Explore how CTI transforms the trading experience, offering traders the opportunity to manage large funds and earn substantial profits through disciplined and consistent trading strategies.

Explore how CTI transforms the trading experience, offering traders the opportunity to manage large funds and earn substantial profits through disciplined and consistent trading strategies.

- Access to Large Capital Up to $4,000,000.

- High Profit Splits Up to 100%.

- Trade Forex, Gold, and Indices.

- Focus on Financial Independence.

- Supports Traders from All Backgrounds.

CTI Review: Unlocking Financial Freedom for Disciplined Traders

City Traders Imperium (CTI) stands out in the financial trading world for its commitment to helping traders from diverse backgrounds achieve financial freedom. This London-based company places a high value on discipline and long-term consistency among its clients. CTI empowers its traders with the opportunity to manage substantial funds up to $4,000,000. Furthermore, it offers exceptionally attractive profit splits, allowing traders to take home up to 100% of the profits earned. The trading instruments available include a variety of Forex pairs, gold, and indices, providing a broad spectrum for trading strategies.

Understanding City Traders Imperium: A Comprehensive Overview

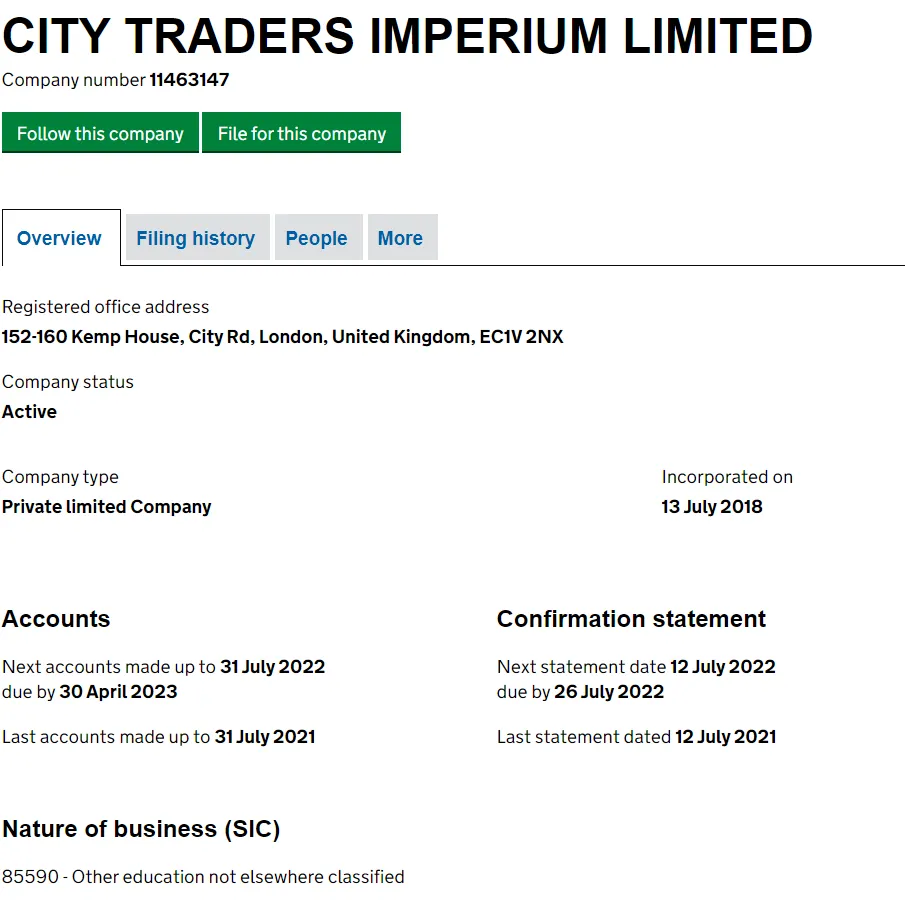

City Traders Imperium (CTI), a prominent proprietary trading firm, is based in the heart of the UK’s financial capital, London. Renowned for its innovative funding programs, CTI caters to a wide range of traders by offering day trading, instant funding, and direct funding options. The instant funding program is designed as a one-step evaluation process, while the direct funding program allows traders to bypass the evaluation stage and start generating profits immediately. In contrast, their day trading funding program involves a more rigorous two-step evaluation.  Unique to CTI’s offerings are its scaling plans, which enable traders to gradually increase their capital management up to $2,000,000 per account. The firm provides its traders with access to the MetaTrader 5 platform, coupled with a tier-1 liquidity provider to ensure the best possible simulation of real market trading conditions. As a testament to their legitimacy, CTI is an officially registered company in the UK, with details publicly available in the Companies’ House records. The firm was founded on July 13th, 2018, by Daniel Bautista, further establishing its presence in the financial trading domain.

Unique to CTI’s offerings are its scaling plans, which enable traders to gradually increase their capital management up to $2,000,000 per account. The firm provides its traders with access to the MetaTrader 5 platform, coupled with a tier-1 liquidity provider to ensure the best possible simulation of real market trading conditions. As a testament to their legitimacy, CTI is an officially registered company in the UK, with details publicly available in the Companies’ House records. The firm was founded on July 13th, 2018, by Daniel Bautista, further establishing its presence in the financial trading domain.

Leadership at City Traders Imperium: The Pioneering Duo

City Traders Imperium is led by a dynamic duo of co-founders, Daniel Martin and Martin Najat, who bring distinct expertise and vision to the firm.

Daniel Martin: A Veteran Trader with a Mission

Daniel Martin, one of the co-founders, brings over two decades of trading experience to City Traders Imperium. His journey in the trading world has been marked by significant success, leading him to financial freedom. However, instead of opting for retirement, Martin chose to channel his expertise into mentoring others. He focuses on enhancing traders’ skills, particularly in the areas of trading psychology and methodology, helping them achieve consistent profitability. His dedication to creating a global network of successful traders stands at the core of his professional mission.

Martin Najat: From Investment Analyst to Visionary Co-Founder

Martin Najat, the second co-founder, has carved a niche for himself as a successful Smart Money Concepts trader. His transformation from an investment analyst in London to a full-time trader was catalyzed by an improvement in his trading psychology, under the guidance of Daniel Martin. Najat’s vision for City Traders Imperium was to empower undercapitalized traders, providing them with the resources to alter their financial trajectories. Under his leadership, CTI is not just a trading firm but a nurturing ground for building a robust team of profitable traders. For those keen on gaining insights into Martin Najat’s trading philosophy and daily updates, following him on Instagram and LinkedIn would provide a closer look into his professional endeavors and contributions to City Traders Imperium.

Funding Programs at City Traders Imperium

City Traders Imperium (CTI) presents three distinct funding programs, each tailored to accommodate the varied needs and skills of traders.

Day Trading Funding Program: The Two-Step Challenge

The Day Trading Funding Program is designed as a two-step challenge, providing traders with a structured pathway to demonstrate their trading prowess. This program is ideal for those who thrive under a tiered progression system, offering a comprehensive assessment of their trading strategy and discipline.

Instant Funding Program: The One-Step Challenge

For traders seeking a more streamlined route, the Instant Funding Program offers a one-step challenge. This program is suited for experienced traders who are confident in their trading strategy and wish to bypass the more extended evaluation process.

Direct Funding Program: Immediate Trading Opportunity

The Direct Funding Program stands out by allowing traders to skip the evaluation phase entirely. This option is particularly appealing to seasoned traders with a proven track record, enabling them to start trading and earning with CTI’s capital right from the outset.

Day Trading Funding Program at City Traders Imperium: The Two-Step Challenge

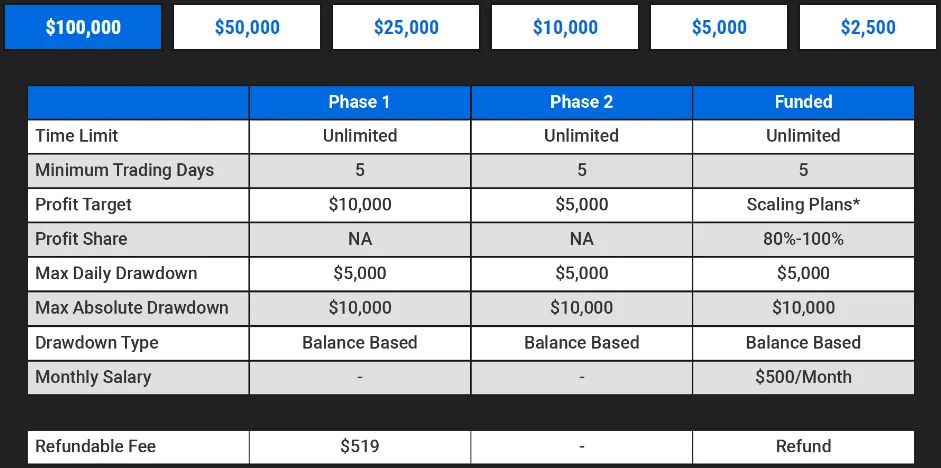

City Traders Imperium’s Day Trading Funding Program is meticulously designed to discover and reward traders who exhibit talent and consistency. This program is divided into two distinct evaluation phases, each with specific criteria and objectives.

Overview of the Two-Phase Evaluation Process

Traders in this program are offered the opportunity to trade with a leverage of 1:33. The evaluation process is segmented into two phases:

- Phase One: Here, the goal is to achieve a 10% profit target without exceeding a 5% maximum daily loss or a 10% maximum loss overall. Traders have the flexibility of no maximum trading day requirements, but must trade for a minimum of five days to progress to the next phase.

- Phase Two: In this phase, traders aim for a 5% profit target while adhering to the same loss limitations as Phase One. Similar to the first phase, there is no cap on the maximum trading days, but a minimum of five trading days is mandatory to advance to a funded account.

Funded Account Benefits and Growth Plan

Upon successful completion of both evaluation phases, traders are awarded a funded account. In this stage, there are no profit targets, but traders must continue to observe the 5% maximum daily loss and 10% maximum loss rules. The profit split begins at 80% for the first 10% earned. Under the growth plan, this can escalate to 90% for a tier 1 growth plan and even reach 100% for a tier 2 growth plan. Additionally, funded traders become eligible for monthly salary bonuses, which vary from $12.5 to $500, depending on the account size being managed.

Account Size and Pricing Structure

- $2,500 account for $39

- $5,000 account for $59

- $10,000 account for $99

- $25,000 account for $179

- $50,000 account for $329

- $100,000 account for $519

Scaling Plan for Day Trading Funding Program Accounts at City Traders Imperium

City Traders Imperium’s Day Trading Funding Program includes an ambitious scaling plan, designed to foster the growth of successful traders. This plan sets clear, achievable targets over a four-month period to qualify for account increases.

Qualifying Criteria for the Scaling Plan

To be eligible for the scaling plan, traders must meet specific criteria within a four-month timeframe:

- Achieve a profit target of at least 10%.

- Ensure profitability in at least two out of the four months.

- Process a minimum of two withdrawals.

- Maintain a positive account balance at the end of the fourth month.

Account Growth Structure

Upon meeting these criteria, traders receive a 30% increase in their original account balance. This increment follows a structured pattern over successive four-month periods:

- After 4 months: A $50,000 account increases to $65,000.

- After the next 4 months: The balance rises from $65,000 to $80,000.

- After the subsequent 4 months: It further escalates from $80,000 to $95,000.

- This pattern continues, progressively increasing the account balance following each successful four-month period.

Trading Instruments

The Day Trading Funding Program at City Traders Imperium allows trading in various instruments, including forex pairs, commodities, and indices, offering traders a diverse range of options to apply their strategies and achieve their targets.

Rules of the Day Trading Funding Program at City Traders Imperium

The Day Trading Funding Program at City Traders Imperium is governed by a set of well-defined rules that traders must adhere to. These rules are critical in maintaining the integrity of the program and ensuring fair opportunities for all participants.

Profit Targets

- Phase 1: The profit target is set at 10%.

- Phase 2: A reduced profit target of 5% is required.

- Funded Accounts: No profit targets are imposed.

Maximum Daily Loss

All account sizes are subject to a maximum daily loss limit of 5%. This is the upper threshold of loss a trader can incur in a single day without violating the account rules.

Maximum Loss

The maximum loss limit is set at 10% across all account sizes. This is the total loss a trader can accumulate before their account is considered violated.

Minimum Trading Days

Traders are required to trade for a minimum of five days in both evaluation phases before they can complete the phase or request a withdrawal.

No Weekend Holding Policy

Traders are not permitted to hold open positions over the weekend, aligning with the program’s risk management protocols.

Third-Party Copy Trading Risk

Using third-party copy trading services comes with a caveat. Traders should be aware that these services might already be utilized by other traders, potentially leading to a duplication of strategies. Exceeding the maximum capital allocation rule with such services may result in the denial of a funded account or withdrawal.

Third-Party EA (Expert Advisor) Risk

Similar risks apply to the use of third-party Expert Advisors (EAs). As with copy trading services, the use of an EA that is already in use by others could lead to strategy duplication. This, in turn, poses a risk of violating the maximum capital allocation rule, which could impact the trader’s eligibility for a funded account or withdrawal.

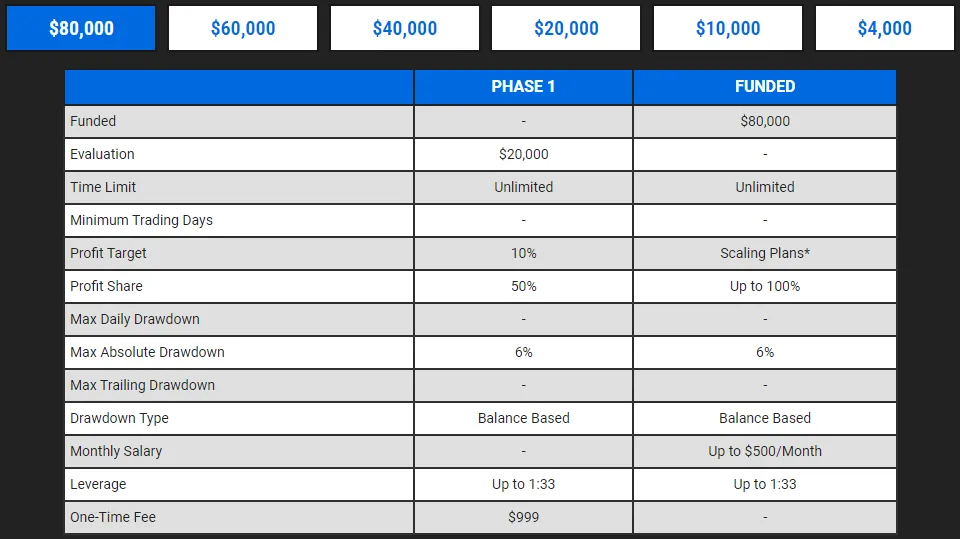

Instant Funding Program Accounts at City Traders Imperium: The One-Step Challenge

City Traders Imperium’s Instant Funding Program is designed as a one-step challenge, offering traders an unrestricted time frame to meet the evaluation requirements with a 1:33 leverage.

Account Size and Pricing

- $4,000 account for $59

- $10,000 account for $149

- $20,000 account for $299

- $40,000 account for $499

- $60,000 account for $749

- $80,000 account for $999

Evaluation Phase Requirements

In the evaluation phase, traders are tasked with achieving a 10% profit target while adhering to a 6% maximum loss rule. There is no time limitation imposed, allowing traders the flexibility to reach this target at their own pace. A key requirement during this phase is the mandatory setting of stop-loss orders on every position opened.

Funded Account Advantages

Upon successful completion of the evaluation phase, traders are granted a funded account. In this stage, there are no profit targets, but traders must continue to observe the 6% maximum loss rule and set stop-loss orders for all positions. The funded account offers the advantage of weekly payout requests, which do not impact account growth or require compensation for paid-out profits.

Profit Split Structure

Traders in the funded account stage are eligible for profit splits ranging from 50% to 100%, based on the profits made. This incentivizes traders to maximize their performance while managing risk effectively.

Scaling Plan for Instant Funding Program Accounts at City Traders Imperium

The Instant Funding Program at City Traders Imperium features a progressive scaling plan, offering traders the opportunity to significantly increase their account size based on their performance.

Scaling Plan Structure

The scaling plan is structured across various phases, with each phase representing a significant increase in account size upon achieving the set profit target. The plan varies depending on the initial account size chosen by the trader:

- Starting with a $1,000 account, the scaling can reach up to $2,000,000 across ten phases.

- A $2,500 account scales up to $2,000,000 in nine phases.

- Beginning with $5,000, the account can grow up to $2,000,000 in eight phases.

- For a $10,000 starting account, the scaling spans seven phases, culminating in $2,000,000.

- Starting at $15,000, the account can scale up to $2,000,000 in six phases.

- A $20,000 account scales to $2,000,000 over five phases.

Eligibility and Profit Target

To be eligible for scaling, traders must achieve a profit target of 10%. Remarkably, withdrawals do not impede the account’s ability to scale. Once the total profits hit the 10% target, the account becomes eligible for scaling.

Scaling Example

For instance, if a trader gains 4.2% in the first week and withdraws the profits, then gains another 5.8% in the second week and withdraws again, the total profits have reached 10%. This makes the trader eligible for an account scale-up, as they have met the 10% profit target.

Trading Instruments

The Instant Funding Program account offers trading in forex pairs, commodities, and indices, providing traders with a diverse range of options to reach their scaling targets.

Rules for the Instant Funding Program Account at City Traders Imperium

The Instant Funding Program at City Traders Imperium, known for its One-step Challenge, is governed by a specific set of rules to ensure fairness and manage risk effectively.

Profit Target

The evaluation phase profit target is set at 10%. Traders must achieve this specific percentage of profit before they can complete the evaluation phase, withdraw profits, or qualify for account scaling.

Maximum Loss Limit

All account sizes have a maximum loss threshold of 6%. This is the cumulative loss limit a trader can incur before their account is considered violated.

Mandatory Stop-Loss Requirement

Traders are required to set a stop-loss on every trading position. This rule is crucial for managing risk and safeguarding the trader’s and the firm’s capital.

Third-Party Copy Trading Risk

Using third-party copy trading services comes with inherent risks. Traders should be aware that if the service is already being used by others, it could lead to identical trading strategies. This might result in a breach of the maximum capital allocation rule, potentially leading to a denial of a funded account or withdrawal.

Third-Party EA (Expert Advisor) Risk

Similarly, the use of third-party Expert Advisors (EAs) carries risks. If an EA is already in use by other traders, it could lead to duplication of strategies. This poses a risk of exceeding the maximum capital allocation rule, which might impact the trader’s eligibility for a funded account or withdrawal.

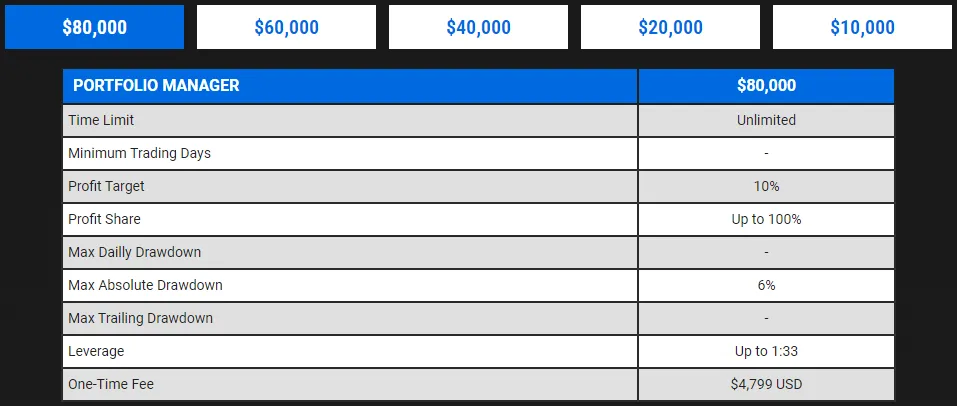

Direct Funding Program Accounts at City Traders Imperium

City Traders Imperium offers a Direct Funding Program that provides traders with an immediate opportunity to earn, bypassing the conventional evaluation process.

Account Size and Pricing

- $10,000 account for $599

- $20,000 account for $1,199

- $40,000 account for $2,399

- $60,000 account for $3,599

- $80,000 account for $4,799

Key Features of the Direct Funding Program

This program is unique in that it allows traders to start trading and earning immediately with a 1:33 leverage. Key aspects of this program include:

- Profit Splits: Traders are entitled to a profit split ranging from 60% to 100%, depending on the profits generated.

- No Time Limitations: There are no minimum or maximum time constraints imposed on trading activities.

The Direct Funding Program is ideally suited for experienced traders who are confident in their trading strategies and seek immediate access to significant capital.

Scaling Plan for Direct Funding Program Accounts at City Traders Imperium

The Direct Funding Program at City Traders Imperium offers a comprehensive scaling plan, enabling traders to significantly increase their account sizes based on their performance.

Scaling Plan Structure

The scaling plan encompasses various phases, each representing a substantial increase in account size upon achieving the set profit target. The plan varies depending on the initial account size selected:

- Starting with a $1,000 account, the scaling can extend up to $2,000,000 across ten phases.

- A $2,500 account scales up to $2,000,000 in nine phases.

- Beginning with $5,000, the account can grow up to $2,000,000 in eight phases.

- For a $10,000 starting account, the scaling spans seven phases, culminating in $2,000,000.

- Starting at $15,000, the account can scale up to $2,000,000 in six phases.

- A $20,000 account scales to $2,000,000 over five phases.

Eligibility for Scaling

To qualify for scaling, traders need to achieve a profit target of 10%. Notably, weekly withdrawals do not hinder the account’s ability to scale. Once total profits hit the 10% target, the account is eligible for scaling.

Scaling Example

For instance, if a trader makes a 4.2% profit in the first week and withdraws it, and then makes a 5.8% profit in the second week and withdraws again, their total profits amount to 10%. This achievement makes the trader eligible for an account scale-up, having met the 10% profit target.

Trading Instruments

The Direct Funding Program account permits trading in forex pairs, commodities, and indices, providing a wide array of choices for traders to reach their scaling targets.

Rules for the Direct Funding Program Account at City Traders Imperium

The Direct Funding Program at City Traders Imperium, designed for immediate trading access, follows a set of rules essential for risk management and maintaining the integrity of the program.

Maximum Loss Limit

All account sizes in the Direct Funding Program have a set maximum loss limit of 6%. This is the cumulative loss a trader can incur before their account is considered violated.

Mandatory Stop-Loss Requirement

Traders are required to set a stop-loss on every trading position. This rule plays a crucial role in risk management and protecting the capital of both the trader and the firm.

Third-Party Copy Trading Risks

When using third-party copy trading services, traders should be aware of the potential risks. If the service is being used by other traders, it could result in identical trading strategies. This might lead to a breach of the maximum capital allocation rule, possibly resulting in a denial of a funded account or withdrawal.

Third-Party EA (Expert Advisor) Risks

Similar risks are associated with the use of third-party Expert Advisors (EAs). If an EA is already being used by other traders, it could lead to strategy duplication. This poses a risk of exceeding the maximum capital allocation rule, which might impact the trader’s eligibility for a funded account or withdrawal.

What Sets City Traders Imperium Apart from Other Proprietary Trading Firms

City Traders Imperium (CTI) distinguishes itself in the proprietary trading industry with its unique approach and diverse offerings that cater to a wide range of traders.

Diverse Funding Programs

CTI stands out with its three distinct funding programs: Day Trading, Instant Funding (One-Step), and Direct Funding programs. This variety ensures that traders of different experience levels and strategies can find a program that best suits their needs.

Flexible Trading Style

Another significant aspect where CTI differs is in the flexibility it offers regarding trading styles. Unlike many other firms, CTI imposes almost no restrictions on trading approaches. Traders are allowed to engage in news trading, hold trades overnight, and over weekends (with the exception of the Day Trading Program).

Day Trading Program: A Two-Phase Evaluation

The Day Trading Program at CTI is a two-phase evaluation process, designed to assess and prepare traders for real-world trading scenarios. This program has a profit target of 10% in phase one and 5% in phase two, coupled with a 5% maximum daily and 10% maximum loss rules. Traders are required to trade for a minimum of five days in each phase to become eligible for weekly payouts. Compared to other leading prop firms, CTI offers average profit targets with the advantage of an unlimited trading period in each evaluation phase.

Scaling Plan in Day Trading Program

CTI’s Day Trading Program includes a scaling plan, providing a clear pathway for traders to increase their account sizes based on their performance. This aspect of the program aligns well with traders aiming for long-term growth and progression. In summary, City Traders Imperium’s unique combination of diverse funding programs, flexible trading style allowances, and structured evaluation processes places it as a distinct and appealing option among proprietary trading firms.

Comparing City Traders Imperium and Funding Pips: A Detailed Overview

When considering City Traders Imperium (CTI) and Funding Pips, it’s insightful to directly compare their trading objectives and terms to understand their distinct offerings.

Trading Objectives Comparison

| Trading Objectives | CTI | Funding Pips |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 100% + Monthly Salary | 80% up to 90% |

This comparison reveals that while both CTI and Funding Pips offer similar frameworks in terms of maximum daily and total loss limits, and unlimited maximum trading periods, there are notable differences in their profit targets, minimum trading days, and profit splits. CTI’s unique offering of a higher profit split potential plus a monthly salary gives it an edge for traders looking for more lucrative opportunities.

Comparative Analysis: City Traders Imperium vs FundedNext

When comparing City Traders Imperium (CTI) and FundedNext, particularly in the context of their evaluation programs, several key aspects highlight the differences and similarities between these two prominent prop firms.

Trading Objectives Comparison

| Trading Objectives | CTI | FundedNext (Evaluation) |

|---|---|---|

| Phase 1 Profit Target | 10% | 10% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 5 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: 30 Calendar Days Phase 2: 60 Calendar Days |

| Profit Split | 80% up to 100% + Monthly Salary | 80% up to 90% |

This side-by-side comparison shows that CTI and FundedNext share similarities in profit targets, loss limits, and minimum trading days. However, a significant difference lies in the maximum trading period, with CTI offering an unlimited period for both phases of evaluation, whereas FundedNext has a defined time limit for each phase. Additionally, CTI’s profit split structure, which ranges up to 100% with a monthly salary, is more generous compared to FundedNext’s 80% to 90% range.

Comparative Analysis: City Traders Imperium vs E8 Funding

In the world of proprietary trading, understanding the nuances of different firms’ offerings is crucial. A comparison between City Traders Imperium (CTI) and E8 Funding highlights these distinctions.

Trading Objectives Comparison

| Trading Objectives | CTI | E8 Funding (Normal) |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 8% (Scaleable up to 14%) |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 100% + Monthly Salary | 80% |

This comparison shows that CTI and E8 Funding have different approaches in certain areas. CTI’s Phase 1 profit target is higher, and its maximum loss is fixed, unlike E8 Funding’s scalable loss limit. CTI also imposes a minimum trading day requirement, which E8 Funding does not. The profit split at CTI is potentially more lucrative, offering up to 100% plus a monthly salary, compared to E8 Funding’s flat 80%.

CTI’s Unique Funding Programs

CTI’s distinction lies in its three diverse funding programs: the Day Trading, Instant Funding, and Direct Funding programs. Each program is structured to cater to different trading styles and experience levels:

- Instant Funding Program: Features various account sizes, a one-phase evaluation with a 10% profit target, a 6% maximum loss, and a mandatory stop-loss rule. There are no minimum or maximum trading day requirements, and a scaling plan is included.

- Direct Funding Program: Allows traders to start earning from day one with weekly payouts. The key focus is on the 6% maximum loss limit and mandatory stop-loss rule. This program also includes a scaling plan and does not impose any trading day limits.

In summary, CTI’s unique offering of three distinct funding programs, along with its flexible trading rules, including the allowance for trading during news and holding trades overnight and on weekends (with some exceptions), sets it apart from other industry-leading prop firms.

Assessing the Realism of Acquiring Capital from City Traders Imperium

When considering the feasibility of obtaining funding from a proprietary trading firm, it’s crucial to evaluate the realism of the trading requirements. City Traders Imperium (CTI) offers various programs with conditions that cater to different trading styles and objectives.

Day Trading Program: Achievable Targets

The Day Trading Program at CTI is set with realistic profit targets of 10% in phase one and 5% in phase two, coupled with reasonable loss limits (5% maximum daily and 10% maximum loss). These targets are aligned with average trading expectations, making it a practical option for traders to receive capital.

Instant Funding Program: One-Step Evaluation

The Instant Funding Program simplifies the process with a one-step evaluation. Traders are required to achieve a 10% profit target, with no time limit imposed. This straightforward and flexible approach makes receiving capital a realistic goal for diligent traders.

Direct Funding Program: Immediate Earning Potential

CTI’s Direct Funding Program is particularly appealing as it allows traders to bypass evaluation phases entirely. Traders can start earning from day one, with no set profit targets and the ability to request weekly withdrawals. This immediate earning potential enhances the program’s practicality.

Conclusion: CTI as a Feasible Option for Traders

Considering the above factors, CTI emerges as a viable option for traders looking for realistic funding opportunities. With its three diverse funding programs, CTI accommodates various trading styles and objectives, offering realistic conditions for receiving payouts on a weekly basis.

Understanding Withdrawal and Payment Proof at City Traders Imperium

For traders considering City Traders Imperium (CTI) for their trading journey, understanding the withdrawal process and the availability of payment proof is crucial.

Withdrawal Process at CTI

Since its incorporation on July 13th, 2018, CTI has offered traders the flexibility to request withdrawals on a weekly basis across all its funding programs. After a withdrawal request is made, traders should allow up to seven days to receive their payment. Traders are presented with three options:

- Withdraw the total amount.

- Withdraw a partial amount.

- Retain the funds in the account as a buffer against drawdowns.

Refund and Withdrawal Methods

Initially, withdrawals are refunded to the source of payment (like a debit/credit card). Once the withdrawal amount surpasses the original payment amount, traders can choose from several withdrawal methods, including:

- PayPal

- Transferwise

- Revolut

- Crypto

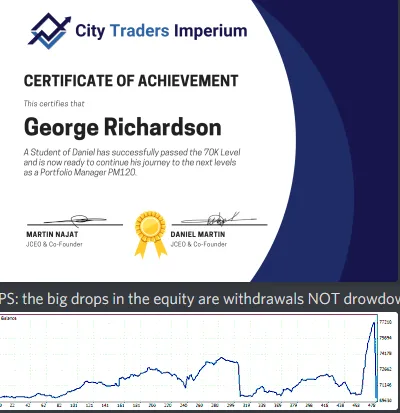

Payment Proof from CTI

CTI provides transparency and builds trust by sharing payment proofs. These can be found in various forms:

- YouTube Channel: Interviews with funded traders are available on CTI’s YouTube channel, offering insights and validations of successful withdrawals.

- Discord Channel: On their Discord channel, under the ‘payout-proof’ section, CTI showcases certificates awarded to individuals who have successfully completed the Evaluation or Portfolio Manager processes.

This comprehensive withdrawal system and the availability of payment proof substantiate CTI’s commitment to transparency and trader support, making it a reliable choice for proprietary trading.

Brokerage and Trading Platforms at City Traders Imperium

Understanding the brokerage services and trading platforms is a vital aspect of evaluating a proprietary trading firm like City Traders Imperium (CTI).

Liquidity Provider and Trading Conditions

CTI distinguishes itself by not utilizing traditional brokers. Instead, they are partnered with a tier-1 liquidity provider, offering traders the best simulated real market trading conditions. This partnership ensures that traders have access to:

- Extremely low spreads, averaging about 0-0.2 on major currency pairs and slightly higher on minor pairs.

- A fixed fee of $9 per lot per trade (comprising $4.50 for opening and $4.50 for closing a trade), making the overall trading cost approximately one pip.

- Excellent execution speed, enhancing the trading experience.

Trading Platform

CTI provides its traders the opportunity to trade on the MetaTrader 5 platform. MT5 is renowned for its advanced trading features, user-friendly interface, and versatility, accommodating various trading strategies and styles. This combination of a tier-1 liquidity provider and the use of MetaTrader 5 positions City Traders Imperium as a competitive choice for traders seeking low-cost trading with efficient and reliable execution.

Trading Instruments Offered by City Traders Imperium

City Traders Imperium (CTI) provides a range of trading instruments suitable for different account types, catering to the diverse preferences of traders.

Trading Instruments for Evaluation Processes

During the Evaluation process, traders have access to the following instruments:

- Forex Pairs: A wide variety of major and minor currency pairs including EURUSD, GBPUSD, NZDUSD, AUDUSD, USDCHF, USDCAD, USDJPY, EURGBP, EURNZD, EURAUD, EURCHF, EURCAD, EURJPY, GBPNZD, GBPAUD, GBPCHF, GBPCAD, GBPJPY, NZDAUD, NZDCHF, NZDCAD, NZDJPY, AUDCHF, AUDCAD, AUDJPY, CADCHF, CADJPY, and CHFJPY.

- Metals: XAUUSD (Gold).

Trading Instruments for Portfolio Manager Accounts

For Portfolio Manager accounts, CTI expands the range of instruments to include:

- Forex Pairs: All the forex pairs available in the Evaluation process.

- Metals: XAUUSD (Gold).

- Indices: Major global indices like S&P500, US30, USTEC, DE30, and UK100.

This selection of Forex pairs, Gold, and Indices ensures that traders can diversify their strategies and find opportunities across various market conditions and asset classes.

Trading Fees at City Traders Imperium

Understanding the trading fee structure is crucial for traders considering City Traders Imperium (CTI) for their trading needs. CTI’s fee structure includes trading commissions and spreads.

Trading Commission Structure

CTI’s trading commission is straightforward and consistent across different asset classes:

- Forex: $4.5 USD per lot

- Commodities: $4.5 USD per lot

- Indices: $4.5 USD per lot

Spread Information

To get an accurate understanding of the live spreads offered by CTI, traders can log in to a demo trading account with the following details:

- Platform: MetaTrader 5

- Server: CBT Limited

- Login Number: 3220

- Password: test3220

- Download Platform: [Click here link]

This access allows traders to experience the real-time trading environment and spreads on CTI’s platform, enabling them to make informed decisions based on their trading strategies and preferences.

Education and Support for Traders at City Traders Imperium

City Traders Imperium (CTI) not only offers trading opportunities but also focuses on the education and support of its traders, ensuring they have the resources needed to succeed in the forex market.

Educational Resources

CTI provides a wealth of educational content accessible through their website. This includes:

- Forex Education: A comprehensive collection of educational materials designed to enhance traders’ knowledge and skills in forex trading. Interested individuals can access these resources [by clicking here link].

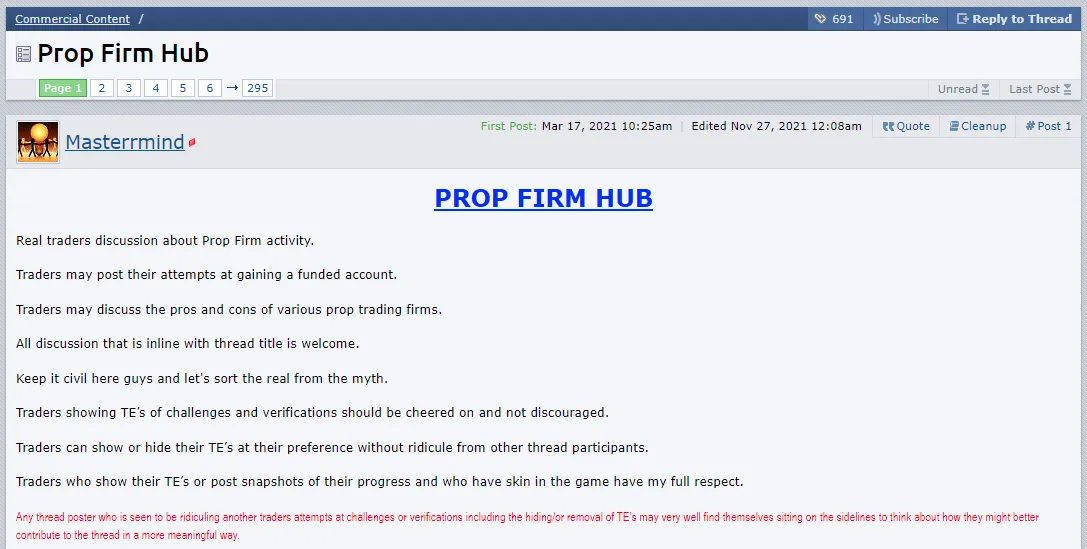

Community Engagement and Discussions

Although CTI does not have a dedicated thread on ForexFactory, the firm is actively discussed within the trading community. Notable mentions include:

- ForexFactory Thread: CTI has been mentioned in the ‘PROP FIRM HUB’ thread, created by a user named Masterrmind. This thread provides insights and discussions about various proprietary trading firms, including CTI. To view this thread, [click here link].

These educational and community engagement resources underscore CTI’s commitment to supporting their traders’ growth and success in the dynamic world of forex trading.

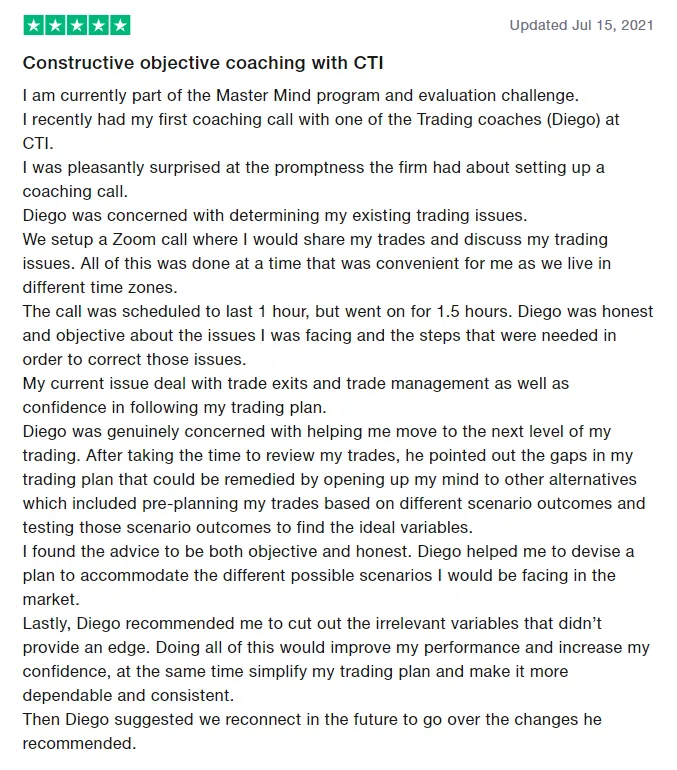

Trader Feedback and Reputation of City Traders Imperium

Traders’ experiences and feedback are crucial indicators of a proprietary trading firm’s reliability and effectiveness. City Traders Imperium (CTI) has garnered significant positive feedback from its community, as evidenced by reviews on various platforms.

Trustpilot Reviews

CTI stands out with its high rating on Trustpilot, reflecting the satisfaction of its traders:

- Rating: An impressive score of 4.8 out of 5, based on 935 reviews, indicating high levels of trader satisfaction.

- Community Engagement: CTI actively engages with their community by responding to every review on Trustpilot, a practice that is not common among most proprietary trading firms. This includes both positive and negative reviews, demonstrating their commitment to transparency and customer service.

Support and Education

CTI is also commended for its robust support system and educational resources, which are highly valued by its traders:

- Support System: CTI provides reliable support, readily offering necessary information and assistance to their traders.

- Educational Resources: The firm is known for its comprehensive educational content and precise trading rules and guidelines. These resources aid traders in better adapting and improving their risk management strategies.

Overall, the positive feedback and high ratings on platforms like Trustpilot, combined with their responsive customer service and educational support, position City Traders Imperium as a well-regarded entity in the proprietary trading firm community.

Social Media Presence of City Traders Imperium

City Traders Imperium (CTI) maintains a robust presence across various social media platforms, offering additional channels for engagement, learning, and community interaction.

Social Media Statistics

- Twitter: CTI’s Twitter account has 965 followers, showcasing their updates and insights into the forex market.

- Facebook: Their Facebook page has garnered a following of 1.8k users, providing a platform for news, educational content, and community engagement.

- YouTube: The CTI YouTube channel, with 4.88k subscribers and 190 uploaded videos, serves as a valuable resource for educational content, trader interviews, and insights into the firm’s operations.

- Instagram: With 15.5k followers, their Instagram profile offers a mix of motivational content, trading tips, and updates on CTI’s activities.

Discord Community

Beyond these platforms, CTI also hosts a Discord channel with 7,924 members. This channel offers a dynamic space for traders to:

- Stay updated with CTI announcements.

- Seek support and assistance in their dedicated support channel.

- Engage with the trading community, sharing and discussing trading strategies.

CTI’s active social media presence and Discord community provide an extensive network for traders to connect, learn, and grow within the CTI ecosystem.

Support Services at City Traders Imperium

City Traders Imperium (CTI) offers a comprehensive support system to assist traders with their inquiries and issues, ensuring a smooth trading experience.

FAQ Page

CTI provides a dedicated FAQ page, which can be a quick and efficient resource for finding answers to common questions. This page covers a range of topics relevant to traders’ needs.

Contact and Social Media Support

For more personalized assistance, traders can reach out to the support team through various channels:

- Email Support: Direct contact is available via email at [email protected], offering detailed and specific responses to trader inquiries.

- Social Media: CTI’s support team is also accessible through their active social media accounts, providing another avenue for engagement and support.

Live Chat Support

CTI features a live chat support option on their website. This service allows traders to send messages and receive timely responses via email, adding another layer of convenience to their support system.

Discord Channel Support

For real-time assistance, traders can utilize the Support channel on CTI’s Discord server. This platform is particularly useful for addressing support or technical issues and engaging with the community for shared solutions. Overall, CTI’s multi-channel support approach, encompassing an FAQ page, email, social media, live chat, and Discord channel, underscores their commitment to providing comprehensive and accessible support to their traders.

Conclusion: Evaluating City Traders Imperium as a Proprietary Trading Firm

City Traders Imperium (CTI) establishes itself as a reputable and versatile proprietary trading firm, offering distinct funding programs and realistic trading objectives for a diverse range of traders.

Diverse Funding Programs

CTI’s three primary funding programs cater to different trader needs and preferences:

- Day Trading Program: This two-phase evaluation challenge aligns with industry standards, requiring traders to complete both phases to access funding and weekly profit splits. With profit targets of 10% and 5% in the respective phases and manageable loss rules (5% maximum daily and 10% maximum loss), the program is designed with achievable goals. Additionally, it offers up to 100% profit splits and account scaling opportunities.

- Instant Funding Program: This program allows traders to select from various account sizes and requires a one-step evaluation with a 10% profit target over an unlimited time frame. Offering an initial 50% profit split, which can increase to 100%, this program is attractive for its scaling potential.

- Direct Funding Program: Ideal for those looking to bypass the evaluation phase, this program offers immediate access to a funded account with weekly profit splits. It necessitates adherence to maximum loss limits and stop-loss rules but provides significant earning and scaling potential, with profit splits ranging from 60% to 100%.

CTI’s Position in the Industry

CTI stands out as a well-established firm offering excellent conditions suitable for a broad spectrum of trading styles. Their straightforward trading rules, coupled with a strong focus on trader education and support, make them an attractive choice for both novice and experienced traders. In summary, CTI’s comprehensive approach to proprietary trading, with its varied funding options, realistic trading objectives, and strong trader support system, solidifies its position as one of the industry-leading proprietary trading firms. It comes highly recommended for anyone seeking a reliable and accommodating trading environment.