooted in a desire to invest in proven and trustworthy traders. Unlike some prop firms that offer instant funding primarily as a means to collect evaluation fees, Mena Funding focuses on building long-term relationships with its traders. This strategy is aimed at nurturing a robust prop trading fund over time, rather than pursuing quick profits through demo accounts.

Flexible Payout Options

Traders with Mena Funding have the flexibility of choosing their payout method. Options include cryptocurrencies such as BTC, LTC, ETH, and USDC, or through Rise, which facilitates payouts via Wise, PayPal, Bank transfer, and other platforms. It’s essential for traders to set up an account with Rise prior to requesting a payout to ensure a smooth transaction process.

Profit and Trading Day Requirements

Upon reaching the Simulated Funded Stage, there are no specific profit targets; however, accounts must maintain a positive balance to qualify for payouts. Moreover, while there are no minimum trading days required at this stage, accounts inactive for 30 consecutive days will be marked as failed and subsequently expire.

Refunds and Withdrawals

Traders who successfully pass the evaluation phase can look forward to their initial fee being refunded with their first payout. However, it’s crucial to note that violations of the simulated funded account rules will render traders ineligible for profit splits, payouts, or refunds. Mena Funding strives to process withdrawals within 2 to 3 business days, ensuring traders receive their earnings promptly. Additionally, the firm distinguishes itself by not imposing monthly fees, with the only cost being a one-time fee at the challenge’s commencement, refunded upon the first withdrawal.

Profit Split: Rewarding Success

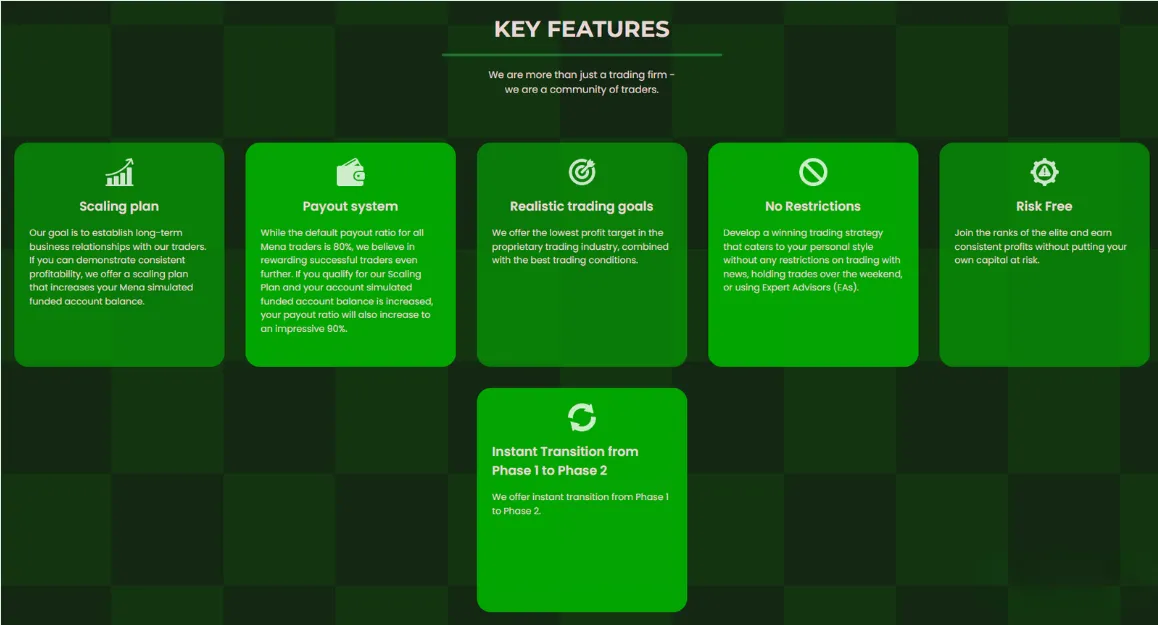

Traders in Mena Funding’s simulated funded trader programs enjoy an 80% profit split, reflecting the firm’s commitment to sharing success. Special promotions may increase this split up to 95%, further incentivizing traders to excel within Mena Funding’s trading framework.

Maximizing Your Trading Potential with Mena Funding

Mena Funding permits traders to manage up to $600,000 in challenges and an equal amount in the simulated funded stage, offering significant opportunities for growth and profitability. While account merging is not available, traders can efficiently manage multiple accounts using copy trading tools, ensuring a unified trading strategy across their portfolio.

Discover Mena Funding’s Exclusive Challenges

The Emperor’s Challenge: This two-stage evaluation process is designed for traders seeking to demonstrate exceptional skills. With rewards including a simulated funded account with 1:100 leverage and up to 95% profit sharing, the Emperor’s Challenge is a testament to trading excellence. Learn more about the Emperor’s Challenge. The Rook’s Challenge: Aimed at aspiring traders, this program offers a choice between Regular or Swing accounts, leading successful participants to a Rook’s Simulated Funded Account with up to 95% profit share. Discover the Rook’s Challenge. The Horseman’s Challenge: Tailored for traders who prefer flexibility in their approach, the Horseman’s Challenge offers Regular or Consistency accounts, with benefits including the use of Expert Advisors and up to 92% profit share. Explore the Horseman’s Challenge.

Account Scaling Plan: Growing with Mena Funding

Mena Funding’s scaling plan enables Simulated Funded traders to increase their account size based on consistent performance. This strategic growth opportunity allows for an increase of up to 25% of the initial account balance, enhancing the potential for larger payouts.

Eligibility for scaling is reviewed every three months, based on profitability and trading activity, including the requirement of processing at least two payouts within the period. This review ensures that only the most diligent and successful traders can expand their trading capacity. Scaling occurs automatically, aligning with withdrawal requests, to maintain the integrity of account balances. Traders who have met the scaling criteria but have not been scaled are encouraged to contact Mena Funding’s support team for a review.

Enhanced Profit Opportunities

With the potential to scale account balances to up to $1.5 million, Mena Funding offers unparalleled growth opportunities for traders. This expansive potential is coupled with an increased profit split, reaching up to 90% once eligibility for the scaling plan is confirmed. The dynamic nature of Mena Funding’s challenges, combined with the strategic account scaling plan, positions traders well for success in the competitive world of forex trading.

Final Thoughts: Navigating Success with Mena Funding

In conclusion, Mena Funding stands out in the crowded field of forex prop firms with its innovative approach to trader evaluation, development, and reward. By offering up to $600,000 in both challenge and simulated funded stages, Mena Funding provides a substantial platform for traders to showcase their skills, grow their portfolios, and achieve remarkable financial success. The firm’s unique challenges — the Emperor’s, Rook’s, and Horseman’s — are thoughtfully designed to cater to a wide array of trading styles and expertise levels. Each challenge not only tests traders’ abilities but also prepares them for the complexities of the forex market, with rewards that are both generous and attainable.

The educational value, combined with the potential for high profit shares of up to 95%, positions Mena Funding as a leading prop firm that genuinely invests in the success of its traders. Mena Funding’s commitment to trader growth is further exemplified by its scaling plan, allowing for automatic account balance increases based on consistent performance.

This plan not only incentivizes excellence and continuous improvement but also offers a clear pathway for traders to escalate their trading capacity to up to $1.5 million, accompanied by an attractive profit split of up to 90%. Despite the absence of account merging, the allowance for managing multiple accounts through copy trading presents a flexible solution for traders aiming to streamline their strategies across various challenges. Moreover, Mena Funding’s strict adherence to KYC/AML compliance, its thorough vetting process for payouts, and the provision of multiple withdrawal options, including cryptocurrencies and traditional banking methods, underscore its dedication to security, transparency, and convenience.

In essence, Mena Funding is not just a prop firm; it’s a partner for ambitious traders looking to navigate the forex market successfully. With its comprehensive challenges, rewarding profit splits, and substantial growth opportunities, Mena Funding is poised to remain at the forefront of forex prop trading, offering a compelling proposition for both novice and experienced traders alike. As the trading landscape continues to evolve, partnering with a firm like Mena Funding could be the key to unlocking new heights of trading success. For those ready to embark on a journey of continuous learning, performance, and financial achievement, Mena Funding offers a proven path to trading excellence.