Discover the world of Funded Trading Plus, a leading proprietary trading firm offering tailored trading programs designed to suit various trader levels and styles. With options ranging from evaluation-based to direct funding programs, Funded Trading Plus stands out for its clear trading rules and generous profit splits, making it an attractive choice for both novice and experienced traders. Let’s delve deeper into what makes Funded Trading Plus a standout in the prop trading industry.

Discover the world of Funded Trading Plus, a leading proprietary trading firm offering tailored trading programs designed to suit various trader levels and styles. With options ranging from evaluation-based to direct funding programs, Funded Trading Plus stands out for its clear trading rules and generous profit splits, making it an attractive choice for both novice and experienced traders. Let’s delve deeper into what makes Funded Trading Plus a standout in the prop trading industry.

- Access to Large Trading Accounts.

- Potential for High Profit Splits.

- Flexible Assessment Options.

- Opportunity for Account Scaling.

- Direct Funding Availability.

- Challenge Phases May Be Daunting.

- Eligibility Criteria for Scaling.

- Limited Risk Management Guidance.

- Account Size Restrictions Initially.

- Performance Pressure for Profit Splits.

Funded Trading Plus stands out in the trading industry by fostering trader success. This London-based company empowers its traders by allowing them to manage accounts of up to $200,000. Subsequently, successful traders have the opportunity to further scale their accounts to a staggering $2,500,000. Options available to traders include a single assessment phase, dual assessment phase challenges, or opting for direct funding. Impressively, upon successful completion of these stages, traders are entitled to enjoy up to 100% profit splits on their earnings, making Funded Trading Plus a lucrative platform for ambitious traders.

Who are Funded Trading Plus?

Funded Trading Plus, a prop trading firm, was established on November 2, 2021, and commenced its operations on December 16, 2021. With its headquarters nestled in London, UK, this firm is recognized for providing its clients with substantial trading capital, allowing them to handle accounts up to $200,000, which can be scaled to a remarkable $2,500,000. In an effort to offer top-notch trading experiences, Funded Trading Plus has strategically partnered with Eightcap, an ASIC-regulated broker based in Melbourne, Australia. The company’s principal place of business is located at 7 Bell Yard, London, England, WC2A 2JR, marking its physical presence in the heart of the financial district.

Meet Simon Massey, CEO of Funded Trading Plus

Simon Massey, the dynamic CEO of Funded Trading Plus, brings a unique blend of adrenaline and ambition to the trading world. Initially pursuing a career in emergency services, Massey dedicated ten years to being a first responder, a role he believed would offer long-term satisfaction. However, as he reflected on his future, he realized that his true calling lay elsewhere. This pivotal moment led him to take a sabbatical, during which he explored various career options.

His entry into the financial arena was influenced by his friend Pasha, an ex-city trader from a major Wall Street bank and a successful retail trader. Learning from Pasha, Massey uncovered the vast array of opportunities in trading, inspiring him to embark on his own trading journey. This newfound passion led him to leave his first career and dive into trading full-time within a few years. Simon’s ambition wasn’t limited to personal success; he was equally passionate about mentoring others. This led to the creation of Trade Room Plus, co-founded with Michael, to share their collective trading expertise and guide aspiring traders.

The inception of Funded Trading Plus stemmed from recognizing the significant advantage that substantial capital provides, an advantage Pasha had as a former city trader. By establishing Funded Trading Plus, Simon Massey and his team have opened the doors for individuals to access higher levels of capital, democratizing opportunities that were once reserved for a select few in the trading community.

Funding Program Options at Funded Trading Plus

Funded Trading Plus caters to a diverse range of traders by offering four distinct programs, each tailored to meet different levels of trading expertise and aspirations. These programs are designed to accommodate traders at various stages of their careers, providing them with the tools and resources to excel in the dynamic world of trading. The available programs are:

- Experienced Trader Program: This program is crafted for traders who have already honed their skills and are looking to elevate their trading journey.

- Advanced Trader Program: Targeted at traders who possess a deeper understanding of the markets and seek to expand their trading prowess.

- Premium Trader Program: Designed for seasoned traders aiming for higher stakes and more significant challenges in their trading endeavors.

- Master Trader Program: This is the pinnacle program for top-tier traders who demonstrate exceptional skill and experience in the trading domain.

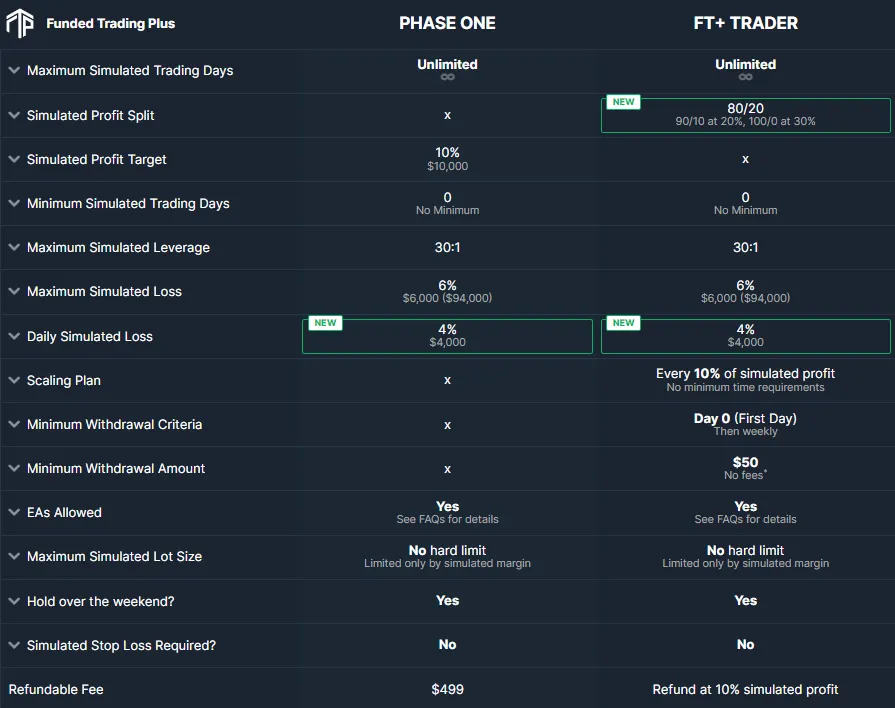

Experienced Trader Program Accounts at Funded Trading Plus

The Experienced Trader Program offered by Funded Trading Plus is designed for traders who can meet the evaluation requirements without any time constraints. This program allows trading with a leverage of 1:30. The account sizes and their respective prices are as follows:

- $12,500 account for $119

- $25,000 account for $199

- $50,000 account for $349

- $100,000 account for $499

- $200,000 account for $949

During the evaluation phase, traders are required to achieve a profit target of 10% while adhering to a 4% maximum daily loss and a 6% maximum trailing drawdown. Notably, there are no minimum or maximum trading day requirements in this phase, offering traders the flexibility to trade at their own pace. Upon successful completion of the evaluation phase, traders are granted a funded account with no profit targets. The only requirements are to maintain the 4% maximum daily loss and 6% maximum trailing drawdown.

Traders can request their first payout upon achieving a minimum profit of $50, with subsequent payouts processed on a weekly basis. Initially, traders receive an 80% profit split, which can increase to 90% upon the first account scaling. Moreover, a 20% return on the funded account qualifies for a 90% payout, and a 30% return escalates the payout to 100%.

Experienced Trader Program Account Scaling Plan at Funded Trading Plus

The Experienced Trader Program at Funded Trading Plus includes a comprehensive account scaling plan, providing traders with a clear pathway to grow their trading capital significantly. The scaling plan is structured across various phases, depending on the starting account size. The progression through these phases is as follows:

- Starting with a $12,500 account, traders can scale up through phases to reach $2,500,000.

- Beginning at $25,000, the scaling potential extends to $2,500,000 in fewer phases.

- A $50,000 starting account offers a scaling path up to $2,500,000 over several stages.

- For a $100,000 account, traders can escalate their account size up to $2,500,000.

- Starting at $200,000, the scaling plan leads up to a $2,500,000 account.

The only requirement to be eligible for scaling is achieving a 10% profit target. Traders have the flexibility to make withdrawals before scaling up, but must maintain a 10% profit in the account to qualify for scaling. For instance, a trader starting with a $200,000 account can manage their funds and trading strategy to incrementally increase their account balance and scale up to higher levels, as demonstrated in the example provided. Additionally, the Experienced Trader Program accounts offer a variety of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies, allowing traders to diversify their trading strategies and portfolio.

Experienced Trader Program Account Rules at Funded Trading Plus

The Experienced Trader Program at Funded Trading Plus is governed by specific rules designed to maintain a balanced and fair trading environment. These rules are critical for traders to understand and adhere to during their trading journey with the program. The key rules include:

- Profit Target: This is a predetermined percentage of profit that traders must achieve to complete an evaluation phase, withdraw profits, or scale their account. The profit target during the evaluation phase is set at 10%.

- Maximum Daily Loss: This rule caps the maximum loss a trader can incur in a day. For all account sizes, the maximum daily loss is set at 4%.

- Maximum Trailing Drawdown: The trailing drawdown is the maximum allowed drawdown, calculated as the difference between the highest account balance achieved and the maximum drawdown. This is set at 6% for all account sizes.

- Third-Party Copy Trading Risk: Traders using third-party copy trading services must be aware that these services might be used by other traders, potentially leading to similar trading strategies. Utilizing such services carries the risk of exceeding the maximum capital allocation rule, which could lead to being denied a funded account or withdrawal.

- Third-Party EA Risk: Similar to copy trading, the use of third-party Expert Advisors (EAs) also poses a risk. If other traders are using the same EA, it could result in identical trading strategies. This, in turn, might lead to exceeding the maximum capital allocation rule, affecting the trader’s eligibility for a funded account or withdrawal.

Understanding and following these rules is essential for traders in the Experienced Trader Program to ensure a successful and compliant trading experience with Funded Trading Plus.

Experienced Trader Program Account Rules at Funded Trading Plus

The Experienced Trader Program at Funded Trading Plus is governed by specific rules designed to maintain a balanced and fair trading environment. These rules are critical for traders to understand and adhere to during their trading journey with the program. The key rules include:

- Profit Target: This is a predetermined percentage of profit that traders must achieve to complete an evaluation phase, withdraw profits, or scale their account. The profit target during the evaluation phase is set at 10%.

- Maximum Daily Loss: This rule caps the maximum loss a trader can incur in a day. For all account sizes, the maximum daily loss is set at 4%.

- Maximum Trailing Drawdown: The trailing drawdown is the maximum allowed drawdown, calculated as the difference between the highest account balance achieved and the maximum drawdown. This is set at 6% for all account sizes.

- Third-Party Copy Trading Risk: Traders using third-party copy trading services must be aware that these services might be used by other traders, potentially leading to similar trading strategies. Utilizing such services carries the risk of exceeding the maximum capital allocation rule, which could lead to being denied a funded account or withdrawal.

- Third-Party EA Risk: Similar to copy trading, the use of third-party Expert Advisors (EAs) also poses a risk. If other traders are using the same EA, it could result in identical trading strategies. This, in turn, might lead to exceeding the maximum capital allocation rule, affecting the trader’s eligibility for a funded account or withdrawal.

Understanding and following these rules is essential for traders in the Experienced Trader Program to ensure a successful and compliant trading experience with Funded Trading Plus.

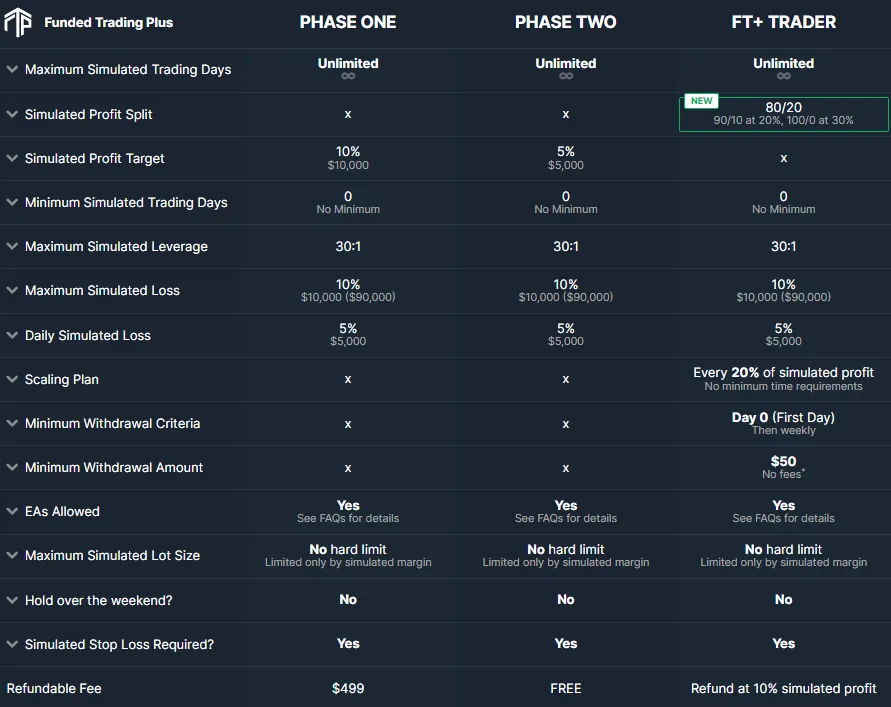

Advanced Trader Program Accounts at Funded Trading Plus

Funded Trading Plus’s Advanced Trader Program is designed to identify and reward serious, skilled traders. It involves a two-phase evaluation period, where traders are permitted to trade with a leverage of 1:30. The program offers various account sizes, each with its respective price:

- $25,000 account for $199

- $50,000 account for $349

- $100,000 account for $499

- $200,000 account for $949

Evaluation Phase One: In this phase, traders must achieve a profit target of 10% without exceeding a 5% maximum daily loss or a 10% maximum trailing drawdown. There are no constraints on the minimum or maximum trading days required to progress to the next phase. Evaluation Phase Two: This phase requires traders to reach a 5% profit target while adhering to the same loss and drawdown limits as in Phase One. Similar to the first phase, there are no trading day requirements to move on to a funded account. Upon successful completion of both evaluation phases, traders are granted a funded account with no set profit targets. The only requirements are to maintain a 5% maximum daily loss and a 10% maximum trailing drawdown. Traders can request their first payout after achieving a minimum profit of $50, with subsequent payouts scheduled on a weekly basis. Initially, the profit split is set at 80%, which can increase to 90% upon the first account scaling. Additionally, a 20% return on the funded account qualifies for a 90% payout, and a 30% return escalates the payout to 100%.

Advanced Trader Program Account Scaling Plan at Funded Trading Plus

The Advanced Trader Program at Funded Trading Plus offers a structured scaling plan, enabling traders to progressively increase their account sizes. The scaling plan is delineated through various phases, starting with different initial account sizes. Here’s an overview of the scaling plan:

- Starting with a $25,000 account, traders can scale up to $2,500,000 through successive phases.

- For a $50,000 starting account, the scaling potential extends to $2,500,000 over several stages.

- Beginning with $100,000, traders can escalate their account size up to $2,500,000 in fewer phases.

To be eligible for scaling, traders must reach a profit target of 20%. Withdrawals are allowed before scaling up, but a 20% profit must be maintained in the account for eligibility. For example, a trader starting with $100,000 can manage their funds and trading strategy to increase their account balance and scale up to higher levels, as illustrated in the provided example. The Advanced Trader Program accounts also offer a range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. This allows traders to diversify their strategies and leverage different market opportunities.

Advanced Trader Program Account Rules at Funded Trading Plus

Funded Trading Plus’s Advanced Trader Program is governed by a set of rules designed to foster a disciplined and strategic trading approach. Understanding these rules is crucial for traders to navigate the program successfully. The key rules include:

- Profit Target: Traders are required to achieve a specific percentage of profit to complete an evaluation phase, withdraw profits, or scale their account. The profit target for Phase 1 is 10%, while Phase 2 requires a 5% profit target. Funded accounts have no set profit targets.

- Maximum Daily Loss: This rule limits the maximum loss a trader can incur on a daily basis. For all account sizes, the maximum daily loss is capped at 5%.

- Maximum Trailing Drawdown: The trailing drawdown is the maximum allowable drawdown, defined as the difference between the highest account balance achieved and the maximum drawdown. All account sizes have a maximum trailing drawdown of 10%.

- Stop-Loss Requirement: Traders must set a stop-loss on every position before opening a trade, ensuring risk management and loss mitigation.

- No Weekend Holding: Open positions cannot be held over the weekend, mandating traders to close all trades before the market closes on Friday.

- Third-Party Copy Trading Risk: Using third-party copy trading services carries the risk of trading strategy duplication, as other traders might also be using the same service. Exceeding the maximum capital allocation rule through such services can lead to the denial of a funded account or withdrawal.

- Third-Party EA Risk: Similar to copy trading, using third-party Expert Advisors (EAs) poses a risk of strategy duplication if other traders use the same EA. This could potentially exceed the maximum capital allocation rule, affecting the eligibility for a funded account or withdrawal.

Adhering to these rules is essential for traders participating in the Advanced Trader Program at Funded Trading Plus, ensuring a compliant and effective trading experience.

Premium Trader Program Accounts at Funded Trading Plus

Funded Trading Plus’s Premium Trader Program is tailored for serious and talented traders, rewarding them for consistent performance during a two-phase evaluation period. This program permits trading with a leverage of 1:30 and offers the following account sizes and prices:

- $25,000 account for $247

- $50,000 account for $397

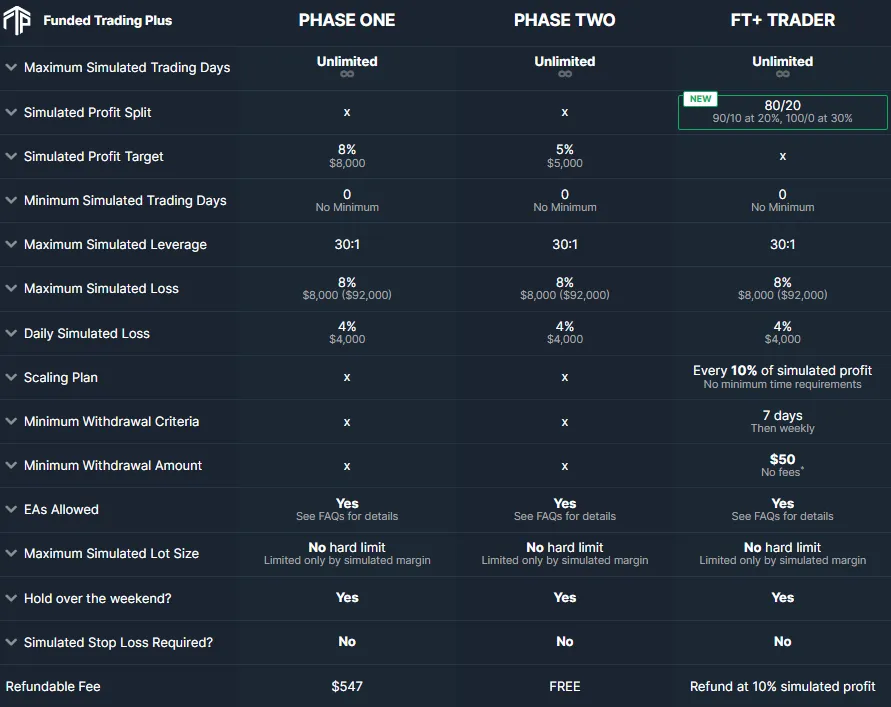

- $100,000 account for $547

- $200,000 account for $1,097

Evaluation Phase One: In this phase, traders must achieve an 8% profit target without exceeding a 4% maximum daily loss or an 8% maximum trailing drawdown. There are no restrictions on the number of trading days needed to advance to the next phase. Evaluation Phase Two: This phase requires traders to reach a 5% profit target while adhering to the same loss and drawdown limits as in Phase One. Like the first phase, there are no specific trading day requirements to transition to a funded account. Successful completion of both evaluation phases grants traders a funded account with no prescribed profit targets. The only requirements are to maintain a 4% maximum daily loss and an 8% maximum trailing drawdown. Traders can request their first payout after securing a minimum profit of $50, with subsequent payouts processed weekly. The initial profit split begins at 80%, which can be raised to 90% with the first account scaling. Additionally, achieving a 20% return on the funded account results in a 90% payout, while a 30% return increases the payout to 100%.

Premium Trader Program Account Scaling Plan at Funded Trading Plus

The Premium Trader Program at Funded Trading Plus includes an ambitious scaling plan, enabling traders to significantly elevate their trading capital through various phases. The plan is detailed as follows, based on different starting account sizes:

- For a $25,000 starting account, the scaling path leads up to $2,500,000 in successive phases.

- Beginning with a $50,000 account, traders can scale their capital to a maximum of $2,500,000 through progressive stages.

- A $100,000 account offers a scaling potential up to $2,500,000 over fewer phases.

- Starting with $200,000, traders can grow their account size up to $2,500,000 in the scaling plan.

To qualify for scaling, traders need to achieve a profit target of 10%. Withdrawals can be made before scaling, but maintaining a 10% profit in the account is essential for eligibility. An example demonstrates how a trader can manage their account by withdrawing profits while simultaneously scaling up. Furthermore, the Premium Trader Program accounts provide traders with a variety of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. This allows for diversified trading strategies and the opportunity to leverage different market conditions.

Premium Trader Program Account Rules at Funded Trading Plus

The Premium Trader Program at Funded Trading Plus is structured around a set of specific rules, essential for traders to follow for a successful trading experience. These rules are designed to encourage discipline and strategic planning in trading. Key rules include:

- Profit Target: Traders must reach a specified percentage of profit to complete an evaluation phase, withdraw profits, or scale their account. The profit target is 8% for Phase 1 and 5% for Phase 2. Funded accounts do not have any profit targets.

- Maximum Daily Loss: This rule defines the maximum loss a trader can incur on a daily basis. For all account sizes in the program, the maximum daily loss is set at 4%.

- Maximum Trailing Drawdown: The maximum trailing drawdown is the allowable drawdown limit, calculated as the difference between the highest account balance achieved and the maximum drawdown. This is set at 8% for all account sizes.

- Third-Party Copy Trading Risk: Traders considering using third-party copy trading services should be aware that such services might already be in use by other traders, potentially leading to identical trading strategies. This risk, if not managed, could exceed the maximum capital allocation rule, resulting in the denial of a funded account or withdrawal.

- Third-Party EA Risk: Using third-party Expert Advisors (EAs) also comes with the risk of strategy duplication if other traders are utilizing the same EA. This could lead to exceeding the maximum capital allocation rule, affecting eligibility for a funded account or withdrawal.

Understanding and adhering to these rules is crucial for traders participating in the Premium Trader Program at Funded Trading Plus, ensuring they can navigate the program effectively and responsibly.

Master Trader Program Accounts at Funded Trading Plus

Funded Trading Plus’s Master Trader Program is uniquely designed for exceptional traders, allowing them to bypass the evaluation phase and begin earning immediately. This program offers traders the opportunity to trade with a leverage of 1:30 and earn significant profit splits. The profit split starts at 80%, with the potential to increase based on the trader’s performance. Notably, achieving a 20% return on the funded account qualifies for a 90% payout, while a 30% return escalates the payout to 100%. The program offers various account sizes, each with its respective price:

The program offers various account sizes, each with its respective price:

- $5,000 account for $225

- $10,000 account for $450

- $25,000 account for $1,125

- $50,000 account for $2,250

- $100,000 account for $4,500

This program is particularly appealing to advanced traders who have proven their skills and seek immediate access to trading capital, allowing them to leverage their experience and strategy right from the start.

Master Trader Program Account Scaling Plan at Funded Trading Plus

The Master Trader Program at Funded Trading Plus offers a comprehensive scaling plan, designed for traders who wish to expand their trading capital significantly. The plan is structured to progress through various phases, with different starting account sizes. The scaling progression includes:

- Starting with a $5,000 account, traders can scale up through nine phases to reach a $2,500,000 account size.

- A $10,000 initial account allows scaling up to $2,500,000 over eight phases.

- With a $25,000 starting account, traders can progress to a $2,500,000 account in seven phases.

- Beginning at $50,000, the scaling potential extends to $2,500,000 over six phases.

- A $100,000 account offers a path to scale up to $2,500,000 in five phases.

The sole requirement for scaling is achieving a profit target of 10%. Traders have the option to withdraw profits before scaling up, but a 10% profit must be present in the account for scaling eligibility. An illustrative example shows how a trader can manage their account by withdrawing profits while also scaling up. In addition to the scaling opportunities, the Master Trader Program accounts provide access to a diverse range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. This allows traders to employ varied strategies and take advantage of different market dynamics.

Master Trader Program Account Rules at Funded Trading Plus

The Master Trader Program at Funded Trading Plus is structured with specific rules to ensure disciplined and strategic trading. These rules are crucial for traders to follow for optimal performance and compliance within the program. Key rules include:

- Maximum Daily Loss: This rule stipulates the maximum loss a trader can incur on a daily basis. For all account sizes in the Master Trader Program, the maximum daily loss is set at 6%.

- Maximum Trailing Drawdown: The maximum trailing drawdown is the allowable drawdown limit, calculated as the difference between the highest account balance achieved and the maximum drawdown. All account sizes have a maximum trailing drawdown of 6%.

- No Weekend Holding: Traders are required to close all open positions before the market closes on Friday, as holding positions over the weekend is not permitted.

- Third-Party Copy Trading Risk: If using third-party copy trading services, traders should be aware of the risk of strategy duplication. Other traders might also be using the same service, which could lead to exceeding the maximum capital allocation rule, affecting the eligibility for a funded account or withdrawal.

- Third-Party EA Risk: Similarly, using third-party Expert Advisors (EAs) also carries the risk of strategy duplication if other traders use the same EA. This could potentially lead to exceeding the maximum capital allocation rule, impacting the trader’s ability to obtain a funded account or withdrawal.

Adherence to these rules is essential for participants in the Master Trader Program at Funded Trading Plus, ensuring a compliant and effective trading experience.

What Sets Funded Trading Plus Apart from Other Prop Firms?

Funded Trading Plus distinguishes itself in the proprietary trading firm landscape with its unique array of funding programs and flexible trading conditions. The firm offers four distinct funding programs: Experienced, Advanced, Premium, and Master, each designed to cater to different levels of trading expertise and aspirations. One of the key differentiators for Funded Trading Plus is the minimal restrictions on trading styles. Unlike many other prop firms, they allow traders the freedom to trade during news events, hold trades overnight, and even over the weekend, with the exception of the Advanced and Master programs. This flexibility is a significant advantage for traders who prefer diverse trading strategies and conditions. In comparison to other industry-leading prop firms, the Experienced Trader Program at Funded Trading Plus is an evaluation program that requires traders to complete one phase before they are eligible for payouts. It features a 10% profit target, coupled with a 4% maximum daily loss and a 6% maximum trailing drawdown. Remarkably, there are no minimum or maximum trading day requirements for accounts in this program, providing traders the liberty to progress at their own pace. The Advanced Trader Program, conversely, involves a two-phase evaluation process. Traders must complete both phases to qualify for payouts, with a profit target of 10% in phase one and 5% in phase two. This program also specifies a 5% maximum daily loss and 10% maximum trailing drawdown. Like the Experienced Trader Program, Funded Trading Plus imposes no minimum or maximum trading day requirements for the Advanced Trader Program accounts, again emphasizing their commitment to trader flexibility and individual pace.

Comparative Analysis: Funded Trading Plus vs True Forex Funds (Standard)

When comparing Funded Trading Plus and True Forex Funds, key differences emerge in terms of trading objectives and requirements. Below is a detailed comparison between the two:

- Phase 1 Profit Target: Funded Trading Plus sets a Phase 1 profit target of 10%, while True Forex Funds requires an 8% profit target.

- Phase 2 Profit Target: Both firms have a Phase 2 profit target of 5%.

- Maximum Daily Loss: The maximum daily loss limit is set at 5% for both Funded Trading Plus and True Forex Funds.

- Maximum Loss: Funded Trading Plus implements a 10% maximum trailing loss, compared to True Forex Funds’ 10% maximum loss.

- Minimum Trading Days: Funded Trading Plus has no minimum trading days requirement, whereas True Forex Funds stipulates a minimum of 5 calendar days.

- Maximum Trading Period: For Funded Trading Plus, both phases have an unlimited trading period. In contrast, True Forex Funds allows 30 calendar days for Phase 1 and 60 calendar days for Phase 2.

- Profit Split: Funded Trading Plus offers a profit split ranging from 80% up to 100%, while True Forex Funds maintains a consistent 80% profit split.

This comparison highlights the unique aspects of each firm, with Funded Trading Plus offering more flexibility in trading days and a potentially higher profit split, whereas True Forex Funds has more defined time constraints but a simpler profit target structure.

Comparative Analysis: Funded Trading Plus vs E8 Funding (Normal)

A comparative look at Funded Trading Plus and E8 Funding (Normal) reveals distinct differences and similarities in their trading objectives and requirements. Here’s a detailed comparison:

- Phase 1 Profit Target: Funded Trading Plus sets a Phase 1 profit target of 10%, compared to E8 Funding’s 8%.

- Phase 2 Profit Target: Both firms require a 5% profit target for Phase 2.

- Maximum Daily Loss: A maximum daily loss of 5% is stipulated by both Funded Trading Plus and E8 Funding.

- Maximum Loss: Funded Trading Plus has a 10% maximum trailing loss, while E8 Funding has an 8% maximum loss, which is scalable up to 14%.

- Minimum Trading Days: Neither firm imposes a minimum trading days requirement, offering flexibility to traders.

- Maximum Trading Period: Both Funded Trading Plus and E8 Funding offer an unlimited trading period for both Phase 1 and Phase 2, allowing traders ample time to achieve their targets.

- Profit Split: Funded Trading Plus offers a profit split ranging from 80% up to 100%, in contrast to E8 Funding’s consistent 80% profit split.

This comparison showcases the flexibility and higher potential profit split offered by Funded Trading Plus, whereas E8 Funding provides a scalable maximum loss option, adding an element of adaptability to its trading conditions.

Comparative Analysis: Funded Trading Plus vs FTMO

Comparing Funded Trading Plus and FTMO reveals both similarities and differences in their trading objectives and criteria. Below is an analysis focusing on various aspects of their trading programs:

- Phase 1 Profit Target: Both Funded Trading Plus and FTMO set a Phase 1 profit target of 10%.

- Phase 2 Profit Target: A 5% profit target is required in Phase 2 for both firms.

- Maximum Daily Loss: Each firm imposes a 5% maximum daily loss.

- Maximum Loss: Funded Trading Plus has a 10% maximum trailing loss, which is similar to FTMO’s 10% maximum loss.

- Minimum Trading Days: Funded Trading Plus does not have a minimum trading days requirement, whereas FTMO requires a minimum of 4 calendar days.

- Maximum Trading Period: Both firms offer an unlimited trading period for Phase 1 and Phase 2, providing ample time for traders to meet their targets.

- Profit Split: Funded Trading Plus offers a profit split ranging from 80% to 100%, compared to FTMO’s 80% to 90%.

Additionally, the Premium Trader Program of Funded Trading Plus is a two-phase evaluation program with an 8% Phase 1 profit target and a 5% Phase 2 target, including a 4% maximum daily loss and 8% maximum trailing drawdown. Unlike many prop firms, Funded Trading Plus does not impose minimum or maximum trading day requirements for this program, granting more flexibility to traders. Moreover, there is no mandatory stop-loss rule, and traders have the option to hold trades over the weekend, offering significant flexibility in trading styles compared to other industry leaders.

Comparative Analysis: Funded Trading Plus vs Funding Pips

When comparing Funded Trading Plus with Funding Pips, we observe several key differences and similarities in their trading objectives and requirements. Here’s a detailed comparison:

- Phase 1 Profit Target: Both Funded Trading Plus and Funding Pips set an 8% profit target for Phase 1.

- Phase 2 Profit Target: A 5% profit target is required in Phase 2 for both firms.

- Maximum Daily Loss: Funded Trading Plus imposes a 4% maximum daily loss, slightly lower than Funding Pips’ 5% limit.

- Maximum Loss: Funded Trading Plus has an 8% maximum trailing loss, while Funding Pips sets a 10% maximum loss.

- Minimum Trading Days: Neither firm has a minimum trading days requirement, providing flexibility to traders.

- Maximum Trading Period: Both firms offer an unlimited trading period for both Phase 1 and Phase 2, allowing traders ample time to achieve their targets.

- Profit Split: Funded Trading Plus offers a profit split ranging from 80% up to 100%, compared to Funding Pips’ range of 80% up to 90%.

This comparison highlights Funded Trading Plus’s slightly more stringent daily loss limit and a lower maximum loss threshold, offering a different risk management profile compared to Funding Pips. Additionally, Funded Trading Plus provides a potentially higher profit split, emphasizing its appeal to traders aiming for higher rewards.

Comparative Analysis: Funded Trading Plus vs Finotive Funding

Comparing Funded Trading Plus with Finotive Funding reveals notable differences and similarities in their trading objectives and requirements. Here’s a breakdown of the comparison:

- Phase 1 Profit Target: Funded Trading Plus has an 8% profit target for Phase 1, slightly higher than Finotive Funding’s 7.5%.

- Phase 2 Profit Target: Both firms require a 5% profit target for Phase 2.

- Maximum Daily Loss: Funded Trading Plus sets a 4% maximum daily loss, compared to Finotive Funding’s 5%.

- Maximum Loss: There’s an 8% maximum trailing loss at Funded Trading Plus, while Finotive Funding imposes a 10% maximum loss.

- Minimum Trading Days: Neither firm mandates a minimum number of trading days, offering flexibility for traders.

- Maximum Trading Period: Both firms provide an unlimited trading period for both Phase 1 and Phase 2.

- Profit Split: Funded Trading Plus offers a profit split ranging from 80% up to 100%, which is more favorable compared to Finotive Funding’s range of 75% up to 95%.

This comparison highlights the slightly more challenging profit targets and tighter daily loss limits of Funded Trading Plus, potentially appealing to traders who favor stricter risk management. Additionally, Funded Trading Plus stands out with its higher profit split potential, offering greater rewards for successful trading.

Comparative Analysis: Funded Trading Plus vs FundedNext (Stellar)

When comparing Funded Trading Plus with FundedNext (Stellar), distinct differences and similarities in their trading objectives and rules become apparent. Here’s a detailed comparison:

- Phase 1 Profit Target: Both Funded Trading Plus and FundedNext set an 8% profit target for Phase 1.

- Phase 2 Profit Target: A 5% profit target is required for Phase 2 in both firms.

- Maximum Daily Loss: Funded Trading Plus has a 4% maximum daily loss, slightly lower than FundedNext’s 5%.

- Maximum Loss: There’s an 8% maximum trailing loss with Funded Trading Plus, compared to FundedNext’s 10% maximum loss.

- Minimum Trading Days: Funded Trading Plus does not require a minimum number of trading days, whereas FundedNext requires 5 calendar days.

- Maximum Trading Period: Both firms offer an unlimited trading period for Phase 1 and Phase 2.

- Profit Split: Funded Trading Plus provides a profit split ranging from 80% to 100%, more favorable than FundedNext’s range of 80% to 90%.

Furthermore, Funded Trading Plus’s Master Trader Programs, which are direct funding programs, stand out with their own set of rules. These include a 6% maximum daily loss and 6% maximum trailing drawdown, with no minimum or maximum trading day requirements. Notably, there are no profit targets for weekly payouts, with profit splits ranging from 80% to 100%. The only requirement is achieving a minimum profit of $50. In summary, Funded Trading Plus differentiates itself from other leading prop firms through its four diverse funding programs and straightforward trading rules. The firm is particularly accommodating for traders who prefer trading during news events, holding trades overnight, and over weekends (with certain program exceptions), making it a versatile choice for a wide range of traders.

Is Getting Capital from Funded Trading Plus Realistic?

When evaluating the feasibility of obtaining capital from a proprietary trading firm like Funded Trading Plus, it’s crucial to assess the realism of their trading requirements in relation to your forex trading style. The allure of high-profit splits and substantial funding can be tempered by stringent performance expectations, such as high percentage gains with low permissible drawdowns, which could significantly diminish the likelihood of success. In the context of Funded Trading Plus, the prospect of receiving capital appears realistic across its various programs:

- Experienced Trader Program: This program offers a balanced approach with an average profit target of 10%, coupled with reasonable loss limits (4% maximum daily and 6% maximum trailing drawdown), making the achievement of capital quite feasible.

- Advanced Trader Program: With average profit targets (10% in phase one and 5% in phase two) and loss rules (5% maximum daily loss and 10% maximum trailing drawdown), this program also presents a realistic path to receiving capital.

- Premium Trader Program: The requirements here include average profit targets (8% in phase one and 5% in phase two) along with moderate loss rules (4% maximum daily loss and 8% maximum trailing drawdown), again suggesting a realistic opportunity for capital acquisition.

- Master Trader Programs: These direct funding programs are highly realistic, as they allow traders to start earning immediately with no profit targets, coupled with the option for weekly withdrawals.

Considering these aspects, Funded Trading Plus emerges as an excellent choice for traders seeking funding. The firm’s diverse range of funding programs, coupled with realistic trading objectives and payout conditions, makes it a viable and attractive option for a broad spectrum of forex traders.

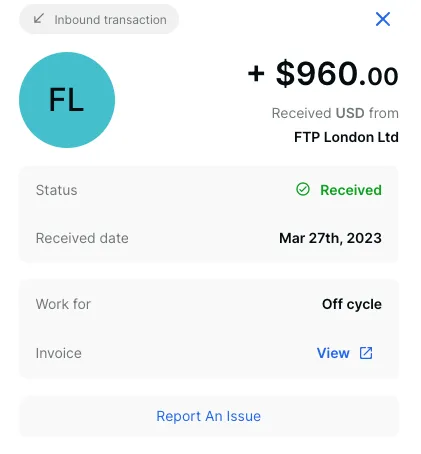

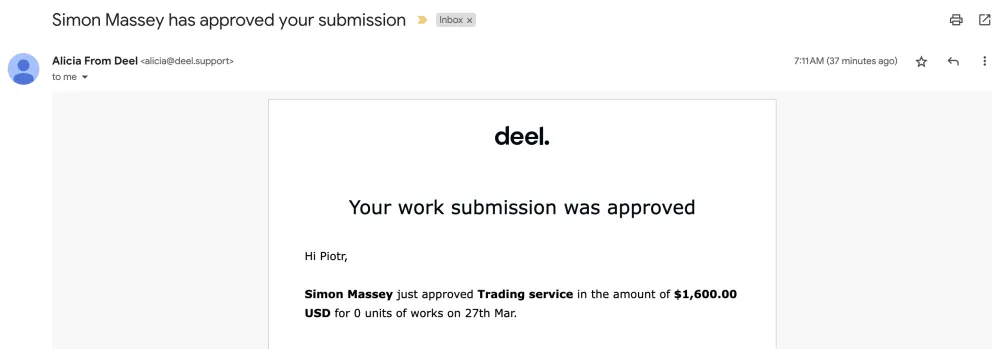

Payment Proof for Funded Trading Plus

Funded Trading Plus, a reputable proprietary trading firm established on November 2, 2021, and officially launched on December 16, 2021, provides transparency and credibility regarding its payment process. Traders interested in verifying the legitimacy of Funded Trading Plus’s payouts can find concrete evidence of payments in the following ways:

- Discord Community: One of the primary sources for payment proof is their Discord server. In the “payouts” channel, members can view various posts and discussions showcasing payment proofs, offering a community-verified insight into the firm’s financial transactions with its traders.

- YouTube Channel: Funded Trading Plus also utilizes its YouTube channel as a platform for sharing success stories. They conduct interviews with successful traders, where discussions often include mentions or demonstrations of payment proofs, thereby providing an additional layer of transparency and trust.

These sources serve as valuable resources for anyone seeking assurance about the firm’s payment practices, ensuring that traders can proceed with confidence when considering Funded Trading Plus as their trading partner.

Funded Trading Plus and Its Broker Partner: Eightcap

Funded Trading Plus collaborates with Eightcap, an ASIC-regulated broker based in Melbourne, Australia. Established in 2009, Eightcap has a clear mission of providing exceptional financial services. They have expanded their global footprint with five offices worldwide, holding multiple regulatory licenses, enabling them to offer trading services globally across various markets like FX, indices, commodities, and shares.

Key Features of Eightcap

Eightcap, considered an average-risk broker, holds a Trust Score of 73 out of 99. They offer an extensive range of trading options, including:

- Forex Trading

- CFD Trading

- Cryptocurrency Trading

- Social Trading/Copy-Trading

- 326 Tradeable Symbols

- 45 Forex Pairs

The broker offers two account types: Raw and Standard, each with its own fee structure. Standard accounts incorporate fees within the spread, while Raw accounts apply a commission fee. Additionally, traders should be aware of the overnight fee, applicable for maintaining open positions overnight.

Trading Platforms Offered by Eightcap

Exclusively a MetaTrader broker, Eightcap offers both MetaTrader 4 and MetaTrader 5 platforms from MetaQuotes Software Corporation. They are committed to delivering a personalized trading experience and have developed an ultra-efficient technological infrastructure. This commitment was recognized when they were awarded the Best Global Forex MT4 Broker at the 2020 Global Forex Awards. Available trading platforms at Eightcap include:

- MetaTrader 4

- MetaTrader 5

Diverse Trading Instruments Offered by Funded Trading Plus

Funded Trading Plus provides a wide array of trading instruments, enabling traders to diversify their portfolios. Available categories include forex pairs, commodities, indices, and cryptocurrencies, each offering a range of options.

Forex Trading Options

- Major pairs like EURUSD, GBPUSD, AUDUSD, NZDUSD, USDCAD

- JPY pairs including USDJPY, EURJPY, GBPJPY, and others

- Various cross pairs like EURGBP, GBPAUD, CADJPY, and more

- Exotic pairs such as EURMXN, USDZAR, SGDJPY, and others

Commodities Trading Instruments

- Precious Metals: XAUUSD (Gold), XAGUSD (Silver), XPTUSD (Platinum)

- Energy Commodities: UKOUSD (Brent Oil), USOUSD (Crude Oil)

Indices Available for Trading

- Major Indices: SPX500, US30, GER30, UK100, and more

- Global Indices: ASX200, FR40, JP225, NDX100, and others

Cryptocurrency Trading Options

- Leading Cryptos: BTCUSD, ETHUSD, LTCUSD, ADAUSD, and more

- Altcoins: DOGEUSD, SOLUSD, LINKUSD, MATICUSD, and various others

- Diverse Crypto Options: AAVEUSD, SHIBUSD, VETUSD, XLMUSD, and many more

With such a broad range of trading instruments, Funded Trading Plus caters to the diverse preferences and strategies of traders, from traditional forex and commodities to the dynamic world of cryptocurrencies.

Understanding Trading Fees with Funded Trading Plus

Trading Commission Structure

Funded Trading Plus has a straightforward commission structure for different asset classes:

- Forex: A fee of 7 USD per lot

- Commodities: No commission charged

- Indices: Commission-free trading

- Crypto: Zero commission on trades

Spread Details

For information on live spreads, Funded Trading Plus suggests logging into their trading accounts. Details for accessing the demo accounts on different platforms are provided:

MetaTrader 4 Demo Account

- Server: EightcapLtd-Demo2

- Login Number: 20073579

- Password: FTPNewPW2023!

- Download MetaTrader 4

MetaTrader 5 Demo Account

- Server: Eightcap Demo

- Login Number: 930355

- Password: FTPTEST1

- Download MetaTrader 5

This detailed guide helps traders to familiarize themselves with the trading fees and spread information, enhancing their trading experience with Funded Trading Plus.

Education and Support Services at Funded Trading Plus

Funded Trading Plus, a branch of the well-established Trade Room Plus founded in 2013, stands as the UK’s premier live trade room for retail traders. This connection underlines their commitment to trader education and support.

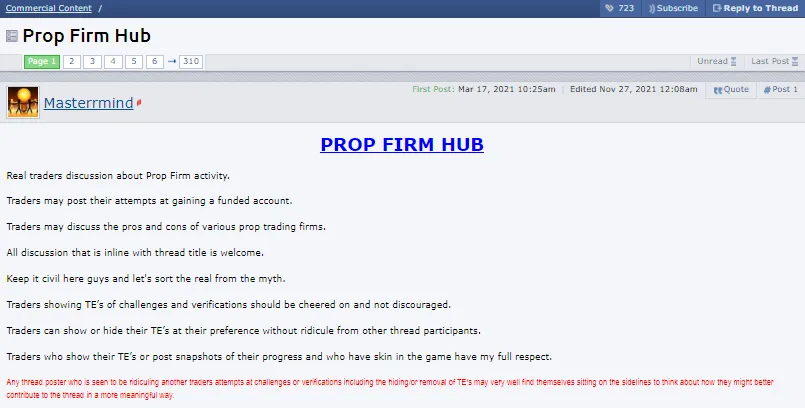

Recognition and Discussions on ForexFactory

While Funded Trading Plus does not have a dedicated thread on ForexFactory, its services and offerings have been highlighted in the ‘PROP FIRM HUB’ thread, initiated by the user Masterrmind. This thread serves as a testament to the firm’s visibility and reputation in the trading community. To view this discussion, you can click here.

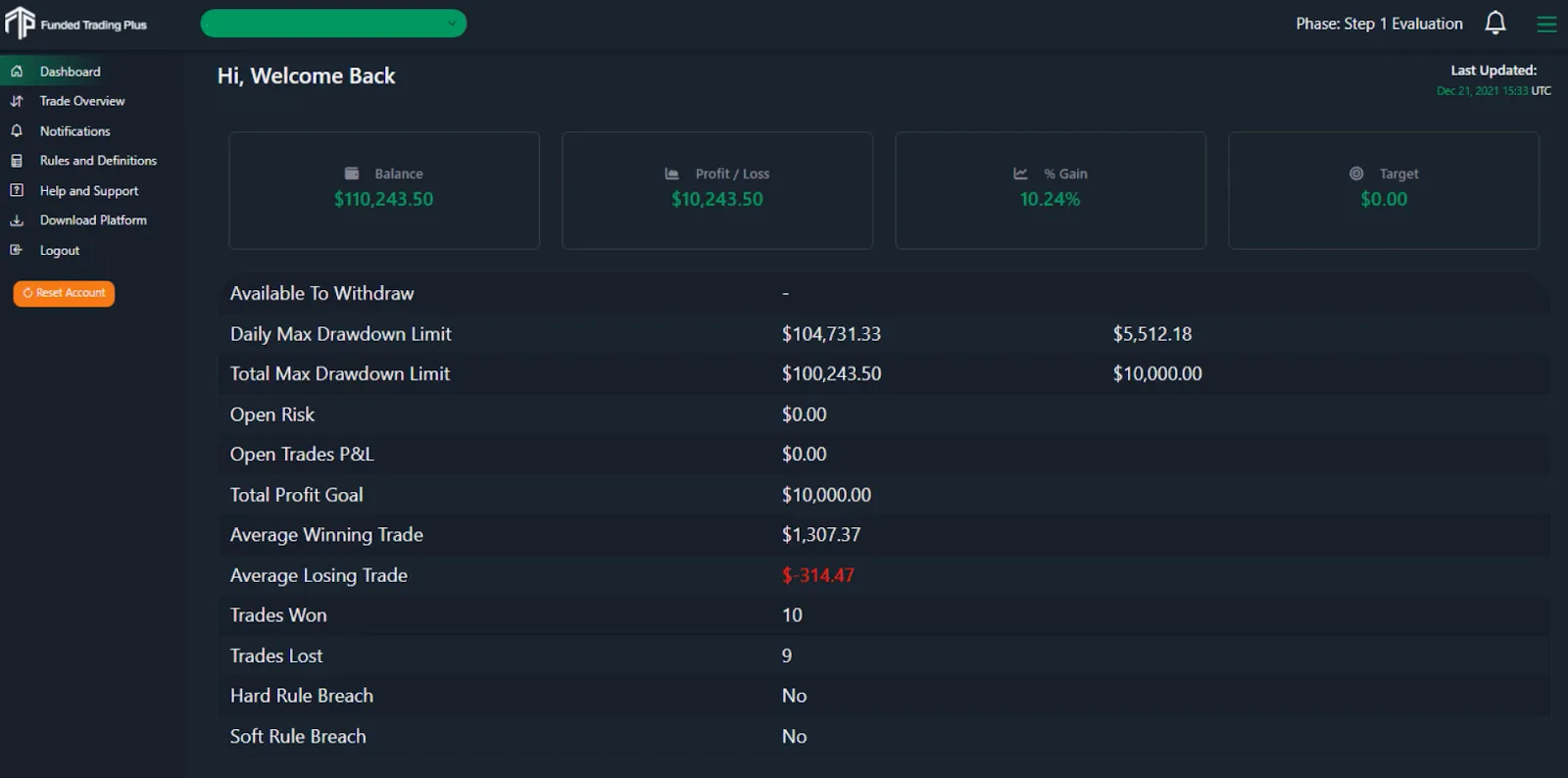

User-Friendly Dashboard for Risk Management

Enhancing the trading experience, Funded Trading Plus offers a well-organized dashboard accessible to all its clients. This tool is designed to simplify risk management by providing comprehensive insights into trading objectives and statistics, thereby aiding traders in making informed decisions. This focus on education and support, combined with practical trading tools, demonstrates Funded Trading Plus’s dedication to supporting its traders’ journey towards success.

Traders’ Feedback on Funded Trading Plus

Funded Trading Plus has garnered positive acclaim from its trading community, reflecting in the feedback and reviews shared by its users.

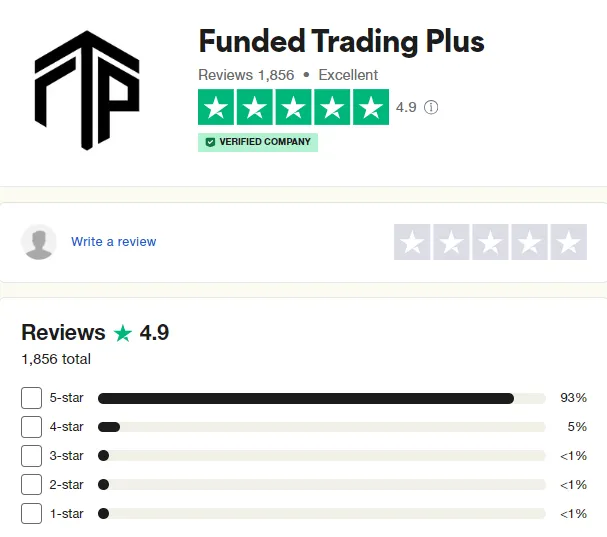

Trustpilot Reviews and Ratings

On Trustpilot, Funded Trading Plus enjoys an impressive reputation, with an excellent score of 4.9 out of 5 based on 1,856 reviews. This high rating is indicative of the positive experiences and satisfaction of its traders.

Community Praise for Support and Dashboard

The trading community has particularly appreciated the prompt and reliable support team at Funded Trading Plus. The team’s readiness to provide necessary information and assistance is highly commended. Additionally, a significant portion of the community has expressed approval of the well-structured dashboard offered by Funded Trading Plus, highlighting its effectiveness in streamlining trading activities. This collective feedback underscores the firm’s commitment to maintaining high standards of customer satisfaction and operational excellence.

Funded Trading Plus on Social Media

Funded Trading Plus extends its presence beyond traditional platforms, engaging with users on various social media channels.

Social Media Reach and Engagement

The firm’s social media statistics are as follows:

- Facebook: A page followed by 12,000 individuals, showcasing their community engagement.

- Twitter: An account with 380 followers, reflecting their active communication and updates.

- YouTube: A channel with 3,310 subscribers and a collection of 30 videos, providing visual content and insights.

- Discord: A vibrant community of 8,647 members, offering a platform for real-time interaction and discussion.

This diverse social media footprint enables Funded Trading Plus to connect with its audience on multiple fronts, offering varied forms of content and community interaction.

Support Services at Funded Trading Plus

Funded Trading Plus provides various support channels to assist their clients effectively and efficiently.

FAQ and Online Resources

For general queries and information, their FAQ page is a handy resource where you can find answers to common questions and guidance on different topics.

Social Media and Email Support

The support team is actively engaged on social media platforms. For direct communication, clients can email them at [email protected].

Live Chat and Email Follow-up

Funded Trading Plus offers live chat support on their website. This feature enables immediate assistance; in cases where the team is not available, they ensure a response within 24 hours via email.

Telephone Assistance

Clients can also reach out to Funded Trading Plus by phone at +44 333 090 9800 for more personalized support.

Discord Community Support

Their Discord channel is another avenue where both the support team and community members collaborate to provide assistance, especially for technical issues or specific queries. These varied support options underscore Funded Trading Plus’s commitment to providing comprehensive and accessible customer service.

Concluding Review of Funded Trading Plus

Funded Trading Plus stands out as a legitimate and reputable proprietary trading firm, offering a range of funding programs tailored to suit different levels of trading experience and expertise. Their programs include Experienced, Advanced, Premium, and Master, each designed with specific goals and rules to cater to diverse trading styles.

Experienced Trader Program

This program is an evaluation-based pathway where traders must meet a 10% profit target while adhering to a 4% maximum daily loss and a 6% maximum trailing drawdown. Successful traders in this program can earn up to 100% profit splits and have the opportunity to scale their accounts.

Advanced Trader Program

The Advanced program is a two-phase evaluation challenge. Traders must achieve a 10% profit target in phase one and 5% in phase two. This program comes with a 5% maximum daily loss and a 10% maximum trailing drawdown. Participants can also earn up to 100% profit splits and scale their accounts.

Premium Trader Program

Similar to the Advanced program, the Premium Trader program is a two-phase evaluation with 8% and 5% profit targets for phase one and two, respectively. The maximum daily loss is set at 4% and the maximum trailing drawdown at 8%. Successful traders can earn up to 100% profit splits and are given scaling opportunities.

Master Trader Program

This program offers direct funding, allowing traders to bypass the evaluation phase and immediately start trading with a funded account. There are no time limits, lot size restrictions, or consistency rules, and traders can earn between 80% to 100% in profit splits. Account scaling is also an option in this program. Overall, Funded Trading Plus is highly recommended for anyone seeking a prop firm with clear and straightforward trading rules. With its well-established status and range of funding programs, it caters to a broad spectrum of traders, positioning itself as a leader in the proprietary trading firm industry.