Searching for a reliable and industry-leading proprietary trading firm? Dive into The Funded Trader’s offerings, where realistic profit targets and transparent rules create a path to success for traders of all backgrounds.

Searching for a reliable and industry-leading proprietary trading firm? Dive into The Funded Trader’s offerings, where realistic profit targets and transparent rules create a path to success for traders of all backgrounds.

- Multiple Funding Programs: Choose from Standard, Rapid, Royal, and Knight challenge accounts to suit your trading style.

- Realistic Profit Targets: The Funded Trader sets achievable profit goals in both evaluation phases.

- Clear Trading Rules: Transparent maximum daily and loss limits provide a structured trading environment.

- High Profit Splits: Earn up to 90% profit splits, allowing for substantial income potential.

- Community Support: Join their community on Discord and receive assistance from both the support team and fellow traders.

- Scalability: The opportunity to scale your trading accounts as you achieve success.

The Funded Trader Review

The Funded Trader is on a mission to identify and nurture skilled traders, offering them a unique opportunity to thrive in fluctuating market environments. This London-based company empowers traders to maximize their earning potential, managing accounts as large as $1,500,000 and benefiting from impressive profit splits of up to 90%. Participants in the funded programme have the flexibility to trade across various markets, including forex pairs, commodities, indices, and cryptocurrencies, paving the way for high profitability.

Who are The Funded Trader?

The Funded Trader, established on May 12, 2021, is a well-regarded proprietary trading firm. With its headquarters located at 14001 W HWY 29, Suite 102, Liberty Hill, TX 78642, the company has established a significant presence in the United States. This prop firm is known for offering its traders the opportunity to handle substantial capital, reaching up to $1,500,000, along with lucrative profit splits that can soar up to 90%. In its pursuit of excellence, the firm collaborates with notable brokers such as Eightcap, ThinkMarkets, and Purple Trading Seychelles, ensuring a robust and versatile trading environment for its participants.

Angelo Ciaramello: The Driving Force Behind The Funded Trader

At the young age of 24, New Jersey native Angelo Ciaramello has emerged as a notable entrepreneur with the inception of The Funded Trader in 2020. This innovative venture began as a startup, revolutionizing the capital markets retail trading sector by introducing a competitive and engaging model.

The Vision and Achievements of Angelo Ciaramello

Under Angelo’s guidance, The Funded Trader transformed the trading landscape by introducing funding challenges. These challenges are unique opportunities for individual traders to not only manage the company’s capital but also to earn a share of the profits. Angelo’s vision was to create a platform where traders could rise through the ranks and achieve the top positions on a leaderboard, fostering a competitive yet rewarding environment. One of Angelo’s remarkable milestones was being acclaimed as one of the top 25 Financial Technology Leaders in New Jersey in 2022, a testament to his leadership and innovation in the financial technology realm.

Connect with Angelo Ciaramello

For those interested in staying updated with Angelo Ciaramello’s latest endeavors, following him on Instagram and LinkedIn is a great way to get insights into his daily activities and professional updates. This connection offers a closer look at the ongoing developments and personal achievements of this young entrepreneur.

Funding Program Varieties

The Funded Trader, a notable prop trading firm, provides its clients with a diverse range of trading programs, catering to various trading styles and preferences. These include:

- Standard Challenge Accounts

- Standard Regular Challenge Accounts

- Standard Swing Challenge Accounts

- Rapid Challenge Accounts

- Rapid Regular Challenge Accounts

- Rapid Swing Challenge Accounts

- Royal Challenge Accounts

- Knight Challenge Accounts

Standard Challenge Accounts at The Funded Trader

The Funded Trader offers a comprehensive Standard Challenge Account program, designed to identify and reward proficient traders. The pricing and account sizes are as follows:

- $5,000 account for $65

- $10,000 account for $129

- $25,000 account for $199

- $50,000 account for $299

- $100,000 account for $499

- $200,000 account for $939

- $300,000 account for $1,409

- $400,000 account for $1,879

This account type involves a two-phase evaluation process. In the regular evaluation program, traders can leverage up to 1:200 during evaluation stages and 1:100 post-funding. The swing evaluation variant offers 1:60 leverage during evaluation and 1:30 when funded, with the added flexibility of holding trades over weekends. Phase one of the evaluation necessitates reaching a 10% profit target without exceeding a 5% maximum daily loss or a 10% maximum total loss. There’s no maximum trading day requirement, but a minimum of three trading days is mandatory to progress to phase two. During phase two, the objective is a 5% profit target, adhering to the same loss limits as phase one. Again, while there’s no maximum trading day limit, a minimum of three trading days is essential for transitioning to a funded account. Once both phases are successfully completed, traders are granted a funded account with no profit targets. The only requirements are to observe the 5% maximum daily loss, 10% maximum total loss, and lot size limits. The initial payout occurs 21 calendar days after the first position on the funded account, with subsequent bi-weekly payouts. Profit shares range from 80% to 90%, depending on the account’s performance.

Add-On Options for Standard Challenge Accounts

The Funded Trader’s Standard Challenge Accounts come with a range of add-on options, enhancing the trading experience:

- Additional Drawdown

- EA’s Enabled

- Standard Challenge Account Scaling Plan

The scaling plan is a key feature of these accounts. To qualify for an account increase, traders must achieve a minimum 6% profit in a three-month period, ensuring profitability in at least two of those months. The account balance then increases by 25% from its original value. For example, an initial $200,000 account, after a successful three-month period, escalates to $250,000. In the subsequent periods, the balance grows progressively: $250,000 to $300,000, then $300,000 to $350,000, and so on. Traders using Standard Challenge Accounts have access to a diverse range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Standard Challenge Account Rules

The Funded Trader’s Standard Challenge Accounts are governed by specific rules to ensure fair and disciplined trading:

- Profit Target: In phase 1, traders need to achieve a 10% profit target, and in phase 2, the target is 5%. Funded accounts are not subject to profit targets.

- Maximum Daily Loss: Set at 5% for all account sizes, this is the highest loss permissible in a single day before the account faces violation.

- Maximum Loss: The overall loss limit is capped at 10% for all account sizes, beyond which the account is considered violated.

- Minimum Trading Days: A minimum of three trading days is required to complete an evaluation phase or to request a withdrawal. Funded accounts do not have a minimum trading day requirement for payouts.

- No Martingale: Martingale strategies are prohibited in trading activities.

- Third-Party Copy Trading Risk: Using third-party copy trading services carries the risk of exceeding maximum capital allocation rules, potentially leading to denial of a funded account or withdrawal.

- No EAs Allowed: The use of any EA services, except for copying purposes, is not permitted.

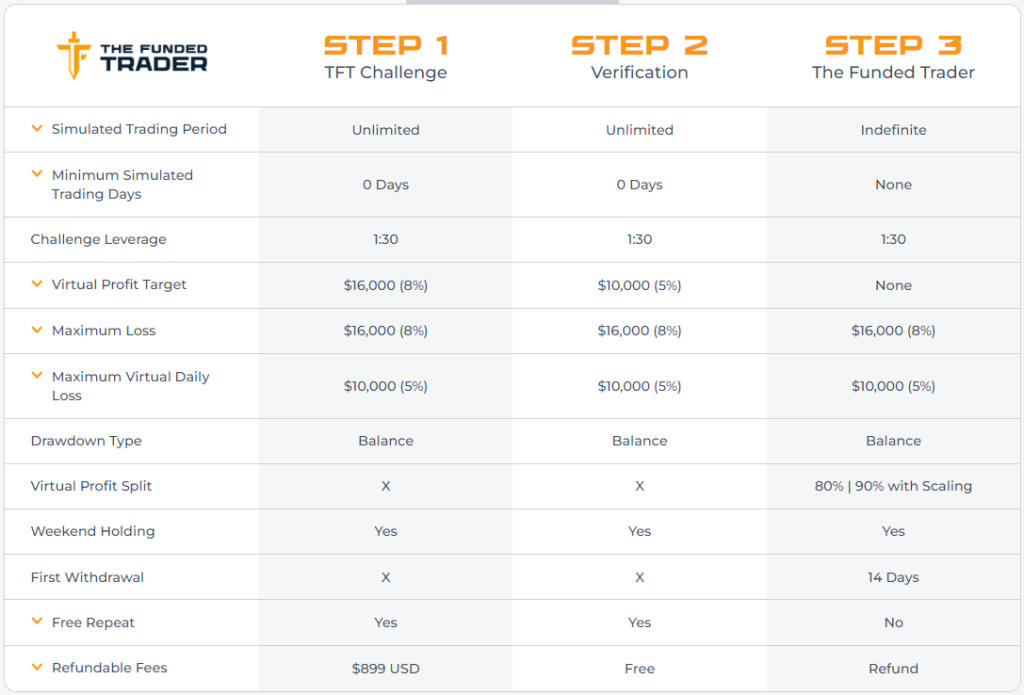

Rapid Challenge Accounts Overview

The Funded Trader’s Rapid Challenge Accounts are tailored for skilled traders, offering a dynamic two-phase evaluation. Account pricing is as follows:

- $5,000 account for $79

- $10,000 account for $129

- $25,000 account for $229

- $50,000 account for $299

- $100,000 account for $499

- $200,000 account for $899

In the regular evaluation program, traders can leverage up to 1:100, while the swing evaluation program offers 1:30 leverage. Swing accounts allow weekend trading, whereas regular accounts require closing trades before the weekend. Phase One Evaluation: The goal is an 8% profit target without exceeding a 5% daily loss or 8% maximum loss. There are no minimum or maximum trading day requirements, but the 8% profit target must be reached without violating loss limits. Phase Two Evaluation: Traders must achieve a 5% profit target, adhering to the same 5% maximum daily loss and 8% maximum loss rules. Like phase one, there are no specific trading day requirements. Successful completion of both phases leads to a funded account with no profit targets, only adhering to the 5% daily loss and 8% maximum loss rules. The first payout occurs 14 calendar days after the first trade in the funded account, with subsequent payouts every two weeks. The profit split schedule is as follows:

- 1st payout: 80% profit split

- 2nd payout: 85% profit split

- 3rd payout: 90% profit split

- 4th and subsequent payouts: 80% profit split

Rapid Challenge Account Scaling Plan

The Rapid Challenge account features an exciting scaling plan, designed to reward traders for their profitability. To participate in this plan, traders need to achieve a profit target of at least 10% during a single profit split period. Once this target is reached, the account size is increased by 10% each time a withdrawal surpasses 10% of the initial account balance.

Understanding the Scaling Process

Let’s break down how this scaling process works with a clear example:

- Starting with an account size of $100,000, if the profit split exceeds 10%, the account is boosted to $110,000.

- Subsequently, if a profit of over 10% is achieved from the $110,000 account, it scales up to $120,000.

- This pattern continues, with each successful profit target leading to a further 10% increase in account size.

Trading Instruments

For traders engaging in the standard challenge accounts, a variety of trading instruments are available. These include forex pairs, commodities, indices, and cryptocurrencies, offering a diverse range of options to suit different trading strategies and preferences.

Rapid Challenge Account Rules

Understanding the rules governing the Rapid Challenge accounts is crucial for traders aiming to succeed in these programs. These rules outline the essential criteria for profit targets, loss limits, and trading strategies.

Profit Targets in Evaluation Phases

The profit target is a predetermined percentage of profit a trader must achieve to complete an evaluation phase, withdraw profits, or scale their account. In Phase 1, the profit target is set at 8%, while Phase 2 requires a profit target of 5%. Notably, funded accounts do not have any profit targets.

Maximum Daily Loss and Overall Loss Limits

- Maximum Daily Loss: This is the highest permissible loss a trader can incur in a day. For all account sizes, this is capped at 5%. Exceeding this limit results in a violation of the account.

- Maximum Overall Loss: Similarly, the maximum total loss allowed is 8% for all account sizes. Breaching this threshold also leads to an account violation.

Restricted Trading Strategies

There are specific restrictions on the trading strategies that can be employed in the Rapid Challenge accounts:

- No Martingale Strategy: Traders are prohibited from using any form of the martingale strategy while trading.

- No Weekend Holding: Holding open positions over the weekend is not allowed.

Third-Party Copy Trading Risks

For those considering third-party copy trading services, it’s important to be aware of the risks. Using such services could lead to a denial of a funded account or withdrawal if it results in exceeding the maximum capital allocation rule, especially if the trading strategy is already widely used by others.

Restrictions on Expert Advisors (EAs)

While the use of EAs is generally restricted, the exception is made for expert advisors intended solely for copying purposes.

Royal Challenge Accounts Overview

The Funded Trader Royal Challenge account is designed to identify and reward skilled and consistent traders through a two-phase evaluation period. This account offers a high leverage of 1:200, appealing to traders looking for significant market exposure.

Royal Challenge Account Options and Pricing

Traders have a variety of account sizes to choose from, each with its corresponding price:

- $50,000 account for $289

- $100,000 account for $489

- $200,000 account for $939

- $300,000 account for $1,399

- $400,000 account for $1,869

Phase One of the Evaluation

In the first phase of evaluation, traders must achieve an 8% profit target while adhering to the 5% maximum daily loss and 10% overall maximum loss limits. Notably, there is no maximum trading day requirement in this phase, but a minimum of five trading days is mandatory to progress to the next phase.

Phase Two of the Evaluation

The second phase requires traders to reach a 5% profit target without exceeding the same loss limits as in Phase One. Like the first phase, there is no maximum number of trading days, but a minimum of five trading days is necessary to qualify for a funded account.

Transition to a Funded Account

Upon successful completion of both evaluation phases, traders are awarded a funded account. In this stage, there are no profit targets, but the 5% maximum daily loss and 10% overall maximum loss rules still apply. The payout structure for the funded account is as follows:

- The first payout occurs 30 calendar days after the first trade in the funded account.

- Subsequent payouts are on a bi-weekly basis.

- The profit split ranges from 80% to 90%, depending on the profits made on the funded account.

Royal Challenge Account Scaling Plan

The Royal Challenge accounts feature an attractive scaling plan, offering significant growth potential for successful traders. This plan is structured to reward consistent profitability over a defined period.

Scaling Plan Criteria and Process

To be eligible for scaling, traders need to achieve a profit target of 6% or more over a three-month period, with at least two of these months being profitable. Upon meeting these criteria, the account balance is increased by 25% of the original amount.

Scaling Examples

Let’s illustrate how this scaling works with a practical example:

- If you start with a $200,000 account and meet the profit target, your account balance will grow to $250,000 after three months.

- In the subsequent three-month period, if the target is again met, the account balance of $250,000 will be scaled up to $300,000.

- Continuing this pattern, the next successful period would see the account balance increasing from $300,000 to $350,000.

- This scaling continues in the same manner for each successful three-month period.

Available Trading Instruments

For traders in the Royal Challenge accounts, a diverse range of trading instruments is accessible. These include forex pairs, commodities, indices, and cryptocurrencies, catering to various trading styles and strategies.

Royal Challenge Account Rules

The Royal Challenge account comes with specific rules that traders must adhere to. These rules encompass profit targets, loss limits, trading days, and acceptable trading strategies, crucial for those participating in the program.

Profit Targets and Evaluation Phases

The profit target is a defined percentage of profit that traders must achieve to complete an evaluation phase, withdraw profits, or scale their account:

- Phase 1: The profit target is 8%.

- Phase 2: The profit target is reduced to 5%.

- Funded accounts do not have set profit targets.

Loss Limitations

Loss limits are crucial to manage risk effectively:

- Maximum Daily Loss: For all account sizes, the maximum daily loss is capped at 5%. Exceeding this limit leads to an account violation.

- Maximum Overall Loss: Similarly, all account sizes have a maximum overall loss limit of 10%. Breaching this limit also results in an account violation.

Minimum Trading Days Requirement

The minimum number of trading days required varies based on the account’s stage:

- Both Phase 1 and Phase 2 require a minimum of 5 trading days to complete an evaluation phase or request a withdrawal.

- Funded accounts do not have a minimum trading day requirement for payouts.

Restricted Trading Strategies

Certain trading strategies are restricted in Royal Challenge accounts:

- No Martingale Strategy: The use of any martingale strategy is prohibited.

Risks of Third-Party Copy Trading

Traders considering third-party copy trading services should be aware of the associated risks:

- Using a third-party copy trading service might involve risk if the strategy is already widely used by other traders.

- This could potentially lead to being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

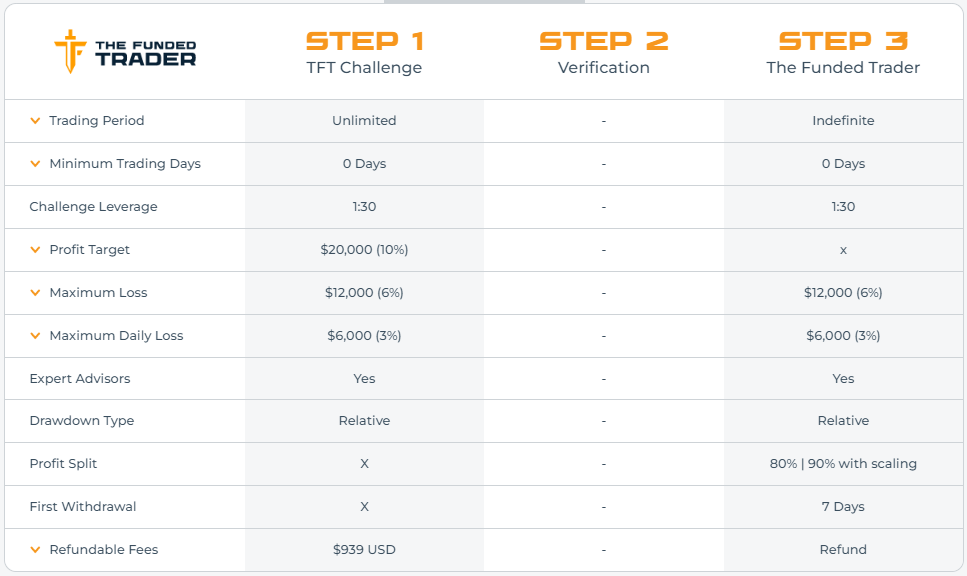

The Funded Trader Knight Challenge Account Review

The Funded Trader offers an intriguing knight challenge account designed to discover and reward skilled traders. This unique one-phase evaluation period is structured to highlight consistent trading talent.

Account Options and Pricing

The knight challenge account presents various account sizes with corresponding prices:

- $25,000 account at $189

- $50,000 account for $289

- $100,000 account available at $489

- $200,000 account priced at $939

One-Phase Evaluation

This evaluation program allows participants to trade with a 1:30 leverage. The primary goal during this phase is to reach a 10% profit target without exceeding the 3% maximum daily loss or 6% maximum trailing loss. Importantly, there are no minimum or maximum trading day requirements in this phase. The only criterion for receiving funding is achieving the profit target.

Funded Account Benefits

Upon successful completion of the evaluation phase, traders are awarded a funded account. This account has no profit targets, but traders must adhere to the 3% maximum daily loss and 6% maximum trailing loss rules. The first payout is scheduled seven calendar days after the first position is placed in the funded account. Subsequently, payouts are made on a weekly basis. Notably, the profit split ranges from 80% to 90%, depending on the profits generated on the funded account.

Knight Challenge Account Scaling Plan

The Knight Challenge accounts offered by The Funded Trader feature an exciting scaling plan, incentivizing traders to achieve consistent profitability over time.

Scaling Plan Requirements

To qualify for the scaling plan, traders need to meet specific criteria:

- Achieve a minimum profit target of 6% within a three-month period.

- Ensure profitability in at least two of the three months.

Upon meeting these requirements, traders receive a 25% increase in their original account balance. Additionally, the first successful scale enhances the profit split from 80% to 90% and increases the daily drawdown limit from 3% to 4%.

Scaling Plan Examples

Here’s how the scaling plan can enhance account balances over time:

- After 3 months: A $200,000 account increases to $250,000.

- After the next 3 months: The balance grows from $250,000 to $300,000.

- After another 3 months: The account rises from $300,000 to $350,000.

- And so on, with each successful scaling period.

Trading Instruments

The knight challenge accounts permit trading in a variety of instruments, including forex pairs, commodities, indices, and cryptocurrencies. This diversity allows traders to utilize their skills across different markets.

Knight Challenge Account Trading Guidelines

Profit Target Specifications

In the Knight Challenge, traders must meet a specific profit target to successfully navigate the evaluation phase, withdraw earnings, or upscale their account. During the evaluation stage, the profit target is set at 10%, while funded accounts are free from any profit target requirements.

Daily Loss Limitation

The maximum daily loss permissible across all account sizes is capped at 3%. This threshold is vital to ensure sustainable trading practices. Notably, upon the first account scaling, this limit adjusts to 4%, offering slightly more flexibility to experienced traders.

Trailing Drawdown Constraints

All accounts, regardless of size, adhere to a maximum trailing drawdown of 6%. This drawdown measures the difference between the peak account balance and the lowest point reached, maintaining a buffer for trading volatility.

Prohibition of Martingale Strategies

Traders participating in the Knight Challenge are prohibited from employing any martingale strategies. This rule is set to foster risk management and discourage aggressive trading behaviors.

Third-Party Copy Trading Advisory

While considering third-party copy trading services, traders should be aware of the inherent risks. Utilizing such services can lead to strategy duplication if other traders are also using the same service. This could potentially result in denial of fund allocation or withdrawal, should the maximum capital rule be exceeded.

Risks Associated with Third-Party EAs

Similar caution applies when using third-party Expert Advisors (EAs). The concurrent use of the same EA by multiple traders might lead to strategy replication. Exceeding the maximum capital allocation rule under these circumstances may also risk fund access and withdrawal privileges.

Unique Aspects of The Funded Trader Compared to Other Prop Firms

Flexible Trading Style Approach

The Funded Trader distinguishes itself from many top-tier prop firms by offering unparalleled flexibility in trading styles. Traders have the freedom to engage in trading during news events, and they can also hold trades overnight and over weekends, which is a notable deviation from the typical restrictions imposed by other firms.

Two-Phase Standard Challenge Program

Unlike its competitors, The Funded Trader implements a two-phase evaluation process in its standard challenge program. Traders must successfully navigate through both phases to qualify for payouts. The first phase demands a 10% profit target, while the second phase requires a 5% profit achievement. These stages are designed to thoroughly assess a trader’s skill and strategy.

Loss and Minimum Trading Day Criteria

In line with maintaining trading discipline, the program sets a 5% maximum daily loss limit and a 10% overall maximum loss threshold. Furthermore, traders are obligated to engage in trading for at least three days in each phase, ensuring a reasonable period for performance evaluation. This contrasts with other leading firms, which often have different loss limits and trading day requirements.

Scaling Plan and Comparative Analysis

The standard challenge program includes a scaling plan, offering traders the opportunity for account growth. When compared to other industry leaders, The Funded Trader features average profit targets and relatively lenient minimum trading day prerequisites, making it an attractive option for a wide range of traders.

Comparing The Funded Trader and Finotive Funding

Overview of Trading Objectives and Conditions

When contrasting The Funded Trader with Finotive Funding, various key aspects such as profit targets, loss limits, trading days, trading period, and profit splits reveal distinct differences and similarities between the two.

Profit Targets in Evaluation Phases

The Funded Trader sets a Phase 1 profit target of 10%, which is slightly higher compared to Finotive Funding’s 7.5%. In Phase 2, both firms align with a 5% profit target, indicating a common threshold for trader proficiency in the latter stage.

Daily and Maximum Loss Limits

The daily loss limit is set at 5% for both, with The Funded Trader offering an option to increase this to 6% using an Add-on. Similarly, the maximum loss limit is 10% for both, with The Funded Trader providing an option to extend this to 12% with an Add-on feature.

Minimum Trading Days Requirement

A notable difference is seen in the minimum trading days requirement. The Funded Trader mandates a minimum of 3 calendar days of trading in each phase, whereas Finotive Funding imposes no such minimum trading day requirement.

Maximum Trading Period

Both The Funded Trader and Finotive Funding offer an unlimited trading period for both Phase 1 and Phase 2, allowing traders ample time to reach their targets without time pressure.

Profit Split

The profit split starts at 80% and can go up to 90% with The Funded Trader, whereas Finotive Funding offers a slightly wider range, from 75% up to 95%, potentially offering a higher share to the trader under certain conditions.

Comparison: The Funded Trader vs. E8 Funding (Extended)

Detailed Analysis of Trading Objectives and Requirements

Comparing The Funded Trader with E8 Funding (Extended) unveils key differences and similarities in their trading objectives, loss limits, trading day requirements, periods, and profit splits.

Profit Targets Across Phases

The Funded Trader sets its Phase 1 profit target at 10%, slightly higher than E8 Funding’s 8%. Both firms align with a 5% profit target for Phase 2, demonstrating a standard expectation for trader performance in the final stage.

Daily and Maximum Loss Limits

Both firms start with a 5% daily loss limit, with The Funded Trader offering an extension to 6% through an add-on. The maximum loss is set at 10% for both, but The Funded Trader allows an increase to 12% with an add-on, and E8 Funding offers scalability up to 14%.

Minimum Trading Days

There’s a distinct difference in the minimum trading days: The Funded Trader requires a minimum of 3 calendar days, while E8 Funding stipulates at least 5 calendar days of trading in each phase.

Maximum Trading Period

Both The Funded Trader and E8 Funding provide traders with an unlimited period to achieve their targets in both Phase 1 and Phase 2, ensuring flexibility in trading strategies and time management.

Profit Split Comparison

The Funded Trader offers a profit split starting at 80%, which can increase to 90%. In contrast, E8 Funding maintains a consistent 80% profit split, highlighting a fixed but fair sharing model.

The Funded Trader vs. Funding Pips: A Comparative Overview

Comparing Trading Objectives and Conditions

An in-depth comparison between The Funded Trader and Funding Pips reveals their unique approaches to trading objectives, loss limits, trading days, periods, and profit splits.

Evaluation Phase Profit Targets

The Funded Trader sets its Phase 1 profit target at 10%, which is slightly higher than Funding Pips’ 8%. In Phase 2, both firms agree on a 5% profit target, indicating a standard benchmark for trader evaluation in this final stage.

Loss Limitations and Add-ons

Both firms start with a 5% maximum daily loss limit. The Funded Trader offers an option to extend this to 6% through an add-on. Maximum loss is set at 10% for both firms, with The Funded Trader providing an option to increase this to 12% using an add-on feature.

Minimum Trading Days Requirement

A notable distinction is seen in the minimum trading days: The Funded Trader requires at least 3 calendar days of trading in each phase, whereas Funding Pips does not specify a minimum trading day requirement.

Unlimited Trading Periods

Both firms offer unlimited trading periods for both Phase 1 and Phase 2, granting traders ample time to achieve their objectives without the pressure of a time limit.

Profit Split Provisions

Profit splits are similar for both firms, starting at 80% and potentially increasing to 90%, reflecting a balanced approach to profit sharing between the trader and the firm.

Rapid Challenge Program of The Funded Trader

In addition to the standard program, The Funded Trader also offers a Rapid Challenge Program. This two-phase evaluation requires an 8% profit target in Phase 1 and 5% in Phase 2, with a 5% maximum daily and 8% maximum loss. Traders need to trade for a minimum of 5 days in each phase. This program, including its scaling plan, stands out for having relatively lower profit targets and minimum trading day requirements compared to other leading prop firms in the industry.

Comparative Analysis: The Funded Trader vs. True Forex Funds (Limitless)

Exploring Trading Objectives and Parameters

This comparison between The Funded Trader and True Forex Funds (Limitless) sheds light on their respective trading objectives, profit targets, loss limits, trading day requirements, periods, and profit splits.

Profit Target Requirements

Both The Funded Trader and True Forex Funds set their Phase 1 profit target at 8%. This consistency extends to Phase 2, where each firm requires a 5% profit target, demonstrating a standard performance expectation in the trading industry.

Daily and Overall Loss Limits

The maximum daily loss allowed is 5% for both firms. However, there is a difference in the overall maximum loss limit: The Funded Trader sets it at 8%, while True Forex Funds allows up to 10%, offering slightly more leeway in trading strategies.

Minimum Trading Days

A key difference is observed in the minimum trading days requirement. The Funded Trader does not specify a minimum, whereas True Forex Funds mandates at least 5 calendar days of trading in each phase.

Unlimited Trading Period Flexibility

Both The Funded Trader and True Forex Funds provide traders with an unlimited time frame to achieve their targets in both Phase 1 and Phase 2, facilitating a stress-free trading environment.

Profit Split Comparison

The Funded Trader offers a profit split starting at 80% and potentially rising to 90%. In contrast, True Forex Funds maintains a steady 80% profit split, reflecting a consistent profit-sharing model.

The Funded Trader vs. FundedNext (Stellar): A Comparative Insight

Side-by-Side Analysis of Trading Objectives

Comparing The Funded Trader with FundedNext (Stellar) reveals similarities and differences in their trading objectives, including profit targets, loss limits, trading day requirements, periods, and profit splits.

Profit Target Benchmarks

Both The Funded Trader and FundedNext (Stellar) have set the Phase 1 profit target at 8%. This uniformity continues into Phase 2, with both firms requiring a 5% profit target, indicating a consistent evaluation standard within the industry.

Daily and Overall Loss Restrictions

Each firm has established a 5% maximum daily loss limit. However, they differ in their overall maximum loss limits, with The Funded Trader setting it at 8% and FundedNext allowing up to 10%, providing traders with a slightly broader risk margin.

Minimum Trading Days Criteria

One of the key differences is in the minimum trading days requirement. The Funded Trader offers flexibility with no minimum trading days, while FundedNext stipulates a minimum of 5 calendar days of trading for each phase.

Maximum Trading Period Comparison

Both firms offer an unlimited trading period for both Phase 1 and Phase 2. This approach enables traders to strategize and achieve their targets without the constraints of a time limit.

Profit Split Provisions

The profit split structure is similar for both firms, starting at 80% and potentially increasing up to 90%. This parity indicates a balanced approach to rewarding trader success and sharing profits.

Comparison Between The Funded Trader and Funded Trading Plus

When evaluating prop trading firms, it’s crucial to understand their trading objectives and terms. A direct comparison between The Funded Trader and Funded Trading Plus reveals distinct differences in their offerings, particularly in the context of their advanced programs.

Trading Objectives and Requirements

Both firms offer unique challenges and benefits within their trading programs. Here’s a detailed comparison:

- Phase 1 Profit Target: The Funded Trader sets an 8% goal, while Funded Trading Plus requires 10%.

- Phase 2 Profit Target: Both firms have a 5% target in this phase.

- Maximum Daily Loss: The limit is set at 5% for both programs.

- Overall Maximum Loss: The Funded Trader maintains an 8% threshold, whereas Funded Trading Plus adopts a trailing 10% approach.

- Minimum Trading Days: Neither program imposes minimum trading days, offering flexibility to traders.

- Maximum Trading Period: Both firms offer unlimited trading periods in both phases.

- Profit Split: Traders can expect a profit split ranging from 80% to 90% in both programs.

Key Differences and Highlights

The Funded Trader’s Royal Challenge Program stands out with its two-phase evaluation process. This program demands traders achieve a profit target of 8% in the first phase and 5% in the second, coupled with a 5% maximum daily loss and a 10% overall maximum loss. Notably, traders are required to trade for a minimum of 5 days in each phase to qualify for funding. This program also includes a scaling plan, a feature that enhances its appeal. In contrast, Funded Trading Plus, a London-based company, offers similar terms but with a slightly higher initial profit target and a trailing maximum loss policy. Compared to other prop firms in the industry, both The Funded Trader and Funded Trading Plus provide competitive profit targets and minimum trading day requirements, making them attractive options for traders looking to partner with a funded programme. Explore more about forex prop firms.

Comparative Analysis of The Funded Trader and FTMO

Understanding the trading objectives and conditions of various prop firms is essential for traders seeking the right platform. This comparison between The Funded Trader and FTMO highlights key aspects of their trading programs.

Trading Objectives Comparison

Both The Funded Trader and FTMO offer comprehensive programs with specific targets and limits. Here’s a detailed breakdown:

- Phase 1 Profit Target: The Funded Trader has an 8% target, while FTMO sets it at 10%.

- Phase 2 Profit Target: Both firms have a consistent 5% target in this phase.

- Maximum Daily Loss: A limit of 5% is set by both The Funded Trader and FTMO.

- Overall Maximum Loss: Both firms align with a 10% maximum loss threshold.

- Minimum Trading Days: The Funded Trader requires a minimum of 5 calendar days, whereas FTMO has a slightly shorter requirement of 4 calendar days.

- Maximum Trading Period: Both offer unlimited trading periods for both phases, allowing ample time for traders to meet their targets.

- Profit Split: Traders can enjoy a profit split ranging from 80% to 90% in both programs.

Distinguishing Features

The Funded Trader’s program, known for its structured two-phase evaluation, demands a slightly lower profit target in the first phase compared to FTMO. This London-based company provides a balanced approach with a reasonable maximum loss limit and a minimum trading period that offers flexibility to traders. FTMO, on the other hand, emphasizes a slightly more challenging initial phase with a higher profit target and a shorter minimum trading day requirement. This structure is designed to assess trader efficiency and skill in a condensed timeframe. Like The Funded Trader, FTMO also boasts a generous profit split, making it an attractive option for skilled traders. In conclusion, while both The Funded Trader and FTMO present similar profit splits and maximum loss limits, subtle differences in their profit targets and minimum trading day requirements distinguish them in the competitive landscape of forex funded programs. Discover more about forex funded programmes.

Comparison Between The Funded Trader and E8 Funding

Comparing trading objectives of different prop firms is crucial for traders to identify the most suitable platform for their needs. In this comparison, The Funded Trader and E8 Funding, particularly the Extended program of E8 Funding, are closely analyzed for their key differences and similarities.

Trading Objectives: A Detailed Comparison

Both The Funded Trader and E8 Funding offer structured trading programs with specific objectives. Here’s a comprehensive look at how they compare:

- Phase 1 Profit Target: Both firms set an 8% target for this phase.

- Phase 2 Profit Target: Consistently, a 5% target is required by both.

- Maximum Daily Loss: The limit is 5% for both The Funded Trader and E8 Funding.

- Overall Maximum Loss: Both have a 10% threshold, with E8 Funding offering scalability up to 14%.

- Minimum Trading Days: Each firm requires a minimum of 5 calendar days of trading.

- Maximum Trading Period: Both programs allow unlimited trading in both phases.

- Profit Split: The Funded Trader offers a profit split ranging from 80% to 90%, whereas E8 Funding maintains a steady 80% split.

Notable Differences and Highlights

The Funded Trader and E8 Funding share many similarities in their trading objectives, including identical profit targets and loss limits. However, E8 Funding distinguishes itself with its scalable maximum loss option, providing traders with the potential to manage a higher loss threshold of up to 14%, under certain conditions. Another key difference lies in the profit split. While The Funded Trader offers a variable profit split, ranging from 80% to 90%, E8 Funding maintains a consistent 80% split. This aspect might influence a trader’s decision, depending on their preference for potential higher earnings versus consistent returns. In summary, while The Funded Trader and E8 Funding have many parallel features, subtle differences in their programs, such as the scalable maximum loss and profit split percentages, provide unique options for traders considering a partnership with a funded programme. Learn more about forex prop firms.

Comparative Review: The Funded Trader vs. SurgeTrader

Choosing the right prop firm is crucial for traders, as each firm offers distinct trading objectives and terms. This comparison between The Funded Trader and SurgeTrader sheds light on their specific offerings and differences, helping traders make informed decisions.

Side-by-Side Trading Objectives Analysis

Let’s delve into the details of what each firm offers:

- Phase 1 Profit Target: Both firms have set an 8% target for the first phase.

- Phase 2 Profit Target: A consistent target of 5% is seen in both programs.

- Maximum Daily Loss: Each firm imposes a 5% daily loss limit.

- Overall Maximum Loss: The Funded Trader has a 10% limit, while SurgeTrader sets it at 8%.

- Minimum Trading Days: The Funded Trader requires 5 calendar days, whereas SurgeTrader imposes no minimum trading days.

- Maximum Trading Period: Both offer unlimited trading periods in both phases.

- Profit Split: Traders can expect a profit split ranging from 80% to 90% in both programs.

Unique Features and Highlights

The Funded Trader distinguishes itself with its versatile one-step evaluation program. This program requires traders to meet a 10% profit target in the evaluation phase, with a 3% maximum daily loss and a 6% maximum trailing loss rule. Notably, this program does not enforce minimum or maximum trading day requirements during the evaluation stage, and includes a scaling plan. Compared to other leading prop firms, The Funded Trader offers more lenient drawdown rules and no time constraints. On the other hand, SurgeTrader stands out with its slightly lower overall maximum loss limit and the absence of minimum trading day requirements, which may appeal to traders seeking more flexibility. In conclusion, The Funded Trader sets itself apart from other leading prop firms by offering four distinct funding programs and more relaxed trading rules. This includes the allowance for trading during news events, holding trades overnight, and over weekends, catering to a wide range of trading styles and strategies. Explore more about forex funded programmes.

Assessing the Realism of Obtaining Capital from The Funded Trader

For forex traders exploring prop firms, it’s vital to gauge the realism of meeting trading requirements to secure capital. This review evaluates The Funded Trader’s various programs to determine how feasible it is for traders to achieve success and receive funding.

Understanding The Funded Trader’s Capital Allocation Criteria

The Funded Trader offers several programs, each with unique targets and rules. Here’s an analysis of the realism involved in meeting these criteria:

Standard Challenge Program

- Profit Targets: A realistic 10% in phase one and 5% in phase two.

- Maximum Loss Rules: Relatively high with a 5% daily and 10% overall limit.

- Conclusion: Achieving the set targets is practical, making this program a viable option for traders.

Rapid Challenge Program

- Profit Targets: Reasonable at 8% for phase one and 5% for phase two.

- Maximum Loss Rules: Balanced with a 5% daily and 8% overall limit.

- Conclusion: The targets are attainable, offering a fair challenge for skilled traders.

Royal Challenge Program

- Profit Targets: Modest at 8% in phase one and 5% in phase two.

- Maximum Loss Rules: Standard with a 5% daily and 10% overall limit.

- Conclusion: This program’s objectives are realistic, aligning well with average trading strategies.

Knight Challenge Program

- Profit Target: An average target of 10%, within reach for many traders.

- Maximum Loss Rules: Moderate with a 3% daily and 6% maximum trailing loss.

- Conclusion: The balance of profit targets and loss rules makes this program a practical choice.

Final Thoughts on The Funded Trader

Considering the diverse range of funding programs with realistic trading objectives and conditions, The Funded Trader emerges as an excellent choice for traders seeking capital. Its four distinct programs cater to various trading styles and strategies, providing a feasible pathway to success and funding. Learn more about forex prop firms.

Learn more about forex prop firms.

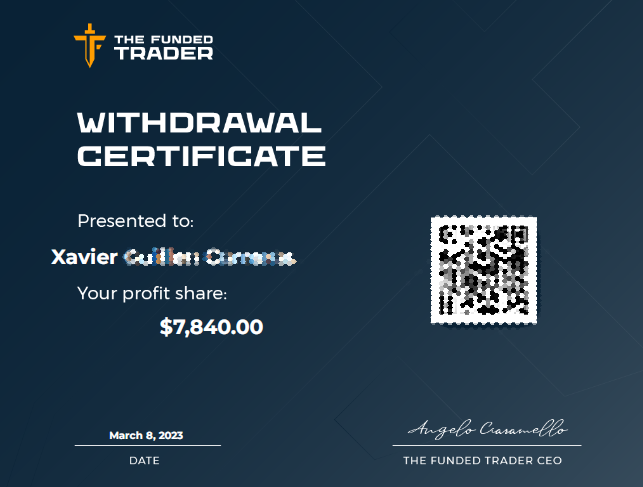

Exploring Payment Proof for The Funded Trader

Since its establishment on May 12, 2021, The Funded Trader has been offering a notable perk to its traders: the opportunity to receive bi-weekly payouts, notably without the requirement of meeting any minimum profit targets. This aspect is a significant highlight of their funding program. For those seeking tangible evidence of these payments, The Funded Trader’s performance is documented through several mediums. Specifically, there are two YouTube videos available which provide clear examples of payment proofs: Beyond these videos, additional proofs of payment are accessible on The Funded Trader’s Discord channel. In the dedicated ‘payout proof’ section, various traders have shared their successful experiences with the platform’s payout process.

Brokers Utilized by The Funded Trader

The Funded Trader collaborates with three notable brokerage firms: Eightcap, ThinkMarkets, and Purple Trading Seychelles. Each of these brokers brings unique strengths and offerings to the table, catering to the diverse needs of traders.

Eightcap

Established in 2009 and headquartered in Melbourne, Australia, Eightcap is regulated by ASIC and prides itself on its mission to deliver exceptional financial services. With five global offices and multiple regulatory approvals, they offer a broad spectrum of trading options in FX, indices, commodities, and shares.

ThinkMarkets

As a premium multi-asset online brokerage, ThinkMarkets has its main offices in London and Melbourne. They provide seamless access to a wide variety of markets and are known for their advanced trading solutions including MetaTrader 4, MetaTrader 5, and the ThinkTrader platform, developed in-house.

Purple Trading Seychelles

Purple Trading Seychelles focuses on providing fair business conditions and cutting-edge technology, positioning themselves as equal partners to their clients.

Available Trading Platforms

When it comes to trading platforms, The Funded Trader offers flexibility. If a trader selects Eightcap or ThinkMarkets, they have the option to trade using either MetaTrader 4 or MetaTrader 5 platforms. On the other hand, choosing Purple Trading Seychelles limits the platform choice to only MetaTrader 4.

Trading Instruments Offered by The Funded Trader

The Funded Trader, a renowned prop trading firm, provides an array of trading instruments across different asset classes. For those looking to dive into forex trading, the firm offers an attractive leverage of 100:1, which is enhanced to 200:1 during the evaluation phase. Additionally, traders have the opportunity to engage with commodities, indices, and cryptocurrencies, each coming with its own set of leverage options.

Forex Trading Options

With The Funded Trader, forex enthusiasts have access to a broad range of currency pairs. These include major pairs like USDCHF, GBPUSD, EURUSD, as well as a variety of other pairs encompassing European, Asian, and other global currencies. Traders can explore pairs such as AUDUSD, EURGBP, CADJPY, and many more, ensuring a diverse forex trading experience.

Commodities

For those interested in commodities, The Funded Trader offers trading in gold (XAUUSD), silver (XAGUSD), platinum (XPTUSD), as well as energy commodities like natural gas (NGAS) and oil (UKOil, USOil). The leverage offered for commodity trading is set at a competitive 40:1.

Indices

Index traders are not left behind, with the prop firm providing options to trade on major indices like the US30, SPX500, NAS100, and more. These indices cover various geographical regions, offering traders a chance to engage with different global markets.

Cryptocurrencies

The Funded Trader steps into the modern trading arena by including cryptocurrencies in its portfolio. Traders can delve into popular cryptocurrencies like Bitcoin (BTCUSD), Ethereum (ETHUSD), and Litecoin (LTCUSD), alongside a variety of other digital currencies, each with a leverage of 2:1. Explore more about forex prop trading firms

Understanding Trading Fees at The Funded Trader

The Funded Trader offers a transparent and competitive fee structure for traders. Understanding these fees is crucial for traders to manage their trading strategies effectively.

Trading Commission Structure

The prop firm’s commission fees vary based on the asset class:

- FOREX: A fee of 3 USD per lot.

- COMMODITIES: Charged at 3 USD per lot.

- INDICES: Enjoy zero commission trading.

- CRYPTO: Also benefits from zero commission.

Spread Information

To gain insights into the current spreads offered by The Funded Trader, traders can log into various demo and live trading accounts provided on different platforms. These platforms include MetaTrader 4 and MetaTrader 5, each with unique server, login, and password details for a real-time experience of the trading environment.

MetaTrader 4 and 5 Accounts

Below are the details for accessing these accounts:

- MetaTrader 4 on ThinkMarkets-Demo 2: Login Number 81000007, Password: lIr4HdB. Download Platform

- MetaTrader 5 on ThinkMarkets-Demo 2: Login Number 100000667, Password: ckvu0jkc. Download Platform

- MetaTrader 5 on EightcapEU-Live: Login Number 82001533, Password: M-2eSuOu. Download Platform

- MetaTrader 4 on PurpleTradingSC-03Demo: Login Number 30000027, Password: jFfWs$L5L*. Download Platform

- MetaTrader 5 on PurpleTradingSC-01MT5: Login Number 6000010, Password: 1iQdS@Zy. Download Platform

For further information on forex funded programmes, visit All Prop Trading Firms.

Education & Support Services at The Funded Trader

Understanding the level of educational content and support provided by The Funded Trader is essential for traders who are considering joining this London-based company.

Availability of Educational Content

The Funded Trader currently does not offer any educational materials directly on its website. This might impact new traders who are looking for resources to enhance their trading knowledge and skills.

Community Engagement and Discussions

While The Funded Trader does not have an official thread on ForexFactory, it is frequently mentioned in a thread titled “PROP FIRM HUB” created by a user named Masterrmind. This thread serves as a platform for discussion and exchange of information among trading professionals and enthusiasts. To view this thread, click here.

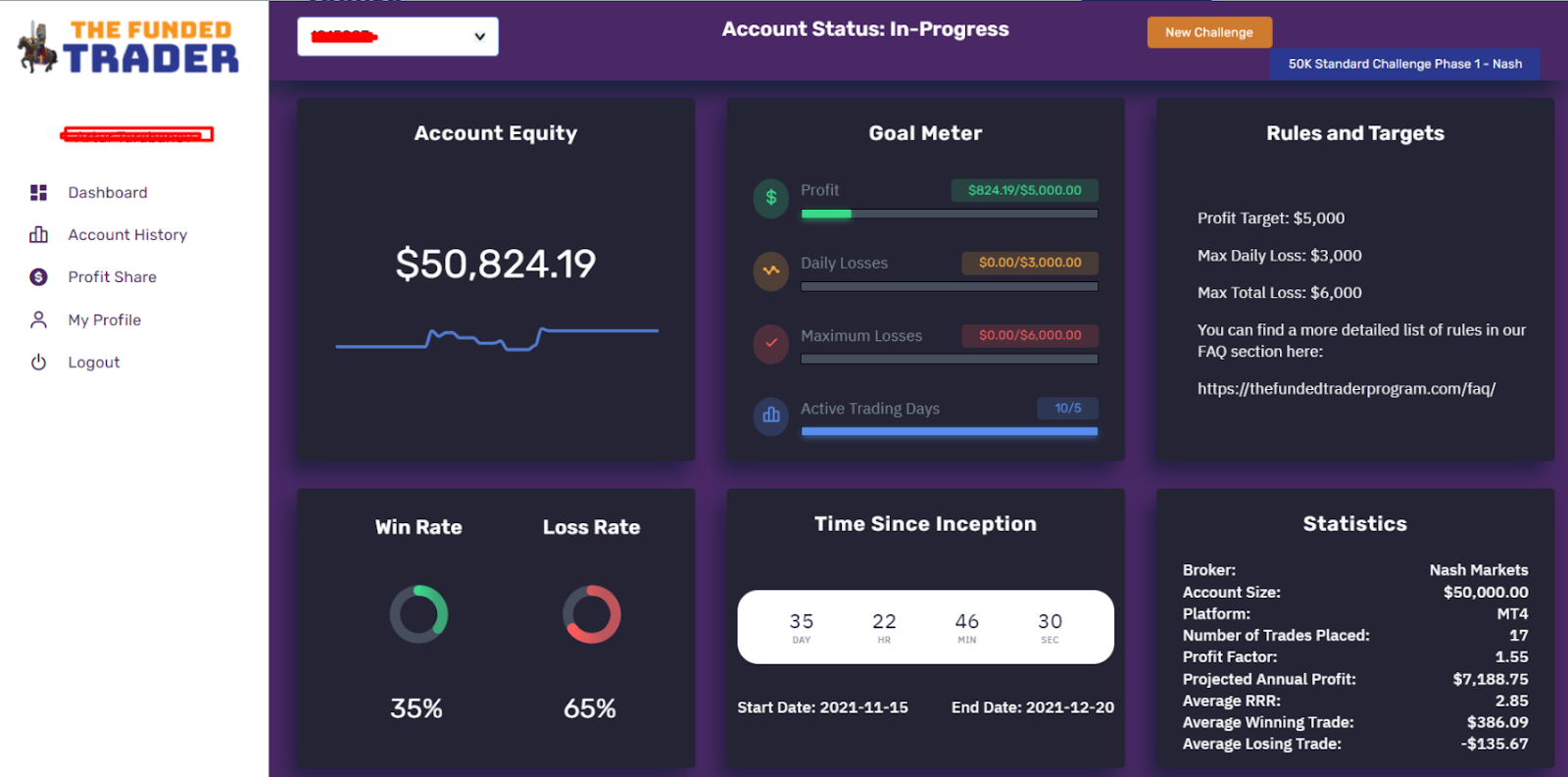

Trader Support and Dashboard

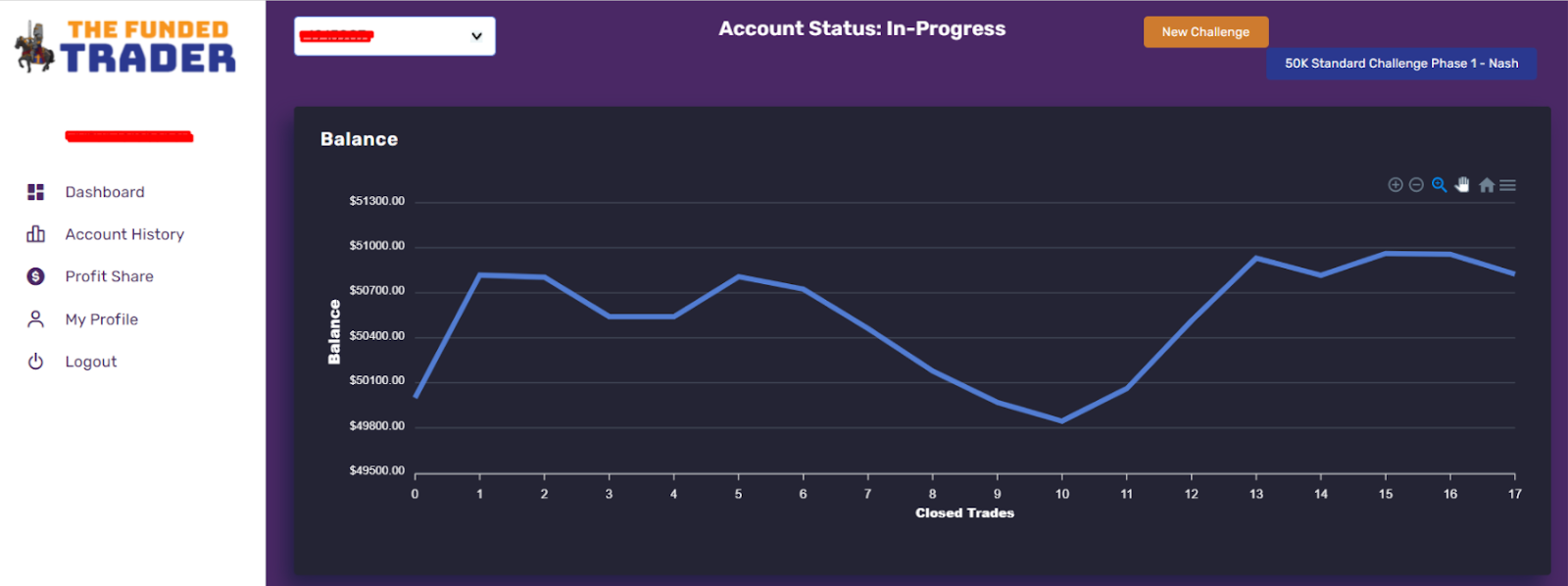

The Funded Trader compensates for the lack of educational resources by providing a comprehensive and well-structured dashboard. This dashboard is accessible to all clients and plays a crucial role in managing risk effectively. It provides detailed statistics and real-time information on open positions, aiding traders in making informed decisions. For more insights into forex prop trading firms, visit All Prop Trading Firms.

The Funded Trader Review: What Traders are Saying

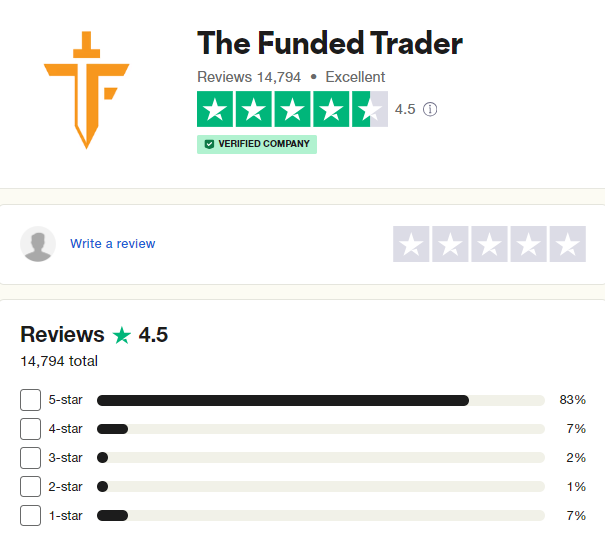

The Funded Trader is highly praised in online reviews. With an impressive 4.5/5 rating from 14,794 reviews on Trustpilot, their community frequently highlights the positive aspects of their services. They are well-regarded for their responsive and understanding support team, always ready to provide essential information and assistance to their clients.

Users have noted how The Funded Trader combines the best features of various prop firms into one cohesive offering, earning them a strong reputation among their clients. This focus on amalgamating strengths from different sources contributes significantly to their high customer satisfaction.

The Funded Trader’s Social Media Presence

The Funded Trader maintains a strong presence across various social media platforms. They boast a substantial following, with their Instagram account attracting 25.5k followers. On Telegram, they have a community of 8,527 subscribers. Their YouTube channel is also noteworthy, with 13.6k subscribers and a collection of 248 videos, offering a wealth of information and insights. In addition, The Funded Trader hosts a vibrant Discord channel with an impressive 42,641 members. This platform serves as a hub for announcements, support queries, and lively discussions on trading strategies, further fostering a sense of community among traders.

Support

If you have any questions or need assistance, The Funded Trader provides various support options to help you.

Frequently Asked Questions (FAQ)

For answers to common queries, visit our FAQ page.

Email Support

You can reach out to our support team via email at support@thefundedtraderprogram.com.

Live Chat Support

We offer live chat support for quick assistance. Send us a message, and you will receive a reply in your email.

Discord Community

Join our Discord channel, where you can access various channels for support and interact with our community and support team to resolve any technical issues or get assistance. Check out our Discord channel for more information.

Conclusion

In conclusion, The Funded Trader is a reputable proprietary trading firm that provides traders with the option to choose from four distinct funding programs: Standard, Rapid, Royal, and Knight.

Standard Challenge Programs

The Standard challenge programs consist of a two-phase evaluation process, where traders must successfully complete both phases to become funded and eligible to earn profit splits. The Funded Trader sets realistic profit targets of 10% in phase one and 5% in phase two, accompanied by a 5% maximum daily and 10% maximum loss rule. These programs offer up to 90% profit splits and the opportunity to scale your trading accounts.

Rapid Challenge Programs

Similar to Standard, the Rapid challenge programs also follow a two-phase evaluation process. Traders are required to achieve profit targets of 8% in phase one and 5% in phase two before becoming funded. The trading objectives align with a 5% maximum daily and 8% maximum loss rule. Rapid challenge programs offer up to 90% profit splits and the flexibility to scale your accounts.

Royal Challenge Programs

Royal challenge programs, like the others, involve a two-phase evaluation process. Traders need to attain profit targets of 8% in phase one and 5% in phase two to qualify for funding. These objectives are supported by a 5% maximum daily and 10% maximum loss rule. Royal challenge programs provide the opportunity to earn up to 90% profit splits and expand your trading accounts.

Knight Challenge Accounts

Knight challenge accounts offer a one-step evaluation program, requiring traders to reach a profit target of 10% to become funded. With a 3% maximum daily and 6% maximum trailing loss rule, these objectives are achievable. One-step evaluation programs offer profit splits ranging from 80% to 90%, allowing you to grow your accounts. I highly recommend The Funded Trader to anyone seeking a proprietary trading firm with transparent and straightforward trading rules. They have a strong reputation in the industry and offer favorable conditions for a diverse range of traders with unique styles. After a comprehensive evaluation, it’s evident that The Funded Trader is among the leading proprietary trading firms in the industry.