Embracing the prop firm challenge is a thrilling yet demanding journey for traders. It’s a critical step to becoming a professional prop trader, where a deep understanding of the financial markets and adept risk management in trading play pivotal roles. In this comprehensive guide, the seasoned professionals at TU share insightful strategies, essential tips, and expert advice to help traders effectively overcome the prop firm challenge and embark on a lucrative trading career.

Effective Trading Strategies for Prop Firm Challenges

Let’s delve into what makes a trading strategy successful in the prop firm environment. The key to triumph lies in adopting consistent, rules-based strategies coupled with stringent risk management measures. These approaches not only optimize profitability but also maintain trading discipline.

Common Trading Pitfalls to Avoid

Aspiring traders should be wary of certain missteps that can derail their progress. These include overtrading, taking excessive risks, overleveraging positions, trading without a solid strategy, being distracted while trading, ignorance of the firm’s rules, and emotional decision-making. Steering clear of these errors can significantly boost your chances of passing the challenge.

Trading on Mobile Devices: Yes or No?

A common query is whether trading on a tablet or mobile phone is acceptable during a prop challenge. Typically, desktop platforms are preferred for their precision in order execution and data analysis. Mobile trading is advisable only if the firm explicitly allows it.

Handling Technical Difficulties

In case of technical issues, immediate communication with the firm’s support team is crucial. Meanwhile, ensure compliance with all the challenge rules. Depending on the situation’s gravity, the firm may offer allowances or reset the challenge on an individual basis.

Up to $400k Sign up with our link and start your challenge from just $44

Get Funded

Up to $260k

10% Off when you sign-up with our link. 12,000 stocks & ETFs Available.

Get Funded

Up to $200k

MT4, and MT5 platforms available

Get Funded

Up to $400k

10% Off when you sign-up with our link and apply code: APTF10

Get Funded

Up to $4m

5% Off when you sign-up with our link

Mastering the Prop Firm Trading Challenge

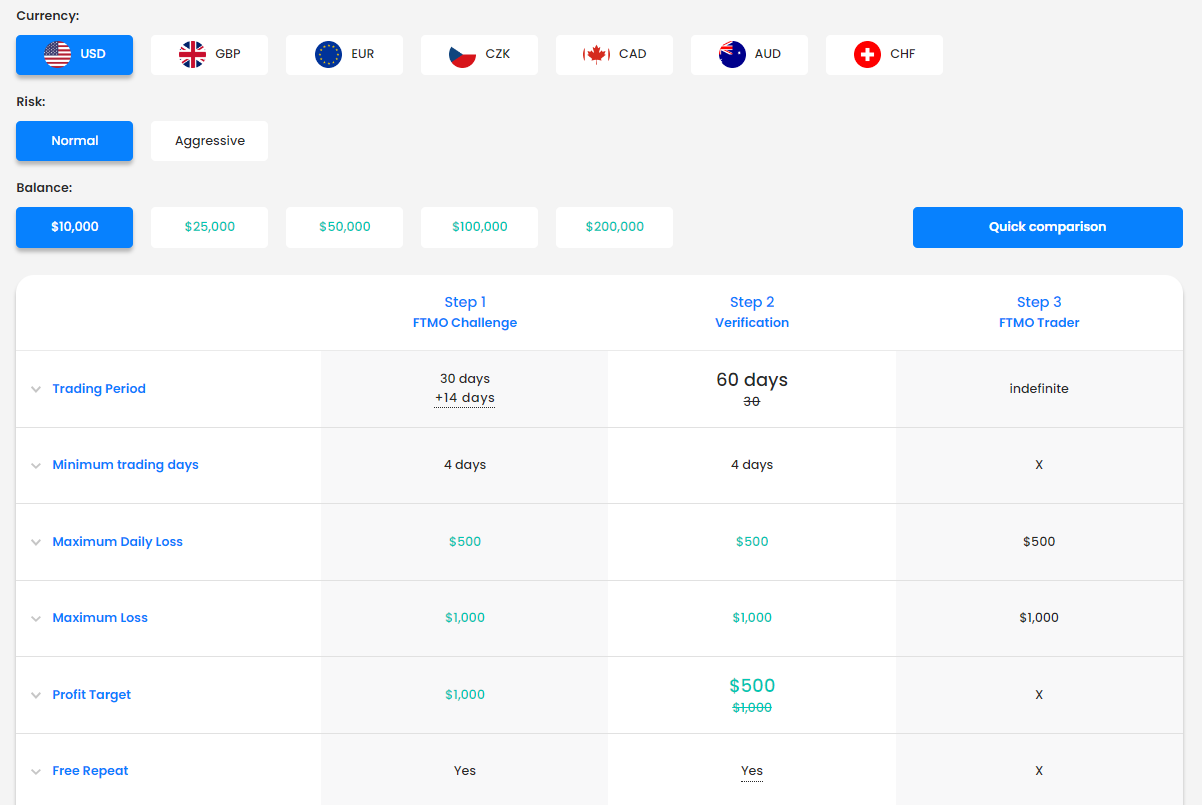

Understanding the intricacies of the prop firm trading challenge can be daunting, but with the right approach, it’s entirely achievable. In this guide, we’ll use FTMO’s prop trading framework as a foundational example. This information, however, is broadly applicable across various leading prop trading firms, making it a versatile guide for any trader.

Begin with a Manageable Challenge

Embarking on your prop firm trading journey with a smaller challenge is a wise strategy. This initial step serves as an introduction to the trading platform, allowing you to grasp the rules and requirements. It’s an opportunity to build your trading confidence, learn from early mistakes, and fine-tune your approach before scaling up to more ambitious challenges.

Emphasize Risk Management

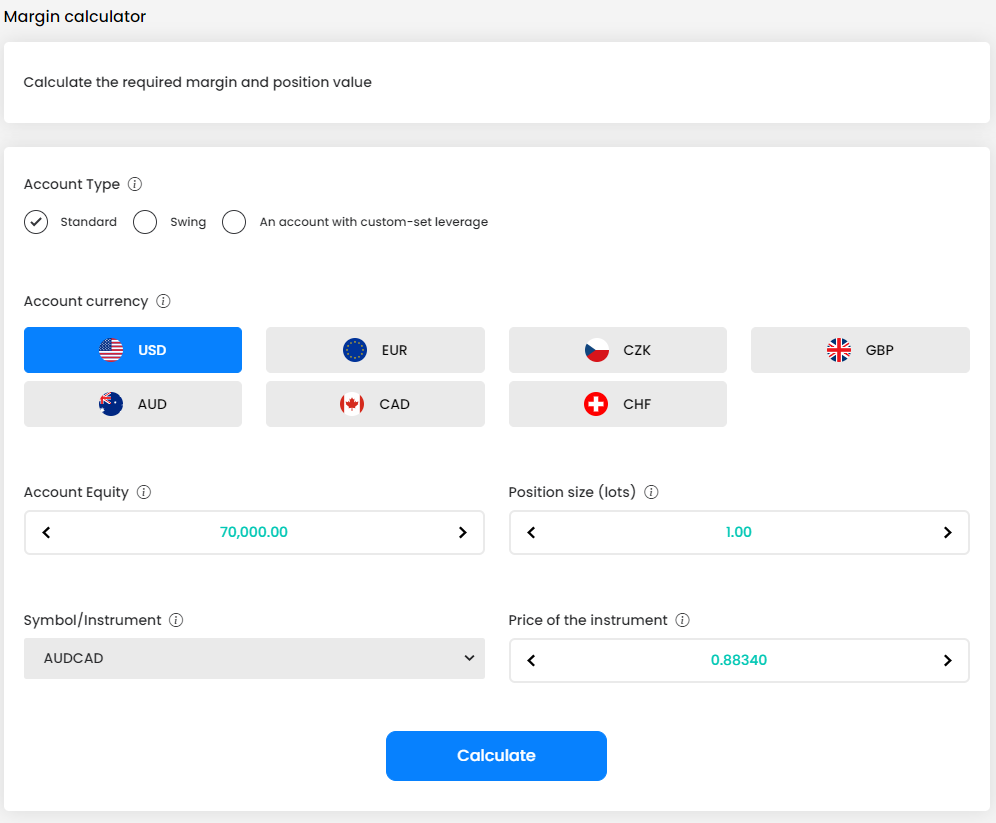

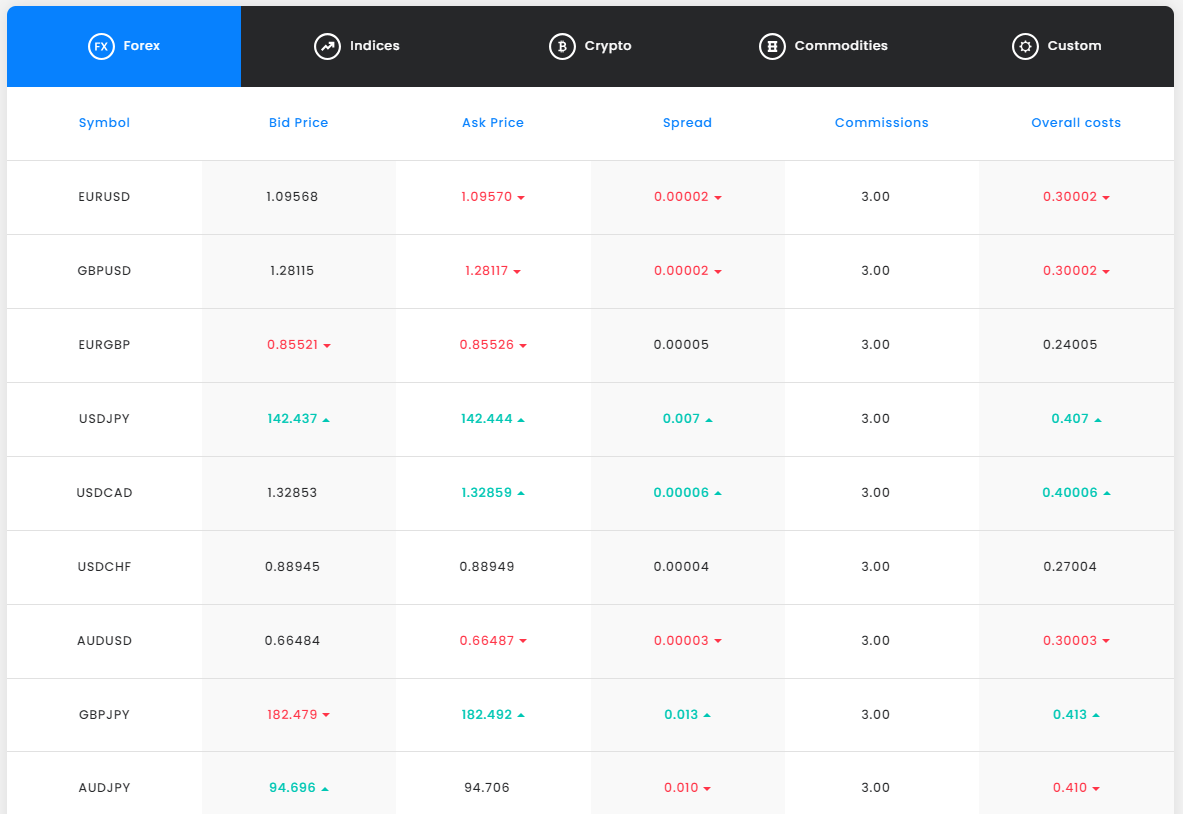

Prop firms heavily weigh a trader’s ability to manage risk. Demonstrating adept risk management is key to succeeding in the challenge. Employ techniques like setting stop-loss orders, carefully managing position sizes, and diversifying trades. This not only shows your grasp of capital protection but also highlights your strategy to limit potential losses. Leverage tools such as the margin calculator, typically available on the prop firm’s platform, to aid your risk management strategies.

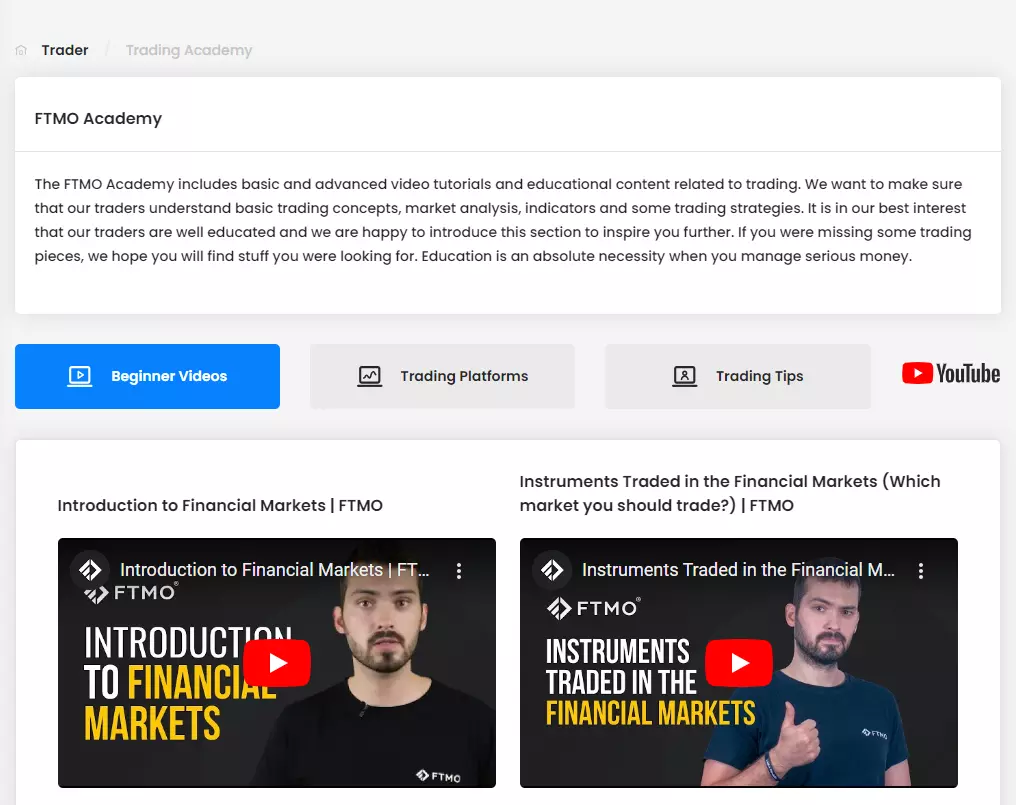

Leverage Educational Tools

Maximize the learning resources offered by the prop firm. These can include training modules, webinars, and tutorials, all geared towards enhancing your trading knowledge and skills. Engaging with these tools deepens your understanding of trading concepts and market behavior, illustrating your dedication to ongoing learning and self-improvement.

Stay Informed with Market Updates

Keeping abreast of market news and analyses is crucial. Regularly consume financial news, track market trends, and scrutinize price movements. Informed trading decisions stem from a solid understanding of fundamental and technical analysis, showcasing your proficiency in interpreting market data.

Engage with Mentors

If available, seize mentorship opportunities or advice from seasoned traders. These mentors can provide you with invaluable insights, refine your trading methods, and offer customized advice. Seeking mentorship demonstrates your eagerness to learn from experienced professionals and apply their guidance to your trading practice.

Self-Guided Strategies for Prop Firm Trading Success

Success in the prop firm trading challenge demands not only knowledge and skill but also self-discipline and strategic planning. Here are essential practices you should embrace to enhance your chances of passing the challenge.

Achieving Consistency and Profitability

Prop firms evaluate traders on their ability to be both consistent and profitable. Consistency means maintaining a steady, positive performance over time, beyond just sporadic high-profit trades. Aim to cultivate a trading history that reflects your capability to generate profits regularly. This steady performance is often more valued than one-off successes.

Maintaining a Detailed Trading Journal

Documenting each trade in a comprehensive journal is crucial. Record your trading rationale, the points of entry and exit, and any pertinent observations for each transaction. This practice is invaluable for reviewing your performance, identifying recurring patterns, and fine-tuning your strategy based on concrete data and self-reflection.

Adhering to Your Trading Strategy

For success in the prop firm challenge, it’s imperative to have a robust, well-tested trading strategy. Before embarking on the challenge, ensure your strategy is clearly defined and thoroughly vetted. Stick to this strategy consistently during the challenge, avoiding impulsive or emotionally driven decisions. Such discipline and steadfast adherence to your strategy demonstrate the qualities prop firms seek in traders.