Delve into an in-depth review of Funding Traders, exploring how their unique blend of trading programs and expert support stands out in the competitive world of proprietary trading.

The Working Mechanism of Funding Traders

Funding Traders operates as a proprietary trading firm, a setup where the firm provides essential capital to its traders for trading activities. In return, these traders share a portion of their profits with the firm, creating a mutually beneficial relationship.

Beyond financial support, Funding Traders plays a pivotal role in enhancing the capabilities of its traders. They offer a comprehensive package that includes crucial trading knowledge, effective tools, and access to a dedicated community of trading enthusiasts. This symbiotic relationship ensures that traders profit handsomely using the firm’s capital, while Funding Traders benefits from the expertise and knowledge of skilled traders. Specializing in the foreign exchange market, Funding Traders equips traders with advanced tools that aid in leveraging their expertise and managing risks effectively. This approach is designed to maximize profit returns for the traders, all while maintaining a low cost of trading operations.

Evaluation Process and Challenges at Funding Traders

At Funding Traders, new sign-ups are required to complete specific challenges, demonstrating their trading prowess and strategic acumen. These challenges are integral for traders to establish themselves as valuable candidates for the firm.

Evaluation Criteria for Standard Challenge Accounts

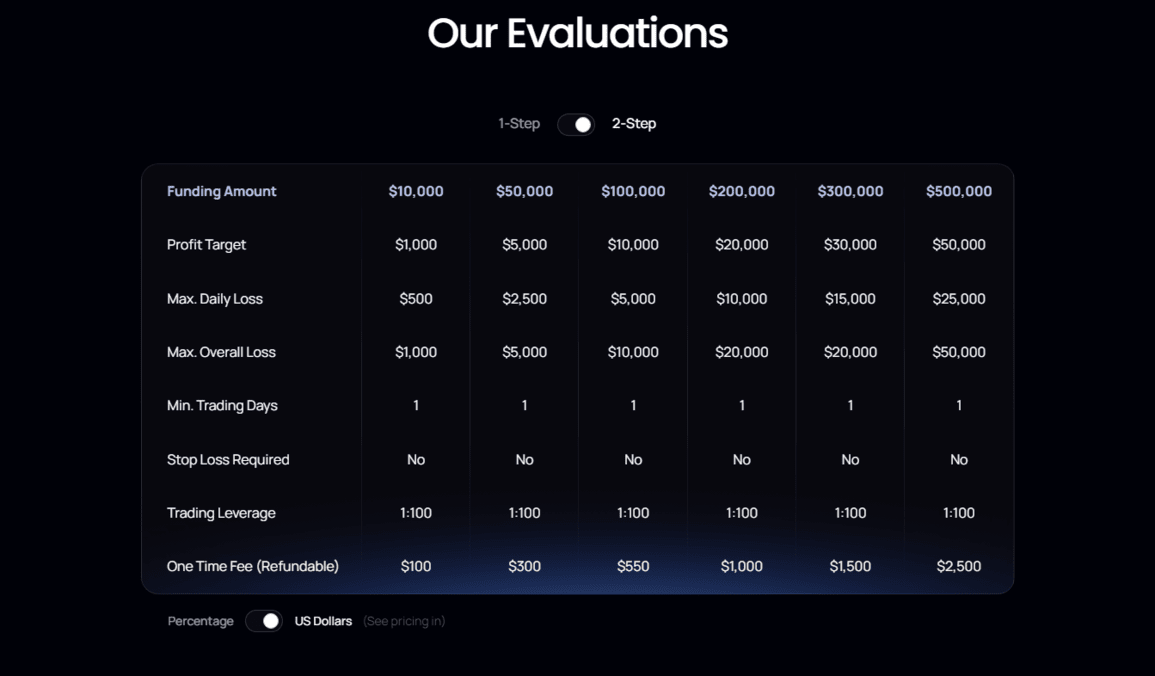

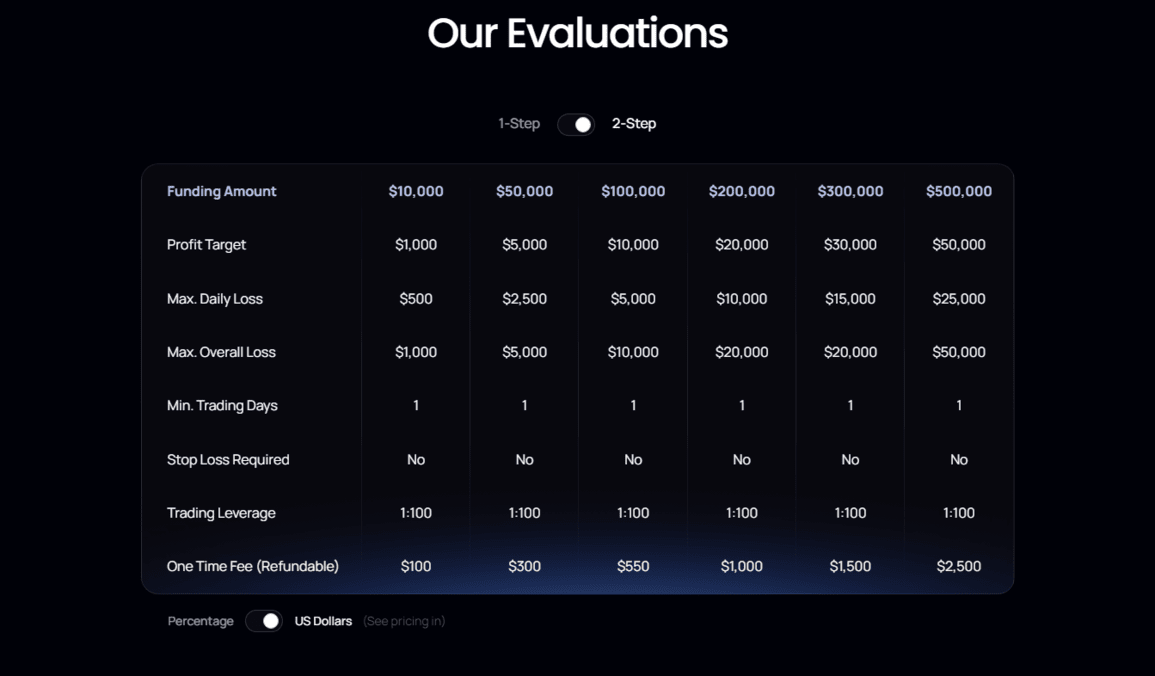

For traders opting for standard challenge accounts, the objective is to achieve a 10% profit without falling below a 5-10% threshold of their account size during the evaluation phase. Funding Traders offers two distinct types of challenges: the 1-step and the 2-step challenges.

1-Step Regular Challenge

Traders selecting the 1-step regular challenge face a target of a 10% profit, with a daily drawdown limit of 4% and an overall drawdown limit of 5%, calculated based on the highest balance.

2-Step Challenge

Conversely, traders undertaking the 2-step challenge need to navigate through two phases. The first phase demands a 10% profit target, followed by a second phase with a 5% profit target. The drawdown limits for this challenge are slightly higher, with a daily drawdown of 5% and an overall drawdown of 10%, which is static based on the balance. It’s noteworthy that the drawdown is reset daily. It’s important to note that participants in both challenges have the opportunity to withdraw their earnings after a period ranging from 7 to 14 calendar days, depending on their chosen funding method.

Pricing Structure at Funding Traders

Funding Traders differentiates itself with a versatile range of trading account options tailored for traders at varying levels of their career. There are six standard account sizes, each tailored to the amount a trader is willing to invest.

Regular Account Options

The most fundamental plan, termed ‘Beginner’, requires a modest entrance fee of $50 and offers $5,000 in funds. At the other end of the spectrum is the ‘Superior’ account, providing $200,000 in funds but at a higher entrance fee of $1,000. Notably, this plan, along with the ‘Advanced’ option, includes access to weekly market prep webinars.

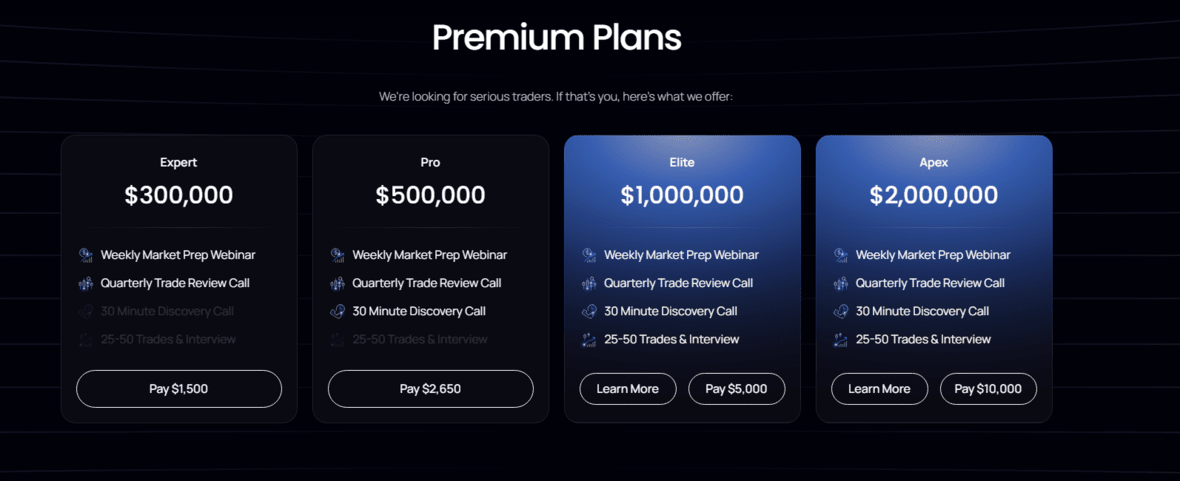

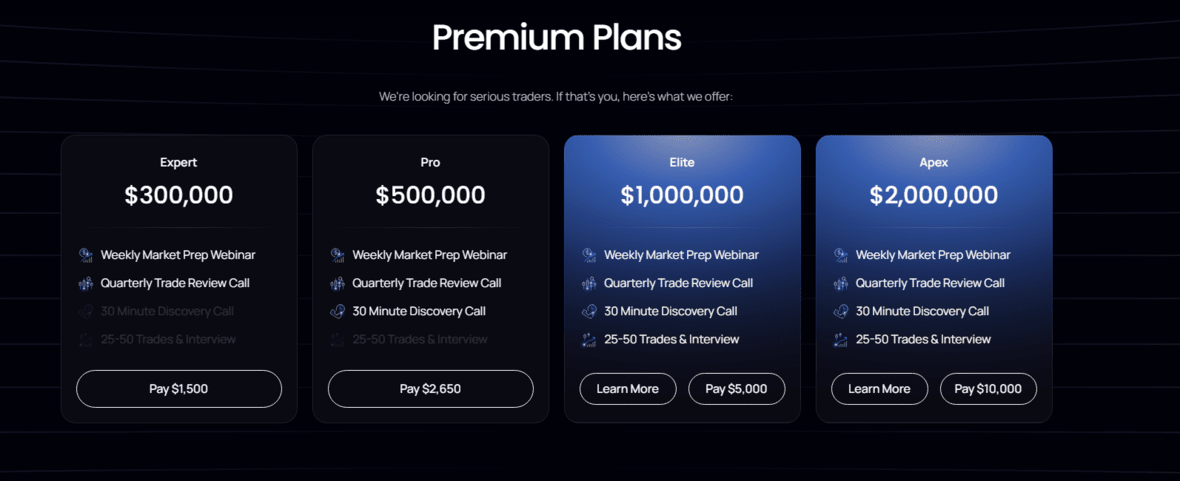

Premium Plans for Serious Traders

For traders aiming for a more significant commitment, Funding Traders presents four premium plans. The ‘Expert’ plan, the most affordable among them, provides $300,000 in funding for an entrance fee of $1,500. This plan also includes weekly market prep webinars and quarterly trade review calls. The apex of their offerings is the ‘Apex’ plan, which demands a $10,000 entrance fee but grants an impressive $2,000,000 in funding. Alongside the benefits offered in the Expert plan, it adds a 30-minute discovery call and allows for 25-50 trades.

Elite and Apex Plans: Special Requirements

Traders opting for the Elite and Apex plans must undergo an interview with Funding Traders’ CEO Stan G. and successfully complete a two-phase challenge process. This is to demonstrate their trading style and ascertain their suitability for these high-level trader programs. Phase 1 of the challenge sets a profit target of 10%, with daily and overall maximum loss caps at 5% and 10%, respectively. The minimum trading period is two months, extending up to six months. Phase 2 maintains similar specifications but with a reduced profit target of 5%.

Key Rules and Unique Features of Funding Traders

Funding Traders offers a flexible trading environment with several noteworthy rules and distinctive features that set it apart from other top proprietary trading firms.

Funding Traders Trading Flexibility and Payouts

Traders at Funding Traders are permitted to engage in news events trading and maintain positions overnight or over weekends. The first payout is accessible 7-14 days after placing the initial trade, with subsequent payouts available within the same timeframe.

Profit Sharing and Account Add-Ons

The default profit split at Funding Traders is set at 80% in favor of the trader. However, traders have the option to increase this percentage up to 100% by purchasing add-ons for their funded accounts.

Scaling Plan and Account Growth

One of the standout features of Funding Traders is their scaling plan. This plan allows for a 25% growth every three months, provided the trader achieves a 10% profit by the end of the period. The maximum allocation per customer is generally capped at $750,000, but for advanced plans, it can scale up to $2,000,000.

Account Merging and Restrictions

Traders have the flexibility to merge accounts by simply sending an email with the details of the accounts to be consolidated. However, it’s important to note that certain practices like exploiting glitches or engaging in high-frequency trading are not permitted.

Trading Platform and Available Assets

Funding Traders utilizes FXCH as their primary liquidity provider and trading platform. The firm offers a diverse range of tradable assets, including forex, indices, stocks, metals, and even provides opportunities for crypto trading.

Payout Methods Offered by Funding Traders

Funding Traders provides two convenient payout methods for its traders, catering to different preferences and geographical locations.

Bank Transfer Payouts

For traders opting for bank transfers, the process involves setting up an account with Deel as an independent contractor. This account must then be linked to the trader’s bank account. The timeframe for receiving funds via bank transfer typically ranges from 1 to 5 business days, ensuring a relatively swift transaction process.

Cryptocurrency Payouts

Alternatively, traders located outside of Deel’s approved countries have the option of receiving their payouts in cryptocurrency. This method boasts the advantage of instantaneous fund transfers, offering a quick and efficient way to access earnings.

Customer Support Services at Funding Traders

At Funding Traders, addressing customer queries and resolving issues promptly is a top priority, reflected in their comprehensive customer support system.

Multiple Channels for Customer Support

Clients have multiple avenues to reach out to the Funding Traders support team. These include:

- Live Chat: For real-time assistance.

- Contact Form: Available on their website for structured queries.

- Social Media: Through their Twitter account and Discord channel for more informal interaction.

- Email Support: Directly at help@fundingtraders.com for detailed inquiries.

Efficient and Responsive Live Chat Team

Our experience with the live chat support was notably impressive. The team was not only attentive but also quick to respond, demonstrating their commitment to providing timely and effective assistance.

Self-Help Options

For those who prefer self-service, Funding Traders offers a comprehensive FAQ section. This resource is particularly useful for finding quick answers to common questions, thereby enhancing the overall customer support experience.

Legitimacy of Funding Traders

The credibility and reliability of Funding Traders are key considerations for potential traders and partners. As of this review, several indicators point towards the legitimacy of Funding Traders.

High Customer Review Score

Funding Traders boasts an impressive 4.9 out of 5 rating on TrustPilot. This high score is based on over 200 customer reviews, reflecting a strong level of satisfaction and trust among its user base.

Positive Aspects Highlighted in Reviews

Key elements frequently mentioned in positive reviews include:

- Their fair and transparent payout policy.

- A supportive community of expert advisors.

- Exceptional customer support services.

- An innovative approach to proprietary trading.

This combination of a high customer review score and positive feedback on various aspects of their service underscores the legitimacy and effectiveness of Funding Traders as a proprietary trading firm.

Final Assessment of Funding Traders

Funding Traders has firmly established itself as a premier choice among proprietary trading firms, particularly notable for its diverse range of plans tailored to traders’ aspirations and skill levels. The firm presents an impressive selection of ten different programs, varying in traded funds and associated fees. This flexibility allows traders to select a program that aligns perfectly with their trading goals and financial capabilities. Additional strengths of Funding Traders include:

- A broad spectrum of trading assets, offering ample opportunities for diversification.

- Guidance and support from seasoned professional traders.

- Access to a comprehensive knowledge hub, aiding in continuous learning and development.

For accomplished forex traders, Funding Traders enhances their potential with a 25% growth scaling plan, a feature that particularly appeals to ambitious traders seeking to expand their trading capacity. Backed by excellent customer support and efficient withdrawal processes, Funding Traders stands out as a top-tier choice for both novice and experienced traders alike, cementing its status as a leading entity in the world of proprietary trading.

Delve into an in-depth review of Funding Traders, exploring how their unique blend of trading programs and expert support stands out in the competitive world of proprietary trading.

- Wide Variety of Trading Programs.

- Support from Experienced Traders.

- Access to Extensive Knowledge Hub.

- 25% Growth Scaling Plan Available.

- Efficient Withdrawal Process.

The Working Mechanism of Funding Traders

Funding Traders operates as a proprietary trading firm, a setup where the firm provides essential capital to its traders for trading activities. In return, these traders share a portion of their profits with the firm, creating a mutually beneficial relationship.

Beyond financial support, Funding Traders plays a pivotal role in enhancing the capabilities of its traders. They offer a comprehensive package that includes crucial trading knowledge, effective tools, and access to a dedicated community of trading enthusiasts. This symbiotic relationship ensures that traders profit handsomely using the firm’s capital, while Funding Traders benefits from the expertise and knowledge of skilled traders. Specializing in the foreign exchange market, Funding Traders equips traders with advanced tools that aid in leveraging their expertise and managing risks effectively. This approach is designed to maximize profit returns for the traders, all while maintaining a low cost of trading operations.

Evaluation Process and Challenges at Funding Traders

At Funding Traders, new sign-ups are required to complete specific challenges, demonstrating their trading prowess and strategic acumen. These challenges are integral for traders to establish themselves as valuable candidates for the firm.

Evaluation Criteria for Standard Challenge Accounts

For traders opting for standard challenge accounts, the objective is to achieve a 10% profit without falling below a 5-10% threshold of their account size during the evaluation phase. Funding Traders offers two distinct types of challenges: the 1-step and the 2-step challenges.

1-Step Regular Challenge

Traders selecting the 1-step regular challenge face a target of a 10% profit, with a daily drawdown limit of 4% and an overall drawdown limit of 5%, calculated based on the highest balance.

2-Step Challenge

Conversely, traders undertaking the 2-step challenge need to navigate through two phases. The first phase demands a 10% profit target, followed by a second phase with a 5% profit target. The drawdown limits for this challenge are slightly higher, with a daily drawdown of 5% and an overall drawdown of 10%, which is static based on the balance. It’s noteworthy that the drawdown is reset daily. It’s important to note that participants in both challenges have the opportunity to withdraw their earnings after a period ranging from 7 to 14 calendar days, depending on their chosen funding method.

Pricing Structure at Funding Traders

Funding Traders differentiates itself with a versatile range of trading account options tailored for traders at varying levels of their career. There are six standard account sizes, each tailored to the amount a trader is willing to invest.

Regular Account Options

The most fundamental plan, termed ‘Beginner’, requires a modest entrance fee of $50 and offers $5,000 in funds. At the other end of the spectrum is the ‘Superior’ account, providing $200,000 in funds but at a higher entrance fee of $1,000. Notably, this plan, along with the ‘Advanced’ option, includes access to weekly market prep webinars.

Premium Plans for Serious Traders

For traders aiming for a more significant commitment, Funding Traders presents four premium plans. The ‘Expert’ plan, the most affordable among them, provides $300,000 in funding for an entrance fee of $1,500. This plan also includes weekly market prep webinars and quarterly trade review calls. The apex of their offerings is the ‘Apex’ plan, which demands a $10,000 entrance fee but grants an impressive $2,000,000 in funding. Alongside the benefits offered in the Expert plan, it adds a 30-minute discovery call and allows for 25-50 trades.

Elite and Apex Plans: Special Requirements

Traders opting for the Elite and Apex plans must undergo an interview with Funding Traders’ CEO Stan G. and successfully complete a two-phase challenge process. This is to demonstrate their trading style and ascertain their suitability for these high-level trader programs. Phase 1 of the challenge sets a profit target of 10%, with daily and overall maximum loss caps at 5% and 10%, respectively. The minimum trading period is two months, extending up to six months. Phase 2 maintains similar specifications but with a reduced profit target of 5%.

Key Rules and Unique Features of Funding Traders

Funding Traders offers a flexible trading environment with several noteworthy rules and distinctive features that set it apart from other top proprietary trading firms.

Funding Traders Trading Flexibility and Payouts

Traders at Funding Traders are permitted to engage in news events trading and maintain positions overnight or over weekends. The first payout is accessible 7-14 days after placing the initial trade, with subsequent payouts available within the same timeframe.

Profit Sharing and Account Add-Ons

The default profit split at Funding Traders is set at 80% in favor of the trader. However, traders have the option to increase this percentage up to 100% by purchasing add-ons for their funded accounts.

Scaling Plan and Account Growth

One of the standout features of Funding Traders is their scaling plan. This plan allows for a 25% growth every three months, provided the trader achieves a 10% profit by the end of the period. The maximum allocation per customer is generally capped at $750,000, but for advanced plans, it can scale up to $2,000,000.

Account Merging and Restrictions

Traders have the flexibility to merge accounts by simply sending an email with the details of the accounts to be consolidated. However, it’s important to note that certain practices like exploiting glitches or engaging in high-frequency trading are not permitted.

Trading Platform and Available Assets

Funding Traders utilizes FXCH as their primary liquidity provider and trading platform. The firm offers a diverse range of tradable assets, including forex, indices, stocks, metals, and even provides opportunities for crypto trading.

Payout Methods Offered by Funding Traders

Funding Traders provides two convenient payout methods for its traders, catering to different preferences and geographical locations.

Bank Transfer Payouts

For traders opting for bank transfers, the process involves setting up an account with Deel as an independent contractor. This account must then be linked to the trader’s bank account. The timeframe for receiving funds via bank transfer typically ranges from 1 to 5 business days, ensuring a relatively swift transaction process.

Cryptocurrency Payouts

Alternatively, traders located outside of Deel’s approved countries have the option of receiving their payouts in cryptocurrency. This method boasts the advantage of instantaneous fund transfers, offering a quick and efficient way to access earnings.

Customer Support Services at Funding Traders

At Funding Traders, addressing customer queries and resolving issues promptly is a top priority, reflected in their comprehensive customer support system.

Multiple Channels for Customer Support

Clients have multiple avenues to reach out to the Funding Traders support team. These include:

- Live Chat: For real-time assistance.

- Contact Form: Available on their website for structured queries.

- Social Media: Through their Twitter account and Discord channel for more informal interaction.

- Email Support: Directly at help@fundingtraders.com for detailed inquiries.

Efficient and Responsive Live Chat Team

Our experience with the live chat support was notably impressive. The team was not only attentive but also quick to respond, demonstrating their commitment to providing timely and effective assistance.

Self-Help Options

For those who prefer self-service, Funding Traders offers a comprehensive FAQ section. This resource is particularly useful for finding quick answers to common questions, thereby enhancing the overall customer support experience.

Legitimacy of Funding Traders

The credibility and reliability of Funding Traders are key considerations for potential traders and partners. As of this review, several indicators point towards the legitimacy of Funding Traders.

High Customer Review Score

Funding Traders boasts an impressive 4.9 out of 5 rating on TrustPilot. This high score is based on over 200 customer reviews, reflecting a strong level of satisfaction and trust among its user base.

Positive Aspects Highlighted in Reviews

Key elements frequently mentioned in positive reviews include:

- Their fair and transparent payout policy.

- A supportive community of expert advisors.

- Exceptional customer support services.

- An innovative approach to proprietary trading.

This combination of a high customer review score and positive feedback on various aspects of their service underscores the legitimacy and effectiveness of Funding Traders as a proprietary trading firm.

Final Assessment of Funding Traders

Funding Traders has firmly established itself as a premier choice among proprietary trading firms, particularly notable for its diverse range of plans tailored to traders’ aspirations and skill levels. The firm presents an impressive selection of ten different programs, varying in traded funds and associated fees. This flexibility allows traders to select a program that aligns perfectly with their trading goals and financial capabilities. Additional strengths of Funding Traders include:

- A broad spectrum of trading assets, offering ample opportunities for diversification.

- Guidance and support from seasoned professional traders.

- Access to a comprehensive knowledge hub, aiding in continuous learning and development.

For accomplished forex traders, Funding Traders enhances their potential with a 25% growth scaling plan, a feature that particularly appeals to ambitious traders seeking to expand their trading capacity. Backed by excellent customer support and efficient withdrawal processes, Funding Traders stands out as a top-tier choice for both novice and experienced traders alike, cementing its status as a leading entity in the world of proprietary trading.