Explore the world of proprietary trading with Alpha Capital Group. Discover their unique evaluation programs, profit splits, and tailored support, designed for both new and experienced traders.

Explore the world of proprietary trading with Alpha Capital Group. Discover their unique evaluation programs, profit splits, and tailored support, designed for both new and experienced traders.

- Flexible Two-Step Evaluation Accounts.

- Realistic Profit Targets in Evaluation.

- Up to 80% Profit Splits.

- Scalable Account Opportunities.

- Supports Diverse Trading Styles.

- Limited Brand Recognition.

- 5% Daily Loss Rule.

- 10% Maximum Loss Limit.

- Relatively New in the Industry.

- No Physical Office Locations.

Alpha Capital Group: Nurturing Successful Proprietary Traders

Alpha Capital Group equips aspiring traders with a comprehensive platform, offering a wealth of resources to aid their progression towards becoming funded proprietary traders. This platform is rich in educational content, featuring insightful videos on market trends, varied trading strategies, and valuable mentorship. Additionally, Alpha Capital Group’s custom-developed trading technology is tailored to enhance the trading experience.

Traders have the opportunity to manage accounts with a value of up to $200,000, and can reap the rewards of an attractive 80% profit split. Trading opportunities span across a diverse range of instruments, including forex pairs, commodities, and indices, providing traders with a broad spectrum of options to apply their skills and knowledge.

Understanding Alpha Capital Group

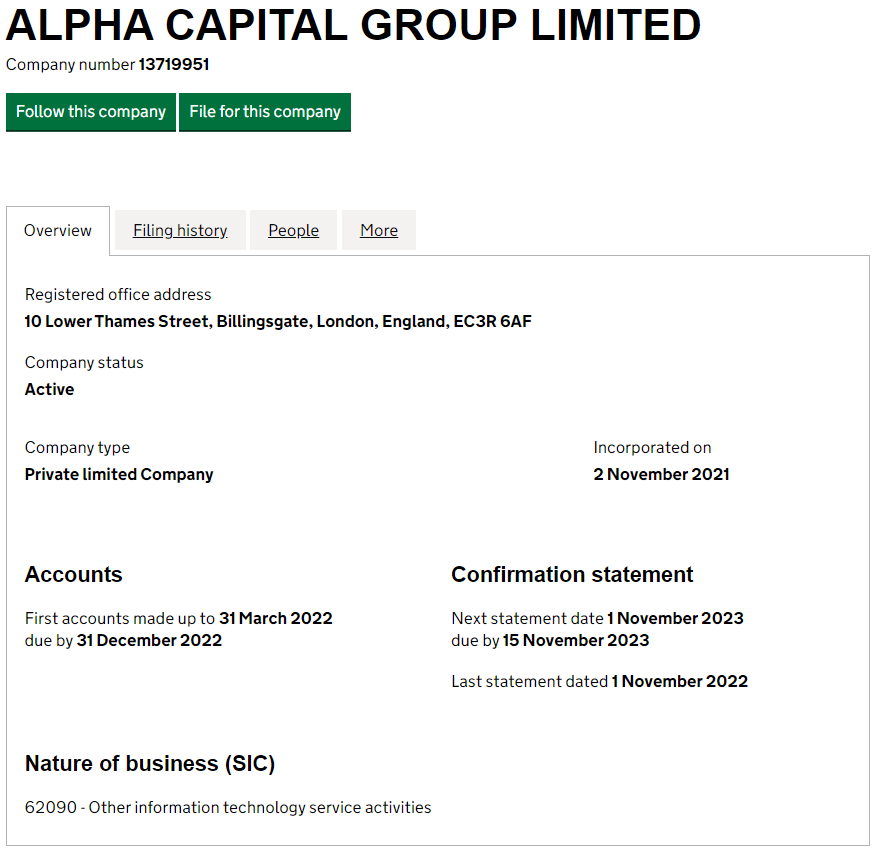

Alpha Capital Group, established on November 2, 2021, is a prestigious proprietary trading firm with its headquarters strategically located in London, UK. This London-based company offers traders the exceptional opportunity to manage substantial capital, extending up to $2,000,000, along with an enticing profit split of 80%. Renowned for their innovative approach, Alpha Capital Group has made a significant mark in the trading world with the launch of ACG Markets, their in-house proprietary execution brokerage. ACG Markets is acclaimed for providing traders with superior trading conditions, enhancing their trading experience. The firm’s main office is situated at 10 Lower Thames Street, Billingsgate, London, England, EC3R 6AF, reinforcing their presence in the heart of one of the world’s leading financial centers.

Renowned for their innovative approach, Alpha Capital Group has made a significant mark in the trading world with the launch of ACG Markets, their in-house proprietary execution brokerage. ACG Markets is acclaimed for providing traders with superior trading conditions, enhancing their trading experience. The firm’s main office is situated at 10 Lower Thames Street, Billingsgate, London, England, EC3R 6AF, reinforcing their presence in the heart of one of the world’s leading financial centers.

Funding Program Options at Alpha Capital Group

The funded programme provided by Alpha Capital Group presents traders with a selection of five different evaluation program account sizes. This flexibility allows traders to choose a program that aligns best with their trading style and goals. Each account size option is meticulously designed to cater to the varying needs and expertise levels of traders, ensuring they can find the perfect fit for their trading journey.

Details of Alpha Capital Group’s Evaluation Program Accounts

The evaluation program accounts at Alpha Capital Group are meticulously structured to identify and reward traders who demonstrate consistency and talent over a two-phase evaluation period. These accounts offer a leverage of 1:100, providing traders with ample opportunity to amplify their trading capabilities. The available account sizes and their corresponding prices are:

The available account sizes and their corresponding prices are:

- $10,000 Account for $97

- $25,000 Account for $197

- $50,000 Account for $297

- $100,000 Account for $497

- $200,000 Account for $997

In Evaluation Phase One, traders are tasked with achieving an 8% profit target without exceeding a 5% maximum daily loss or a 10% overall maximum loss. There are no maximum trading day requirements in this phase, but a minimum of three trading days is mandatory to progress to Phase Two. Evaluation Phase Two sets a profit target of 5% with the same loss limitations as Phase One. Similar to the first phase, there are no maximum trading day requirements, but traders must trade for a minimum of three days to advance to a funded account. Upon successful completion of both phases, traders are awarded a funded account. In this stage, there are no profit targets, but traders must adhere to the 5% maximum daily loss and 10% maximum loss rules. The first payout is scheduled 14 calendar days after the first trade on the funded account, with subsequent bi-weekly payouts on the 14th and 28th of each month. The profit split for traders in the funded account stage is set at an attractive 80%.

Scaling Plan for Evaluation Program Accounts at Alpha Capital Group

The evaluation program accounts at Alpha Capital Group offer a beneficial scaling plan, designed to further enhance the trading prospects of successful traders. Traders are eligible to request scaling when they achieve a 10% growth in their trading account. This scaling opportunity is particularly attractive as it amounts to 10% of the balance in the funded account. An added advantage of this scaling plan is the ability for traders to withdraw the full profits earned on their funded account while concurrently scaling their account balance. This unique feature ensures that traders do not have to sacrifice their earned profits for the sake of account growth. Trading instruments available in the evaluation program accounts include forex pairs, commodities, and indices, providing traders with a diverse range of options to apply their trading strategies and achieve the necessary growth for scaling.

Rules for Evaluation Program Accounts at Alpha Capital Group

Alpha Capital Group has set specific rules for their evaluation program accounts to ensure fair and disciplined trading. These rules are crucial for traders to understand and adhere to for successful progression through the program phases and into a funded account.

- Profit Target: In Phase One, traders must achieve an 8% profit target, while Phase Two requires a 5% profit target. Funded accounts have no profit target requirements.

- Maximum Daily Loss: All account sizes are subject to a 5% maximum daily loss limit to prevent excessive risk-taking.

- Maximum Loss: A 10% overall maximum loss limit is set for all account sizes, beyond which the account is considered violated.

- Minimum Trading Days: Both evaluation phases require a minimum of three trading days. Funded accounts, however, do not have a minimum trading day requirement.

- Lot Size Limit: Lot sizes are capped based on the account size, as follows:

- $10,000 account: 5 lots

- $25,000 account: 10 lots

- $50,000 account: 20 lots

- $100,000 account: 40 lots

- $200,000 account: 80 lots

- No Martingale Strategy: Traders are prohibited from using any martingale strategies in their trading.

- Average Trade Duration: All trades must be held for a minimum of 2 minutes.

- Third-Party Copy Trading Risk: Using third-party copy trading services poses the risk of exceeding the maximum capital allocation rule, potentially leading to denial of a funded account or withdrawal.

- Third-Party EA Risk: Similarly, using a third-party EA (Expert Advisor) could risk exceeding the maximum capital allocation rule, affecting the trader’s eligibility for a funded account or withdrawal.

Understanding and respecting these rules is essential for traders aiming to succeed in Alpha Capital Group’s evaluation program and in managing a funded account.

Distinctive Features of Alpha Capital Group Compared to Other Prop Firms

Alpha Capital Group stands out in the proprietary trading industry with several key features that differentiate it from other leading prop firms. One of the most notable aspects is the offering of five different account sizes in their two-step evaluation program, each accompanied by clear and straightforward rules. These evaluation program accounts are characterized by relatively low profit targets in both phases, which makes them appealing for traders aiming for achievable goals.

The profit targets are set at 8% for phase one and 5% for phase two. In addition, traders benefit from the flexibility to trade during news events, hold trades overnight, and over the weekends – options that are not always available with other prop firms. Another significant advantage is the two-phase evaluation process required by Alpha Capital Group, which is designed to thoroughly assess a trader’s skills before they become eligible for payouts.

Additionally, the program includes a 5% maximum daily and 10% maximum loss rule, along with a requirement of a minimum of three trading days in both phases before advancing to a funded account. The evaluation program accounts at Alpha Capital Group also feature a scaling plan, further enhancing the growth potential for successful traders. When compared to other industry leaders, Alpha Capital Group’s approach with lower profit targets and straightforward trading objectives and rules sets it apart, offering a unique and trader-friendly environment.

Comparative Analysis: Alpha Capital Group vs. E8 Funding

When comparing Alpha Capital Group and E8 Funding, it’s insightful to look at various trading objectives to understand the differences and similarities between these two leading proprietary trading firms.

| Trading Objectives | Alpha Capital Group | E8 Funding (Normal) |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 8% (Scalable to 14%) |

| Minimum Trading Days | 3 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 80% |

Both Alpha Capital Group and E8 Funding share similarities in their profit targets for both phases, maximum daily loss, and profit splits. However, notable differences lie in the maximum loss policy and minimum trading days requirement, with Alpha Capital Group having a 10% maximum loss and a 3-calendar-day minimum, compared to E8 Funding’s scalable maximum loss and no minimum trading days.

Comparative Analysis: Alpha Capital Group vs. FundedNext (Stellar)

When evaluating Alpha Capital Group alongside FundedNext (Stellar), a comparative look at their trading objectives reveals both similarities and differences between these two prop trading firms.

| Trading Objectives | Alpha Capital Group | FundedNext (Stellar) |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 3 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 80% up to 90% |

Alpha Capital Group and FundedNext (Stellar) are similar in their phase profit targets, maximum daily loss, and maximum loss. However, they differ in their minimum trading days, with Alpha Capital Group requiring 3 calendar days compared to FundedNext’s 5 calendar days. Additionally, while both offer a starting profit split of 80%, FundedNext provides the potential to increase the split up to 90%.

Comparative Analysis: Alpha Capital Group vs. Funding Pips

An insightful comparison of Alpha Capital Group with Funding Pips reveals how each proprietary trading firm structures its trading objectives, shedding light on their unique offerings and policies.

| Trading Objectives | Alpha Capital Group | Funding Pips |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 3 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 80% up to 90% |

In summary, while Alpha Capital Group and Funding Pips share similarities in their profit targets, maximum loss, and daily loss limits, they differ in their approach to minimum trading days and profit splits. Alpha Capital Group requires a minimum of 3 calendar days of trading, whereas Funding Pips has no such requirement. Additionally, while Alpha Capital Group offers a fixed 80% profit split, Funding Pips provides an opportunity to increase the profit split up to 90%. In conclusion, Alpha Capital Group distinguishes itself from other industry-leading prop firms by offering five different evaluation account sizes with straightforward rules, coupled with the flexibility for traders to engage in trading during news events, hold trades overnight, and during weekends.

Assessing the Realism of Acquiring Capital with Alpha Capital Group

When evaluating the feasibility of obtaining capital from proprietary trading firms, it’s crucial to consider the alignment of their trading requirements with your forex trading style. The allure of a high profit split on a well-funded account can be overshadowed by unrealistic expectations of high percentage gains paired with low maximum drawdowns, which can significantly reduce the likelihood of success. Alpha Capital Group’s Evaluation program accounts are designed with realism in mind. The profit targets are set at attainable levels – 8% in phase one and 5% in phase two – and are accompanied by reasonable maximum loss rules, including a 5% maximum daily and a 10% maximum overall loss. This balance of objectives offers a realistic pathway for traders to succeed and secure funding. In conclusion, Alpha Capital Group emerges as an excellent option for traders seeking funding. The firm provides a choice of five different two-step evaluation account sizes, each with realistic trading objectives and conditions. This approach not only enhances the possibility of receiving payouts but also aligns well with a wide range of trading styles, making Alpha Capital Group a viable and attractive choice for aspiring forex traders.

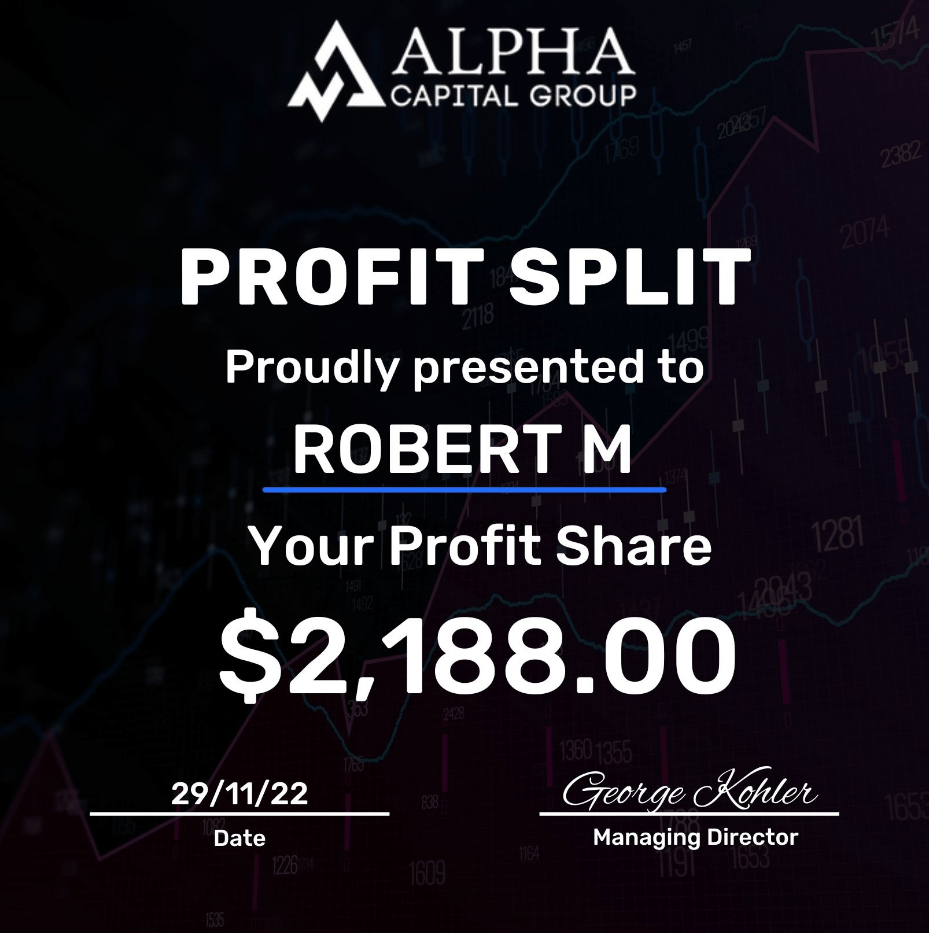

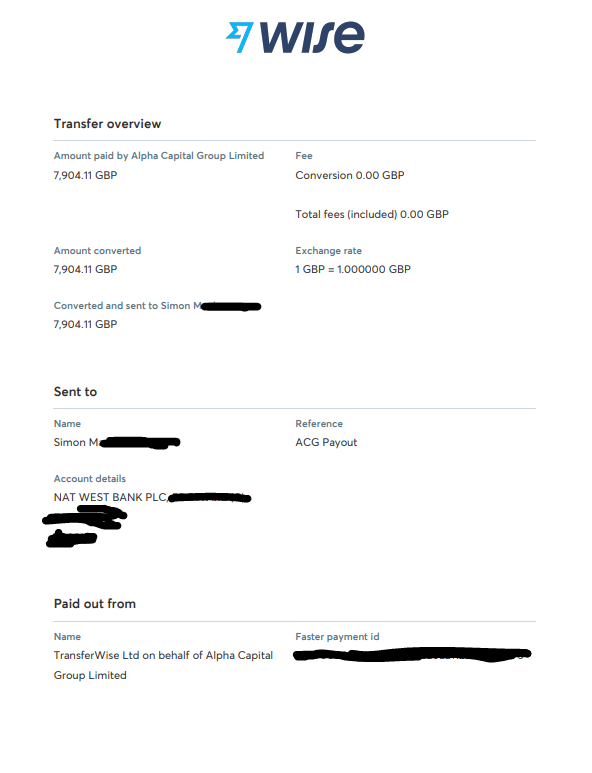

Payment Proof from Alpha Capital Group

Since its incorporation on November 2, 2021, Alpha Capital Group has established a reliable payment system for its traders. Once funded, traders are eligible for bi-weekly payouts, with the notable absence of minimum profit targets. Specifically, traders can request withdrawals on the 14th and 28th of each month. For those interested in verifying the credibility of these payments, Alpha Capital Group offers tangible proof of payouts. Two such examples of payout proof are available for review:

- Payout Proof 1: Demonstrates a successful payout to a trader.

- Payout Proof 2: Shows another instance of a trader receiving their earnings.

Additional evidence of payouts, similar to the ones mentioned above, can be found by joining Alpha Capital Group’s Discord channel. Within the channel, there is a dedicated ‘payout proof’ section where numerous examples of successful trader payouts are regularly posted, offering transparency and reassurance to current and prospective traders.

Brokers Used by Alpha Capital Group

Alpha Capital Group employs its proprietary brokerage, ACG Markets, as their primary trading server. This exclusive brokerage is specially designed for the traders of Alpha Capital Group, providing them with superior trading conditions that are tailored to their needs. ACG Markets stands out with its array of offerings, ensuring traders have access to an institutional trading experience. Key features of ACG Markets include:

- Institutional Trading Experience: Offers traders a professional-level trading environment.

- Prime Liquidity: Ensures smooth and efficient trade executions.

- Ultra-low Latency: Provides a swift trading experience with minimal delay.

- Sub 30ms Targeted Execution Time: Aims for rapid execution of trades.

- Raw Spreads from 0.1: Offers competitive spreads starting as low as 0.1.

- Trading Instruments: Includes a diverse range of forex pairs, commodities, and indices.

In terms of trading platforms, Alpha Capital Group allows its traders to operate on both MetaTrader 5 and cTrader. These platforms are renowned for their robust features and user-friendly interfaces, making them a top choice for traders seeking efficient and effective trading tools.

Trading Instruments Available at Alpha Capital Group

Alpha Capital Group offers its traders a broad spectrum of trading instruments, accompanied by a leverage of 1:100. This range ensures that traders have access to various markets, catering to different trading preferences and strategies. The available trading instruments are categorized into three main groups:

Forex Pairs

- AUD/CAD, AUD/CHF, AUD/JPY, AUD/NZD, AUD/USD

- CAD/CHF, CAD/JPY, CHF/JPY, EUR/AUD, EUR/CAD

- EUR/USD, EUR/CHF, EUR/GBP, EUR/JPY, EUR/NZD

- GBP/AUD, GBP/CAD, GBP/CHF, GBP/JPY, GBP/NZD

- GBP/SGD, NZD/CAD, NZD/CHF, NZD/JPY, NZD/USD

- USD/CAD, USD/CHF, USD/JPY, and more.

Commodities

- XAU/USD (Gold), XAG/USD (Silver), USOil, UKOil

Indices

- US500, EUSTX50, GER30, HK50, JPN225

- NAS100, UK100, US30

These options provide traders with the flexibility to engage in diverse trading strategies across different markets, enhancing the potential for successful trading outcomes.

Trading Fees at Alpha Capital Group

Alpha Capital Group offers a competitive fee structure for its traders, which is an important consideration for anyone looking to join a proprietary trading firm. The details of the trading commissions and spreads are as follows:

Trading Commission

- Forex: 0 USD per lot

- Commodities: 0 USD per lot

- Indices: 0 USD per lot

Spread

To get a comprehensive understanding of the live spreads offered by Alpha Capital Group, traders are encouraged to log in to the trading account with the following details:

| Platform | Server | Login Number | Password | Download Platform |

|---|---|---|---|---|

| MetaTrader 5 | ACGMarkets-Live | 1189526 | APTF | Click here |

This direct access allows traders to observe and analyze the live spreads, helping them make informed decisions about their trading strategies and potential costs.

Education & Support for Traders at Alpha Capital Group

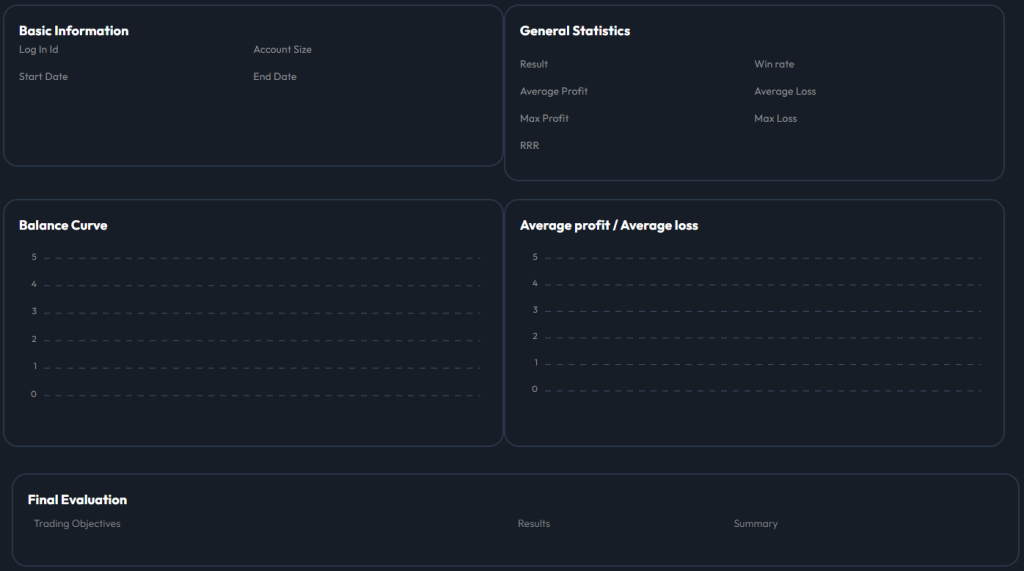

Alpha Capital Group is committed to nurturing the growth and development of its traders. To facilitate this, they are in the process of launching the Alpha Academy, which will offer educational courses and strategies tailored to unlock the full potential of their traders. This initiative underscores their dedication to providing comprehensive support for their clients. In addition, Alpha Capital Group has developed numerous Automated Trading Systems, specifically designed to cater to the unique needs of their traders. This technology integration demonstrates their commitment to offering advanced tools for enhancing trading efficiency and success. While Alpha Capital Group does not have a dedicated thread on ForexFactory, they are actively discussed in the “PROP FIRM HUB” thread created by MasterrMind. This thread features various details about the firm and the features it offers, providing a platform for user discussions and insights. To view the mentioned thread, click here. Unique among proprietary trading firms, Alpha Capital Group offers a free trial option before starting the evaluation challenge. This trial enables traders to familiarize themselves with the platform and its requirements, thereby reducing the likelihood of errors when they decide to purchase the challenge. Furthermore, Alpha Capital Group provides a well-structured dashboard accessible to all clients. This dashboard is an invaluable tool for managing risk and monitoring the objectives and statistics of their trading activities, further supporting traders in their journey with the firm.

In addition, Alpha Capital Group has developed numerous Automated Trading Systems, specifically designed to cater to the unique needs of their traders. This technology integration demonstrates their commitment to offering advanced tools for enhancing trading efficiency and success. While Alpha Capital Group does not have a dedicated thread on ForexFactory, they are actively discussed in the “PROP FIRM HUB” thread created by MasterrMind. This thread features various details about the firm and the features it offers, providing a platform for user discussions and insights. To view the mentioned thread, click here. Unique among proprietary trading firms, Alpha Capital Group offers a free trial option before starting the evaluation challenge. This trial enables traders to familiarize themselves with the platform and its requirements, thereby reducing the likelihood of errors when they decide to purchase the challenge. Furthermore, Alpha Capital Group provides a well-structured dashboard accessible to all clients. This dashboard is an invaluable tool for managing risk and monitoring the objectives and statistics of their trading activities, further supporting traders in their journey with the firm.

Alpha Capital Group Review: Customer Feedback

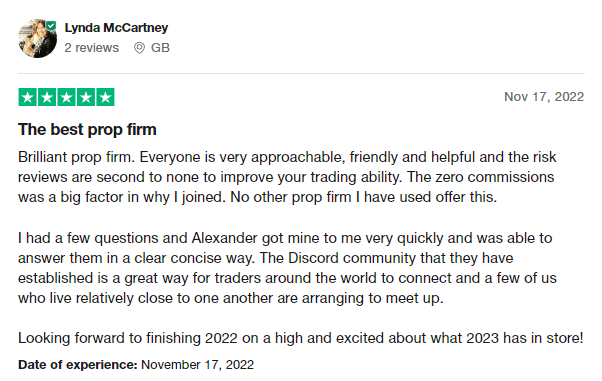

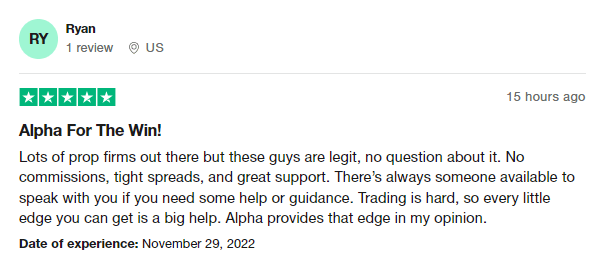

Alpha Capital Group has garnered widespread acclaim for its services, as evidenced by the enthusiastic reviews it receives. A standout feature of their customer experience is the rapid and efficient support team, renowned for its helpful guidance and prompt resolution of any issues.

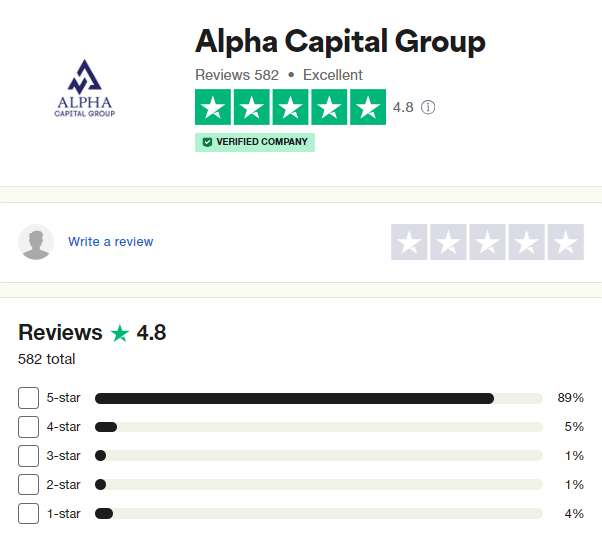

High Trustpilot Ratings

On Trustpilot, the prop firm boasts an impressive 4.8/5 rating from 582 reviews, reflecting the positive experiences of a large segment of their community. This high score underscores the company’s commitment to customer satisfaction and trustworthiness.

Exceptional Customer Support

Community members frequently highlight the prop firm’s support team, praising their quick response times and effective problem-solving skills. Whether it’s providing vital information or guiding customers to a resolution, the support team consistently delivers top-notch service.

User-Friendly Dashboard and Fee Structure

Additionally, many users appreciate the intuitive design of the company’s dashboard, which enhances the overall trading experience. Another significant advantage noted by the community is the absence of commission fees, making trading with the prop firm even more appealing.

Alpha Capital Group’s Social Media Presence

Alpha Capital Group extends its reach beyond traditional platforms, establishing a notable presence on various social media channels.

Instagram Engagement

The prop firm has successfully cultivated a following on Instagram, boasting 3,739 followers. This engagement reflects their active involvement and connectivity with the trading community on this platform.

Facebook Community

On Facebook, the prop firm enjoys a significant following, with an impressive 40,000 followers. This large community indicates a strong and widespread interest in their offerings and updates.

YouTube Content and Subscribers

The prop firm’s YouTube channel, with 517 subscribers, is a hub for educational and informative content, featuring a total of 102 uploaded videos. This platform serves as a valuable resource for both novice and experienced traders alike.

Discord Channel Membership

Additionally, their Discord channel hosts 2,145 members, providing a dynamic and interactive space for traders to connect, share insights, and discuss trading strategies.

Support Services at Alpha Capital Group

Alpha Capital Group provides comprehensive support to ensure a seamless experience for its users, offering various channels for assistance and information.

Informative FAQ Page

The prop firm’s FAQ page is a valuable resource for general information, covering the essentials of their proprietary trading firm and funding program rules. This section serves as the first point of reference for common queries.

Live Chat Support

For more personalized assistance, the prop firm’s live chat support on their website is highly recommended. The support team is known for its reliability and effectiveness in resolving any issues you may encounter.

Social Media and Email Communication

The support team is also accessible through their social media platforms, offering another avenue for help. Alternatively, direct email communication is available at support@alphacapitalgroup.uk, ensuring prompt and detailed responses.

Discord Channel Interaction

Engagement extends to their Discord channel, where you can not only seek support from the team but also engage with other community members. This interactive platform fosters a sense of community and shared learning among traders.

Final Thoughts on Alpha Capital Group

After a comprehensive review, it’s clear that Alpha Capital Group stands out as a distinguished proprietary trading firm in the industry.

Flexible Evaluation Account Options

The firm offers a selection of five different two-step evaluation account sizes, catering to diverse trading preferences and strategies. This flexibility is a significant advantage for traders seeking a platform that aligns with their specific needs.

Realistic Evaluation Programs

Their two-phase evaluation challenges are in line with industry standards, requiring traders to meet attainable profit targets of 8% in the first phase and 5% in the second. These targets, balanced with a 5% maximum daily and 10% maximum loss rule, present realistic goals for traders.

Profitable Trading Opportunities

Upon successful completion of the evaluation phases, traders become eligible for funding and can earn up to 80% profit splits. Additionally, the opportunity to scale accounts further enhances the earning potential.

Recommendation for Diverse Traders

Alpha Capital Group is highly recommended for anyone seeking a prop firm with clear and straightforward trading rules. Despite being relatively new in the field, they offer excellent conditions suitable for a wide range of trading styles.

Industry Standing

Considering all aspects of their offerings, Alpha Capital Group firmly positions itself as one of the leading proprietary trading firms in the market today, meriting serious consideration from aspiring and experienced traders alike.

alex scam help﹫ maℹl .¢OM is an expert, he proved it to me, it’s still hard to believe that he got back my funds in just 48 hours, I’m filled with happiness 😊