Discover TopTier Trader, a leading force in the forex prop trading world. Dive into our in-depth review to explore their innovative funding programs, trader-friendly policies, and the overall trading experience they offer. Whether you’re a seasoned trader or just starting, find out why TopTier Trader could be your next trading destination.

Discover TopTier Trader, a leading force in the forex prop trading world. Dive into our in-depth review to explore their innovative funding programs, trader-friendly policies, and the overall trading experience they offer. Whether you’re a seasoned trader or just starting, find out why TopTier Trader could be your next trading destination.

- Diverse Funding Programs.

- Realistic Profit Targets.

- 24/7 Support Availability.

- Strong Social Media Presence.

- Transparent Fee Structure.

Exploring the Opportunities at TopTier Trader

TopTier Trader fosters an environment where traders are empowered to flourish in their trading endeavors. The firm offers the flexibility for traders to operate at their own pace and to maintain their positions for any duration they see fit. The primary limitations in place are against the use of Expert Advisors (EAs) and copy trading strategies. Beyond these constraints, TopTier Trader focuses primarily on adhering to loss limits. Their principal aim is to collaborate with consistent traders, offering them a lucrative reward structure with profit splits ranging from 80% to 90%.

Understanding Who TopTier Trader Is

TopTier Trader, a burgeoning name in the proprietary trading firm landscape, commenced its operations on October 18, 2021. Situated in Delaware, USA, this firm extends a helping hand to traders who are grappling with capital limitations, offering funding up to $600,000. They entice traders with an attractive profit split, starting at 80% and potentially escalating to 90%. Additionally, TopTier Trader has a scaling plan for their outstanding traders, allowing them to manage balances up to $2,000,000. They facilitate their clients’ trading activities by partnering with ThinkMarkets as their broker.

Diverse Funding Program Options at TopTier Trader

At TopTier Trader, traders have the opportunity to select from a variety of funding program options, each designed to cater to different trading styles and preferences. These include:

- Regular TopTier Challenge Evaluation Program Accounts: This program is tailored for traders who prefer the standard evaluation process.

- Swing TopTier Challenge Evaluation Program Accounts: Ideal for traders with a swing trading strategy, offering more flexibility in holding positions.

- TopTier Challenge Plus Evaluation Program Accounts: An advanced option for traders seeking higher challenges and rewards.

Regular TopTier Challenge Evaluation Program Accounts

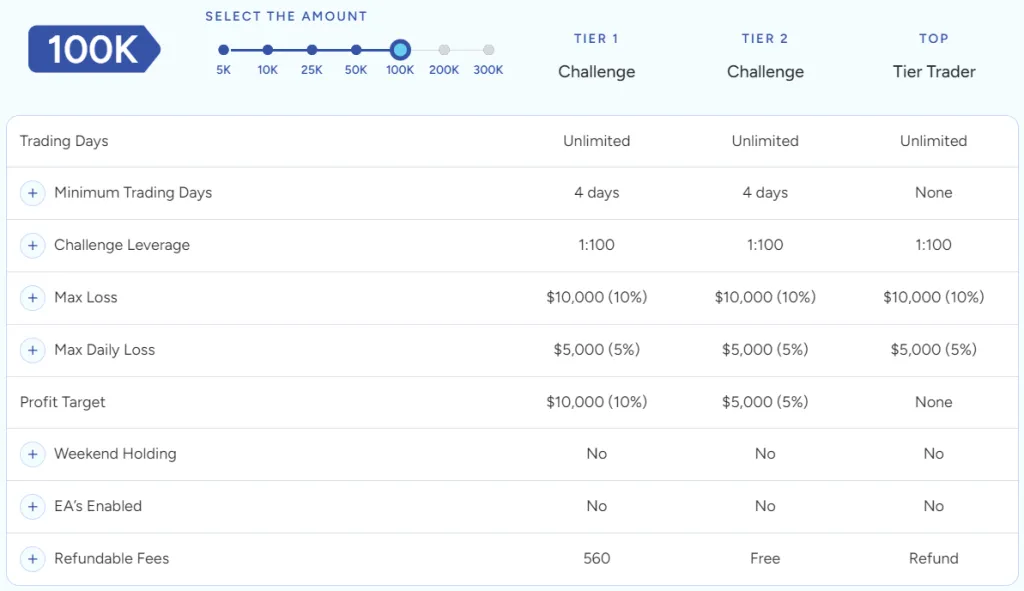

The Regular TopTier Challenge Evaluation Program Account is specifically designed to identify and reward serious and talented traders. This two-phase evaluation process is a test of consistency and skill, offering traders the chance to trade with a leverage of 1:100. The program encompasses various account sizes, each with its own pricing:

- $5,000 account for $55

- $10,000 account for $99

- $25,000 account for $255

- $50,000 account for $350

- $100,000 account for $560

- $200,000 account for $999

- $300,000 account for $1,489

Evaluation Phase One involves reaching a 10% profit target without exceeding a 5% maximum daily loss or a 10% maximum total loss. Traders are given 40 calendar days from their first position to meet this target and must trade on at least four days to progress to Phase Two. Evaluation Phase Two sets a profit target of 5%, maintaining the same daily and maximum loss limits. Here, traders have 60 calendar days from their first position to meet this target and must trade on a minimum of four days to qualify for a funded account. Successful completion of both phases leads to a funded account with no profit targets. The only requirements are to adhere to the 5% maximum daily loss and 10% maximum total loss rules. The first payout is available 14 calendar days from the first position in the funded account. This period imposes no minimum trading day requirement or other restrictions. Profit splits in this stage are set at 80% based on the trader’s profits.

Scaling Plan for Regular TopTier Challenge Evaluation Program Accounts

The Regular TopTier Challenge Evaluation Program Account offers an enticing scaling plan. To qualify for this plan, traders need to achieve a minimum profit target of 6% within a three-month period, ensuring profitability in at least two of those three months. Successful achievement of this target results in a 25% increase in the original account balance, with the potential to scale up to a maximum of $2,000,000. For example:

- After 3 months, a $200,000 account is elevated to $250,000.

- In the following 3 months, the balance can grow from $250,000 to $300,000.

- In the next period, the balance may rise from $300,000 to $350,000.

- This incremental growth continues in a similar pattern.

The available trading instruments for these evaluation program accounts include forex pairs, commodities, indices, and cryptocurrencies, offering a diverse range of options for traders.

Key Rules for Regular TopTier Challenge Evaluation Program Accounts

The Regular TopTier Challenge Evaluation Program Account comes with specific rules designed to maintain trading discipline and risk management:

- Profit Target: This is the set percentage of profit a trader must achieve to complete an evaluation phase, withdraw profits, or scale their account. In Phase 1, the profit target is 10%, and in Phase 2, it’s 5%. Funded accounts have no profit targets.

- Maximum Daily Loss: This is the highest loss a trader can incur in a single day before the account is considered violated. All account sizes have a maximum daily loss limit of 5%.

- Maximum Loss: This refers to the overall maximum loss a trader can reach before the account is considered violated. For all account sizes, the maximum loss is set at 10%.

- Minimum Trading Days: This is the minimum number of days a trader must trade to complete an evaluation phase or request a withdrawal. Both phases require a minimum of four trading days. Funded accounts do not have a minimum trading day requirement.

- No Weekend Holding: Traders are not permitted to hold open positions over the weekend.

- No Martingale Allowed: The use of any martingale strategy is prohibited while trading.

- No Copy Trading Allowed: Traders are not allowed to engage in any form of copy trading services.

Swing TopTier Challenge Evaluation Program Accounts

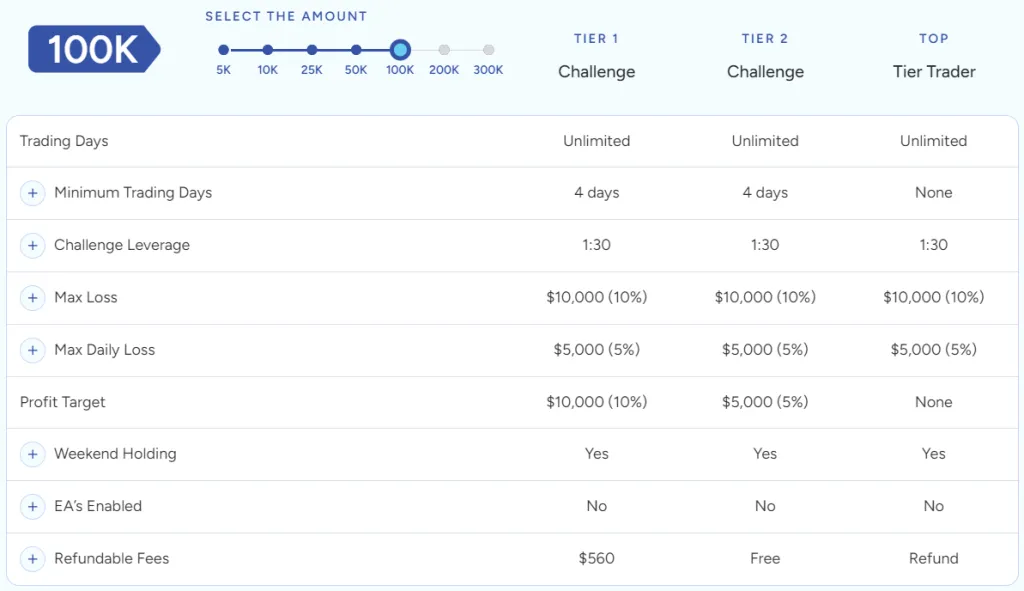

The Swing TopTier Challenge Evaluation Program Account is designed for traders seeking a more conservative approach with a focus on identifying serious and talented individuals. This program allows trading with a leverage of 1:30 and encompasses the following account sizes and fees:

- $5,000 account for $55

- $10,000 account for $99

- $25,000 account for $255

- $50,000 account for $350

- $100,000 account for $560

- $200,000 account for $999

- $300,000 account for $1,489

Evaluation Phase One challenges traders to achieve a 10% profit target without exceeding a 5% maximum daily loss or a 10% total loss limit. This target must be reached within 40 calendar days from the first position placed on the evaluation account, and traders must trade for at least four days to advance to Phase Two. Evaluation Phase Two requires traders to meet a 5% profit target while adhering to the same loss limits. This target should be reached within 60 calendar days from the first position, with a minimum trading requirement of four days to qualify for a funded account. Upon successful completion of both phases, traders are awarded a funded account with no set profit targets, only needing to respect the 5% maximum daily loss and 10% total loss rules. The first payout occurs 14 calendar days from the first position in the funded account, with no minimum trading days or other restrictions. The profit split in this stage is 80% based on the trader’s earnings in the funded account.

Scaling Plan for Swing TopTier Challenge Evaluation Program Accounts

Swing TopTier Challenge Evaluation Program Accounts feature a compelling scaling plan. To qualify, traders must achieve a profit target of at least 6% over a three-month period, ensuring profitability in two out of those three months. Successful completion leads to an account increase of 25% of the original balance, with the possibility of scaling up to a maximum of $2,000,000. Examples of scaling progression:

- After 3 months, a $200,000 account increases to $250,000.

- Following the next 3 months, the balance grows from $250,000 to $300,000.

- After another 3 months, the balance further escalates from $300,000 to $350,000.

- This pattern of growth continues similarly thereafter.

For trading in these evaluation program accounts, the instruments available include forex pairs, commodities, indices, and cryptocurrencies, offering a wide range of trading options.

Rules for Swing TopTier Challenge Evaluation Program Accounts

Swing TopTier Challenge Evaluation Program Accounts operate under a set of defined rules to ensure disciplined trading and risk management:

- Profit Target: Traders are required to achieve a specific percentage of profit to complete an evaluation phase, withdraw profits, or scale their account. The profit target for Phase 1 is 10%, and for Phase 2, it is 5%. Funded accounts are not subject to profit targets.

- Maximum Daily Loss: This is the highest loss a trader can incur in one day before the account is considered violated. For all account sizes, this is set at 5%.

- Maximum Loss: This is the total maximum loss a trader can reach before the account is considered violated. For all account sizes, the maximum loss is capped at 10%.

- Minimum Trading Days: This refers to the minimum number of trading days required before completing an evaluation phase or requesting a withdrawal. Both phases necessitate a minimum of four trading days. Funded accounts do not have minimum trading day requirements.

- No Martingale Allowed: The use of any martingale strategy is strictly prohibited in these accounts.

- No Copy Trading Allowed: Traders are not permitted to use any type of copy trading services.

TopTier Challenge Plus Evaluation Program Accounts

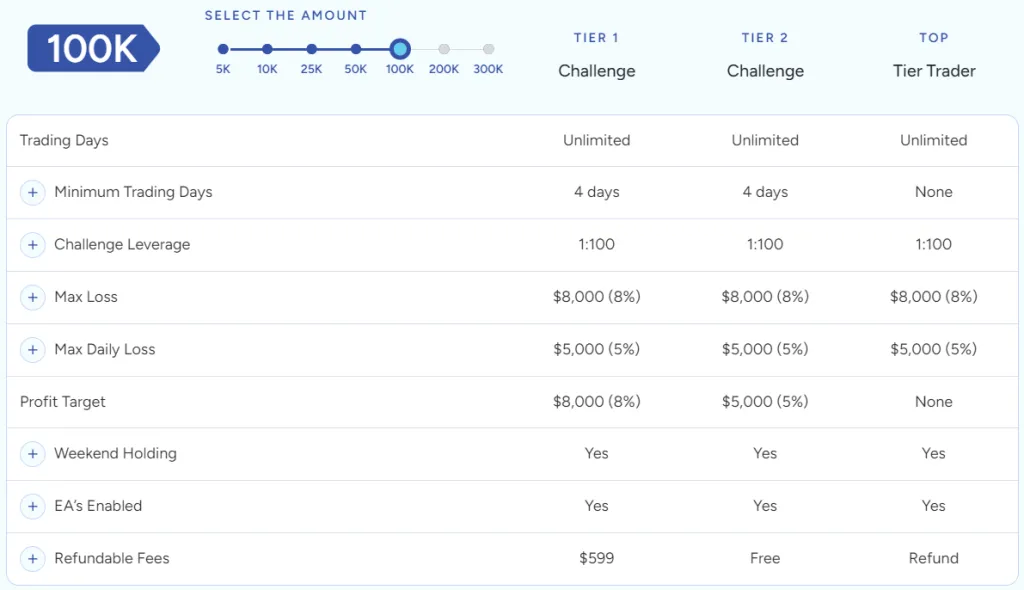

The TopTier Challenge Plus Evaluation Program Account is tailored for serious and skilled traders, offering a rewarding two-phase evaluation period. This program features trading with a leverage of 1:100 and includes the following account sizes and associated fees:

- $5,000 account for $65

- $10,000 account for $99

- $25,000 account for $250

- $50,000 account for $375

- $100,000 account for $599

- $200,000 account for $999

- $300,000 account for $1,399

Evaluation Phase One sets a profit target of 8%, with traders required to stay within a 5% maximum daily loss and an 8% maximum total loss. The target must be reached within 40 calendar days from the first position, and a minimum of four trading days is necessary to move on to Phase Two. Evaluation Phase Two demands a profit target of 5%, adhering to the same daily loss limit but with an 8% total loss limit. This target should be achieved within 70 calendar days from the first position, with a requirement of at least four trading days to qualify for a funded account. Upon successful completion of both phases, traders are granted a funded account without profit targets. The only requirements are to comply with the 5% maximum daily loss and 8% total loss rules. The first payout is scheduled 14 calendar days from the first position in the funded account, with no minimum trading days or other restrictions during this period. Profit splits in this stage range from 80% to 90%, based on the profits made in the funded account.

Scaling Plan for TopTier Challenge Plus Evaluation Program Accounts

The TopTier Challenge Plus Evaluation Program Accounts feature an attractive scaling plan. To be eligible, traders need to achieve a profit target of at least 6% over a three-month period, ensuring that two out of these three months are profitable. Meeting these criteria results in an account increase of 25% of the original balance, with the potential to scale up to a maximum balance of $2,000,000. Examples of account growth include:

- After 3 months, a $200,000 account is increased to $250,000.

- Following the next 3 months, the account balance can rise from $250,000 to $300,000.

- In the subsequent 3 months, the balance may grow from $300,000 to $350,000.

- This pattern of incremental growth continues in a similar manner.

For these evaluation program accounts, traders can choose from a range of trading instruments including forex pairs, commodities, indices, and cryptocurrencies, offering a wide array of trading opportunities.

Rules for TopTier Challenge Plus Evaluation Program Accounts

The TopTier Challenge Plus Evaluation Program Accounts are governed by a set of rules that ensure disciplined trading and adherence to risk management standards:

- Profit Target: Traders must achieve a specific percentage of profit to complete an evaluation phase, withdraw profits, or scale their account. The profit target for Phase 1 is 8%, and for Phase 2, it’s 5%. Funded accounts do not have set profit targets.

- Maximum Daily Loss: This is the highest loss a trader can incur in a single day before the account is considered violated. For all account sizes, this limit is set at 5%.

- Maximum Loss: This refers to the overall maximum loss a trader can reach before the account is considered violated. For all account sizes, the maximum loss is capped at 8%.

- Minimum Trading Days: This is the minimum number of trading days required before a trader can complete an evaluation phase or request a withdrawal. Both phases require a minimum of four trading days. Funded accounts do not have minimum trading day requirements.

- No Martingale Allowed: The use of any martingale strategy is strictly prohibited while trading in these accounts.

What Sets TopTier Trader Apart in the Proprietary Trading Industry

TopTier Trader distinguishes itself in the proprietary trading firm landscape with its unique offerings and approach. The firm stands out primarily due to its two distinct two-step evaluation funding programs: the TopTier Challenge and the TopTier Challenge Plus. A key feature that sets them apart is the flexibility in trading style they offer. Unlike many competitors, TopTier Trader imposes almost no restrictions on trading methods. Traders are free to engage in trading during news events, hold positions overnight, and even over weekends. In contrast to other prop firms, TopTier Trader’s evaluation process is structured into a two-phase program. This requires traders to successfully complete both phases to be eligible for payouts. The profit target is set at 10% for phase one and 5% for phase two, accompanied by a 5% maximum daily and 10% maximum total loss limit. Moreover, a minimum of four trading days in each phase is mandatory before a trader can be considered for funding. Another distinguishing feature is their scaling plan, a notable aspect when compared to other leading firms in the industry. While their profit targets and minimum trading day requirements are on par with industry standards, it’s the combination of these elements that makes TopTier Trader an attractive option for many traders.

Comparing TopTier Trader with True Forex Funds (Limitless)

When evaluating the key trading objectives between TopTier Trader and True Forex Funds (Limitless), several differences and similarities become evident. This comparison is crucial for traders to make informed decisions on which proprietary trading firm aligns best with their trading style and goals.

| Trading Objectives | TopTier Trader | True Forex Funds (Limitless) |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 4 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 80% |

This comparative table highlights that while both firms offer similar benefits such as unlimited maximum trading periods and identical profit splits, they differ in areas such as the Phase 1 profit target and minimum trading days. These differences are pivotal in determining the right fit for traders based on their individual preferences and trading strategies.

Comparative Analysis: TopTier Trader vs. E8 Funding (Normal)

When comparing TopTier Trader with E8 Funding (Normal), it’s essential to delve into their specific trading objectives to understand the differences and similarities. This comparison offers valuable insights for traders deciding between these two proprietary trading firms.

| Trading Objectives | TopTier Trader | E8 Funding (Normal) |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 8% (Scaleable up to 14%) |

| Minimum Trading Days | 4 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 80% |

This table reveals both similarities and variances between TopTier Trader and E8 Funding. Key distinctions include the Phase 1 profit target and the maximum loss, which is scalable in E8 Funding. The absence of a minimum trading day requirement in E8 Funding contrasts with TopTier Trader’s stipulation. These factors are crucial in guiding traders to choose the firm that aligns best with their trading approach and objectives.

Comparative Overview: TopTier Trader vs. Funding Pips

An insightful comparison between TopTier Trader and Funding Pips reveals significant aspects of their trading objectives, highlighting both similarities and differences. This comparison is pivotal for traders in choosing a prop firm that aligns with their trading style and goals.

| Trading Objectives | TopTier Trader | Funding Pips |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 4 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 80% up to 90% |

While both TopTier Trader and Funding Pips offer similar features like unlimited maximum trading periods and comparable profit targets for each phase, they differ in their profit split percentages and minimum trading day requirements. Additionally, the TopTier Challenge Plus evaluation program, another offering from TopTier Trader, differs with a first phase profit target of 8%, a maximum loss of 8%, and a requirement of a minimum of seven trading days in each phase. These elements are crucial in defining the unique offerings of each firm, aiding traders in their decision-making process.

Comparison Between TopTier Trader and FundedNext (Stellar)

Comparing TopTier Trader with FundedNext (Stellar) provides valuable insights into their respective trading objectives, highlighting similarities and differences essential for traders making an informed decision about which firm best suits their trading approach.

| Trading Objectives | TopTier Trader | FundedNext (Stellar) |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 8% | 10% |

| Minimum Trading Days | 4 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 90% | 80% up to 90% |

This comparative table illustrates that while both TopTier Trader and FundedNext (Stellar) offer similar profit targets for each phase and identical profit splits, they differ in aspects such as maximum loss limits and minimum trading days. Such distinctions are key in guiding traders to choose a firm that aligns with their specific trading needs and preferences.

Comparing TopTier Trader with Finotive Funding

A comparative analysis between TopTier Trader and Finotive Funding highlights key aspects of their trading objectives, offering traders essential insights to choose the prop firm that best suits their needs.

| Trading Objectives | TopTier Trader | Finotive Funding |

|---|---|---|

| Phase 1 Profit Target | 8% | 7.5% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 8% | 10% |

| Minimum Trading Days | 4 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 90% | 75% up to 95% |

This table reveals that while TopTier Trader and Finotive Funding share similarities in several aspects like maximum daily loss and unlimited maximum trading periods, they differ in areas like the Phase 1 profit target and profit split percentages. Additionally, the minimum trading day requirements vary, with Finotive Funding offering more flexibility. These distinctions are crucial for traders in determining which firm aligns more closely with their trading strategy and goals.

Comparison Review: TopTier Trader vs Funded Trading Plus

When examining the key trading objectives and policies of TopTier Trader and Funded Trading Plus, several distinctions and similarities come to light. This comparison aims to provide a clear perspective on what each forex prop firm offers to its traders.

Trading Objectives and Policies

- Profit Target in Phase 1: TopTier Trader sets an 8% profit target, while Funded Trading Plus requires a slightly higher 10%.

- Profit Target in Phase 2: Both firms have a uniform 5% profit target in the second phase.

- Maximum Daily Loss: A consistent policy between the two, with both allowing a maximum daily loss of 5%.

- Overall Maximum Loss: TopTier Trader limits losses to 8%, whereas Funded Trading Plus allows up to 10% but with a trailing feature.

- Minimum Trading Days: TopTier Trader requires a minimum of 4 calendar days, whereas Funded Trading Plus imposes no such minimum.

- Maximum Trading Period: Both companies offer unlimited trading periods for both phases.

- Profit Split: Starting at 80%, both firms offer the potential to increase the profit split up to 90%.

In summary, TopTier Trader sets itself apart in the prop trading industry by not restricting trading styles. This flexibility includes trading during news events, holding trades overnight, and maintaining positions over weekends.

Is Achieving Funding with TopTier Trader a Realistic Goal?

When seeking a prop firm that aligns with your forex trading approach, it’s crucial to evaluate the realism of their trading requirements. High-profit splits and substantial capital offerings might seem attractive, but stringent requirements on monthly gains and tight maximum drawdown limits can drastically reduce your chances of success.

TopTier Trader’s Capital Accessibility

TopTier Trader, known for its feasible trading conditions, offers two distinct funding programs:

The TopTier Challenge Evaluation Program

- Profit Targets: A balanced 10% in phase one and 5% in phase two, aligning with industry averages.

- Maximum Loss Rules: Standard 5% maximum daily and 10% maximum loss limits.

The TopTier Challenge Plus Evaluation Program

- Profit Targets: Slightly more attainable with 8% in phase one and 5% in phase two, below industry averages.

- Maximum Loss Rules: Again, a reasonable 5% maximum daily and 8% maximum loss.

Considering these aspects, TopTier Trader emerges as a commendable option for traders aiming to secure funding. The firm provides two varied funding programs, both featuring realistic trading objectives and fair conditions for payouts, enhancing the likelihood of trader success. For more insights on forex funded programmes, TopTier Trader stands out as a firm worth considering.

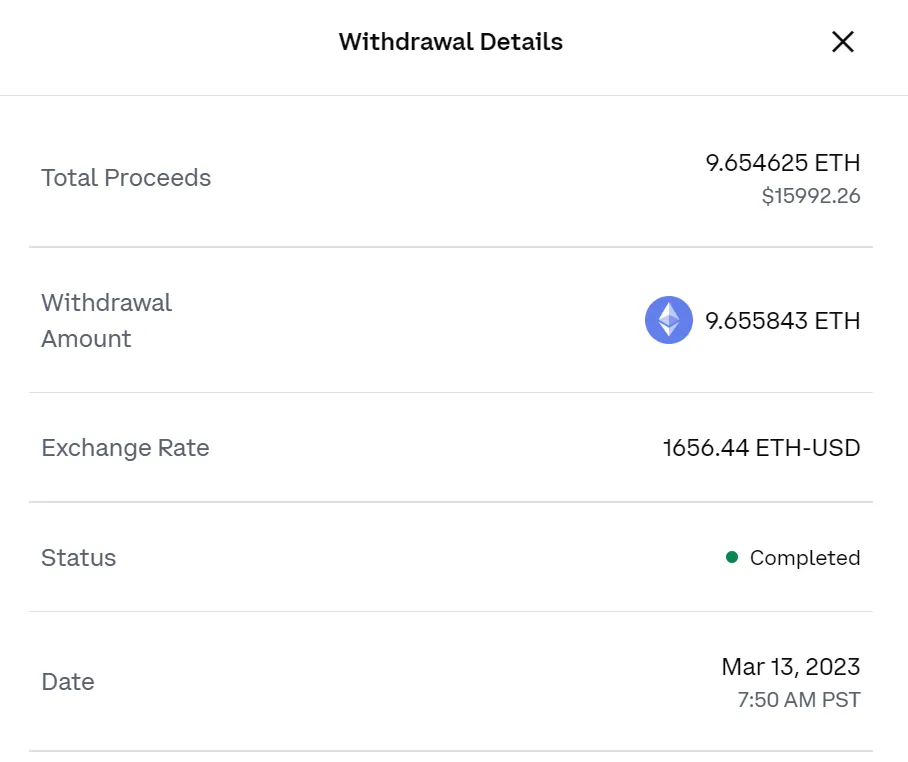

Understanding Payment Proof and Processes at TopTier Trader

Established on October 18, 2021, TopTier Trader has implemented a straightforward process for traders to claim their profit splits. This process is a vital aspect to consider when exploring options for forex prop firms.

Withdrawal and Payout Procedures

- Withdrawal Requests: Traders are required to submit an invoice to request withdrawals of their profit splits. These submissions undergo a review process.

- Initial Payout Timeline: Depending on the account type, traders must keep their account active for either 14 or 30 calendar days before requesting their first payout.

- Subsequent Payouts: Following the initial payout, traders are eligible for bi-weekly payouts.

- Processing Time: The processing of payments typically takes between 24-48 hours, during which the profit splits are calculated and deducted.

Verifying Payment Proof

For those seeking assurance regarding the reliability of payouts, TopTier Trader offers several avenues:

- Discord Channel: Traders can join the TopTier Trader Discord channel, where a dedicated section titled ‘payout proof’ provides real-time payment verifications.

- YouTube Interviews: The company’s YouTube channel features interviews with their traders, offering additional insights and proof of payment. Watching these interviews can give a realistic glimpse into the experiences of traders with the firm.

In summary, TopTier Trader not only presents a structured and transparent payout system but also offers accessible platforms for payment verification, reinforcing its credibility as a trusted prop trading firm.

Exploring the Brokerage Partnerships of TopTier Trader

For those interested in the brokerage choices of TopTier Trader, a key aspect to consider is the firm’s selection of brokers and the platforms they offer. This information is crucial for traders to understand the trading environment and tools they will have access to.

TopTier Trader’s Brokerage Choice

TopTier Trader partners with ThinkMarkets, a distinguished multi-asset online brokerage.

- Headquarters: ThinkMarkets is headquartered in London and Melbourne, positioning itself as a globally recognized broker.

- Market Access: They offer expedient access to a broad spectrum of markets, catering to a variety of trading preferences.

- Trading Solutions: ThinkMarkets is renowned for providing some of the industry’s leading trading solutions, including the popular MetaTrader 4, MetaTrader 5, and their proprietary ThinkTrader platform.

Available Trading Platforms

- MetaTrader 4: This platform is known for its user-friendly interface and comprehensive analytical tools, making it a favorite among forex traders.

- MetaTrader 5: Offering advanced trading functions and superior tools, MetaTrader 5 caters to traders looking for a more robust trading experience.

In summary, TopTier Trader’s choice of ThinkMarkets as its broker aligns with the firm’s commitment to providing its traders with reliable, high-quality trading environments. The availability of platforms like MetaTrader 4 and 5 ensures that traders have access to some of the best tools in the industry. This partnership highlights TopTier Trader’s dedication to offering top-tier services in the realm of prop trading firms.

Overview of Trading Instruments Offered by TopTier Trader

TopTier Trader, a notable forex prop firm, provides its traders with a diverse range of trading instruments across various markets, each with specific leverage options. This variety ensures that traders can find instruments that align with their trading strategies and preferences.

Trading Instruments and Leverage Details

TopTier Trader offers the following instruments with respective leverage options:

- Forex Pairs: Available with a leverage of 100:1.

- Commodities: Traders can engage in commodity trading with a leverage of 40:1.

- Indices: Offered with a leverage of 30:1.

- Cryptocurrencies: Available with a leverage of 2:1, catering to the growing interest in digital currencies.

Detailed List of Available Instruments

Forex Pairs

Traders have access to a wide range of forex pairs including major pairs like USDCHF, GBPUSD, EURUSD, and exotic pairs like USDZAR, EURZAR, and many more.

Commodities

Commodities trading includes options like Copper, Natural Gas (NGAS), UK Oil (UKOil), US Oil (USOil), and precious metals such as Silver (XAGUSD) and Gold (XAUUSD).

Indices

Indices available for trading include global indices like the DAX, NAS100, US30, and more, offering a comprehensive range of options for those interested in equity markets.

Cryptocurrencies

The firm also provides the opportunity to trade in popular cryptocurrencies such as Bitcoin (BTCUSD), Ethereum (ETHUSD), and Litecoin (LTCUSD). In conclusion, the extensive range of trading instruments at TopTier Trader, along with their tailored leverage options, make it a versatile choice for traders seeking a diverse trading experience in the prop trading sphere.

Understanding Trading Fees at TopTier Trader

For traders considering TopTier Trader, it’s crucial to comprehend the fee structure for different asset classes. This information helps in evaluating the cost-effectiveness of trading with the firm.

Trading Commission Details

- Forex: A commission of 7 USD per lot is charged for Forex trading.

- Commodities: Trading in commodities also incurs a commission of 7 USD per lot.

- Indices: No commission is charged for trading indices.

- Cryptocurrencies: Cryptocurrency trades are commission-free.

Spread Information

To get a real-time understanding of the spreads, TopTier Trader provides access to demo accounts on different platforms:

| Platform | Server | Login Number | Password | Download Platform |

|---|---|---|---|---|

| MetaTrader 4 | 83280211 | alm1kgj | ThinkMarkets-Demo 3 | Click here |

| MetaTrader 5 | 11980153 | -dBq0vKq | ThinkMarkets-Demo | Click here |

This table provides essential login details for accessing the demo accounts on MetaTrader 4 and MetaTrader 5 platforms, allowing potential traders to experience the trading environment and understand the spread structure firsthand. In summary, TopTier Trader offers a transparent and detailed fee structure for its trading services, ensuring traders can make informed decisions. The ability to access live spreads through demo accounts further enhances the transparency of the firm’s practices, positioning it as a reliable choice in the prop trading firm landscape.

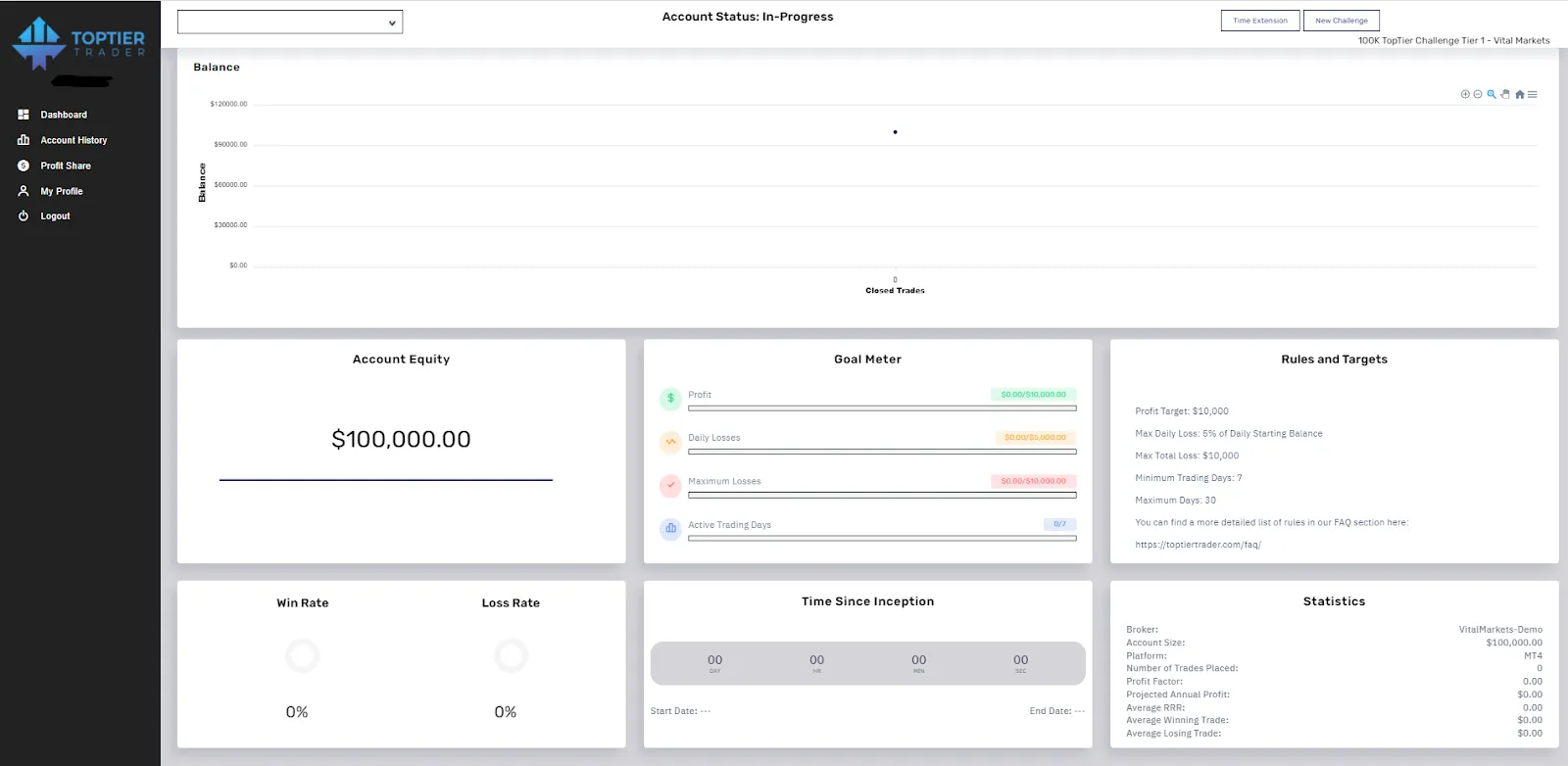

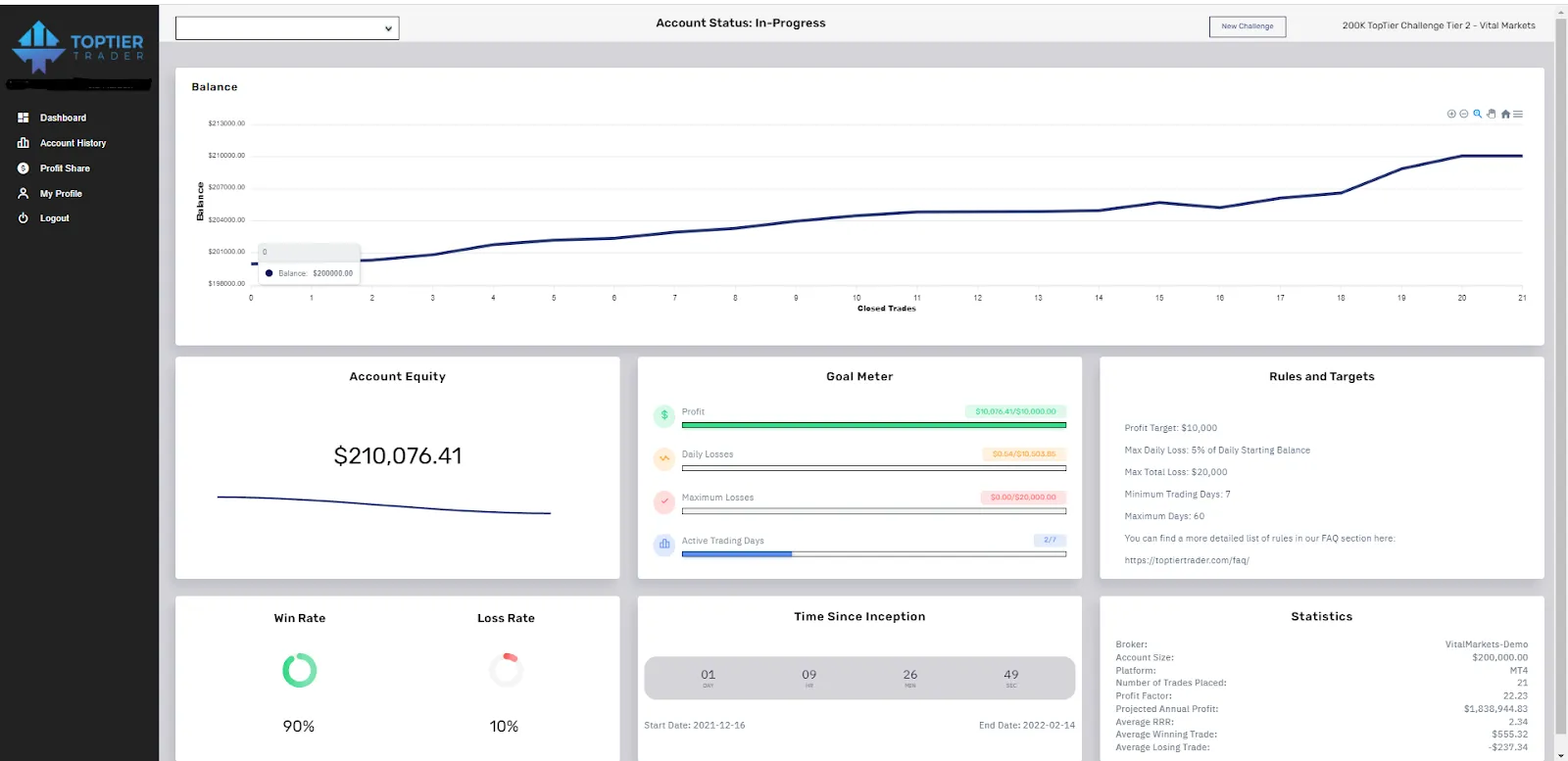

Education & Support for Traders at TopTier Trader

When considering a partnership with a forex prop firm like TopTier Trader, it’s important to understand the level of educational content and support tools available for traders. This aspect is crucial for both novice and experienced traders in enhancing their trading skills and managing their portfolios effectively.

Lack of Educational Content

It’s noteworthy that TopTier Trader does not currently offer educational content on its website. This might be a consideration for those who are seeking comprehensive educational resources as part of their trading experience.

Support Tools for Traders

- Well-Structured Dashboard: TopTier Trader compensates for the lack of educational materials by providing a well-structured trader dashboard. This tool is accessible to all clients and is instrumental in managing risk and tracking performance.

- Statistics Page for Closed Positions: The trader dashboard includes a detailed statistics page that allows traders to review and analyze their closed positions, offering insights into past trading strategies and outcomes.

- Statistics Page for Open Positions: Additionally, the dashboard offers a page for open positions, enabling traders to monitor and manage their current trades effectively.

While the absence of educational content might be a limitation for some, the advanced support tools provided by TopTier Trader’s dashboard are valuable assets for effective risk management and performance tracking. These tools can significantly aid traders in making informed decisions and optimizing their trading strategies in the competitive world of prop trading.

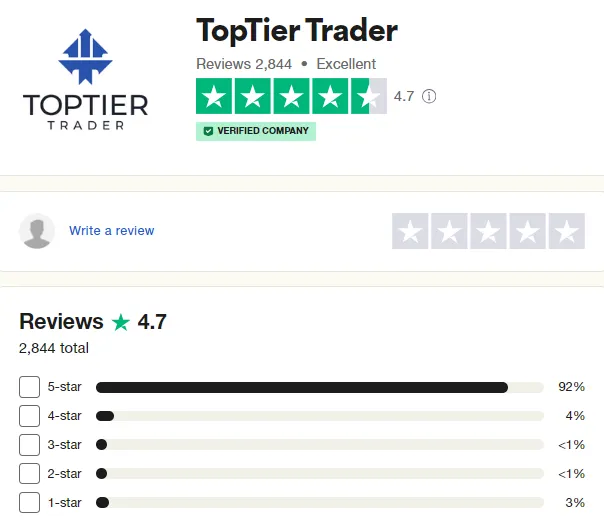

Traders’ Perspectives on TopTier Trader

Understanding the reputation and client satisfaction of a forex prop firm is crucial for traders considering a partnership. In this regard, exploring the feedback and comments from existing traders about TopTier Trader provides valuable insights into the firm’s performance and client support.

Overall Trader Feedback

TopTier Trader boasts impressive feedback from its user community:

- Trustpilot Ratings: The firm has garnered a high score of 4.7 out of 5 based on 2,844 reviews, reflecting strong client satisfaction and credibility in the industry.

- Community Engagement: A large number of community members actively share their positive experiences and feedback on Trustpilot, highlighting the firm’s effective engagement with its client base.

Client Testimonials on Support

- Support Team Efficiency: Clients have frequently mentioned the promptness and reliability of TopTier Trader’s support service, emphasizing its importance in a trading firm.

- Patience and Guidance: The support team is praised for its patience and commitment to guiding clients through various processes, ensuring they receive all the necessary information and support.

- Client Satisfaction: This aspect of support and guidance has been a significant factor in client satisfaction, as evidenced by the positive testimonials.

In conclusion, the high ratings and positive trader feedback underline TopTier Trader’s reputation as a supportive and reliable prop firm. The firm’s commitment to providing efficient, patient, and thorough support contributes greatly to its standing as a trusted and respected entity in the prop trading community.

Social Media Presence of TopTier Trader

In the digital age, a strong social media presence is a key indicator of a company’s engagement and outreach. TopTier Trader, a notable forex prop firm, maintains a significant presence across various social media platforms, reflecting its commitment to staying connected with its community.

TopTier Trader’s Social Media Footprint

- Instagram: Boasts a substantial following of 36.5k followers, indicating a robust and active social media engagement.

- YouTube: The firm’s YouTube channel has 6.81k subscribers and a library of 31 videos, offering insights and updates related to trading.

- Telegram: With 5,396 subscribers, their Telegram account serves as a direct line for updates and communications.

- Facebook: The firm also has a presence on Facebook with 729 followers, broadening its reach across different social platforms.

Community Engagement and Support

TopTier Trader extends its community engagement through a Discord channel, which boasts 16,585 members. This platform serves multiple purposes:

- Announcements: Members can stay updated with all the latest announcements from the firm.

- Support Channel: The Discord channel includes a dedicated support section where members can seek help and guidance.

- Community Interaction: It provides a space for traders to discuss trading strategies and share insights, fostering a sense of community among users.

In summary, the extensive and diverse social media presence of TopTier Trader not only highlights its commitment to maintaining a dynamic and engaged online community but also offers multiple channels for information, support, and interaction for its users. This aspect further solidifies TopTier Trader’s position as a connected and responsive entity in the prop trading firm landscape.

Support Services at TopTier Trader

Effective support services are crucial for traders, especially when dealing with complex markets and trading platforms. TopTier Trader, a prominent forex prop firm, offers a range of support options to ensure their clients have access to the help and information they need.

Available Support Channels

- FAQ Page: For general inquiries and basic information, TopTier Trader provides a comprehensive FAQ page on their website. This can be a quick resource for finding answers to common questions.

- Social Media Support: The firm is active on social media platforms, offering another avenue for support and direct communication.

- Website Live Chat: For immediate assistance, their website features a live chat option, allowing traders to get real-time help directly from the support team.

24/7 Support Availability

Understanding the need for continuous support in the trading world, TopTier Trader’s support team is available 24/7. This round-the-clock availability ensures that clients can receive assistance at any time, which is particularly beneficial for traders operating in different time zones or those who trade during non-standard hours.

Discord Channel for Support

In addition to the above-mentioned channels, TopTier Trader also has a dedicated Discord channel. This platform serves multiple purposes:

- It provides a space for real-time support, where traders can ask questions and receive prompt responses.

- The Discord channel also fosters a community environment, allowing traders to share experiences and solutions, adding an extra layer of peer support.

In summary, TopTier Trader’s comprehensive support system, including their 24/7 availability and multiple channels of communication, reflects their commitment to providing thorough and accessible support to their clients. This aspect of their service is a testament to their dedication to client satisfaction and positions them as a reliable choice in the prop trading firm arena.

Final Thoughts on TopTier Trader

After a thorough analysis of TopTier Trader, a prominent name in the forex prop trading sphere, it’s clear that this firm offers a substantial platform for traders looking to advance in the industry.

Two Distinct Funding Programs

TopTier Trader distinguishes itself with two main funding programs:

- TopTier Challenge: This is a standard two-phase evaluation program. Traders need to achieve profit targets of 10% in phase one and 5% in phase two, under realistic conditions of 5% maximum daily and 10% maximum loss. Successful completion leads to funding and eligibility for 80% profit splits, along with account scaling opportunities.

- TopTier Challenge Plus: Similar to the TopTier Challenge, this program also involves a two-phase evaluation, but with slightly different targets of 8% in phase one and 5% in phase two, and a maximum loss limit of 8%. This program offers profit splits ranging from 80% up to 90%, alongside scaling opportunities.

Recommendation and Conclusion

TopTier Trader stands out as a well-established and reliable prop trading firm. It caters to a diverse array of traders, thanks to its straightforward trading rules and realistic evaluation criteria. The firm’s ability to accommodate various trading styles, combined with its transparent policies and supportive infrastructure, makes it an excellent choice for traders at different levels of expertise. Overall, considering the features, support, and opportunities provided by TopTier Trader, it is undoubtedly one of the more competitive and promising proprietary trading firms in the industry. I highly recommend TopTier Trader for anyone seeking a reputable and effective platform in the world of proprietary trading. For more insights and details on prop trading firms, visit All Prop Trading Firms.