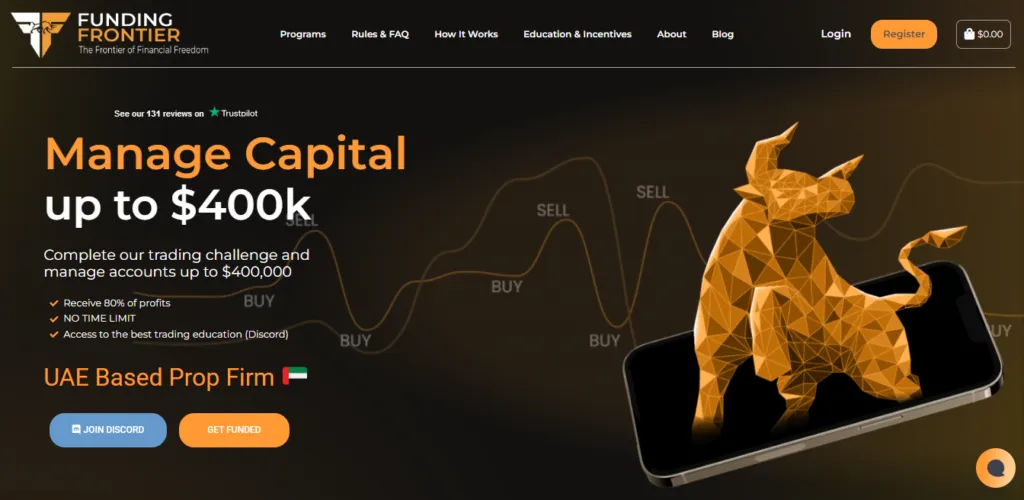

Exploring the dynamic world of forex trading, Funding Frontier emerges as a notable prop trading firm based in the UAE. Known for its trader-centric approach, this firm provides the capital, tools, and support necessary for both novice and experienced traders to thrive in the forex market. Let’s delve into what makes Funding Frontier a go-to choice for aspiring forex traders.

Exploring the dynamic world of forex trading, Funding Frontier emerges as a notable prop trading firm based in the UAE. Known for its trader-centric approach, this firm provides the capital, tools, and support necessary for both novice and experienced traders to thrive in the forex market. Let’s delve into what makes Funding Frontier a go-to choice for aspiring forex traders.

- Generous Profit Share Up to 80%.

- Flexible Account Sizes for All Traders.

- Realistic and Achievable Profit Targets.

- Accessible to Traders Worldwide.

- Multiple Tradable Instruments Available.

Table of Contents

Funding Frontier Review: Empowering Traders in the Forex Market

Funding Frontier stands out as a prop firm dedicated to empowering traders in the forex market. Their unique funding program equips traders with the necessary capital to engage in forex trading without the need to invest personal funds.

Interested traders can simply sign up on Funding Frontier’s platform. The process involves selecting a preferred account size and paying a nominal fee to commence trading activities. The primary objective for traders is to demonstrate profitability and consistency to successfully navigate the firm’s trading challenge. Achieving this milestone grants them the status of a funded trader, entitling them to a generous profit share and a reimbursement of their initial registration fee upon their first earnings withdrawal. Funding Frontier offers a bi-weekly withdrawal opportunity, allowing traders to regularly cash out their profits. This feature is a stepping stone for many in building a sustainable income source and advancing their forex trading aspirations.

Who is the Ideal Candidate for Funding Frontier?

Funding Frontier caters to individuals with a fervent interest in forex trading and a desire to leverage their trading skills to earn a livelihood. This prop firm is an ideal match for those eager to explore and maximize their trading potential in the digital arena. By providing access to the firm’s capital, Funding Frontier offers a unique platform for traders to excel in the forex market. However, eligibility to join this program is contingent upon being at least 18 years old. In addition to age requirements, the prop firm places a high emphasis on profitability and adherence to specific trading guidelines. Success on their platform is closely tied to a trader’s ability to navigate these rules effectively.

Understanding Funding Frontier: A UAE-Based Prop Firm

Funding Frontier, a prop firm rooted in the UAE, offers a distinctive opportunity for individuals to engage in forex trading using its capital. This initiative is designed to accommodate a wide range of traders, offering various account sizes to suit different trading needs and financial capabilities. The process begins with a straightforward selection of an account size, tailored to fit your budget. With this account, you can venture into the forex market, aiming to generate profits and fulfill your trading aspirations. A pivotal aspect of Funding Frontier’s program is the challenge that traders must overcome to access real funding for live market trading. This challenge serves as a benchmark to assess a trader’s proficiency, profitability, and adherence to the firm’s trading regulations. Essentially, Funding Frontier emphasizes the importance of demonstrating skillful trading and a robust understanding of the market. This vetting process ensures that only the most capable traders are entrusted with the firm’s capital for forex trading. To delve deeper into the operational dynamics of this prop firm, let’s explore how it functions in practice.

How Funding Frontier Facilitates Forex Trading with its Capital

Funding Frontier operates on a model similar to BrightFunded, providing traders with the necessary capital to engage in the forex market. The core of this model is a generous profit-sharing scheme, where if you’re profitable, you receive up to 80% of the profits, while Funding Frontier retains the remaining 20%. This structure is designed to help traders establish a stable income stream, with success in the forex market being largely dependent on profitability and effective trade management. Adherence to the platform’s trading rules and consistent, profitable trading are crucial for assured success. Before accessing the company’s capital for trading, you must first pass through an evaluation process, which includes a challenging assessment of your trading skills. Let’s explore the three main stages of this journey:

Step One: Trading Challenge

- The journey begins with a trading challenge. You select an account size that suits your strategy, with options ranging from $5,000 to $200,000.

- The challenge requires trading according to your style, while adhering to the firm’s rules and hitting a set profit target. This stage allows trading of all available instruments on the platform.

Step Two: Verification Stage

- This stage is about verifying your trading skills by achieving a lower profit target than the first stage. It’s essential to demonstrate consistency and skill, not just a one-time success.

Step Three: Funded Trader

- Upon successful completion of the first two stages, you graduate to trading with real company capital in a live funded account. There’s no set profit target, but consistency and profitability remain key.

- As a funded trader, you’re entitled to up to 80% of the profits you generate, reinforcing the incentive to maximize your trading efficacy.

With no fixed time limit for trading, you have the freedom to trade at your own pace, aligning with your experience and strategy.

Starting Your Trading Journey with Funding Frontier

Embarking on a trading journey with Funding Frontier is designed to be accessible and streamlined. Here’s a breakdown of the steps to get you started:

Step One: Registration

- Begin by registering on the Funding Frontier platform. This involves providing your personal details to join their membership program.

- Once registered, you gain access to various services on the dashboard, including the ability to participate in trading challenges.

Step Two: Choose Your Challenge

- Next, select the account size you wish to use throughout your trading journey. It’s important to consider the pricing of each account size to ensure it aligns with your financial capability.

- To assist in making an informed decision, refer to the pricing section of this review for detailed information on the cost of each account size.

Step Three: Trade

- Upon successful payment, Funding Frontier will promptly send your account credentials to your email, typically within five minutes.

- These credentials include dashboard access and user logins, equipping you with everything needed to commence your trading activities.

With these steps, you are well on your way to starting a promising trading journey on Funding Frontier.

Funding Frontier Trading Rules Explained

Funding Frontier operates under specific trading rules designed to structure and guide your trading journey. Here’s a detailed overview of these rules:

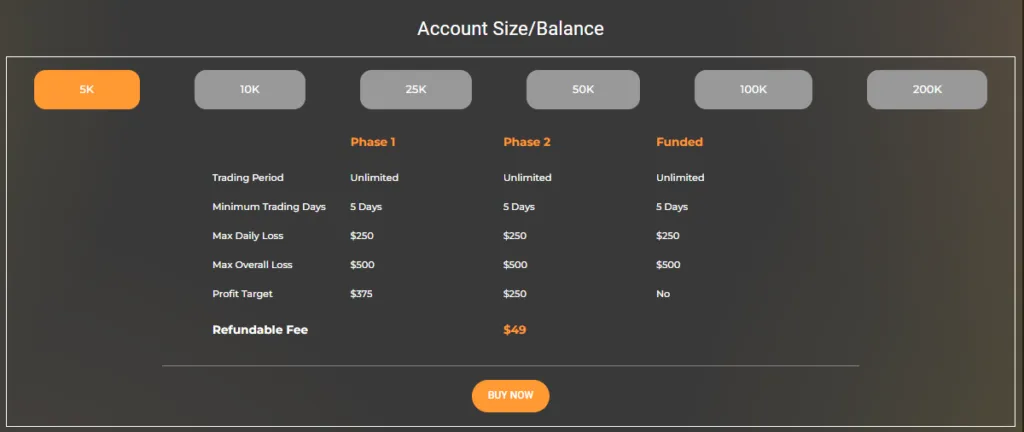

Profit Targets

- The challenge stage has a profit target of 7.5%, while the verification stage requires a lower target of 5%.

Funding Frontier Minimum and Maximum Trading Days

- A minimum of five trading days is mandated, offering a swift progression to a funded account for skilled traders.

- No maximum trading days are set, allowing traders, especially novices, ample time to refine their skills.

Loss Limits

- The maximum daily loss is capped at 5%, and exceeding this limit risks account termination.

- The total loss limit is set at 10% of the initial account balance, with breaching this threshold resulting in account deactivation.

Profit Share

- Funding Frontier offers an attractive profit share of up to 80%, making it a lucrative option for traders aiming to build passive income.

Trading Leverage

- Leverage varies by instrument, with Forex pairs at 1:50, commodities at 1:20, indices at 1:10, and cryptocurrencies at 1:2.

Additional Trading Options

- News trading is permitted, providing traders the flexibility to capitalize on market-moving events.

- Use of expert advisors is allowed, aiding those with less experience in making informed trading decisions.

- Weekend holding of trades is an option, catering to those who prefer continuous trading over the weekends.

These rules form the foundation of trading on Funding Frontier, ensuring a structured approach while offering sufficient flexibility for various trading strategies.

Trading Instruments Available on Funding Frontier

Funding Frontier offers a diverse range of trading instruments, catering to a wide array of trading preferences. The available instruments include:

- Forex Pairs: A staple in forex trading, you have access to major currency pairs.

- Commodities: This includes a variety of tradable commodities.

- Indices: For those interested in broader market movements.

- Cryptocurrencies: A modern addition for traders looking to delve into digital currencies.

It’s important to note that when trading in the forex market, Funding Frontier specifies the use of pairs ending with the suffix ‘x’. Examples include GBPJPYx, EURUSDx, among others. This specification is part of their trading framework, ensuring consistency in the instruments traded on their platform.

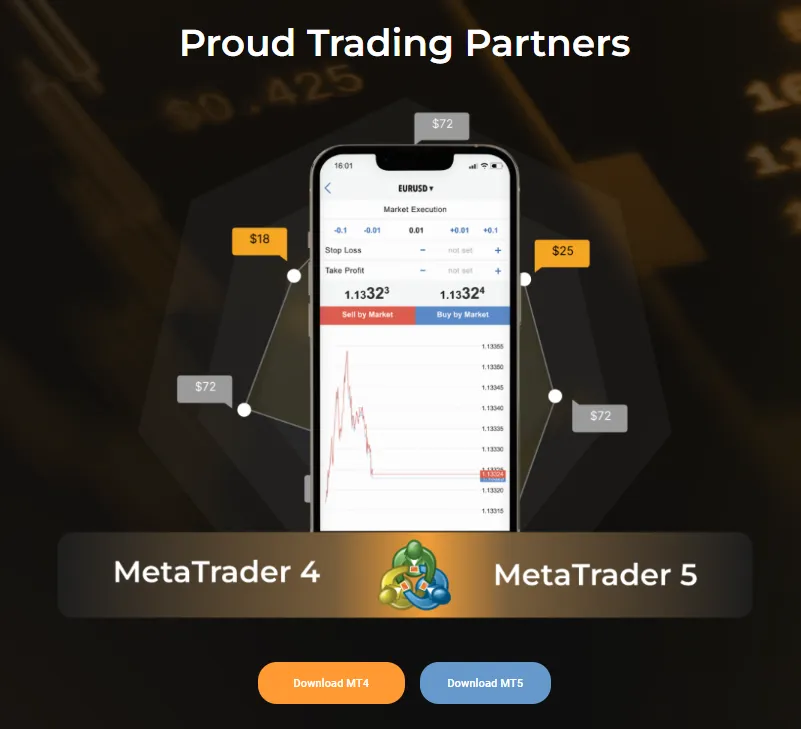

Funding Frontier’s Supported Trading Platforms

Funding Frontier, as a prop firm, accommodates the use of both Metatrader4 (MT4) and Metatrader5 (MT5) platforms for trading activities. These platforms are widely recognized for their robust features and user-friendly interfaces, catering to a range of trading styles and strategies.

- Metatrader4 (MT4): Renowned for its analytical tools, this platform is a popular choice among forex traders.

- Metatrader5 (MT5): An advanced version, offering additional features and extended capabilities.

Before starting your trading journey with Funding Frontier, ensure that your trading device is compatible with either MT4 or MT5. This compatibility check is crucial for a smooth and efficient trading experience on the platform.

Cost of Joining Funding Frontier: Account Size Options

The cost to join Funding Frontier varies based on the account size you choose during registration, offering options for traders with different budget capacities. Here’s a breakdown of the pricing for each available account size:

- $5,000 account size: $49.

- $10,000 account size: $84.

- $25,000 account size: $195.

- $50,000 account size: $290.

- $100,000 account size: $490.

- $200,000 account size: $945.

After making your payment, the process to receive your account credentials on the platform typically takes up to five minutes. However, in some cases, it may extend up to four hours. Funding Frontier also offers a promotional discount of up to 12.5% off the challenge fee, making it even more affordable to get started. This discount is available for early registrants within a five-day validity period, emphasizing the advantage of prompt action for those interested in joining the platform.

Funding Frontier’s Refund Policy Details

Funding Frontier provides a notable refund policy, offering up to 25% of the registration fee back to traders who successfully achieve a funded account status. This policy is designed to reward traders who demonstrate the skill and consistency required to progress through the platform’s evaluation stages.

- Eligibility for the refund is contingent upon reaching a funded account within the platform.

- Upon making your first payout, the refund is processed along with your profits, credited directly to your wallet.

It’s important to note that this refund is not applicable if you fail to attain a funded account status. In such cases, the registration fee is non-refundable, emphasizing the importance of meeting the platform’s trading criteria and challenges.

Payout Structure and Rewards at Funding Frontier

Funding Frontier has established a systematic payout system for its traders, characterized by regular withdrawal opportunities and commission-based incentives. Here’s an overview of how payouts and rewards are structured:

Bi-weekly Payouts

- Traders are eligible to request withdrawals every fourteen days, aligning with their trading activities on the platform.

Commission Earnings

- There is an opportunity to earn commissions based on the number of accounts purchased on the platform. This serves as an additional financial incentive for active traders.

Additional Rewards for Active Members

- Funding Frontier also promises extra rewards for traders who become active members of their platform. These rewards are designed to further motivate and benefit consistent and dedicated traders.

Note that to avail of these payout opportunities and rewards, you need to join Funding Frontier and actively participate in trading. This commitment to trading is essential to unlock the full range of benefits offered by the platform.

The Founders of Funding Frontier: Zain Omar and Keashif Beyg

Funding Frontier was co-founded by Zain Omar and Keashif Beyg, who currently hold the positions of CEO I and CEO II, respectively. Each founder brings a unique blend of expertise and experience to the firm.

Zain Omar: A Journey from Property to Forex

- Zain Omar’s professional background is rooted in property development, where he spent several years honing his skills.

- His passion for the financial market led him to pursue a master’s degree in finance and investment, deepening his understanding of trading and market dynamics.

- This educational and professional journey culminated in him co-founding Funding Frontier, bringing his expertise to the forex market.

Keashif Beyg: An Entrepreneur with a Trading Acumen

- Keashif Beyg is celebrated as a successful entrepreneur, boasting over seven years of experience in trading.

- His entrepreneurial spirit and trading proficiency play a pivotal role in shaping the vision and operations of Funding Frontier.

The combined experience and knowledge of Zain Omar and Keashif Beyg have been instrumental in establishing Funding Frontier as a reputable player in the forex market.

Assessment of Funding Frontier’s Legitimacy

Based on comprehensive research and personal evaluation, Funding Frontier emerges as a legitimate prop firm in the forex market. Here are some key aspects that contribute to its credibility:

Accessible Trading Challenges

- Funding Frontier, based in the UAE, offers a user-friendly challenge structure, enhancing accessibility for more traders to achieve funded accounts.

Flexibility in Trading Time

- The absence of strict time limits for completing trading stages offers flexibility, especially beneficial for traders who may require more time to refine their strategies.

Inclusivity for Novice Traders

- Their funding program is accommodating to traders with varying levels of experience, including those who are relatively new to trading.

Affordable Account Options

- With competitive and discounted pricing options, Funding Frontier makes it financially feasible for a wide range of traders to own an account.

Importance of Trading Skill and Adherence to Rules

- While the platform is welcoming, success is contingent upon possessing adequate trading skills and consistently adhering to the trading rules set by the firm.

- High profitability and rule compliance are critical for successful fund withdrawal and continued participation on the platform.

It’s important for potential traders to weigh these factors and understand the requirements and risks involved. For those seeking alternatives, other prop firms like AquaFunded are also worth exploring.

An Honest Assessment of Funding Frontier

Providing a transparent and candid review, here’s an in-depth assessment of Funding Frontier, focusing on various critical aspects:

Profit Splits: 8/10

With a generous profit share of up to 80%, Funding Frontier stands out in enabling traders to significantly benefit from their trades and build a passive income.

Scaling Opportunities: 1/10

The lack of clear information regarding scaling opportunities on the platform is a notable drawback, leaving traders uncertain about potential growth in account size.

Profit Targets: 8/10

The firm sets realistic profit targets, facilitating easier progression to funded accounts and attracting a broader range of traders.

Affordability: 7/10

With account options starting from $49 and additional discounts, Funding Frontier is accessible to traders with varying financial capabilities, particularly appealing to those with limited funds.

Trader Support: 5/10

While contact information is provided, the lack of detailed trader support on the website is a concern, as comprehensive support is crucial for a positive trading experience.

Tradable Assets: 8/10

The variety of tradable assets, including forex pairs, indices, commodities, and cryptocurrencies, enhances the trading experience by offering numerous opportunities for diversification.

Trustworthiness

Positive testimonials and high online ratings contribute to the firm’s credibility, instilling trust among its users.

Overall Rating: 7/10

Considering all factors, Funding Frontier is rated 7/10, marking it as a promising prop firm in the forex market, particularly suited for traders seeking to explore and expand their trading potential.

Public Perception and Reviews of Funding Frontier

Funding Frontier has garnered a substantial amount of feedback from its traders, both on their official website and on external platforms like Trustpilot. This feedback offers valuable insights into the experiences of traders with the firm. Here’s a snapshot of what people are saying:

Trustpilot Ratings

- As of December 7, 2023, Funding Frontier boasts an impressive rating of 4.5/5 stars on Trustpilot, based on 131 reviews.

Individual Reviews

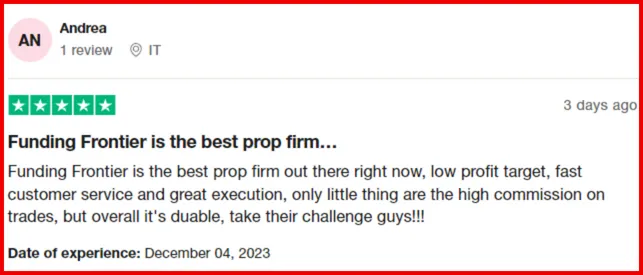

- Andrea: Awarding a five-star rating, Andrea considers Funding Frontier one of the best prop firms online.

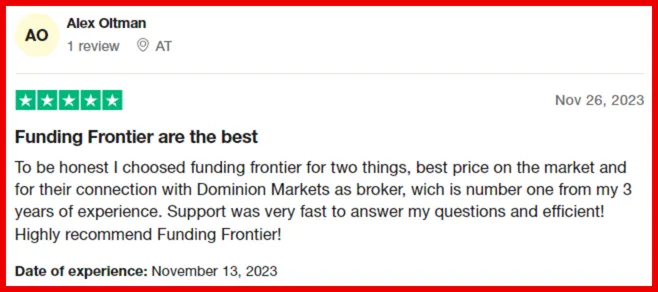

- Alex Oltman: Echoing similar sentiments, Alex Oltman praises the firm as the best in the market.

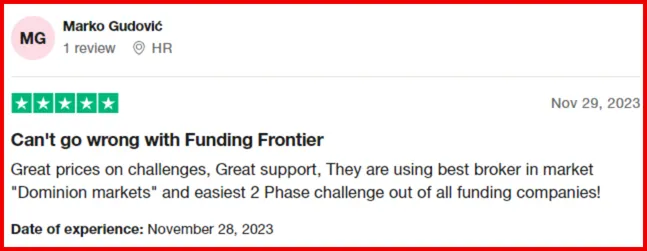

- Marko Gudovic: Marko gives a five-star rating, highlighting the difficulty in finding faults with the platform.

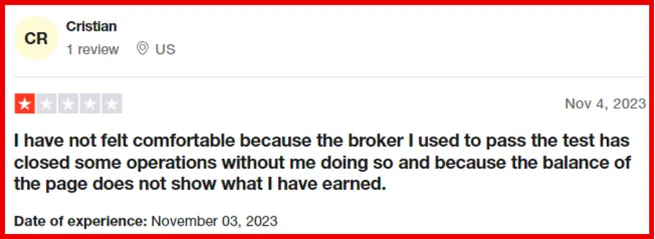

- Cristian: Offering a contrasting view, Cristian expresses dissatisfaction with a one-star rating.

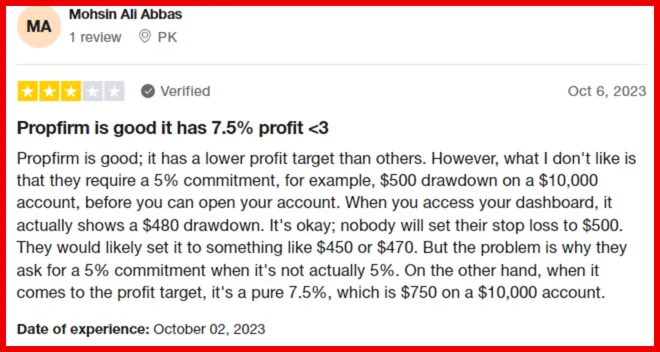

- Mohsin Ali: Impressed by the 7.5% profit target, Mohsin Ali gives a three-star rating, indicating a mixed experience.

These reviews, ranging from highly positive to critical, provide a multifaceted view of Funding Frontier, reflecting the diverse experiences of its users.

Frequently Asked Questions About Funding Frontier

To ensure your account remains active on Funding Frontier, it’s essential to log into your account at least once every thirty days. Inactivity beyond this period risks account deactivation.

Timeframe for Reaching a Funded Account

The duration to achieve a funded account status is contingent on your trading speed and proficiency. Skilled traders can potentially reach this milestone within 10 days, based on the minimum trading days requirement for each stage.

Ownership of Multiple Trading Accounts

Funding Frontier permits the ownership of multiple trading accounts. However, the total capital across all accounts is capped at $400,000, guiding the maximum number and size of accounts you can maintain.

Geographical Restrictions

There are no specific country restrictions for trading with Funding Frontier. Traders worldwide are welcome to join and participate in their funding program. Nevertheless, traders from the UAE may find additional advantages due to the firm’s location.