Searching for a prop trading firm that supports your trading journey with flexible funding options? The Lionheart Funding Program might be the answer. Offering a variety of challenges that cater to different trading styles, Lionheart provides opportunities to access funded accounts without ongoing fees or time constraints on evaluations. Dive into this review to explore how Lionheart stands out in the competitive prop trading landscape and whether it aligns with your trading goals.

Searching for a prop trading firm that supports your trading journey with flexible funding options? The Lionheart Funding Program might be the answer. Offering a variety of challenges that cater to different trading styles, Lionheart provides opportunities to access funded accounts without ongoing fees or time constraints on evaluations. Dive into this review to explore how Lionheart stands out in the competitive prop trading landscape and whether it aligns with your trading goals.

- Multiple challenge options to suit different trading styles.

- No ongoing fees for participants.

- Flexible evaluation periods with no time limits.

- Competitive profit split of 90/10 for funded traders.

- Access to realistic trading conditions with market quotes.

Lionheart Funding Program Review: What You Need to Know

The Lionheart Funding Program is a trading firm that offers traders the opportunity to access capital through a series of trading challenges. This firm aims to identify skilled traders and provide them with funding based on their performance during the evaluation process.

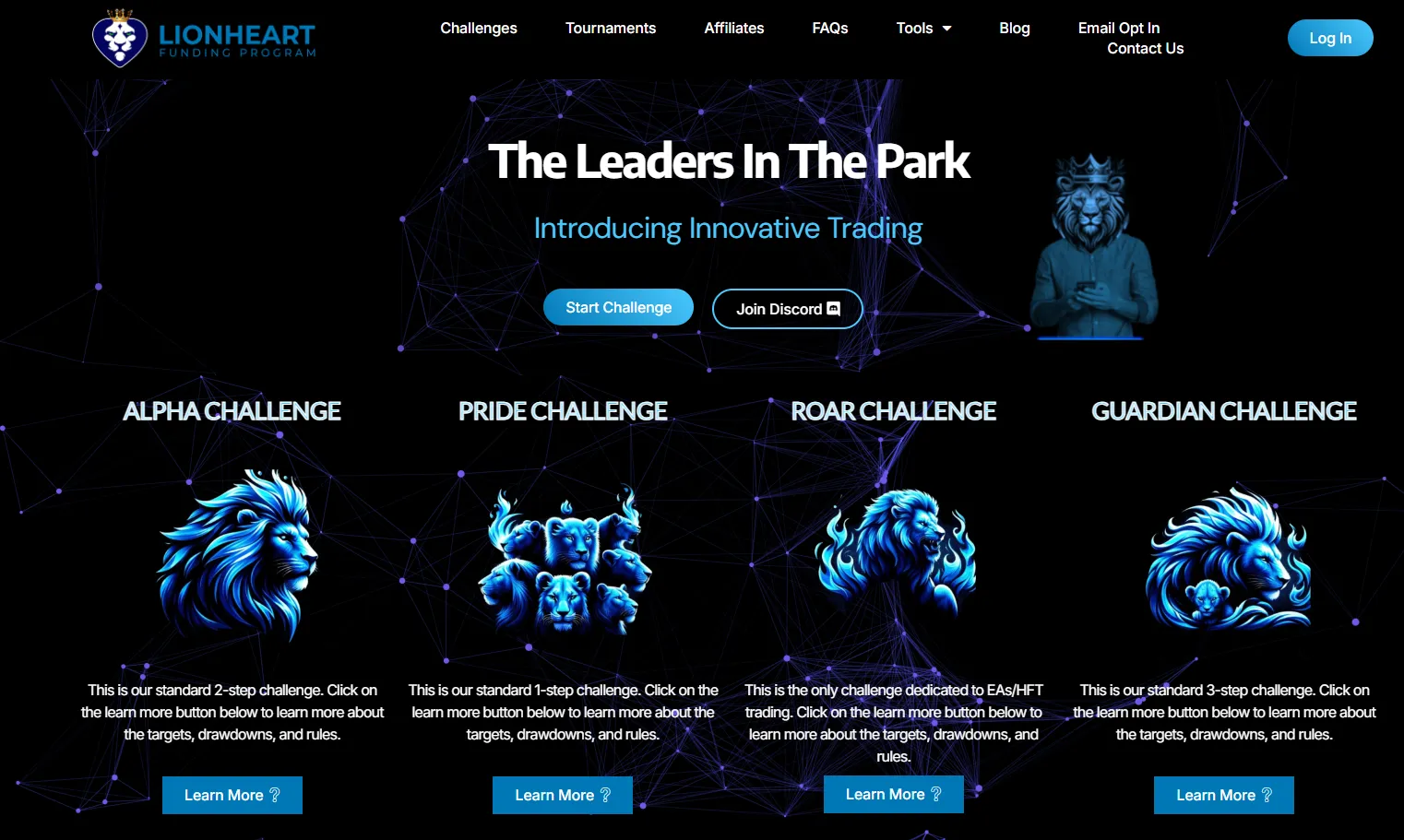

What Are the Different Challenges Offered?

Lionheart Funding Program provides several challenges designed to assess trading skills and discipline:

- Alpha Challenge: A standard 2-step challenge that evaluates trading targets, drawdowns, and rules.

- Pride Challenge: A 1-step challenge focusing on meeting specific trading criteria in a single phase.

- Roar Challenge: This challenge is tailored specifically for traders using Expert Advisors (EAs) or High-Frequency Trading (HFT) strategies.

- Guardian Challenge: A 3-step challenge that tests traders through multiple phases with increasing levels of evaluation.

How Does the Funding Process Work?

The funding process at Lionheart is divided into three key phases:

- Skill Test: This initial phase is designed to evaluate trading skills across one, two, or three phases, with the aim of achieving a realistic profit target.

- Access: Upon successful completion of the evaluation phases, traders are granted access to funded accounts.

- Funded: Traders who pass the evaluation can start trading with the firm’s capital, allowing them to earn real profits by trading responsibly and consistently.

Is the Lionheart Funding Program Right for You?

Choosing a prop trading firm like Lionheart Funding Program depends on your trading style, risk tolerance, and preferences for the evaluation process. With various challenges available, traders have the flexibility to select an option that aligns with their strengths, whether they prefer one-step evaluations or multi-phase challenges. However, it’s important to carefully review the terms, conditions, and associated risks before participating.

Lionheart Funding Program Challenges Overview

Alpha Challenge Details

The Alpha Challenge by Lionheart Funding Program is structured to evaluate traders through a two-phase process. It focuses on balance drawdowns and requires traders to meet specific profit targets to progress and eventually get funded.

- Profit Target: 8% in Phase One, 5% in Phase Two, and no specific target in the funded stage.

- Daily Drawdown: Capped at 5% throughout all phases and when funded.

- Overall Drawdown: Maintained at 10% for all stages, ensuring consistent risk management.

- Max Trading Days: Unlimited, providing flexibility in trading duration.

- Minimum Trading Days: No minimum trading days are required, allowing traders to progress at their own pace.

- Withdrawal Time: 14 days once funded.

- Profit Split: Traders receive 90% of profits during the funded stage.

- News Trading: Not allowed at any stage.

- Expert Advisors (EAs): EAs are permitted only on the Roar Challenge, not in the Alpha Challenge.

- Leverage: 1:100 across all phases.

Pride Challenge Details

The Pride Challenge offers a simplified, one-phase evaluation for traders seeking a quicker route to funding.

- Profit Target: 10% in the single evaluation phase, with unlimited targets once funded.

- Daily Drawdown: Limited to 3% during both evaluation and funded phases.

- Overall Drawdown: Set at 6%, maintaining stricter risk limits compared to other challenges.

- Drawdown Type: Balance Drawdown.

- Max Trading Days: Unlimited, providing ample time to meet targets.

- Minimum Trading Days: No minimum trading days are required.

- Withdrawal Time: 14 days once funded.

- Profit Split: Traders retain 90% of profits when trading funded accounts.

- News Trading: Allowed during the evaluation phase, but not in funded accounts.

- Expert Advisors (EAs): Permitted only on the Roar Challenge.

- Leverage: 1:100 throughout the process.

Guardian Challenge Details

The Guardian Challenge is a three-phase evaluation that incrementally tests traders before granting access to funded capital.

- Profit Target: 6% in Phase One, 5% in Phase Two, 4% in Phase Three, and no set target once funded.

- Daily Drawdown: Consistently set at 4% across all phases, including funded accounts.

- Overall Drawdown: Maintained at 8% throughout all phases and the funded stage.

- Drawdown Type: Balance Drawdown.

- Max Trading Days: Unlimited, allowing traders to progress at their preferred pace.

- Minimum Trading Days: No minimum trading days are required.

- Withdrawal Time: 14 days for funded accounts.

- Profit Split: A 90/10 split in favor of the trader during the funded stage.

- News Trading: Allowed during all phases, including the funded stage.

- Expert Advisors (EAs): Permitted only on the Roar Challenge.

- Leverage: 1:100 for all stages.

Roar Challenge Details

The Roar Challenge is specifically designed for traders using Expert Advisors (EAs) and involves a two-step evaluation process.

- Profit Target: 10% in Phase One, 5% in Phase Two, with no specific target once funded.

- Daily Drawdown: Capped at 4% for both evaluation phases and when funded.

- Overall Drawdown: Set at 10% across all stages.

- Drawdown Type: Balance Drawdown.

- Max Trading Days: Unlimited, offering flexibility in meeting targets.

- Minimum Trading Days: No minimum trading days required.

- Withdrawal Time: 14 days once funded.

- Profit Split: Traders keep 90% of the profits during the funded stage.

- News Trading: Allowed during evaluation and funded stages.

- Expert Advisors (EAs): Allowed during evaluation but not in the funded stage.

- Leverage: 1:100 throughout the evaluation and funded stages.

Understanding Prop Firms and Lionheart’s Approach

Prop firms provide traders with access to capital, allowing them to employ their own strategies and share in the profits. Historically, traditional prop firms required large initial capital and were less accessible to retail traders. The Lionheart Funding Program aims to make prop trading more inclusive by offering various challenges without ongoing fees, though it requires traders to pass evaluations to access funded accounts. Funded accounts are simulated with real market quotes, and performance data is used by partnered firms to manage trades and risk effectively.

Trading Conditions and Rules

Lionheart Funding Program offers favorable trading conditions, including competitive spreads and commissions through their broker partner, Eightcap. Leverage is set at 1:100 for Forex, Metals, and Energy, 1:40 for Indices, and 1:4 for Cryptocurrencies. Traders can use Expert Advisors (EAs) and algorithms, but only within specific challenges like the Roar Challenge, and must avoid prohibited strategies such as arbitrage, grid trading, and copy trading. Hedging and account merging are not permitted to maintain the integrity of trading performance evaluations.

Withdrawal Policies and Funded Account Details

Once traders achieve funded status, they operate on demo accounts that mimic real market conditions. Profits can be withdrawn bi-weekly after the initial 30-day trading period, with processing typically completed within two business days. Withdrawals can be requested via the trader’s dashboard, and payouts are handled through bank transfers or cryptocurrency. Lionheart guarantees payouts for legitimate profits, backed by legal agreements, though all payouts are vetted by a risk team to ensure compliance with terms and conditions.

Eligibility, Account Management, and Other Considerations

To participate in Lionheart’s challenges, traders must be at least 18 years old and reside outside certain restricted regions. There are no time limits to pass the evaluation phases, providing flexibility for traders to progress at their own pace. Accounts must be held in the trader’s name to qualify for payouts, and traders are responsible for their tax obligations as independent contractors. Additionally, Lionheart allows unlimited evaluation accounts, with a maximum funded limit of $600,000, and offers a scaling plan for successful traders up to $2.5 million.

Conclusion: Final Thoughts on the Lionheart Funding Program

The Lionheart Funding Program positions itself as an accessible and flexible option for traders looking to leverage external capital without the significant barriers traditionally associated with prop trading firms. By offering multiple challenge options—including the Alpha, Pride, Guardian, and Roar Challenges—Lionheart caters to a wide range of trading styles and preferences. Whether you are a trader who prefers a straightforward, single-phase evaluation or someone who thrives in more rigorous multi-phase assessments, Lionheart provides pathways that align with different risk profiles and strategic approaches.

One of the standout features of Lionheart is its commitment to flexibility, allowing unlimited time to complete evaluation phases and accommodating traders with competitive spreads, commissions, and leverage. However, traders should be mindful of the program’s limitations, such as the restrictions on certain trading strategies like hedging and the exclusive allowance of EAs only within specific challenges. The simulated nature of funded accounts also means that traders are working in a controlled environment where real capital is not at immediate risk, but their performance is crucial for moving forward. Despite the structured and simulated nature of the funded accounts, Lionheart ensures that the trading experience is closely aligned with real market conditions, providing traders with a realistic platform to showcase their skills.

The firm’s payout structure, highlighted by a 90/10 profit split, is competitive and shows a clear intention to reward successful traders adequately. Additionally, the absence of ongoing fees and the firm’s legal backing for payouts further solidify its credibility and commitment to supporting its traders. Overall, the Lionheart Funding Program offers a compelling proposition for traders who are serious about advancing their trading careers with external capital. Its well-defined challenges, reasonable risk management requirements, and focus on identifying and nurturing talent make it a strong contender in the prop trading space. However, as with any trading venture, prospective participants should carefully evaluate the terms, conditions, and their personal readiness to meet the program’s demands. For traders who align well with Lionheart’s criteria, this program could be a valuable step towards achieving more substantial trading success.

You guys are the best in the inderstry of forex trading.