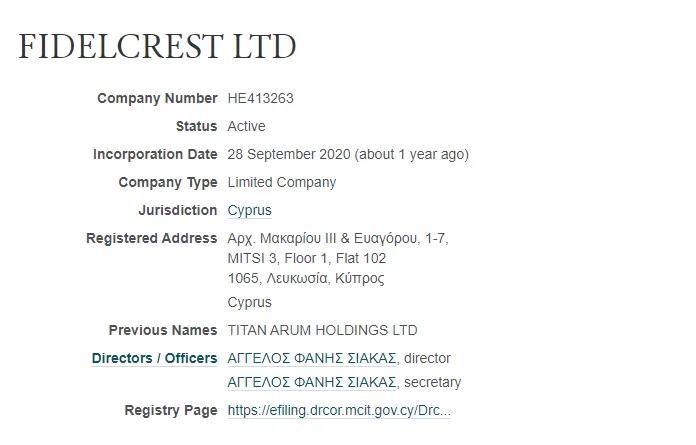

Excerpt: Fidelcrest, a visionary proprietary trading firm, emerged in 2018 from the bustling financial hub of Nicosia, Cyprus. Conceived by seasoned forex trading professionals, this firm marks its global presence with a specialized IT department located in Tallinn, Estonia. Renowned for providing aspiring traders with the opportunity to manage significant capital, up to $2,000,000, Fidelcrest has established a robust partnership with the Foreign Exchange Clearing House to ensure dependable and efficient trading services.

Excerpt: Fidelcrest, a visionary proprietary trading firm, emerged in 2018 from the bustling financial hub of Nicosia, Cyprus. Conceived by seasoned forex trading professionals, this firm marks its global presence with a specialized IT department located in Tallinn, Estonia. Renowned for providing aspiring traders with the opportunity to manage significant capital, up to $2,000,000, Fidelcrest has established a robust partnership with the Foreign Exchange Clearing House to ensure dependable and efficient trading services.

- High Trustpilot score of 4.6 out of 5.

- Free, unlimited retries for evaluation.

- Various additional options available.

- Brokered by Foreign Exchange Clearing House with raw spreads.

- Customer support in multiple languages.

- Permissible overnight holding and news trading.

- Leverage options up to 1:200.

- Offers capital management up to $2,000,000.

- Aggressive accounts require profit targets ranging from 15% to 20%

Table of Contents

Established in 2018, Fidelcrest is a proprietary trading firm founded by a group of seasoned forex traders and professionals. The aim was to create a robust platform that caters to the needs of trading enthusiasts. The firm is centrally located in Nicosia, Cyprus, with the address being Arch. Makariou III & 1-7 Evagorou, MITSI 3, 1st floor, office 102 C 1065. A noteworthy aspect of Fidelcrest is its IT department, which is strategically positioned in Tallinn, Estonia, to bolster their global operations. Fidelcrest offers significant opportunities to its clients, allowing them to manage capital up to $2,000,000. They have established a partnership with the Foreign Exchange Clearing House as their broker, which ensures a reliable and efficient trading experience for their clients.

Overview of Fidelcrest Funding Programs

Fidelcrest provides a diverse range of funding programs, catering to various trader profiles and strategies. These programs are designed to offer flexibility and cater to different risk appetites.

Micro Trader Evaluation Program Accounts

- Normal Micro Trader Evaluation Program Accounts: Tailored for traders who prefer a standard approach to trading.

- Aggressive Micro Trader Evaluation Program Accounts: Suited for traders who adopt a more aggressive trading strategy.

Pro Trader Evaluation Program Accounts

- Normal Pro Trader Evaluation Program Accounts: Designed for professional traders who follow a conventional trading methodology.

- Aggressive Pro Trader Evaluation Program Accounts: Ideal for professional traders who engage in high-risk, aggressive trading tactics.

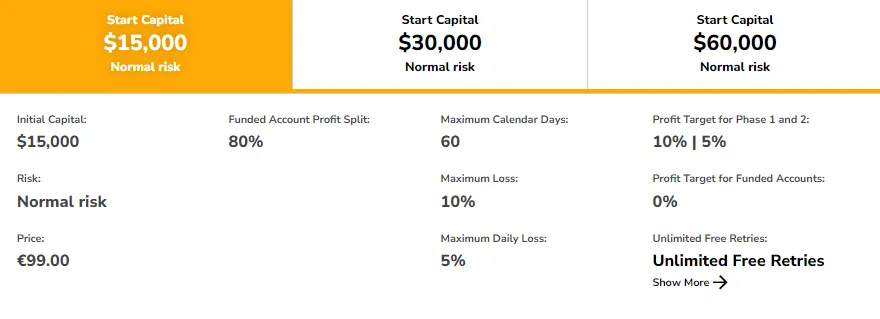

Normal Micro Trader Evaluation Program Overview

The Normal Micro Trader Evaluation Program by Fidelcrest is designed to identify and reward skilled traders. This program is structured in two distinct evaluation phases, each with specific requirements and objectives.

Program Details and Leverage

Participants in this program can trade with a leverage of up to 1:200. The program offers various account sizes, each with a corresponding enrollment fee:

- Account Size $15,000 – Fee: €99

- Account Size $30,000 – Fee: €199

- Account Size $60,000 – Fee: €299

Evaluation Phase One

In the first phase, traders must achieve a 10% profit target without exceeding a 5% maximum daily loss or a 10% overall loss. This target must be reached within 60 calendar days of the first position placed on the evaluation account. There is no minimum trading day requirement to progress to the second phase.

Evaluation Phase Two

During the second phase, the profit target is set at 5%, with the same loss limits as phase one. This target also needs to be achieved within 60 calendar days from the first position. As in the first phase, there are no minimum trading day requirements to qualify for a funded account.

Funded Account and Profit Sharing

Upon successful completion of both evaluation phases, traders are granted a funded account. In this phase, there are no profit targets, but traders must adhere to the 5% maximum daily loss and 10% maximum overall loss rules. The first payout is available ten days after the first position is placed on the funded account, provided certain criteria are met. These include trading for a minimum of 10 calendar days and being in profit. Traders enjoy an 80% profit split on the gains made on their funded account.

Normal Micro Trader Evaluation Program Account Scaling Plan

As of the current update, Fidelcrest’s Normal Micro Trader Evaluation Program does not offer a scaling plan. This means that traders participating in this program will operate with the initial account size and conditions provided at the onset of the program.

Rules of the Normal Micro Trader Evaluation Program Account

Profit Targets

The program sets specific profit targets for traders to achieve. In Phase 1, the profit target is 10%, while in Phase 2, it is set at 5%. Once traders transition to a funded account, there are no profit targets imposed.

Maximum Daily Loss

All account sizes in the program have a maximum daily loss limit of 5%. Exceeding this limit results in a violation of the account terms.

Maximum Overall Loss

The program enforces a maximum overall loss limit of 10% across all account sizes. Breaching this limit also constitutes a violation of the account terms.

Maximum Trading Days

Traders have a maximum period of 60 calendar days in both Phase 1 and Phase 2 to reach the specified profit targets or to meet withdrawal criteria.

Restrictions on Martingale Strategies

The use of any martingale strategy is strictly prohibited while trading in this program.

Role of the Risk Desk Team

The Risk Desk Team evaluates a trader’s strategy to determine its suitability for the proprietary firm. If a trader’s strategy is deemed ineligible, a refund is issued for the evaluation account.

Third-Party Copy Trading Risks

Traders intending to use third-party copy trading services must consider the risk of duplicated strategies. Using such services could lead to denial of a funded account or withdrawal if it results in exceeding the maximum capital allocation rule.

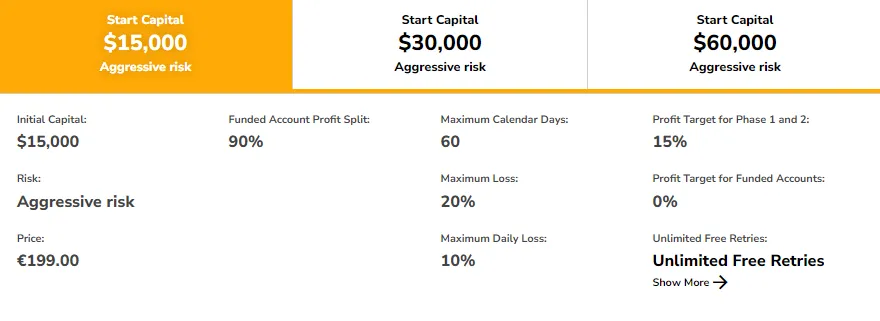

Aggressive Micro Trader Evaluation Program Accounts

Fidelcrest’s Aggressive Micro Trader Evaluation Program is tailored for traders who demonstrate serious commitment and skill, and who are comfortable with higher risks. This two-phase evaluation program offers increased leverage and profit potential.

Program Leverage and Account Options

The program allows trading with up to 1:200 leverage. Available account sizes and their respective fees are:

- Account Size $15,000 – Fee: €199

- Account Size $30,000 – Fee: €299

- Account Size $60,000 – Fee: €399

Evaluation Phase One

In the first phase, traders are required to reach a 15% profit target without exceeding a 10% maximum daily loss or a 20% overall loss. This target must be met within 60 calendar days of placing the first position, with no minimum trading day requirement to progress to the next phase.

Evaluation Phase Two

The second phase also demands a 15% profit target, maintaining the same daily and overall loss limits. Similar to the first phase, traders have 60 calendar days to achieve this target, with no minimum trading days required for advancing to a funded account.

Funded Account and Profit Sharing

Successful completion of both phases leads to a funded account, free of profit targets. The account is governed by a 10% maximum daily loss and a 20% maximum overall loss rule. The first payout is possible ten days after the first position on the funded account, contingent on trading for a minimum of 10 calendar days and being in profit. The profit split for traders in this program is an attractive 90% of the profits earned on the funded account.

Scaling Plan for Aggressive Micro Trader Evaluation Program Accounts

The Aggressive Micro Trader Evaluation Program Accounts at Fidelcrest currently do not offer a scaling plan. Participants in this program are expected to operate with the initial account size and terms provided at the beginning of the program, without the option for scaling.

Rules of the Aggressive Micro Trader Evaluation Program Account

Profit Targets

For both Phase 1 and Phase 2, the program sets a profit target of 15%. Traders must meet this target to complete each evaluation phase or to make withdrawals. In funded accounts, there are no set profit targets.

Maximum Daily Loss

The program imposes a maximum daily loss limit of 10% across all account sizes. Exceeding this limit results in a violation of the account terms.

Maximum Overall Loss

There is also a maximum overall loss limit of 20% for all account sizes. Breaching this limit constitutes a violation of the account terms.

Maximum Trading Days

Traders have a maximum of 60 calendar days in both Phase 1 and Phase 2 to reach the specified profit targets or to meet withdrawal criteria.

Prohibition of Martingale Strategies

The use of martingale strategies is strictly forbidden in this program.

Role of the Risk Desk Team

The Risk Desk Team evaluates the suitability of a trader’s strategy for the proprietary firm. If deemed ineligible, a refund is provided for the evaluation account.

Third-Party Copy Trading Risks

Traders using third-party copy trading services must be aware of the risk of strategy duplication. Such services could lead to denial of a funded account or withdrawal if they result in surpassing the maximum capital allocation rule.

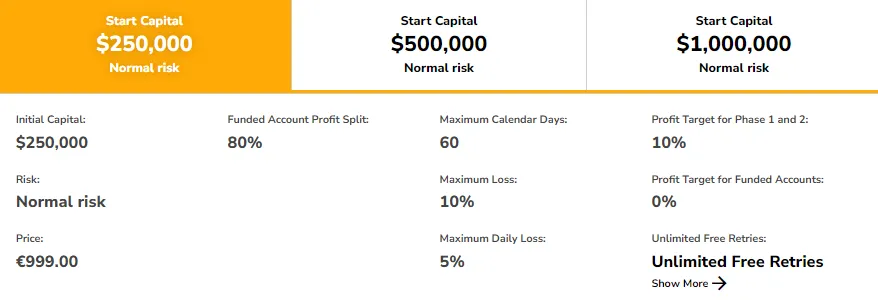

Normal Pro Trader Evaluation Program Accounts

The Normal Pro Trader Evaluation Program at Fidelcrest is crafted for skilled and committed traders, offering a substantial opportunity in a two-phase evaluation process. This program is designed for traders aiming for high trading volumes and consistency.

Program Leverage and Account Options

Participants can trade with up to 1:200 leverage. The program offers the following account sizes with their respective fees:

- Account Size $250,000 – Fee: €999

- Account Size $500,000 – Fee: €1,899

- Account Size $1,000,000 – Fee: €2,999

Evaluation Phase One

In the first phase, traders are tasked with achieving a 10% profit target, adhering to a 5% maximum daily loss and a 10% overall loss limit. This target must be reached within 60 calendar days of the first position on the evaluation account, with no minimum trading day requirement for advancing to the next phase.

Evaluation Phase Two

The second phase mirrors the first in terms of profit targets and loss limits. Traders again strive for a 10% profit target within the same 60-day period and loss constraints, without a minimum trading day requirement to qualify for a funded account.

Funded Account and Profit Sharing

Successfully completing both phases leads to a funded account, where no profit targets are set. Traders must continue to respect the 5% maximum daily loss and 10% maximum loss rules. The first payout opportunity arises ten days after the first trade on the funded account, provided the trader has traded for a minimum of 10 calendar days and is in profit. The profit share offered is an appealing 80% of the profits made on the funded account.

Scaling Plan for Normal Pro Trader Evaluation Program Accounts

The Normal Pro Trader Evaluation Program Accounts at Fidelcrest currently do not offer a scaling plan. This means that traders enrolled in this program will maintain their initial account size and conditions throughout the duration of the program, without the option for scaling.

Rules of the Normal Pro Trader Evaluation Program Account

Profit Targets

Traders in Phase 1 and Phase 2 are required to achieve a 10% profit target to complete the evaluation or to make withdrawals. Funded accounts operate without set profit targets.

Maximum Daily Loss

A maximum daily loss limit of 5% is set for all account sizes, and exceeding this limit results in a violation of the account terms.

Maximum Overall Loss

The program also enforces a maximum overall loss limit of 10% across all account sizes. Surpassing this limit constitutes an account violation.

Maximum Trading Days

The maximum trading period for reaching profit targets in both Phase 1 and Phase 2 is 60 calendar days.

Prohibition of Martingale Strategies

The use of any martingale strategy is strictly prohibited within this program.

Role of the Risk Desk Team

The Risk Desk Team assesses the suitability of a trader’s strategy for the proprietary firm. Ineligible strategies result in a refund for the evaluation account.

Third-Party Copy Trading Risks

Traders using third-party copy trading services should consider the risk of strategy duplication. This can lead to denial of a funded account or withdrawal if it results in exceeding the maximum capital allocation rule.

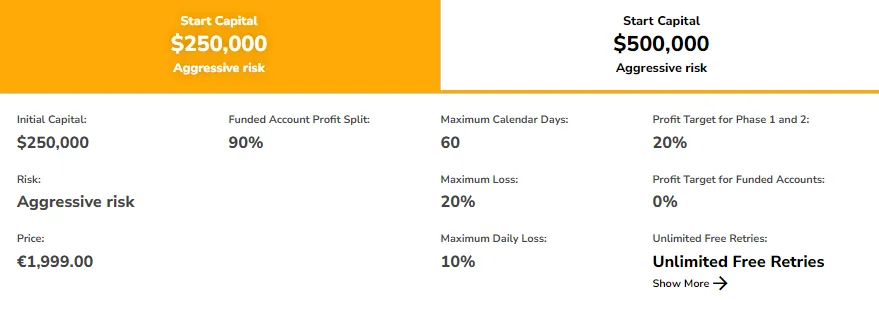

Aggressive Pro Trader Evaluation Program Accounts

The Aggressive Pro Trader Evaluation Program at Fidelcrest is designed for traders who demonstrate exceptional skill and commitment, offering a challenging yet rewarding two-phase evaluation process. This program is tailored for traders who are comfortable with higher risks and seek larger profit targets.

Program Leverage and Account Options

Participants in this program can trade with a leverage of 1:200. The available account sizes and their fees are as follows:

- Account Size $250,000 – Fee: €1,999

- Account Size $500,000 – Fee: €3,499

Evaluation Phase One

The first phase requires traders to achieve a 20% profit target without exceeding a 10% maximum daily loss or a 20% overall loss limit. This target must be met within 60 calendar days of the first position on the evaluation account, with no minimum trading day requirement to advance to the next phase.

Evaluation Phase Two

Phase two also sets a 20% profit target, maintaining the same daily and overall loss limits. Traders have 60 calendar days to reach this target from the first position, without a minimum trading day requirement for qualifying for a funded account.

Funded Account and Profit Sharing

Upon successful completion of both evaluation phases, traders are awarded a funded account. In this phase, there are no profit targets, but the 10% maximum daily loss and 20% maximum loss rules still apply. The first payout is available ten days after the first trade on the funded account, provided the trader has traded for at least 10 calendar days and is in profit. The profit share in this program is a favorable 90% of the profits earned on the funded account.

Scaling Plan for Aggressive Pro Trader Evaluation Program Accounts

The Aggressive Pro Trader Evaluation Program Accounts at Fidelcrest currently do not offer a scaling plan. This indicates that traders in this program are expected to operate within the parameters of their initial account size and terms, without the possibility of scaling during the program’s duration.

Rules of the Aggressive Pro Trader Evaluation Program Account

Profit Targets

The Aggressive Pro Trader program sets a 20% profit target for both Phase 1 and Phase 2. Completion of these phases or withdrawals requires achieving this target. Funded accounts, however, do not have set profit targets.

Maximum Daily Loss

There is a maximum daily loss limit of 10% across all account sizes. Exceeding this limit results in a violation of the account terms.

Maximum Overall Loss

The program also imposes a maximum overall loss limit of 20% for all account sizes. Breaching this limit constitutes an account violation.

Maximum Trading Days

Traders have a maximum period of 60 calendar days in both Phase 1 and Phase 2 to reach the specified profit targets or meet withdrawal criteria.

Prohibition of Martingale Strategies

The use of martingale strategies is strictly forbidden within this program.

Role of the Risk Desk Team

The Risk Desk Team assesses the suitability of a trader’s strategy for the proprietary firm. Strategies deemed ineligible will result in a refund for the evaluation account.

Third-Party Copy Trading Risks

Traders considering third-party copy trading services should be aware of the risk of strategy duplication. Usage of such services might lead to denial of a funded account or withdrawal if it results in exceeding the maximum capital allocation rule.

Special Add-On Options for Evaluation Program Purchase

Fidelcrest offers a range of special add-on options for traders enrolling in their evaluation programs. These options provide additional benefits and flexibility to enhance the trading experience.

Add Insurance

Receive a free second account if you fail your first Challenge phase. This option is available for all account sizes and types, at an additional cost of 30% on the one-time fee.

Double Your Capital

Get a second account for free after making a profit with your funded account. This option increases the one-time fee by 50% and is available for all account sizes and types.

Double Your Leverage

Opportunity to trade with up to 1:200 leverage, allowing control over larger position sizes. This option is available for all account sizes and types, with an additional 20% on the one-time fee.

Unlimited Retry

Offers the chance for unlimited retries on your evaluation phases if you are in profit at the end of your trading period. This benefit is free for all account sizes and types.

Additional Free Add-On Choices

Upon purchase, you can also choose one of the following free add-ons:

- Unlimited trading day period during both evaluation phases.

- Maximum trading period of 60 calendar days with a free retry option if the drawdown is less than 2%.

Unique Aspects of Fidelcrest Compared to Other Prop Firms

Fidelcrest stands out in the proprietary trading firm industry due to its straightforward trading rules and flexible trading conditions, distinguishing it from other leading firms.

Flexible Trading Conditions

Traders at Fidelcrest have the freedom to trade during news events, hold trades overnight, and keep positions open over weekends. This level of flexibility is a significant advantage compared to many other prop firms.

Micro Trader Evaluation Program Structure

The Micro Trader evaluation program at Fidelcrest is a two-phase process, each with distinct profit targets and loss rules. This structure is designed to thoroughly assess a trader’s skills before they are eligible for payouts.

Normal vs. Aggressive Risk Accounts

- Normal risk accounts require a 10% profit target in phase one and 5% in phase two. They are governed by a 5% maximum daily loss and a 10% maximum overall loss rule in both evaluation phases and after reaching funded status.

- Aggressive risk accounts have a consistent 15% profit target for both phases. The maximum daily loss is set at 10%, with a maximum overall loss of 20%, applicable in both evaluation phases and once funded.

Both normal and aggressive risk accounts have no minimum trading day requirements during evaluation phases. Unlike some industry peers, the Micro Trader evaluation program accounts do not offer a scaling plan.

Industry-Average Trading Objectives

Fidelcrest’s trading objectives align with industry averages, ensuring a balanced approach to risk and reward for traders.

Comparative Analysis: Fidelcrest and True Forex Funds

This comparison highlights the differences in trading objectives between Fidelcrest (both Normal and Aggressive Risk) and True Forex Funds (Limitless).

| Trading Objectives | Fidelcrest Normal Risk | Fidelcrest Aggressive Risk | True Forex Funds (Limitless) |

|---|---|---|---|

| Phase 1 Profit Target | 10% | 15% or 20% | 8% |

| Phase 2 Profit Target | 5% or 10% | 15% or 20% | 5% |

| Maximum Daily Loss | 5% | 10% | 5% |

| Maximum Loss | 10% | 20% | 10% |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: 60 Calendar Days Phase 2: 60 Calendar Days (Unlimited with add-on) | Phase 1: 60 Calendar Days Phase 2: 60 Calendar Days (Unlimited with add-on) | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 90% | 80% |

Comparative Analysis: Fidelcrest and FundedNext

This comparison outlines the key trading objectives of Fidelcrest (Normal and Aggressive Risk) versus FundedNext (Stellar).

| Trading Objectives | Fidelcrest Normal Risk | Fidelcrest Aggressive Risk | FundedNext (Stellar) |

|---|---|---|---|

| Phase 1 Profit Target | 10% | 15% or 20% | 8% |

| Phase 2 Profit Target | 5% or 10% | 15% or 20% | 5% |

| Maximum Daily Loss | 5% | 10% | 5% |

| Maximum Loss | 10% | 20% | 10% |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: 60 Calendar Days Phase 2: 60 Calendar Days (Unlimited with add-on) | Phase 1: 60 Calendar Days Phase 2: 60 Calendar Days (Unlimited with add-on) | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 90% | 80% up to 90% |

Comparative Analysis: Fidelcrest and Funded Trading Plus

This comparison provides an overview of the trading objectives between Fidelcrest’s Normal and Aggressive Risk programs and Funded Trading Plus’s Advanced program.

| Trading Objectives | Fidelcrest Normal Risk | Fidelcrest Aggressive Risk | Funded Trading Plus (Advanced) |

|---|---|---|---|

| Phase 1 Profit Target | 10% | 15% or 20% | 10% |

| Phase 2 Profit Target | 5% or 10% | 15% or 20% | 5% |

| Maximum Daily Loss | 5% | 10% | 5% |

| Maximum Loss | 10% | 20% | 10% (Trailing) |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: 60 Calendar Days Phase 2: 60 Calendar Days (Unlimited with add-on) | Phase 1: 60 Calendar Days Phase 2: 60 Calendar Days (Unlimited with add-on) | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 90% | 80% up to 90% |

Additional Comparison with Fidelcrest Pro Trader Program

Fidelcrest’s Pro Trader evaluation program, compared to other industry-leading prop firms, involves a two-phase evaluation process. Normal risk accounts target 10% profit in both phases, while aggressive risk accounts aim for 15% in each. Both account types adhere to a 5% maximum daily loss rule and a 10% maximum loss rule for normal risk, with 10% and 20% respectively for aggressive risk, applicable in both evaluation phases and after funded status is achieved. Unlike some peers, Fidelcrest’s Pro Trader program does not offer scaling. The trading objectives align with industry standards.

Comparative Analysis: Fidelcrest and Funding Pips

This table compares the trading objectives of Fidelcrest (Normal and Aggressive Risk) with those of Funding Pips.

| Trading Objectives | Fidelcrest Normal Risk | Fidelcrest Aggressive Risk | Funding Pips |

|---|---|---|---|

| Phase 1 Profit Target | 10% | 15% or 20% | 8% |

| Phase 2 Profit Target | 5% or 10% | 15% or 20% | 5% |

| Maximum Daily Loss | 5% | 10% | 5% |

| Maximum Loss | 10% | 20% | 10% |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: 60 Calendar Days Phase 2: 60 Calendar Days (Unlimited with add-on) | Phase 1: 60 Calendar Days Phase 2: 60 Calendar Days (Unlimited with add-on) | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 90% | 80% up to 90% |

Comparative Analysis: Fidelcrest and Finotive Funding

This table compares the trading objectives of Fidelcrest (Normal and Aggressive Risk) with those of Finotive Funding.

| Trading Objectives | Fidelcrest Normal Risk | Fidelcrest Aggressive Risk | Finotive Funding |

|---|---|---|---|

| Phase 1 Profit Target | 10% | 15% or 20% | 7.5% |

| Phase 2 Profit Target | 5% or 10% | 15% or 20% | 5% |

| Maximum Daily Loss | 5% | 10% | 5% |

| Maximum Loss | 10% | 20% | 10% |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: 60 Calendar Days Phase 2: 60 Calendar Days (Unlimited with add-on) | Phase 1: 60 Calendar Days Phase 2: 60 Calendar Days (Unlimited with add-on) | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 90% | 75% up to 95% |

Comparative Analysis: Fidelcrest and E8 Funding

This table compares the trading objectives of Fidelcrest’s Normal and Aggressive Risk programs with E8 Funding’s Normal program.

| Trading Objectives | Fidelcrest Normal Risk | Fidelcrest Aggressive Risk | E8 Funding (Normal) |

|---|---|---|---|

| Phase 1 Profit Target | 10% | 15% or 20% | 8% |

| Phase 2 Profit Target | 5% or 10% | 15% or 20% | 5% |

| Maximum Daily Loss | 5% | 10% | 5% |

| Maximum Loss | 10% | 20% | 8% (Scaleable up to 14%) |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: 60 Calendar Days Phase 2: 60 Calendar Days (Unlimited with add-on) | Phase 1: 60 Calendar Days Phase 2: 60 Calendar Days (Unlimited with add-on) | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 90% | 80% |

Unique Aspects of Fidelcrest

Fidelcrest differentiates itself from other industry-leading prop firms by offering two distinct funding programs. Additionally, Fidelcrest provides traders with straightforward trading rules, including the flexibility to trade during news events, hold positions overnight, and over weekends.

Assessing the Realism of Getting Capital from Fidelcrest

Evaluating the practicality of trading requirements is crucial when considering prop firms. An attractive profit split on a highly funded account may seem appealing, but stringent requirements on gains and drawdowns can significantly impact the likelihood of success.

Micro Trader Evaluation Program Accounts

The realism of receiving capital from the Micro Trader evaluation program accounts stems from the choice between normal and aggressive risk account types:

- Normal Risk Account Types: Feature average profit targets (10% in phase one, 5% in phase two) and average maximum loss rules (5% daily, 10% overall).

- Aggressive Risk Account Types: Set higher profit targets (15% in both phases) with increased maximum loss rules (10% daily, 20% overall).

Pro Trader Evaluation Program Accounts

Similarly, the Pro Trader evaluation program accounts offer realistic capital acquisition opportunities, also available in normal and aggressive risk types:

- Normal Risk Account Types: Have average profit targets (10% in both phases) and maximum loss rules (5% daily, 10% overall).

- Aggressive Risk Account Types: Demand higher profit targets (20% in both phases) with more considerable maximum loss rules (10% daily, 20% overall).

Considering these aspects, Fidelcrest emerges as a viable option for traders seeking funding. The evaluation program accounts offer realistic trading objectives and conditions, enhancing the possibility of achieving payouts.

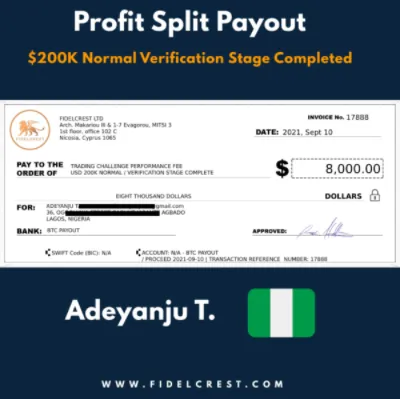

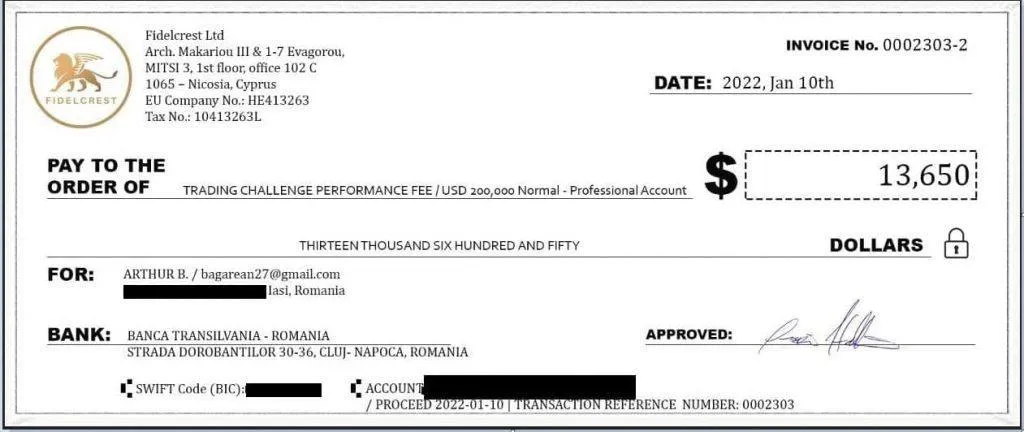

Verifying Payment Proof for Fidelcrest

Established in 2018 and incorporated in 2020, Fidelcrest is a relatively new yet significant player in the prop trading industry.

Sources for Payment Proof

Prospective and current traders can find evidence of payments from Fidelcrest through various channels:

- YouTube Channel: Fidelcrest has a YouTube channel where they regularly post updates, including payment proofs.

- News Section on Website: The official website of Fidelcrest features a News section that provides insights and updates, including payment proofs.

Additional Verification Source

For further verification, interested individuals can visit:

- Instagram Account: The Instagram account named ‘Fidelcrestgroup’ showcases additional payment proof. Click here to visit the Instagram page directly.

Broker Partnership of Fidelcrest

Fidelcrest, a renowned name in the proprietary trading industry, has established a significant partnership for its brokerage services.

Broker Details

Fidelcrest’s chosen broker is the Foreign Exchange Clearing House, known for its reliability and comprehensive services in the forex market.

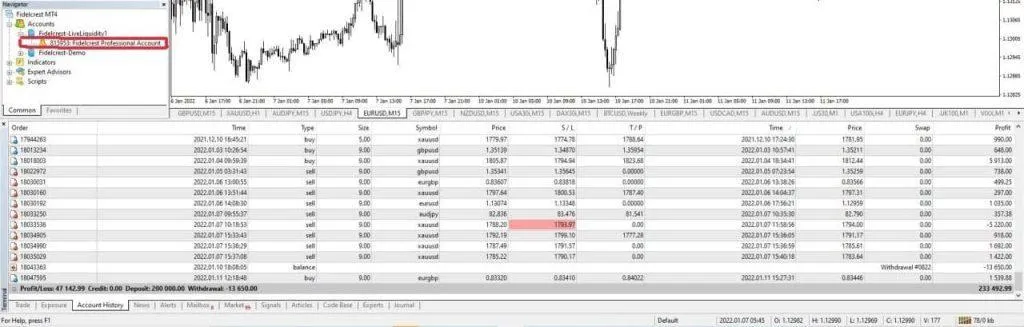

Available Trading Platforms

In terms of trading platforms, Fidelcrest accommodates a wide range of trading styles and preferences by offering:

- MetaTrader 4: A popular platform known for its user-friendly interface and advanced trading tools.

- MetaTrader 5: An enhanced version offering additional features and expanded capabilities for traders.

Trading Instruments Available at Fidelcrest

Fidelcrest offers a diverse array of trading instruments, catering to various trading preferences and strategies. The range includes forex pairs, commodities, indices, stocks, and cryptocurrencies.

Forex Pairs

Traders can engage in currency trading with a wide selection of forex pairs, including but not limited to:

- Major pairs like EURUSD, GBPUSD, AUDUSD, USDCAD, USDJPY

- Cross pairs such as EURJPY, GBPJPY, AUDCAD, CHFUSD

- Exotic pairs including AUDHUF, GBPPLN, USDILS, USDMXN

Commodities

Commodity trading options include:

- Precious metals: XAUUSD (Gold), XAGUSD (Silver)

- Energy commodities: USOil, UKOil, NGAS

- Agricultural products: COTTON, WHEAT, SOYBEAN, CORN, COCOA, COFFEE

Indices

A wide range of global indices are available, such as:

- Major indices: DAX30, STOXX50, UK100, AUS200, USA500

- Regional indices: HKG50, JP225, USA30, USA100

Stocks

An extensive list of stocks from various sectors is accessible, including:

- Technology: AAPL, GOOG, FB, MSFT, IBM

- Finance: JPM, BAC, GS, C

- Consumer goods: KO, PEP, PG, MCD

Cryptocurrencies

For crypto enthusiasts, a variety of cryptocurrencies are offered, such as:

- Mainstream cryptocurrencies: BTCUSD, ETHUSD, LTCUSD

- Altcoins: EOSUSD, IOTUSD, XRPUSD

Overview of Trading Fees at Fidelcrest

Fidelcrest maintains a straightforward structure for its trading commissions across different asset classes.

Trading Commission

The commission structure for various assets is as follows:

- FOREX: 6 USD per lot

- COMMODITIES: 6 USD per lot

- INDICES: 6 USD per lot

- STOCKS: 6 USD per lot

- CRYPTO: 6 USD per lot

Checking Live Spreads

To view the live spreads, traders can log in to the trading account using the following details:

- Platform: Meta Trader 4

- Server: ForeignExchangeClearingHouse-Demo

- Login Number: Zd3dchl

- Password: 1712029

- To download the platform, click here.

Education and Support Offered by Fidelcrest

Fidelcrest’s approach to trader education and support is somewhat unique compared to other firms in the industry.

Education Content

Currently, Fidelcrest does not offer educational content directly on its website. This might affect traders who are seeking extensive educational resources from their trading firm.

Online Community and Discussions

Despite the lack of formal educational content, traders can gain insights from Fidelcrest’s engagement in online trading communities:

- Fidelcrest has a thread on ForexFactory, which offers insights into the firm’s operations and trader experiences. The thread’s last update was on December 30th, 2019.

- The firm is frequently mentioned in a thread named ‘PROP FIRM HUB’ created by the user Masterrmind on ForexFactory. This thread provides a platform for discussions and shared experiences related to various prop firms, including Fidelcrest.

To view the mentioned thread on ForexFactory, click here.

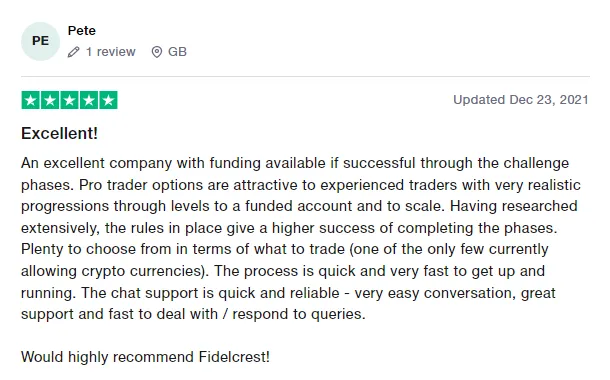

Feedback and Comments from Traders on Fidelcrest

Fidelcrest has garnered positive feedback from its trading community, reflecting well on its services and support.

Trustpilot Reviews

On Trustpilot, Fidelcrest enjoys a high rating, evidenced by:

- A 4.6/5 rating from a total of 1,422 reviews, indicating widespread satisfaction among its users.

Support Team’s Performance

Key highlights of the community feedback include:

- Efficient and reliable support team, known for providing comprehensive information and assistance on various aspects, including the firm’s trading rules, objectives, and resolution of any encountered issues.

- Quick and helpful customer service, addressing traders’ issues promptly and effectively.

Funding Program Options

Another significant aspect that has received positive feedback is:

- The variety in funding program options, offering both Micro and Pro accounts. This flexibility caters to a broad spectrum of traders, from beginners to experienced, with account sizes ranging from $15,000 to $1,000,000.

Fidelcrest’s Presence on Social Media

Fidelcrest maintains an active presence on various social media platforms, engaging with its community and providing updates and insights.

Social Media Followings

Fidelcrest’s social media statistics are as follows:

- Facebook: The Facebook page boasts 12k followers.

- Instagram: Their Instagram account has 6,699 followers.

- Twitter: Fidelcrest’s Twitter handle has gathered 305 followers.

- LinkedIn: The LinkedIn page has 685 followers.

- YouTube: Their YouTube channel has 3.29k subscribers and features 22 uploaded videos.

Discord Community

In addition to these platforms, Fidelcrest has a Discord channel, which serves as a platform for community communication and interaction.

Support Options at Fidelcrest

Fidelcrest provides multiple channels of support to assist traders with their queries and concerns.

FAQ Page

Their FAQ page is a comprehensive resource for information about the firm, covering a wide range of topics and questions.

Social Media and Email Support

Additional support options include:

- Social Media: The support team is active on Fidelcrest’s social media platforms.

- Email: Direct email support is available at support@fidelcrest.com for more personalized assistance.

Live Chat Support

Fidelcrest also offers:

- Active live chat support available 24/5, ensuring timely responses and help during the weekdays (Monday – Friday).

Final Thoughts on Fidelcrest

Fidelcrest has established itself as a legitimate proprietary trading firm, offering diverse program options and conditions suited for various trading styles.

Micro Trader Evaluation Program

The Micro Trader evaluation programs follow an industry-standard, two-phase challenge, leading to funding and profit split opportunities:

- Normal Risk Accounts: Require 10% profit in phase one and 5% in phase two, with 5% maximum daily and 10% maximum overall loss rules.

- Aggressive Risk Accounts: Set at 15% profit targets for both phases, with 10% daily and 20% overall maximum loss limits.

- Profit splits in this program range from 80% to 90%, based on the selected risk type.

Pro Trader Evaluation Program

Similarly, the Pro Trader evaluation programs offer:

- Normal Risk Accounts: 10% profit targets in both phases, with 5% daily and 10% overall loss limits.

- Aggressive Risk Accounts: Higher profit targets of 20% in both phases, coupled with 10% daily and 20% overall loss limits.

- Profit splits range from 80% to 90%, dependent on the chosen risk profile.

Recommendation

Fidelcrest is highly recommended for traders seeking a prop firm with clear and straightforward trading rules and who have honed a consistent trading strategy. Catering to a wide array of traders with different strategies, Fidelcrest stands out as one of the more accommodating and reputable firms in the proprietary trading industry.