Dive into our in-depth review of OneUp Trader, where we uncover the dynamics of their funded trading accounts, evaluation process, and unique benefits for ambitious traders.

Dive into our in-depth review of OneUp Trader, where we uncover the dynamics of their funded trading accounts, evaluation process, and unique benefits for ambitious traders.

- Wide Range of Account Sizes.

- Up to 90% Profit Split.

- Transparent Fee Structure.

- Structured Evaluation for Traders.

- Same-Day Withdrawal Processing.

- Only Futures Contracts Trading.

- $1,000 Minimum Withdrawal Limit.

- No Bots or Algorithmic Trading.

- Limited Information on Ownership.

- Bank Wire Only for Withdrawals.

OneUp Trader 2023 Comprehensive Review

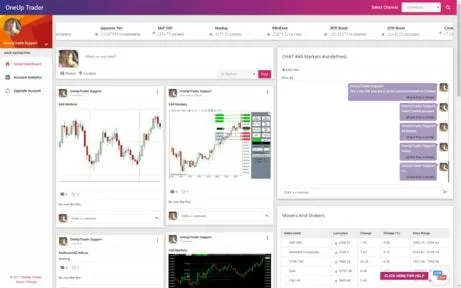

OneUp Trader, a renowned prop trading firm, provides funded trading accounts ranging from $25,000 to $250,000 against a monthly subscription fee. This article delves into the workings of OneUp Trader’s funded accounts, highlighting key features, eligibility criteria, and weighing the pros and cons compared to other trading platforms.

About OneUp Trader

The OneUp Trader, a prop firm based in Philadelphia, USA, offers funded accounts to those who meet specific eligibility requirements. This unique opportunity allows traders to operate with the firm’s capital, eliminating any personal financial risk. OneUp Trader’s core mission is to empower motivated individuals to achieve the status of fully funded traders. The firm prides itself on its transparent, community-focused, and simple approach, fostering an environment conducive to creating a successful funded trading profile.

Understanding the Operations of OneUp Trader

OneUp Trader simplifies its offerings into a singular, streamlined product: funded trading accounts available for a monthly fee. Here’s how you can embark on your trading journey with this London-based company:

Step 1: Selecting Your Account

The funded programme provides account sizes ranging from $25,000 to $250,000, accompanied by either a 90% or 50% profit split option. Each account type is subject to a monthly subscription fee, and comes with specific targets, daily loss limits, and trailing drawdowns. Here are the details for each account size:

- $25,000 Account: Choose between a $125/month fee for a 90% profit split or $105/month for a 50% split. This account allows up to 3 contracts, includes a $100 balance reset, a $1,500 profit target, a $500 daily loss limit, and a $1,500 trailing drawdown. The first $10,000 profit is yours at 100%.

- $50,000 Account: Options include a $150/month fee for a 90% split or $120/month for a 50% split. This account permits up to 6 contracts, comes with a $100 balance reset, a $3,000 profit target, a $1,250 daily loss limit, and a $2,500 trailing drawdown. The first $10,000 profit is entirely yours.

- Larger Accounts: Accounts at $100,000, $150,000, and $250,000 also offer similar structures, with varying limits on contracts, balance resets, profit targets, daily loss limits, and trailing drawdowns. The first $10,000 in profit is always at a 100% split.

Step 2: The Evaluation Process

Prior to accessing the capital from OneUp Trader, you’ll need to pass a minimum 15-day online evaluation, which excludes weekends and holidays. This assessment phase is crucial for demonstrating your trading skills. While target values and trailing drawdown balances differ across account sizes, some universal rules apply:

- Trade only during allowed hours.

- Adhere to Dynamic Scaling Targets.

- Avoid exceeding the trailing drawdown limit.

- Meet consistency requirements (aggregate of three days’ profits should be at least 80% of your best day).

- Close all positions around major economic releases as per the firm’s guidelines.

Successful completion of the evaluation leads to a questionnaire and a contract agreement before funding is granted. Note, multiple accounts can be opened for evaluation, but only one funded account will be provided.

Step 3: Platform Selection

After passing the evaluation, your account approval and setup will take a few days. OneUp Trader offers several platform options like NinjaTrader, Sierra Chart, QuanTower, R Trader, and R Trader Pro. Free market data is accessible during evaluation via Rithmic. Platform access is available either through a monthly fee or, in some cases, free with certain conditions like account opening minimums. Remember, all platform-related fees are the funded trader’s responsibility.

Step 4: Activation and Maintenance of Funded Account

Upon completing the above steps, you’ll receive credentials for your funded account. However, maintaining this account requires adherence to certain standards. This includes a minimum weekly trading volume, at least 50% of the average during the evaluation. Additionally, a 90-day probationary period mandates your account to be positive every 15 days.

Additional Details on OneUp Trader’s Operations

OneUp Trader implements several measures to guide traders towards successful futures trading. Understanding these additional details is crucial for anyone considering their funded accounts:

Protective Measures in the Evaluation Phase

The London-based company has designed its evaluation process to ensure only those ready for a funded account succeed. The scaling plan structure prevents over-trading by limiting the number of lots, safeguarding you from failing due to over-leverage. Additionally, the probationary period focuses on nurturing investor skills. If your performance doesn’t meet the profit targets within 30 days, you’ll be notified, allowing you time to adjust your strategies.

Restrictions on Trading Methods

It’s important to note that OneUp Trader does not permit the use of bots or algorithmic trading systems for its funded accounts. Strategies that rely heavily on automation, like arbitrage trading, might not showcase your trading prowess effectively. The firm emphasizes the importance of consistency, suggesting that traders stick to strategies that have historically been profitable for them.

Focusing on Futures Contracts

The prop firm specializes in futures contracts, covering a range that includes metal futures (like gold and platinum), e-mini futures, and forex futures, depending on the capabilities of your chosen trading platform. When selecting a platform, consider aspects such as subscription fees, minimum deposit requirements, peer-to-peer trading options, and the availability of customer support through phone or email.

Company Transparency

OneUp Trader maintains a private stance regarding its ownership and foundational details. The absence of such information might raise questions for some traders. While regulation is not mandatory for the firm, transparency in publishing details about company and trader successes, along with security liabilities, could enhance trust and credibility among its users.

Understanding Fees with OneUp Trader

OneUp Trader’s fee structure is straightforward, focusing mainly on monthly subscription and commission fees for your funded account. Let’s delve into the specifics:

Subscription and Commission Fees

The monthly subscription fee varies depending on your chosen account size and the profit split option. Alongside this, total commissions are also applicable and are influenced by factors like your trading volume, profits, and the account size. Notably, OneUp Trader steers clear of hidden charges, maintaining transparency in its fee structure.

Commission Rates for Specific Assets

For detailed commission rates per side or round trip (R/T) on different assets, OneUp Trader’s website is the go-to resource. As an example, during our review, the fee for trading the e-mini S&P 500 was set at $2.04 per side, and all currency futures were charged at a commission of $2.06.

Withdrawal Policy and Procedures

One particularly favorable aspect is the absence of withdrawal fees. However, there is a minimum withdrawal limit set at $1,000. To initiate a profit withdrawal, users must send an email to the company, specifying the desired amount. If the withdrawal threshold is met, processing happens on the same day. It’s important to note that withdrawals are exclusively handled via bank wire transfer.