In the competitive world of proprietary trading, Blue Guardian stands out as a firm committed to empowering traders. Offering a range of evaluation programs designed to cater to different trading strategies, Blue Guardian has established itself as a go-to destination for traders seeking flexibility and realistic trading objectives. In this comprehensive review, we delve into the unique features of Blue Guardian’s programs, examining how they accommodate various trading styles and offer a clear path to success.

In the competitive world of proprietary trading, Blue Guardian stands out as a firm committed to empowering traders. Offering a range of evaluation programs designed to cater to different trading strategies, Blue Guardian has established itself as a go-to destination for traders seeking flexibility and realistic trading objectives. In this comprehensive review, we delve into the unique features of Blue Guardian’s programs, examining how they accommodate various trading styles and offer a clear path to success.

- Flexible Trading Styles Allowed.

- Realistic Profit Targets.

- Diverse Evaluation Programs.

- Supportive Trading Conditions.

- Opportunity for Account Scaling.

A Detailed Review of Blue Guardian for Traders

Blue Guardian places a high emphasis on discipline and risk management as key traits in its traders. The firm targets those who are committed to long-term consistency in their trading careers. Offering account sizes that can reach up to $200,000, Blue Guardian provides its traders with the opportunity to earn substantial profits. Notably, the profit split stands at an impressive 85%, allowing traders to take home a significant portion of their earnings. The trading options available include a variety of forex pairs, commodities, indices, and cryptocurrencies, offering a diverse range of instruments to trade with.

Understanding Blue Guardian: A Comprehensive Overview

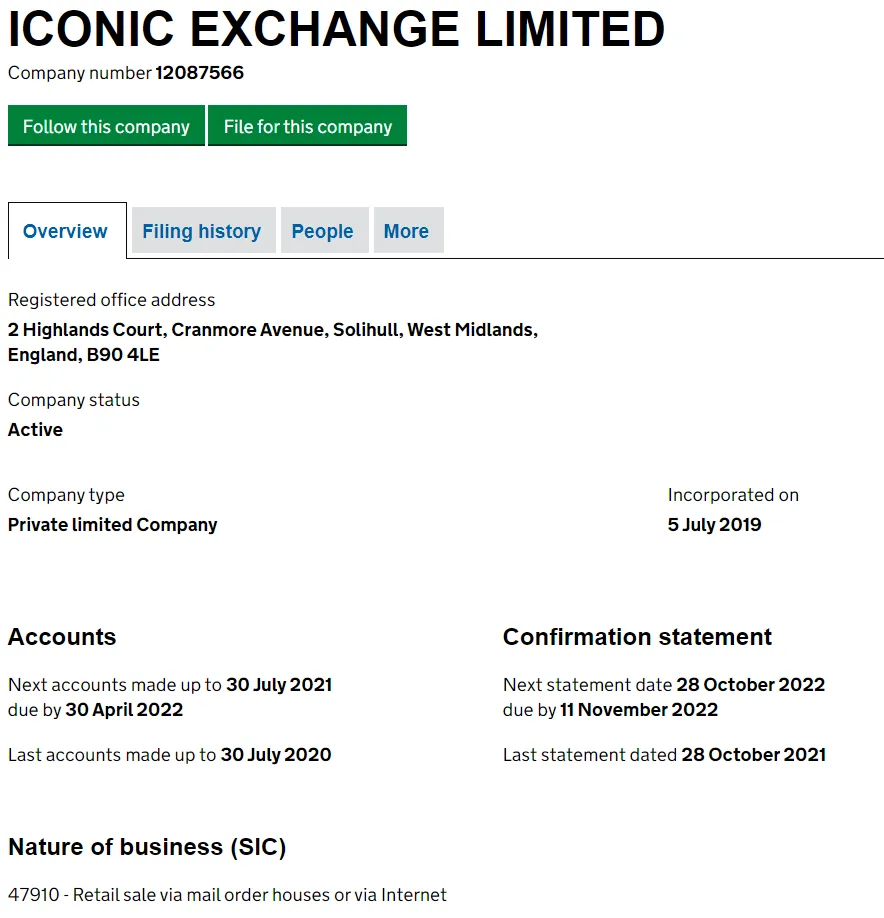

Blue Guardian, known officially as Iconic Exchange Limited and trading as Blue Guardian, is a notable proprietary trading firm that began its journey in June 2019. Making its presence known publicly in September 2021, Blue Guardian quickly established itself in the trading world. They offer traders an exceptional opportunity to manage accounts with balances up to a staggering $2,000,000, coupled with an attractive profit split of 85%. This lucrative arrangement highlights their commitment to empowering traders.  In terms of partnerships, Blue Guardian collaborates with renowned brokers such as Eightcap and Purple Trading Seychelles, adding to its credibility and reach in the trading domain. The headquarters of Blue Guardian are strategically located in the vibrant Dubai Silicon Oasis, specifically in DDP, Building A2, Dubai, United Arab Emirates, marking their presence in a key financial hub.

In terms of partnerships, Blue Guardian collaborates with renowned brokers such as Eightcap and Purple Trading Seychelles, adding to its credibility and reach in the trading domain. The headquarters of Blue Guardian are strategically located in the vibrant Dubai Silicon Oasis, specifically in DDP, Building A2, Dubai, United Arab Emirates, marking their presence in a key financial hub.

Leadership at Blue Guardian: CEO Sean Baiton

Sean Baiton stands at the helm of Blue Guardian as its CEO, bringing a wealth of trading knowledge and experience specific to the proprietary trading firm sector. His expertise encompasses a broad range of trading services, including signal provision and the application of advanced techniques like machine learning and quantitative analysis. These skills are particularly instrumental in the development of sophisticated trading bots. Under Sean Baiton’s guidance, Blue Guardian has developed a solid strategic approach, addressing both short-term and long-term objectives. His role is crucial in not only defining but also executing the company’s vision and mission. Sean’s contributions have been pivotal in both the establishment and the thriving success of Blue Guardian, marking him as a key figure in the company’s ongoing journey.

Funding Program Options at Blue Guardian

Blue Guardian provides its traders with a choice of three distinct funding program accounts, each designed to cater to varying needs and trading styles. These programs include:

- Unlimited Guardian Evaluation: This program offers a unique and flexible approach, allowing traders to operate without the constraints of a fixed evaluation period.

- Elite Guardian Evaluation: Tailored for the more experienced traders, this option provides a comprehensive platform to showcase their trading expertise and skills.

- Rapid Guardian Evaluation: Designed for those seeking a faster route, this program emphasizes quick evaluation and progression for efficient and effective trading.

Unlimited Guardian Evaluation Program at Blue Guardian

The Unlimited Guardian Evaluation Program offered by Blue Guardian is meticulously designed to identify and reward traders for their consistency and skill over a two-phase evaluation period. This program enables traders to use leverage of 1:100, providing them with significant trading power.

Program Account Options and Pricing

- $10,000 account for $87

- $25,000 account for $187

- $50,000 account for $297

- $100,000 account for $497

- $200,000 account for $947

Phase One: Initial Evaluation

In the first phase, traders are tasked with reaching an 8% profit target. They must adhere to a maximum daily loss limit of 4% and an overall maximum loss limit of 8%. Importantly, there are no restrictions on minimum or maximum trading days in this phase. Advancing to the next phase requires hitting the 8% profit target without exceeding the loss limits.

Phase Two: Advanced Evaluation

The second phase challenges traders to achieve a 4% profit target, with the same loss limits as in phase one. Again, there are no trading day requirements in terms of minimum or maximum. Completion of this phase, by reaching the 4% profit target without violating the loss rules, leads to a funded account status.

Transition to Funded Account

Upon successfully completing both evaluation phases, traders are granted a funded account. In this stage, there are no profit targets; however, traders must maintain the 4% maximum daily loss and 8% maximum loss rules. The first payout occurs 14 calendar days after placing the first position in the funded account, with an impressive 85% profit split based on the account’s earnings.

Scaling Plan for Unlimited Guardian Evaluation Program Accounts

The Unlimited Guardian Evaluation Program Accounts at Blue Guardian include a dynamic scaling plan. This plan is designed to incentivize and reward profitable trading over a defined period.

Scaling Plan Criteria and Growth Potential

To qualify for account scaling, traders need to achieve a minimum profit target of 12% within a three-month period, ensuring profitability in at least two of those months. Upon meeting these criteria, the account balance is increased by 30% of its original value.

Scaling Plan Examples

- For an initial $200,000 account, a successful 3-month period would increase the balance to $260,000.

- In the subsequent 3 months, if the criteria are met again, the balance of $260,000 would be scaled up to $320,000.

- Continuing this trend, the next 3-month period could see an increase from $320,000 to $380,000.

- This pattern continues, offering substantial growth opportunities for consistent performers.

Traders in the Unlimited Guardian Evaluation Program are permitted to trade with a range of instruments, including forex pairs, commodities, indices, and cryptocurrencies. This variety allows for diverse trading strategies and the opportunity to leverage different market conditions.

Rules for the Unlimited Guardian Evaluation Program Account

The Unlimited Guardian Evaluation Program Account at Blue Guardian is governed by a set of clearly defined rules to ensure fair and disciplined trading practices. These rules include:

Profit Targets

- Phase 1 requires traders to achieve an 8% profit target.

- In Phase 2, the profit target is set at 4%.

- Funded accounts operate without any specific profit targets.

Maximum Daily Loss

All account sizes are subject to a maximum daily loss limit of 4%. Exceeding this limit results in a violation of the account.

Maximum Loss

The overall maximum loss allowed across all account sizes is capped at 8%. Reaching this threshold constitutes a violation of the account.

Third-Party Copy Trading Risk

Traders using third-party copy trading services should be aware of the risk of capital allocation duplication. If too many traders use the same strategy, it could lead to a denial of a funded account or withdrawal due to exceeding the maximum capital allocation rule.

Third-Party EA Risk

When employing a third-party Expert Advisor (EA), traders should consider the risk associated with strategy duplication. Similar to copy trading, the use of a common third-party EA by multiple traders might lead to exceeding the maximum capital allocation rule, affecting the possibility of receiving a funded account or making withdrawals.

Elite Guardian Evaluation Program Accounts at Blue Guardian

The Elite Guardian Evaluation Program Account, offered by Blue Guardian, is specifically designed for experienced and disciplined traders. This program focuses on rewarding consistency through a structured two-phase evaluation period, providing traders with leverage of 1:50.

Program Account Options and Pricing

- $10,000 account for $120

- $25,000 account for $240

- $50,000 account for $370

- $100,000 account for $570

- $200,000 account for $1,090

Phase One: Initial Evaluation

During the first phase, traders must reach an 8% profit target while adhering to a 4% maximum daily loss and a 10% overall maximum loss limit. There is no maximum trading day requirement in this phase, but traders must complete a minimum of five trading days to advance to the next phase.

Phase Two: Advanced Evaluation

The second phase requires traders to achieve a 4% profit target, maintaining the same daily and overall loss limits as in phase one. Similar to phase one, there are no maximum trading day requirements, but traders must complete at least five trading days to qualify for a funded account.

Transition to Funded Account

Upon successful completion of both evaluation phases, traders are granted a funded account. In this stage, no specific profit targets are set, but the 4% maximum daily loss and 10% maximum loss rules still apply. The first payout is scheduled 14 calendar days after the first position is placed in the funded account, with traders enjoying an 85% profit split based on their earnings.

Scaling Plan for Elite Guardian Evaluation Program Accounts

Blue Guardian’s Elite Guardian Evaluation Program Accounts offer a scaling plan to motivate and reward successful trading over a sustained period.

Scaling Plan Criteria and Growth Prospects

To be eligible for scaling, traders are required to hit a profit target of 12% or more within a three-month period, ensuring profitability in at least two of these months. Achieving this goal leads to a 30% increase in the original account balance.

Scaling Plan Examples

- Starting with a $200,000 account, a successful 3-month period would result in an increase to $260,000.

- Subsequent achievement over the next 3 months would raise the $260,000 balance to $320,000.

- Continuing this pattern, the next 3-month period could boost the balance from $320,000 to $380,000.

- This progression continues, offering significant growth opportunities for consistent performers.

Participants in the Elite Guardian Evaluation Program can trade a variety of instruments, including forex pairs, commodities, indices, and cryptocurrencies. This diverse range allows for flexibility in trading strategies and capitalizes on different market dynamics.

Rules for the Elite Guardian Evaluation Program Account

The Elite Guardian Evaluation Program Account at Blue Guardian adheres to a specific set of rules to ensure fair and disciplined trading. These rules include:

Profit Targets

- The profit target for Phase 1 is set at 8%.

- In Phase 2, the profit target is reduced to 4%.

- Funded accounts operate without specified profit targets.

Maximum Daily Loss

All account sizes are subject to a maximum daily loss limit of 4%. Exceeding this threshold results in a violation of the account.

Maximum Loss

For all account sizes, the overall maximum loss allowed is capped at 10%. Reaching this limit constitutes a violation of the account.

Minimum Trading Days

Both phases of the evaluation require a minimum of five trading days. This duration is essential before completing a challenge phase or requesting a withdrawal.

Third-Party Copy Trading Risk

Traders considering third-party copy trading services should be aware of the potential risk associated with strategy duplication. Excessive usage of a common strategy by multiple traders might lead to a denial of a funded account or withdrawal due to surpassing the maximum capital allocation rule.

Third-Party EA Risk

When using a third-party Expert Advisor (EA), traders should consider the risk of strategy overlap. Like copy trading, using a widely-employed third-party EA may risk exceeding the maximum capital allocation rule, affecting the possibility of obtaining a funded account or making withdrawals.

Rapid Guardian Evaluation Program Accounts at Blue Guardian

The Rapid Guardian Evaluation Program Account, offered by Blue Guardian, is tailored for experienced and disciplined traders, focusing on a streamlined one-phase evaluation process. This program features a leverage of 1:100, catering to traders who prefer a more dynamic trading approach.

Program Account Options and Pricing

- $10,000 account for $97

- $25,000 account for $197

- $50,000 account for $297

- $100,000 account for $497

- $200,000 account for $947

Evaluation Phase Requirements

In the evaluation phase, traders are tasked with achieving a 10% profit target. They must adhere to a maximum daily loss limit of 4% and a maximum trailing loss limit of 6%. Importantly, there are no minimum or maximum trading day requirements in this phase. The only criterion for moving to a funded account is reaching the profit target.

Transition to Funded Account

Successful completion of the evaluation phase leads to a funded account. In this stage, there are no specific profit targets; however, the 4% maximum daily loss and 6% maximum trailing loss rules still apply. The first payout is scheduled 14 calendar days after placing the first position in the funded account. Subsequent payouts follow a bi-weekly schedule. Traders enjoy an 85% profit split based on the earnings from their funded account.

Scaling Plan for Rapid Guardian Evaluation Program Accounts

Blue Guardian’s Rapid Guardian Evaluation Program Accounts feature an enticing scaling plan designed to reward consistent and profitable trading over a set period.

Scaling Plan Criteria and Potential Growth

To qualify for the scaling plan, traders are required to achieve a profit target of 12% or more within a three-month period, with profitability maintained in at least two of those months. Meeting these criteria results in a 30% increase in the original account balance.

Scaling Plan Examples

- For an initial $200,000 account, achieving the target in a 3-month period results in an increased balance of $260,000.

- Upon repeating this success in the next 3 months, the account balance would grow from $260,000 to $320,000.

- Continuing this trend, the following 3-month period could see the account balance rising from $320,000 to $380,000.

- This pattern offers substantial growth opportunities for traders who consistently perform well.

Traders participating in the Rapid Guardian Evaluation Program are allowed to trade a variety of instruments, including forex pairs, commodities, indices, and cryptocurrencies, thus offering a wide array of trading options.

Rules for the Rapid Guardian Evaluation Program Account

The Rapid Guardian Evaluation Program Account at Blue Guardian is structured around a set of defined rules to ensure disciplined and fair trading practices. These rules are as follows:

Profit Target

- The evaluation phase has a set profit target of 10%.

- Funded accounts do not have specified profit targets.

Maximum Daily Loss

All account sizes are subject to a maximum daily loss limit of 4%. Surpassing this limit constitutes a violation of the account.

Maximum Trailing Drawdown

The maximum trailing drawdown for all accounts is capped at 6%. This drawdown is calculated as the difference between the highest account balance achieved and the maximum drawdown level.

Third-Party Copy Trading Risk

Traders considering third-party copy trading services should be aware of the potential risk involved with strategy duplication. If many traders employ the same strategy through a common copy trading service, it may lead to exceeding the maximum capital allocation rule, potentially resulting in a denial of a funded account or withdrawal.

Third-Party EA Risk

For traders intending to use a third-party Expert Advisor (EA), there is a risk of strategy overlap. Similar to copy trading, the widespread use of the same third-party EA might exceed the maximum capital allocation rule, affecting the possibility of acquiring a funded account or making withdrawals.

What Sets Blue Guardian Apart from Other Proprietary Trading Firms?

Blue Guardian distinguishes itself from other leading proprietary trading firms in several key aspects:

- Variety of Funding Programs: Unlike many competitors, Blue Guardian offers three distinct funding program accounts, catering to a range of trader needs and preferences.

- Flexibility in Trading Style: They place no restrictions on trading styles. Traders have the freedom to trade during news events, hold trades overnight, and even over weekends.

- Unlimited Guardian Evaluation Program: This unique two-phase evaluation program requires traders to complete both phases for eligibility for payouts. The profit targets are set at 8% for phase one and 4% for phase two, with a maximum daily loss of 4% and a maximum overall loss of 8%. Crucially, there are no minimum or maximum trading day requirements in either phase.

- Scaling Plan: The Unlimited Guardian Evaluation Program includes a scaling plan, a feature not commonly found in other industry-leading prop firms.

- Comparative Ease in Profit Targets: Blue Guardian’s profit targets are relatively lower compared to those of its peers, coupled with the absence of strict trading day requirements, making their programs more accessible to a wider range of traders.

These characteristics make Blue Guardian an attractive option for traders seeking flexibility, varied program choices, and lower barriers to profitability.

Comparative Analysis: Blue Guardian vs. True Forex Funds (Limitless)

When comparing Blue Guardian with True Forex Funds (Limitless), several key differences in their trading objectives stand out:

| Trading Objectives | Blue Guardian | True Forex Funds (Limitless) |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 4% | 5% |

| Maximum Daily Loss | 4% | 5% |

| Maximum Loss | 8% | 10% |

| Minimum Trading Days | No Minimum Trading Days | 5 Calendar Days |

| Maximum Trading Period | Unlimited for Both Phases | Unlimited for Both Phases |

| Profit Split | 85% | 80% |

This comparison highlights that while both firms offer similar profit targets in Phase 1, Blue Guardian provides a more lenient structure in terms of profit targets, maximum loss limits, and trading day requirements in subsequent phases, along with a higher profit split percentage.

Comparative Analysis: Blue Guardian vs. Funded Trading Plus (Premium)

A comparison between Blue Guardian and Funded Trading Plus (Premium) reveals some similarities and differences in their trading objectives:

| Trading Objectives | Blue Guardian | Funded Trading Plus (Premium) |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 4% | 5% |

| Maximum Daily Loss | 4% | 4% |

| Maximum Loss | 8% | 8% (Trailing) |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited for Both Phases | Unlimited for Both Phases |

| Profit Split | 85% | 80% up to 90% |

This comparison indicates that Blue Guardian and Funded Trading Plus (Premium) share similar approaches in several aspects like profit targets for Phase 1, maximum daily loss, and lack of minimum trading days. However, Blue Guardian offers a slightly lower Phase 2 profit target and a fixed higher profit split, whereas Funded Trading Plus provides a variable profit split that can potentially be higher.

Comparative Analysis: Blue Guardian vs. E8 Funding (Extended)

Here’s how Blue Guardian compares to E8 Funding (Extended) across various trading objectives:

| Trading Objectives | Blue Guardian | E8 Funding (Extended) |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 4% | 5% |

| Maximum Daily Loss | 4% | 5% |

| Maximum Loss | 8% | 10% (Scalable up to 14%) |

| Minimum Trading Days | No Minimum Trading Days | 5 Calendar Days |

| Maximum Trading Period | Unlimited for Both Phases | Unlimited for Both Phases |

| Profit Split | 85% | 80% |

Blue Guardian’s Elite Guardian Evaluation Program, which is a two-phase evaluation program, requires traders to meet profit targets of 8% in phase one and 4% in phase two, with a 4% maximum daily loss and 10% maximum loss. Unlike E8 Funding, it has no minimum trading day requirement, although five calendar days are needed for the elite program. This program also includes a scaling plan. Blue Guardian’s lower profit targets and lack of maximum trading day requirements offer a more accessible path to payouts compared to other industry-leading prop firms.

Comparative Analysis: Blue Guardian vs. Funding Pips

An in-depth comparison of Blue Guardian and Funding Pips across various trading objectives reveals the following differences and similarities:

| Trading Objectives | Blue Guardian | Funding Pips |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 4% | 5% |

| Maximum Daily Loss | 4% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited for Both Phases | Unlimited for Both Phases |

| Profit Split | 85% | 80% up to 90% |

This comparison indicates that while Blue Guardian and Funding Pips share similar phase 1 profit targets, Blue Guardian has a lower phase 2 profit target and a lower maximum daily loss limit. However, Blue Guardian requires a minimum of 5 trading days, whereas Funding Pips has no such requirement. In terms of profit split, Blue Guardian offers a consistent 85%, while Funding Pips provides a variable profit split ranging from 80% to 90%.

Comparative Analysis: Blue Guardian vs. FundedNext (Stellar)

Comparing the trading objectives of Blue Guardian with those of FundedNext (Stellar) reveals the following key differences and similarities:

| Trading Objectives | Blue Guardian | FundedNext (Stellar) |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 4% | 5% |

| Maximum Daily Loss | 4% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 5 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Unlimited for Both Phases | Unlimited for Both Phases |

| Profit Split | 85% | 80% up to 90% |

Both Blue Guardian and FundedNext offer similar phase 1 profit targets and identical maximum loss limits. However, Blue Guardian sets a slightly lower phase 2 profit target and a lower maximum daily loss limit. The minimum trading days requirement is the same for both firms. While Blue Guardian offers a steady 85% profit split, FundedNext provides a variable profit split ranging from 80% to 90%.

Comparative Analysis: Blue Guardian vs Finotive Funding

This review provides an in-depth comparison of the trading objectives and features of Blue Guardian and Finotive Funding, two prominent players in the prop trading industry.

Trading Objectives Breakdown

Understanding the specifics of each firm’s trading objectives is crucial for traders considering their options. Here’s a detailed look at how Blue Guardian and Finotive Funding stack up against each other:

- Phase 1 Profit Target: Blue Guardian sets a target of 8%, while Finotive Funding is slightly lower at 7.5%.

- Phase 2 Profit Target: For Blue Guardian, it’s 4%, in contrast to Finotive Funding’s higher target of 5%.

- Maximum Daily Loss: Blue Guardian limits this to 4%, whereas Finotive Funding allows up to 5%.

- Total Maximum Loss: Both firms enforce a 10% cap.

- Minimum Trading Days: Blue Guardian requires at least 5 calendar days, while Finotive Funding imposes no minimum trading days.

- Maximum Trading Period: Both phases offer unlimited trading periods in both firms.

- Profit Split: Blue Guardian provides an 85% profit split, whereas Finotive Funding offers a variable range from 75% to 95%.

Blue Guardian’s Unique Rapid Guardian Program

Blue Guardian’s most recent program, the Rapid Guardian evaluation, requires traders to complete a single phase to become eligible for payouts. The targets and rules in this program are distinct:

- A 10% profit target for the evaluation phase.

- A maximum daily loss capped at 4% and a 6% maximum trailing loss.

- Flexibility with no minimum or maximum trading day constraints.

- An included scaling plan for growth potential.

Compared to other leading prop firms, Blue Guardian’s drawdown rules are average, with the added advantage of no time restrictions.

Blue Guardian’s Diverse Funding Programs and Unrestricted Trading Style

Blue Guardian stands out in the industry by offering three distinct funding program opportunities. Unlike most leading prop firms, they do not regulate traders’ styles. This flexibility allows traders to:

- Trade during news events.

- Hold positions overnight and during weekends.

Is Securing Capital from Blue Guardian a Realistic Goal?

When assessing the feasibility of securing capital from prop trading firms like Blue Guardian, it’s vital to examine the trading requirements relative to your forex trading style. An attractive profit split or a well-funded account may seem appealing, but they need to be balanced against realistic profit targets and drawdown limits to gauge the likelihood of success.

Evaluating the Realism of Blue Guardian’s Funding Programs

Blue Guardian offers various evaluation programs, each with its own set of targets and rules. Let’s explore how realistic these programs are in terms of meeting their trading objectives and securing funding.

Unlimited Guardian Evaluation Program

- Profit Targets: 8% in Phase 1 and 4% in Phase 2, which are relatively low and achievable.

- Maximum Loss Rules: 4% maximum daily and 8% overall loss, which are average in the industry.

- Trading Period: Unlimited maximum trading days with no minimum requirements, offering ample time to meet objectives.

Elite Guardian Evaluation Program

- Profit Targets: Maintains similar targets of 8% in Phase 1 and 4% in Phase 2.

- Maximum Loss Rules: A 4% maximum daily loss and a slightly higher 10% total maximum loss.

- Trading Period: Unlimited maximum trading days to complete both evaluation phases.

Rapid Guardian Evaluation Program

- Profit Target: A moderate 10% target with balanced loss rules.

- Maximum Loss Rules: 4% maximum daily and 6% maximum trailing loss, aligning with industry standards.

- Trading Flexibility: No minimum trading day requirement and an unlimited maximum trading period.

Considering these factors, Blue Guardian emerges as a commendable choice for traders seeking funding. The trading objectives set by its three evaluation programs – Unlimited Guardian, Elite Guardian, and Rapid Guardian – are realistic and well-aligned with the conditions for successful payouts. For more information on forex prop firms and their evaluation programs, visit All Prop Trading Firms.

Understanding Payment Proof for Blue Guardian

Blue Guardian, established in June 2019 and going public in September 2021, offers traders the opportunity to earn and withdraw profits upon successful completion of any of their three funding programs. Understanding the process and evidence of payments is crucial for traders considering this platform.

Withdrawal Process and Timeline

After achieving success in one of Blue Guardian’s funding programs and generating profits in the funded account, traders become eligible to request withdrawals. Here’s how the withdrawal process works:

- Initial Withdrawal: Eligibility for the first withdrawal arises after 14 calendar days of receiving your funded account.

- Subsequent Withdrawals: All future withdrawals can be requested on a bi-weekly basis, offering regular opportunities to access earnings.

Where to Find Payment Proof

For those interested in verifying the legitimacy of payments from Blue Guardian, their Telegram channel serves as a primary source. The channel is a hub where the community actively shares their payment proofs, providing transparency and reassurance to prospective and current traders. Note: The images mentioned are not displayed here due to policy restrictions. However, they can be viewed directly on Blue Guardian’s Telegram channel. For more information on forex funded programs and their payment structures, visit All Prop Trading Firms.

Brokers Utilized by Blue Guardian

For traders considering Blue Guardian as their prop firm of choice, understanding the brokers they partner with is crucial. Blue Guardian collaborates with two well-regarded brokers: Eightcap and Purple Trading Seychelles.

Eightcap: A Melbourne-Based ASIC-Regulated Broker

Founded in 2009, Eightcap is recognized for its commitment to delivering exceptional financial services. This ASIC-regulated broker, headquartered in Melbourne, Australia, offers a wide range of trading opportunities. Here’s what makes Eightcap stand out:

- Global Presence: With five offices globally, they cater to clients all over the world.

- Regulatory Compliance: They adhere to regulations in multiple jurisdictions, ensuring a secure trading environment.

- Trading Options: Clients can trade across various markets including FX, indices, commodities, and shares.

Purple Trading Seychelles: Focusing on Fairness and Advanced Technology

Purple Trading Seychelles is dedicated to offering equitable business conditions and cutting-edge technologies to their clients. They strive to be equal partners to their clients, ensuring a reliable and transparent trading experience.

Trading Platforms Supported

Both Eightcap and Purple Trading Seychelles provide access to popular trading platforms, catering to a wide range of trader preferences:

- MetaTrader 4: Known for its user-friendly interface and advanced trading tools.

- MetaTrader 5: Offers more advanced features and is preferred by traders looking for a more comprehensive trading experience.

For more information on forex trading and brokerage services, visit All Prop Trading Firms.

Trading Instruments Available with Blue Guardian

Blue Guardian offers a diverse range of trading instruments across multiple asset classes, each with specific leverage options. This variety caters to traders with different interests and strategies in the forex and broader financial markets.

Forex Trading with Blue Guardian

Forex traders have access to a wide selection of currency pairs with a leverage of 1:100. Some of the major pairs available include:

- USDCHF, GBPUSD, EURUSD, EURJPY, USDCAD

- AUDUSD, EURGBP, EURAUD, EURCHF, GBPCHF

- And many others covering major, minor, and exotic pairs.

Commodities Trading

Commodities trading at Blue Guardian is offered with a leverage of 1:20. Traders can engage in trading popular commodities such as:

- Gold (XAUUSD), Silver (XAGUSD), Platinum (XPTUSD)

- Copper, Natural Gas (NGAS)

- Crude Oils: UKOil and USOil

Indices Trading

Indices are available with a leverage of 1:50, featuring major global indices like:

- US30, SPX500, DAX, UK100, ESP35

- JPY225, FRA40, EUSTX50, NAS100

Cryptocurrency Trading

For those interested in the dynamic world of cryptocurrencies, Blue Guardian provides trading with a leverage of 1:2. The cryptocurrency options include:

- Bitcoin (BTCUSD), Ripple (XRPUSD), Ethereum (ETHUSD), Litecoin (LTCUSD)

- And an extensive list of other popular cryptocurrencies.

Blue Guardian’s comprehensive range of trading instruments across forex, commodities, indices, and cryptocurrencies ensures that traders of all preferences have ample opportunities to engage in the markets. For further insights into trading instruments and strategies, visit All Prop Trading Firms.

Understanding Trading Fees at Blue Guardian

For traders considering Blue Guardian, it’s essential to understand the trading fee structure, which includes commissions and spreads across various asset classes. This clarity helps in making informed decisions and managing trading costs effectively.

Trading Commission Structure

Blue Guardian charges trading commissions based on the asset class. Here’s a breakdown of the commission fees:

- Forex: $6 USD per lot.

- Commodities: $6 USD per lot.

- Indices: No commission (0 USD per lot).

- Cryptocurrencies: $6 USD per lot.

Understanding Spreads

Spreads can vary based on market conditions and the specific assets being traded. To get a real-time view of the spreads, traders can log into the trading platform with the following details:

| Platform | Server | Login Number | Password | Platform Download |

|---|---|---|---|---|

| MetaTrader 4 | EightcapLtd-Demo3 | 2145708153 | yrm8cg4ju5 | Click here |

Note: The login details provided are for a demo account, which allows you to view live spreads without any financial commitment. For more details on forex trading costs and account management, visit All Prop Trading Firms.

Education & Support Services at Blue Guardian for Traders

Blue Guardian, established in 2019, has evolved from its initial roots as a Forex Signal provider and educational institution to a comprehensive prop firm. This transition has broadened its offerings to include evaluations for funding traders. Understanding the education and support services available at Blue Guardian is crucial for traders considering this platform.

Blue Guardian’s Evolution and Online Presence

Since its rebranding in 2021, Blue Guardian has expanded its focus to include prop firm evaluations, allowing a wider range of traders to achieve funding. Although they do not have a dedicated thread on ForexFactory, their presence is notable in the following threads:

- PROP FIRM HUB thread created by user Masterrmind, where Blue Guardian is frequently mentioned.

- PROP FIRM ELITE thread by PaulMF, also featuring multiple mentions of Blue Guardian.

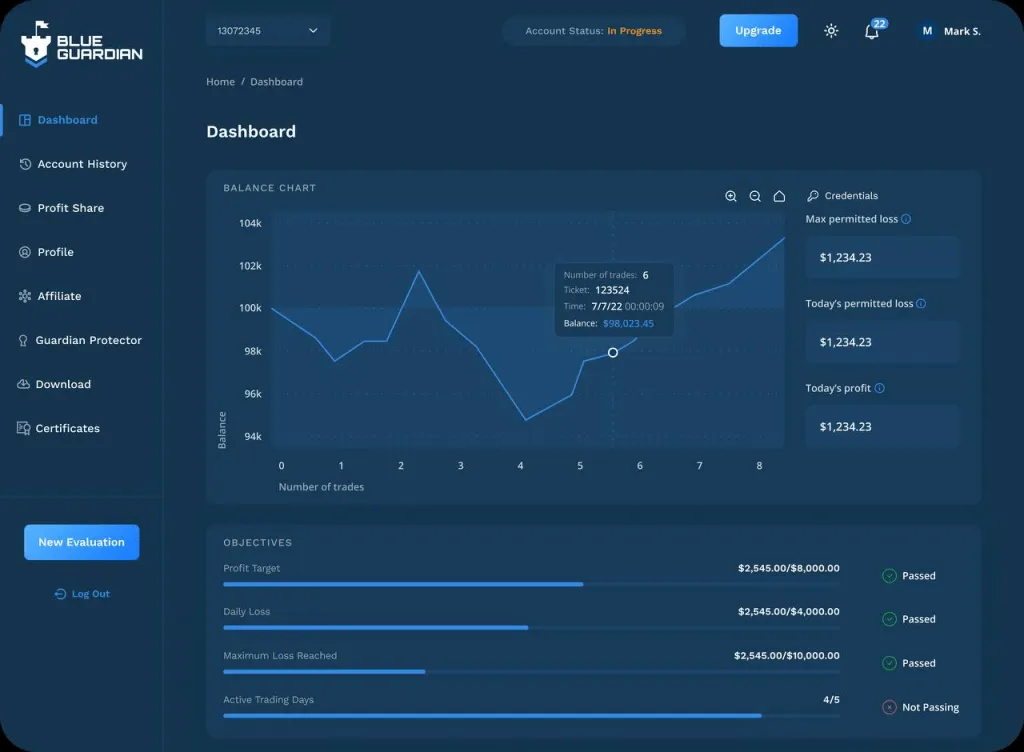

Trading Practice and Risk Management Tools

While Blue Guardian does not offer a free trial, potential traders can still familiarize themselves with the trading environment through demo accounts provided by their associated brokers, Eightcap and Purple Trading Seychelles. This offers an opportunity to test trading conditions and strategies without financial risk. Furthermore, Blue Guardian provides a well-organized dashboard for all clients, designed to aid in effective risk management. This dashboard presents all critical statistics and objectives in one easily accessible location, enhancing the trading experience and decision-making process. For more insights into forex trading education, support services, and prop firm evaluations, visit All Prop Trading Firms.

Traders’ Feedback on Blue Guardian

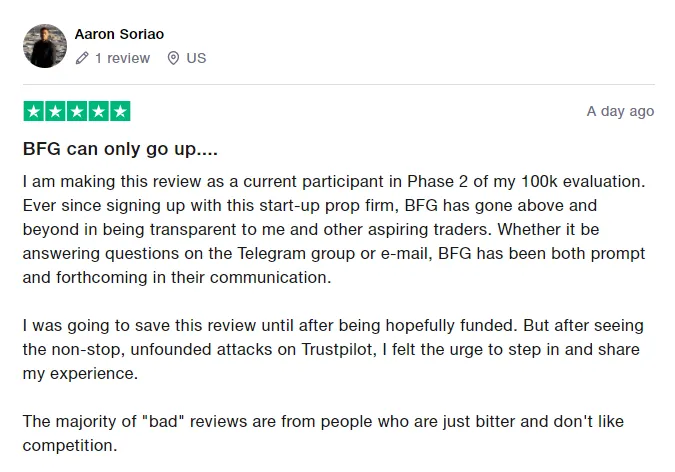

Gauging trader sentiment is crucial when considering a prop firm like Blue Guardian. Reviews and comments from actual users provide valuable insights into the firm’s performance, customer service, and overall reliability. Here’s what traders are saying about Blue Guardian:

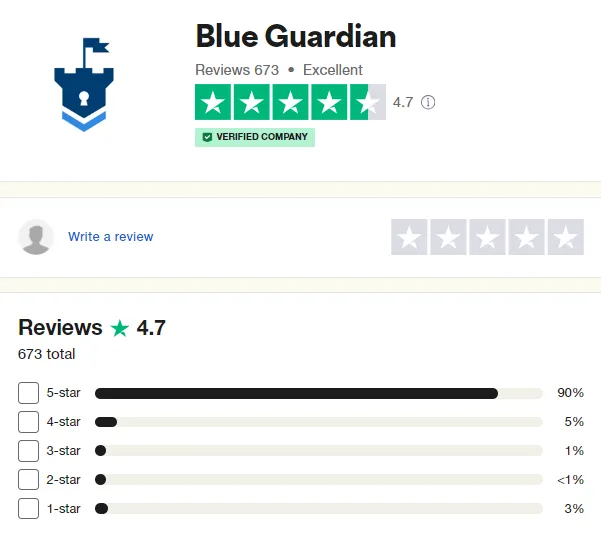

Trustpilot Reviews: A Testament to Quality

Blue Guardian has garnered impressive feedback on Trustpilot, reflecting the positive experiences of its community. Key highlights from these reviews include:

- An excellent overall score of 4.7 out of 5, based on 673 reviews.

- Recognition of the firm’s growth and improvements post-rebranding.

- Appreciation for the updates and enhancements made to benefit the community.

Community Praise for Responsiveness and Clarity

One of the most commended aspects of Blue Guardian is the team’s responsiveness. Traders have noted the prompt and clear communication provided by the Blue Guardian team, especially in addressing queries or concerns.

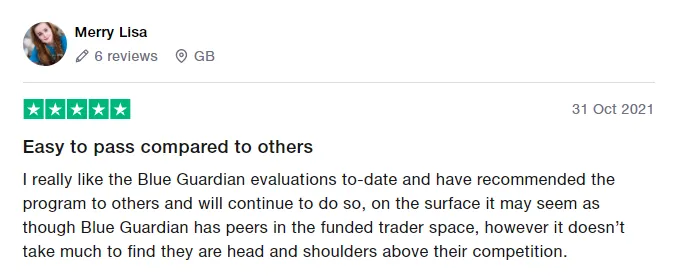

Positive Views on Evaluation Phase Requirements

Another aspect that stands out in trader feedback is the evaluation phase requirements set by Blue Guardian. These requirements are deemed easier to achieve compared to other firms, particularly highlighted for:

- The flexibility and minimal restrictions on trading style.

- The realistic and attainable targets set for traders in the evaluation phases.

This positive feedback from the trading community underscores Blue Guardian’s commitment to providing a supportive and effective trading environment. For more insights into trader experiences and reviews of prop firms, visit All Prop Trading Firms.

Blue Guardian’s Presence on Social Media

Social media platforms are essential for modern prop trading firms to engage with their community, share updates, and provide insights. Blue Guardian’s presence on social media platforms like Instagram and Telegram highlights its commitment to staying connected with its audience.

Blue Guardian on Instagram

Blue Guardian has established a significant following on Instagram, which is a testament to its popularity and active engagement with traders. Key details include:

- Followers: The account boasts 9,476 followers, indicating a robust and growing community.

- Content: Regular updates, educational content, and insights into the trading world.

Engagement on Telegram

Telegram serves as another critical platform for Blue Guardian, offering direct communication and updates. Notable aspects of their Telegram account include:

- Subscribers: A subscriber base of 2,115, reflecting a dedicated and engaged audience.

- Interactions: The channel is used for announcements, community discussions, and support.

Blue Guardian’s active presence on these social media platforms demonstrates its dedication to maintaining a close-knit and informed trading community. For more information on forex trading and community engagement, visit All Prop Trading Firms.

Support Services at Blue Guardian

Effective support is a cornerstone of a reliable prop trading firm. Blue Guardian offers multiple channels of support to ensure their clients have access to the information and assistance they need. Here’s an overview of the support services provided by Blue Guardian:

Comprehensive FAQ Page

For immediate answers to common queries, Blue Guardian’s FAQ page is a useful resource. It covers a wide range of topics, providing quick and easy access to essential information.

Contacting the Support Team

Blue Guardian’s support team is readily accessible through various channels:

- Social Media: Quick and informal responses through their social media platforms.

- Email Support: Direct email assistance is available at [email protected] for more detailed inquiries.

Live Chat Support

For real-time assistance, Blue Guardian provides live chat support on their website. This service is especially beneficial for immediate help with specific issues or questions. The live chat is available:

- Business Hours: Monday to Friday, from 10 AM to 6 PM GMT+1.

Blue Guardian’s array of support services ensures that traders can receive the help they need in a timely and efficient manner. For additional information on support services in forex trading, visit All Prop Trading Firms.

Conclusion: Blue Guardian’s Standing in the Proprietary Trading Industry

As a proprietary trading firm, Blue Guardian has established itself as a legitimate and reliable choice for traders. Offering a range of evaluation programs and flexibility in trading styles, it caters to a diverse group of traders. Let’s summarize the key aspects that make Blue Guardian a noteworthy option in the industry.

Trading Style and Evaluation Programs

Blue Guardian’s standout feature is its non-restrictive approach to trading styles, allowing traders to engage during news, hold trades overnight, and trade over weekends. The firm offers three distinct evaluation programs:

- Unlimited Guardian Evaluation Program: A two-phase challenge with realistic profit targets of 8% in phase one and 4% in phase two. Key features include a 4% maximum daily and 8% maximum loss rule, unlimited trading period, and no minimum trading days. Successful traders can earn 85% profit splits and have opportunities for account scaling.

- Elite Guardian Evaluation Program: Similar to Unlimited Guardian but with a 10% maximum loss rule and a minimum of 5 trading days required. It also offers an 85% profit split and account scaling opportunities.

- Rapid Guardian Evaluation Program: A one-step program with a 10% profit target, 4% maximum daily, and 6% trailing loss rules. This program also offers an unlimited trading period, no minimum trading days, and 85% profit splits with scaling options.

Recommendation and Industry Standing

Blue Guardian is highly recommended for traders seeking straightforward rules and those with a consistent trading strategy. The firm’s well-established reputation, coupled with excellent conditions for various trading styles, makes it a top contender in the proprietary trading firm sector. Its commitment to realistic trading objectives, combined with a supportive infrastructure, positions Blue Guardian as one of the better choices in the industry. For more insights into proprietary trading firms and their offerings, visit All Prop Trading Firms.